Author: Memento Research

Compiled by: Saoirse, Foresight News

Data as of December 20, 2025. Metrics: Percentage change from TGE opening to present, calculated based on Fully Diluted Valuation (FDV) + Market Capitalization (MC)

Summary

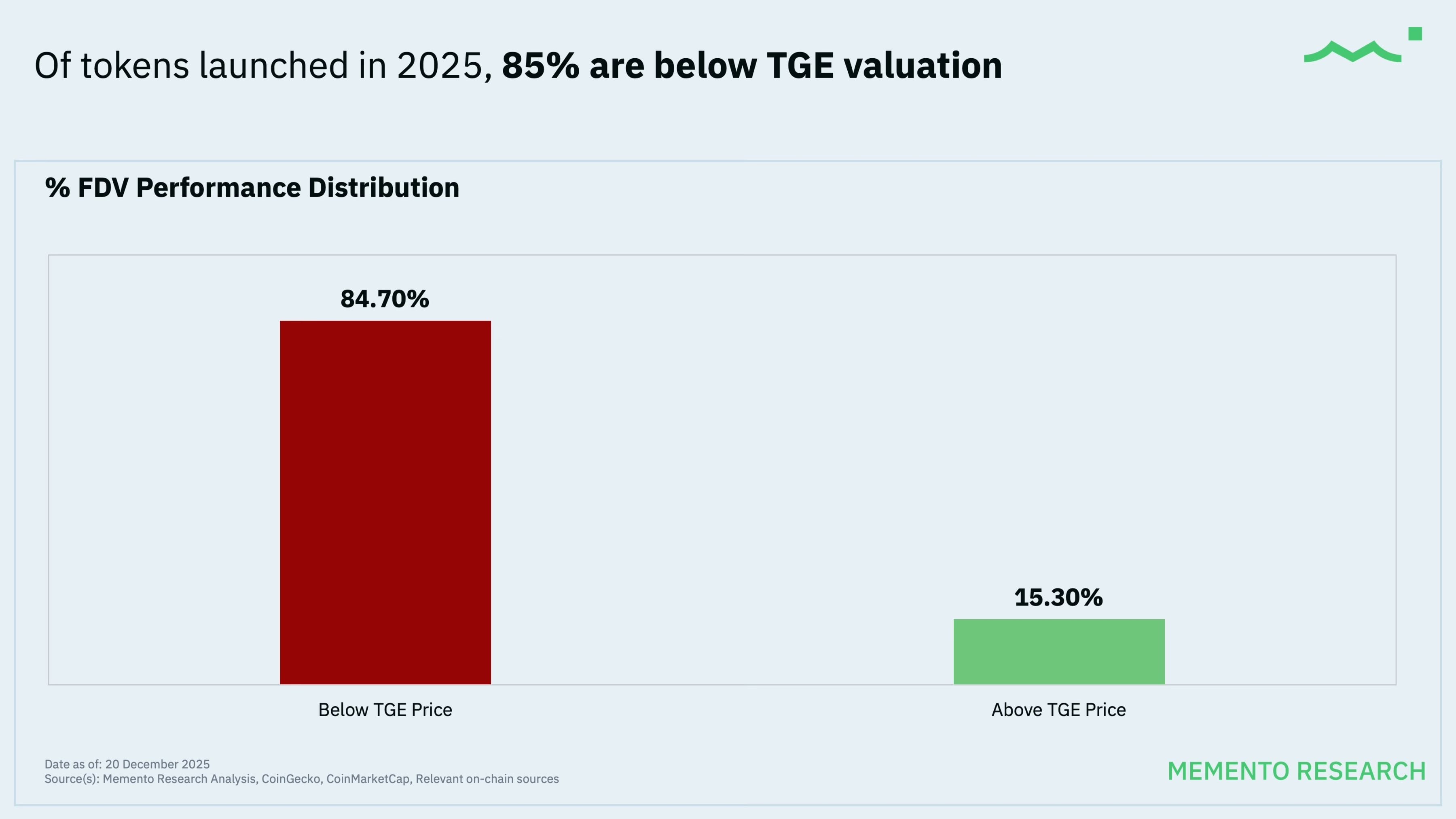

We tracked 118 token launches in 2025, and the results are dismal:

- 84.7% (100 out of 118 projects) have token prices below their initial token generation event (TGE) valuation, meaning about four-fifths of the launched projects are in a loss state;

- Median performance: Since launch, Fully Diluted Valuation (FDV) has dropped by 71.1%, and Market Capitalization (MC) has dropped by 66.8%;

- The "average" masks the harsh truth: although the equal-weighted portfolio (calculated by FDV) has seen a decline of about 33.3%, the FDV-weighted portfolio has plummeted by 61.5%, indicating a worse situation (this means that larger, more hyped projects performed worse);

- Only 18 out of 118 projects (15.3%) achieved price increases (marked "green"): the median increase for rising tokens is 109.7% (about 2.1 times), while the remaining 100 projects all declined (marked "red"), with the median decrease for falling tokens at 76.8%.

