Author: Jonas, Foresight Research

The Next Financial Super App: A Huge Opportunity Hidden in Plain Sight

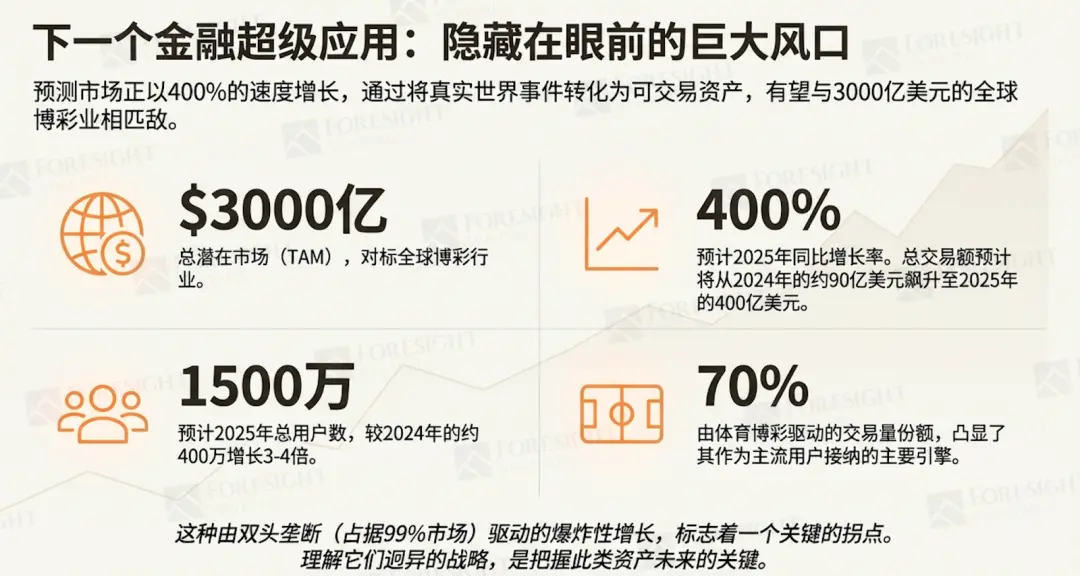

As a rapidly growing niche, the development trajectory of prediction markets is clear, aiming to challenge the mature global gambling industry. By transforming real-world events into tradable assets, these platforms are unlocking a new form of financial speculation and information aggregation. The momentum in this field is evident from its explosive growth data:

Overall potential market size: This market benchmarks against the global gambling industry, which is valued at up to $300 billion, indicating significant growth potential.

Expected year-on-year growth rate by 2025: An astonishing growth rate of 400% is anticipated, with total trading volume expected to surge from approximately $900 million in 2024 to $40 billion in 2025.

Expected total number of users by 2025: The user base is projected to grow 3-4 times, increasing from about 4 million in 2024 to 15 million in 2025.

Major growth engine: Currently, 70% of the market's trading volume is driven by sports betting, highlighting its key role in attracting mainstream users.

This explosive growth is almost entirely captured by a dual oligopoly: Kalshi and Polymarket. Together, they account for 99% of the market share. However, their stark differences in regulation, technology, and marketing strategies mark a critical turning point. This article analyzes the competitive landscape defined by these two dominant forces, examining the strategic games reshaping the market and future opportunities.

