Source: Galaxy Research

Translation: Golden Finance

The closing price of Bitcoin in 2025 is expected to be roughly on par with the beginning of the year.

In the first ten months of this year, the cryptocurrency market experienced a genuine bullish wave. Regulatory reforms continued to advance, ETFs continued to attract funds, and on-chain activity became increasingly active. Bitcoin reached an all-time high of $126,080 on October 6.

However, after the frenzy, the market did not see the anticipated breakthrough; instead, it experienced rotation, repricing, and rebalancing. The failure of macro expectations, a shift in investment narratives, leveraged liquidations, and massive sell-offs by whales collectively disrupted the market balance. Prices fell, confidence waned, and by December, Bitcoin had retreated to just over $90,000—a journey that was far from smooth.

Although 2025 may end with a price decline, the year still attracted genuine institutional adoption and laid the groundwork for the next phase of actual activation in 2026. In the coming year, we expect stablecoins to surpass traditional payment rails, tokenized assets to enter mainstream capital and collateral markets, and enterprise-level Layer 1 blockchains to transition from pilot projects to actual settlements. Additionally, we anticipate that public chains will rethink their value capture methods, DeFi and prediction markets will continue to expand, and AI-driven payments will eventually manifest on-chain.

Without further ado, here are Galaxy Research's 26 predictions for the cryptocurrency market in 2026.

1. Bitcoin Price

Prediction 1: BTC has a certain probability of reaching $250,000 by the end of 2026.

2026 is difficult to predict due to market volatility, but it is still possible for Bitcoin to set a new all-time high in 2026.

Current options market pricing shows that as of the end of June 2026, the probabilities of Bitcoin reaching $70,000 or $130,000 are roughly equal; by the end of 2026, the probabilities of reaching $50,000 or $250,000 are also similar. This wide range reflects the market's high uncertainty regarding recent trends. At the time of writing, the overall crypto market is deeply entrenched in a bear market, and Bitcoin has failed to regain upward momentum. We believe that recent risks remain tilted downward until BTC firmly establishes itself in the $100,000 to $105,000 range. Other factors in the broader financial market also contribute to uncertainty, such as the pace of AI capital expenditures, the monetary policy environment, and the U.S. midterm elections in November.

This year, we have observed a structural decline in Bitcoin's long-term volatility levels—partly due to the introduction of larger-scale options coverage/BTC yield strategies. Notably, the current BTC volatility smile curve shows that the volatility pricing of put options is higher than that of call options, which is the opposite of the situation six months ago. This indicates that the market is shifting from the skew typically seen in developing growth markets to a pricing model closer to traditional macro assets.

This maturation trend is likely to continue. Whether Bitcoin will drop close to the 200-week moving average or not, the maturity and institutional adoption of this asset class are continuously improving. 2026 may be a lackluster year for Bitcoin, but whether it closes at $70,000 or $150,000, our bullish view (over a longer cycle) will only strengthen. The increasingly open institutional access channels are combining with loose monetary policies and the market's urgent demand for non-dollar hedging assets. Bitcoin is likely to follow gold in the next two years, becoming a widely adopted hedge against currency devaluation. — Alex Thorn (Head of Research, Galaxy Research)

2. Layer-1 and Layer-2

Prediction 2: The total market capitalization of internet capital markets on Solana will surge to $2 billion (currently about $750 million).

The on-chain economy of Solana is maturing, primarily reflected in the market activity shifting from meme-driven to new models, and the success of new launch platforms focused on directing capital into genuinely profitable businesses. The improvement in Solana's market structure and the demand for tokens with fundamental value further reinforce this shift. As investor preferences turn towards sustainable on-chain businesses rather than fleeting meme cycles, the internet capital market will become a decisive pillar of Solana's economic activity. — Lucas Tcheyan (Research Associate, Galaxy Research)

Prediction 3: At least one launched, universal Layer-1 blockchain will embed revenue-generating applications into the protocol, directly redirecting its value back to the native token.