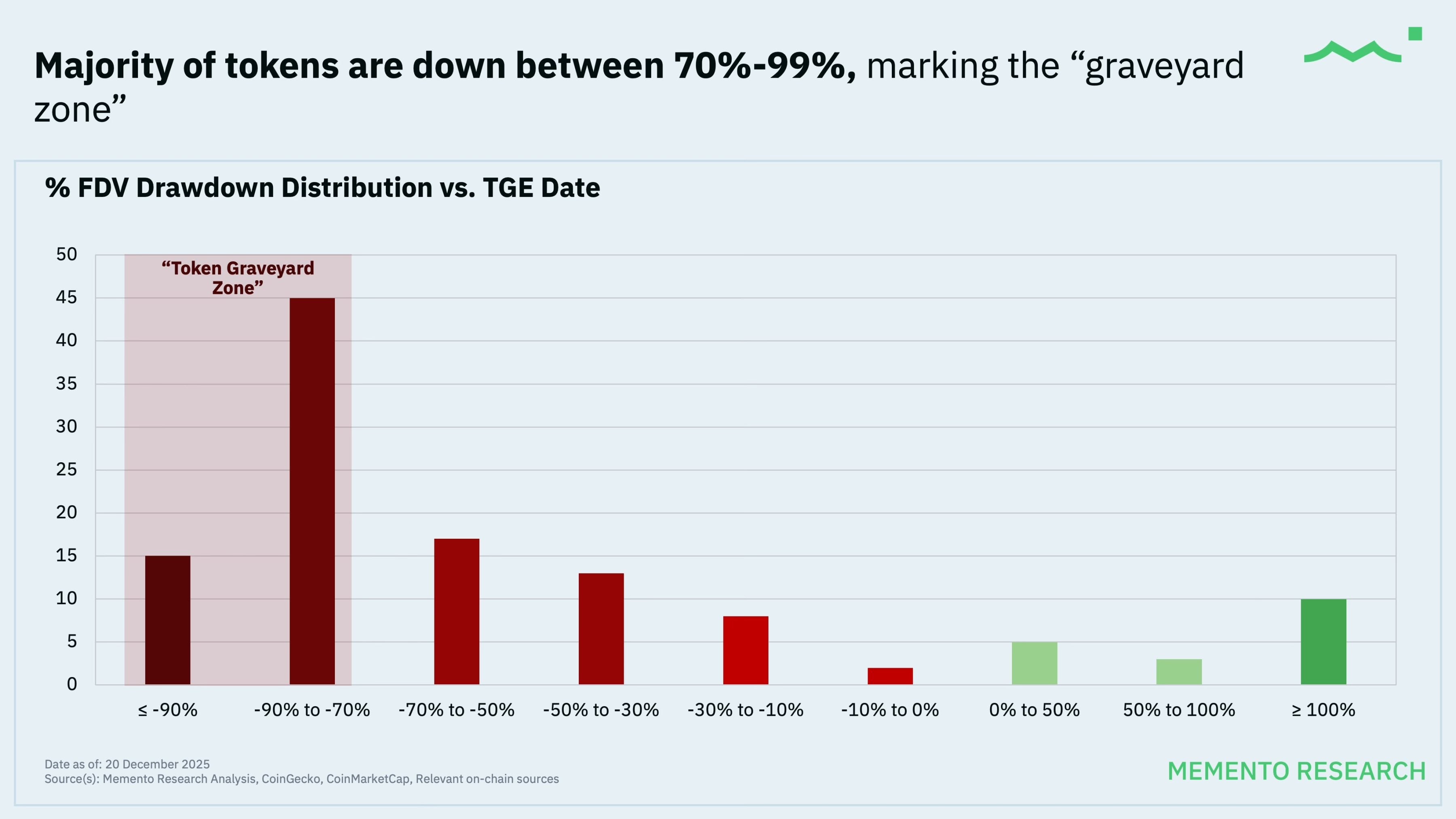

Distribution of Fully Diluted Valuation (FDV) Declines

Current Status Summary:

- Only 15% of token prices remain above their initial token generation event (TGE) valuation;

- As many as 65% of token launch projects have seen prices drop by over 50% from their TGE launch price, with 51% of projects experiencing declines exceeding 70%.