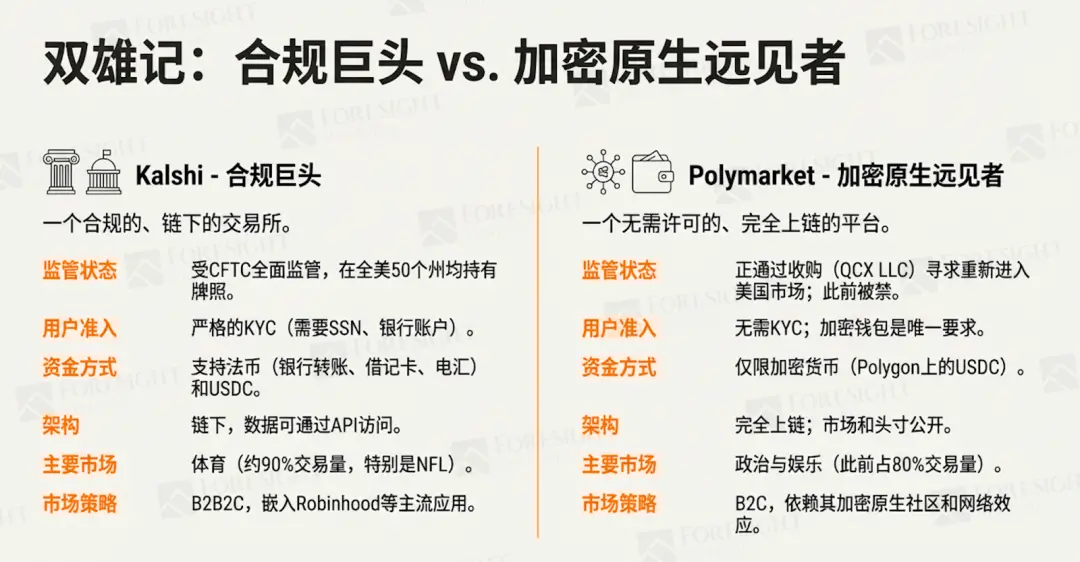

1. The Battle of Two Platforms: Compliant Giants vs. Crypto-Native Visionaries

To understand the landscape of prediction markets, one must first recognize the fundamental differences between its two leaders, Kalshi and Polymarket. Their opposing philosophies represent not just operational details but two distinct visions for the future of this asset class. Kalshi embodies a compliant, top-down model designed to integrate into the mainstream market, while Polymarket advocates a permissionless, bottom-up model rooted in crypto-native principles. This strategic divergence defines the current competitive dynamics and will shape the industry's development.

Core Comparison

| Kalshi | Polymarket | |--------|------------| | Positioning | Compliant off-chain exchange | Crypto-native on-chain platform | | Regulatory Status | Regulated by CFTC, licensed in 50 states | Previously banned, seeking to re-enter the U.S. market through acquisition | | User Access | Strict KYC: requires social security number, bank account, etc. | No KYC required: only needs a crypto wallet | | Funding Channels | Bank transfer, debit card, USDC, wire transfer | Only supports USDC deposits on the Polygon chain | | Technical Architecture | Off-chain operation, data accessed via API | Fully on-chain operation, markets and positions publicly verifiable | | Main Categories | Sports (about 90%), especially NFL football | Politics/entertainment (80% during election periods) | | Marketing Strategy | B2B2C: embedded in mainstream apps like Robinhood | B2C: relies on crypto-native community and network effects |

This high-level comparison reveals two fundamentally different business logics. While Polymarket established an early advantage with its crypto-native appeal, a single, pivotal event would soon demonstrate the overwhelming power of the other model, dramatically shifting the balance of market forces.

2. Winning Strategy: How a Collaboration Disrupted the Market

Although Polymarket built an early and formidable dominance through the strong network effects of the crypto ecosystem, its position was not unshakeable. As a compliant challenger, Kalshi executed a strategic partnership that proved that mainstream distribution channels, fully supported by compliance, could overwhelm the crypto-native moat. This move was not just a growth strategy but a strategic game that disrupted the market, validating a completely different business model.

The key to this transformation was Kalshi's integration with retail brokerage giant Robinhood. This partnership began on August 19, embedding Kalshi's NFL prediction market directly into the Robinhood app. This allowed Kalshi to directly reach Robinhood's massive user base of 27.4 million funded accounts, with a 60-70% overlap with Kalshi's target users.

The effects were immediate and far-reaching, triggering a complete reversal of market leadership and validating the effectiveness of Kalshi's compliance-driven, B2B2C strategy.

Market share reversal: Within months, Polymarket's dominant market share plummeted from about 95% to 32%, while Kalshi's share soared from just 8% to 66%.

Trading volume impact: Kalshi's annualized trading volume skyrocketed from about $300 million to an estimated $40-50 billion, increasing nearly 200 times.

User impact: Kalshi's daily active users grew 20 times to 75,000, while Polymarket's daily active users correspondingly dropped by 50% to 24,000.

This event was not just about growth; it was a strategic masterstroke. It demonstrated that in the battle for the U.S. market, entering mainstream distribution channels through compliant means could be a more powerful weapon than the permissionless network effects of the crypto world. This shift laid the groundwork for a deeper analysis of the unique and lasting business models each platform is currently pursuing.

3. Analyzing the Business Models and Strategies of the Dual Oligopoly

The dramatic changes in market share tell only part of the story. To understand the future of prediction markets, one must look beyond trading volume charts and analyze the unique, long-term strategic moats and business models each platform is building. Kalshi is waging a regulated war against the traditional sports betting industry, while Polymarket is executing a transformation from a consumer-facing platform to an institutional-level data provider.

Kalshi's Moat: A Disruptive Attack on Sports Betting

The best way to understand Kalshi's strategy is to view it as a "disruptive attack" on the traditional sports betting industry. It is not competing with Polymarket at the crypto-native level but is leveraging its unique regulatory position to outsmart and disrupt traditional giants like DraftKings and FanDuel. This attack is built on two pillars.