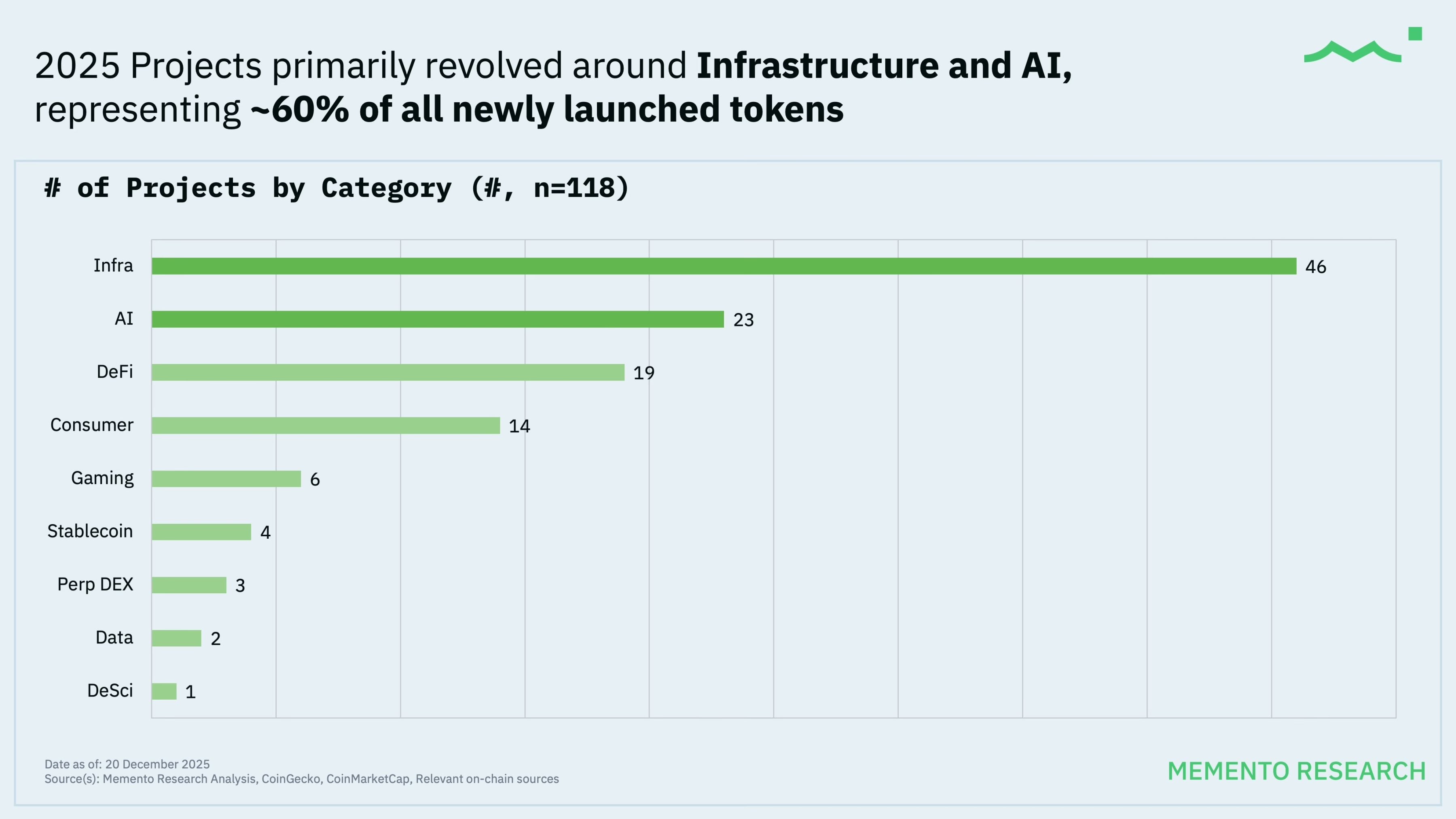

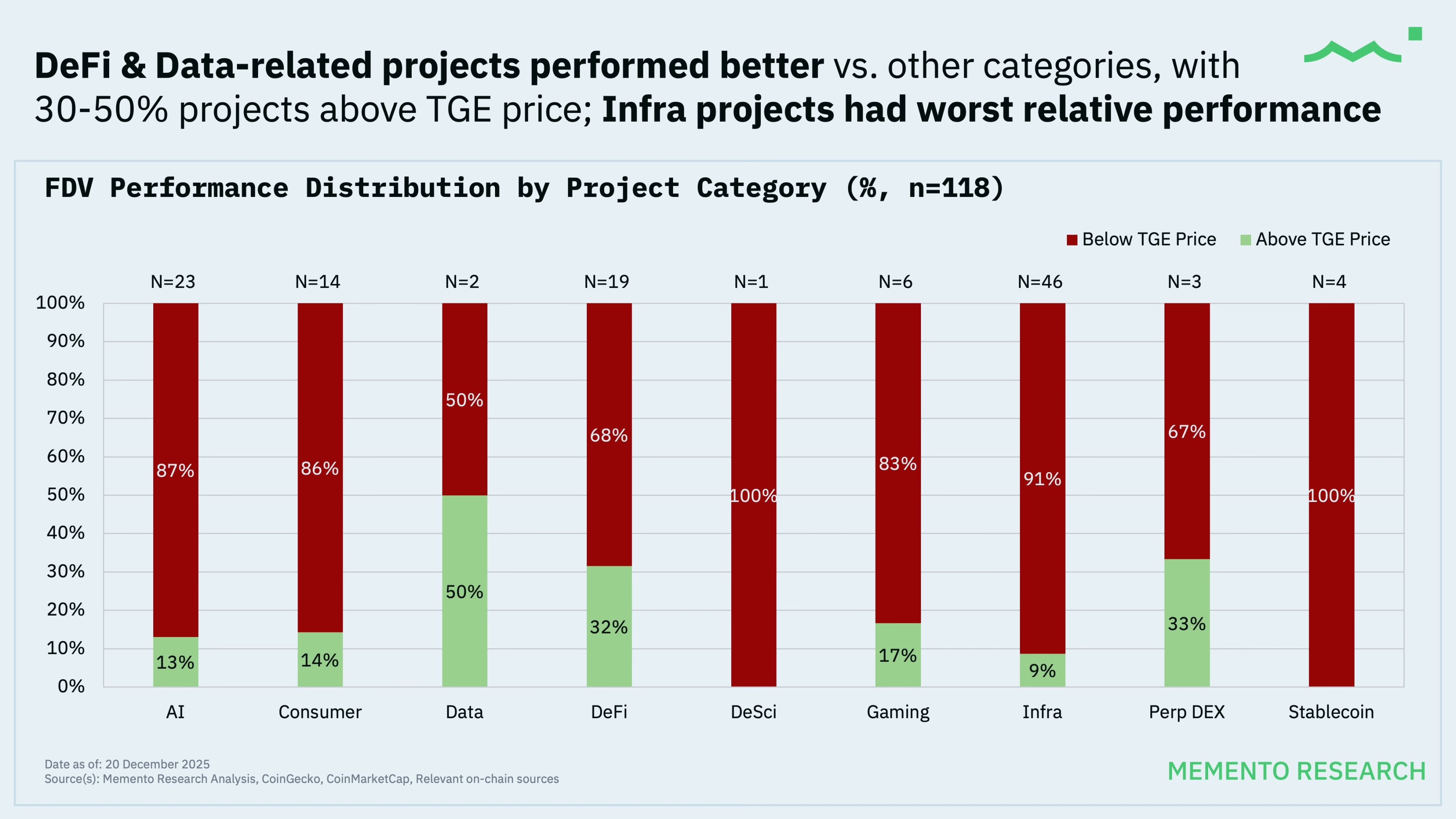

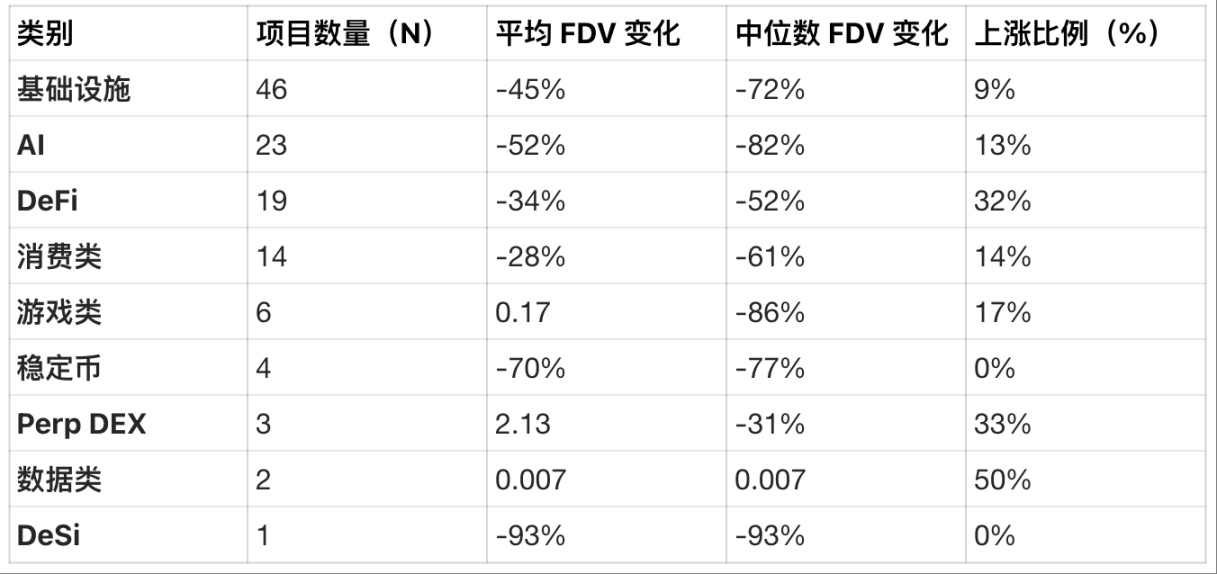

2025 Projects Categorized by Type and Relative Performance

Token launch projects in 2025 are primarily concentrated in two major areas—Infrastructure (Infra) and Artificial Intelligence (AI), which together account for 60% of all newly issued tokens. However, there are significant differences in average and median returns across different categories, which are worth noting.