Regulatory Arbitrage: National Coverage

Traditional sports betting platforms are limited by the fragmented legal systems of various states, being legal in only about 30 U.S. states. In contrast, Kalshi operates under a federal license from the Commodity Futures Trading Commission, making it a federally regulated financial product legal in all 50 states. This advantage opens up vast, untapped markets like California and Texas, effectively bypassing state-level gambling restrictions and creating a national competitive edge.

Superior Capital Efficiency: User Value Proposition

Kalshi offers a fundamentally more transparent and capital-efficient product than its sports betting competitors. Traditional platforms often charge users a "tax" of up to 25-30% as a fee for early cash-out. In contrast, Kalshi operates like a financial exchange, providing a better product with no withdrawal penalties or additional fees. This clear value proposition attracts mature players and erodes the user base of traditional systems.

Polymarket's Transformation: B2C Feint Under B2B Endgame

As Kalshi conquers the U.S. retail market, Polymarket is strategically shifting from a challenging B2C revenue model to a highly viable B2B data-as-a-service endgame. The clearest signal of this strategic transformation is the $2 billion investment from Intercontinental Exchange (ICE, the parent company of the New York Stock Exchange). This converts Polymarket's speculative user activity into quantifiable, sellable institutional assets.

This new B2B strategy is built on three core components:

Assets: On-chain real-time probability data generated by a global user network, creating a powerful alternative data source.

Distributors: ICE plans to package this data, positioning itself as a global distributor for institutional clients.

Institutional Products: This raw data becomes the foundation for a range of new institutional-level financial products, including:

New sentiment indicators: Real-time market probabilities provided to hedge funds and investment banks to track public sentiment.

Enhanced risk modeling: Data used for macroeconomic forecasting and corporate risk assessment.

New financial derivatives: ICE can issue derivatives based on Polymarket's data, creating "event-driven ETFs" that track events like Federal Reserve interest rate decisions or election outcomes.

Financial and Operational Comparison

The divergent strategies of Kalshi and Polymarket are clearly reflected in their financial and operational models. The table below provides a detailed comparison, synthesizing existing data to highlight their fundamental differences.

| Kalshi | Polymarket | |--------|------------| | Revenue Status | Profitable: Over $200 million in revenue in the first half of 2025 | No revenue: 5 years in operation without charging | | Charging Model | Transaction fee: 0.7-3.5% of contract amount per transaction (average 0.8%) | Early 2% profit share, now no fees under order book model | | Trading Mechanism | Central Limit Order Book (CLOB) | Early AMM, now off-chain order book + on-chain settlement | | Liquidity Incentives | Larger investment: Approximately $35,000 daily (annualized about $12.7 million) | Ongoing investment: About $5 million annually to maintain core market | | Result Arbitration | Centralized human arbitration (CFTC regulated) |

Decentralized Oracle (UMA Oracle)

Ultimately, the comparison is stark: Kalshi operates as a traditional, revenue-focused exchange executing a validated playbook. In contrast, Polymarket prioritizes network growth and liquidity, funding operations from its treasury while building its long-term institutional data strategy, rather than pursuing immediate monetization.

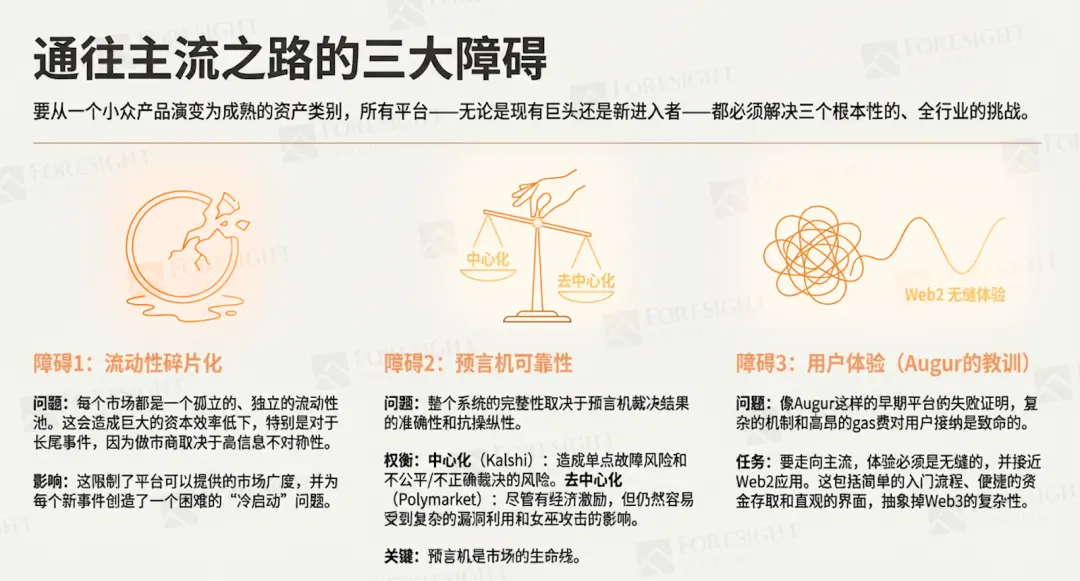

4. Three Major Barriers on the Road to Mainstream Adoption

Despite their respective successes and clear strategic paths, both Kalshi and Polymarket must overcome three fundamental, industry-wide challenges to evolve prediction markets from niche products into a mature and widely adopted asset class. These barriers involve market structure, system integrity, and user accessibility.

- Fragmented Liquidity

The structure of prediction markets creates severe capital efficiency issues. Each new market—whether about election outcomes or football match results—represents an independent, isolated liquidity pool. This causes capital to be dispersed across thousands of different events, limiting market depth and perpetuating a persistent "cold start" problem for each newly launched market. This inefficiency makes it difficult for platforms to offer a broad market and may deter market makers facing high information asymmetry.

- Oracle Reliability

Oracles—the mechanisms that report real-world outcomes of events—are the lifeline of the market. The integrity of the entire system depends on their ability to accurately report results and resist manipulation. Here, the dual oligopoly approach presents clear trade-offs. Kalshi's centralized model is efficient but creates a single point of failure risk and the unfair adjudication risk of limited user recourse. Polymarket's use of UMA's decentralized approach distributes trust but remains vulnerable to complex economic attacks. Its reliance on UMA for adjudication in markets involving hundreds of millions of dollars has been seen as a potential systemic risk, which will become more pronounced as the amounts involved grow.

- User Experience (Lessons from Augur)

The failures of early platforms like Augur provide important lessons for the industry. Augur's complex mechanisms, reliance on native tokens, and high Ethereum gas fees set insurmountable barriers for mainstream users. The requirements for achieving mass adoption are clear: the experience must be seamless and close to Web2 applications. This includes a simple onboarding process, convenient funding channels, and an intuitive interface that abstracts away the complexities of Web3—principles that both Kalshi and Polymarket are actively pursuing.

Overcoming these structural challenges is crucial. The platform that most effectively addresses these issues will be best positioned to seize strategic opportunities in the future global competitive landscape.

5. Strategic Blueprint: Where the Real Opportunities Lie

As the dust settles on the market share reversal, the strategic landscape is becoming clear. While the two giants, Kalshi and Polymarket, have effectively occupied the U.S. market through their respective moats in regulation and network effects, the battle for other regions of the world is just beginning. The next phase of competition will not only be determined by scale but will depend on local knowledge, refined execution, and differentiated strategies.

Judgment on the U.S. Market: A Closed Dual Oligopoly

For aspiring entrepreneurs and investors, the conclusion is clear: the window of opportunity to establish a new, U.S.-focused successful prediction market has essentially closed. The combination of Kalshi's strong regulatory moat and Polymarket's deep, network effect-driven liquidity has created a fortress that is extremely difficult for new entrants to breach. The time and capital costs required to achieve regulatory compliance and overcome cold start liquidity issues are too high to justify the attempt.

Global Opportunities: Deep Localization is the Path to Victory

While the U.S. market has become concentrated, Polymarket's major weaknesses on the global stage present clear opportunities for new challengers. Its current strategy of "big and broad," offering a generic market, often lacks focus on sports events, political occurrences, and cultural moments that resonate within specific regions.

The counter-strategy for new entrants to succeed in non-U.S. markets is "deep localization." This approach focuses not on competing with incumbents on a global scale but on decisively winning in specific, high-potential areas. The blueprint for this strategy is built on three core pillars:

Content Localization: Highly focused on creating markets for regional sports leagues, local political events, and culturally relevant entertainment topics that global platforms like Polymarket naturally overlook. This creates a higher quality and more engaging content supply for local users.

Community Localization: Establishing dedicated, local-language communities and marketing channels. This fosters a sense of belonging and grassroots support that centralized, English-first platforms find difficult to replicate.

Model Differentiation: Utilizing more decentralized governance models, such as DAOs (Decentralized Autonomous Organizations), to empower local communities and build strong grassroots support. This "trick" can create a powerful competitive advantage relative to more centralized management platforms.

Prediction markets are at a clear turning point. In the U.S., the market has been consolidated by two strategically distinct yet equally powerful giants—one building a regulated financial exchange and the other constructing an institutional data behemoth. The future of this market is set. However, the global stage remains vast, creating enticing opportunities for agile, localized challengers to build the next wave of successful prediction platforms.

Recommended Reading:

The Hidden Concerns Behind Web3 Super Unicorn Phantom

Why Asia's Largest Bitcoin Treasury Company Metaplanet Isn't Bottom Fishing?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。