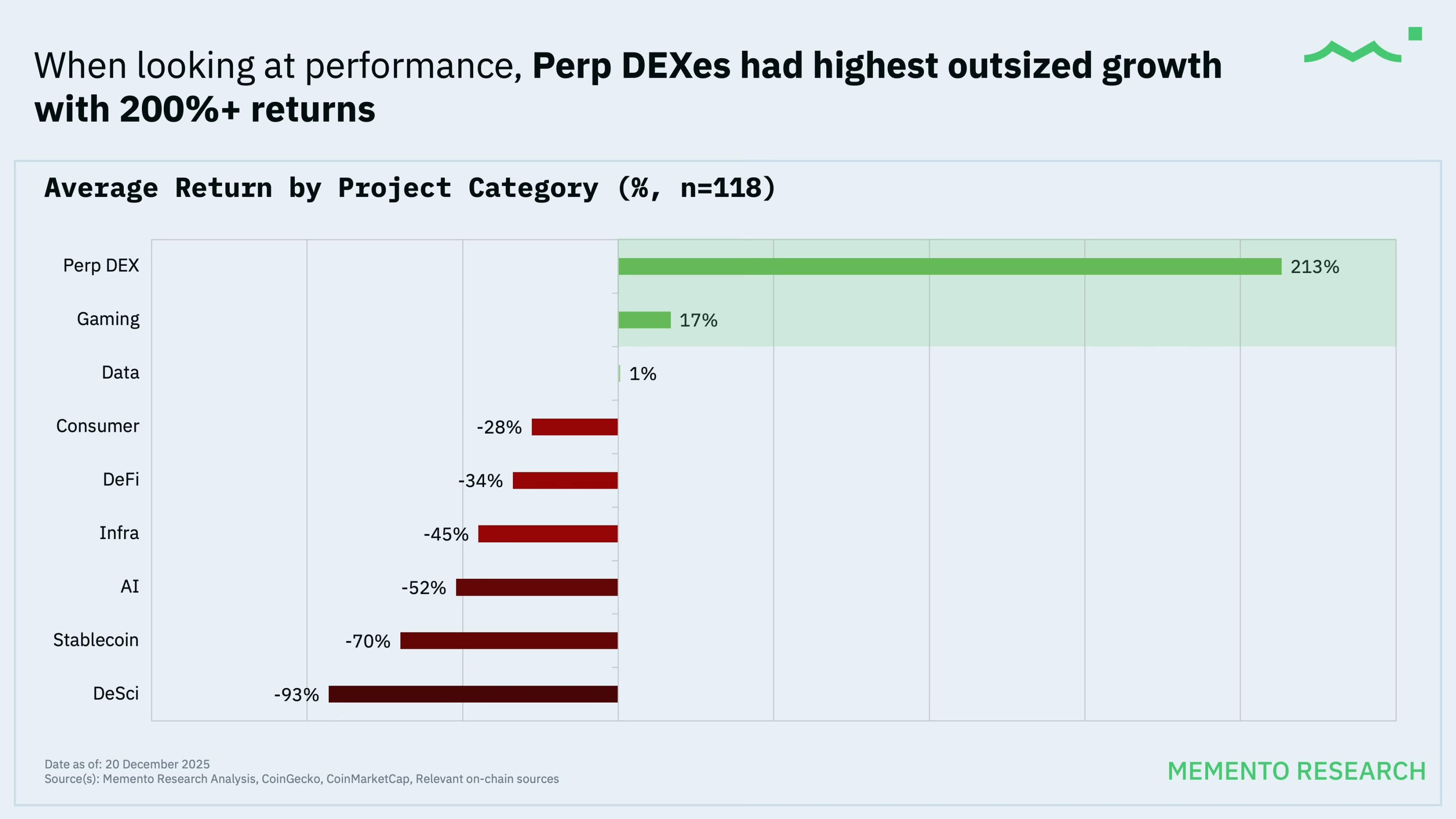

Data Interpretation:

- The main trend in 2025 is the rise of decentralized exchanges for perpetual contracts (Perp DEX), represented by Hyperliquid, with Aster also successfully launching in the fourth quarter. Although the sample size for this category is small and the median remains negative, perpetual contract DEXs (average increase of 213%) can be considered the "standout winners";

- The sample size for gaming projects is too small to draw meaningful conclusions and is heavily influenced by individual outliers—this results in a positive average increase, but a median decline of 86%;

- Decentralized Finance (DeFi) is the field with the highest "hit rate" (32% of projects increased), where it is more about "survivor survival" rather than the emergence of "blockbuster projects";

- Projects in the Infrastructure (Infra) and Artificial Intelligence (AI) sectors are clustered and highly competitive, with poor performance; the median declines for these two categories are 72% and 82%, respectively.

Correlation Between Initial Fully Diluted Valuation (FDV) and Project Performance

The Most Clear Conclusion from the Data:

- There are 28 token launches with an initial Fully Diluted Valuation (FDV) ≥ $1 billion;

- Currently, the prices of all these projects have declined (with an increase rate of 0%), and the median decline is about 81%;

- This also explains why the FDV-weighted index (decline of 61.5%) performs far worse than the equal-weighted index (decline of 33.3%)—the poor performance of large initial projects has dragged down the overall market.

Key Points:

The initial valuations of projects were set too high, far exceeding their fair value, leading to poor long-term performance and larger declines.

2025 Review and Outlook

From the above data, the following conclusions can be drawn:

- For most tokens, the token generation event (TGE) is often a "worse entry point," with the median price performance result being "a decline of about 70%";

- The token generation event (TGE) is no longer an "early entry window"; for those projects that are overhyped but have weak fundamentals, TGE may even represent a price "top";

- Projects issued with high initial FDV have not "grown to match their valuation"; instead, their pricing has been significantly adjusted downward;

- History is remarkably similar: most TGE projects are concentrated in the infrastructure sector (with many AI projects due to the current AI bubble), but these areas are precisely the "disaster zones" for losses;

- If you plan to participate in TGE investments, you are essentially "betting that you can find rare outlier projects," because from a basic probability standpoint, most projects perform very poorly.

If we categorize the 2025 market by quartiles of initial FDV, the pattern becomes very clear: token launch projects with the lowest initial FDV and cheapest pricing are the only category with a considerable survival rate (40% of projects increased), with a relatively mild median decline (about -26%); whereas all projects with initial FDV above the median have essentially been repriced to rock bottom, with median declines ranging from -70% to -83%, and almost no projects achieving increases.

Therefore, a core lesson can be summarized from this data set: the token generation events (TGE) of 2025 represent a "valuation reset period"—most token prices continue to decline, with only a few outlier projects achieving increases; and the higher the FDV at the time of the project's initial issuance, the greater the eventual decline.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。