The deepening reassessment of how Layer-1 captures and maintains value will drive public chains towards more inclined designs. Hyperliquid's successful embedding of perpetual contract exchanges, along with the broad transfer of economic value capture from the protocol layer to the application layer (i.e., the embodiment of the "fat application theory"), is reshaping expectations of what value a neutral base layer should provide. As applications increasingly retain most of the value they create, more public chains are exploring whether certain revenue-generating underlying functions should be directly embedded into the protocol to strengthen the economic model at the token level. Early signs are already emerging. Ethereum founder Vitalik Buterin recently called for the development of low-risk, economically meaningful DeFi to support ETH's value, highlighting the pressure on Layer-1 to prove its sustainable value capture capability. The MegaEth project plans to launch a native stablecoin and return its revenue to validators, while the upcoming AI-focused Layer-1, Ambient, aims to internalize reasoning fees. These examples indicate an increasing willingness among public chains to control key applications and monetize them. This lays the groundwork for a mainstream Layer-1 to take a critical step in 2026: formally embedding a revenue-generating application at the protocol layer and directing its economic value towards the native token. — Lucas Tcheyan (Research Associate, Galaxy Research)

Prediction 4: There will be no inflation rate reduction proposals for Solana in 2026; the current proposal SIMD-0411 will be withdrawn without a vote.

Solana's inflation rate was a focal point of community controversy last year. Although a new inflation reduction proposal (SIMD-0411) was introduced in November, there is still a lack of consensus on the best path forward; instead, there is growing consensus that this would distract from more pressing priorities, such as implementing microstructural adjustments to the Solana market. Additionally, adjusting SOL's inflation policy could affect its future positioning as a neutral store of value and monetary asset. — Lucas Tcheyan (Research Associate, Galaxy Research)

Prediction 5: Enterprise-level L1 will upgrade from pilot phase to real settlement infrastructure.

At least one Fortune 500 bank, cloud service provider, or e-commerce platform will launch a branded enterprise-level L1 in 2026, settling over $1 billion in real economic activity and operating a production-grade cross-chain bridge connected to public DeFi.

Early enterprise chains were mostly internal experiments or marketing efforts. The next wave will be more inclined towards dedicated base layers built for specific verticals, with their validation layers open to regulated issuers and banks, while leveraging public chains for liquidity, collateral, and price discovery functions. This will further highlight the differences between neutral public L1s and vertically integrated enterprise-level L1s—the latter will integrate issuance, settlement, and distribution within a single enterprise tech stack. — Christopher Rosa (Research Analyst, Galaxy Research)

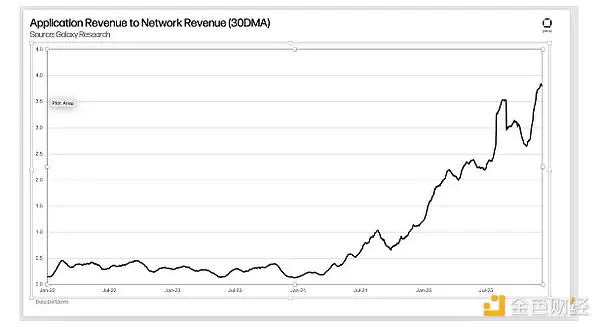

Prediction 6: The ratio of application revenue to network revenue will double in 2026.

As trading, DeFi, wallets, and emerging consumer applications continue to dominate on-chain fee generation, value capture is increasingly shifting from the base layer. Meanwhile, the network is structurally reducing the value lost through MEV and pushing for fee compression at both L1 and L2 levels, thereby shrinking the revenue base of the infrastructure layer. This will accelerate value capture at the application layer, allowing the "fat application theory" to continue to lead over the "fat protocol theory." — Lucas Tcheyan (Research Associate, Galaxy Research)

3. Stablecoins and Asset Tokenization

Prediction 7: The U.S. Securities and Exchange Commission (SEC) will provide some form of exemption relief to expand the use of tokenized securities in DeFi under its "innovation exemption" program.

The SEC will offer some form of exemption relief to promote the development of the on-chain tokenized securities market. This could take the form of a so-called "no-action letter" or under a new type of "innovation exemption"—a concept that SEC Chair Gary Gensler has mentioned multiple times. This move will allow legitimate, non-packaged on-chain securities to develop in the public blockchain's DeFi market, rather than just utilizing blockchain technology for backend capital market activities (as indicated by the recent no-action letter from the U.S. custodial trust and settlement company). The formal rule-making process will begin in the second half of 2026, aimed at drafting rules for brokers, dealers, exchanges, and other traditional market participants to use crypto assets or tokenized securities. — Alex Thorn (Head of Research, Galaxy Research)

Prediction 8: The SEC will face lawsuits from traditional market participants or industry organizations due to its innovation exemption policy.

Whether from trading firms, market infrastructure providers, or lobbying organizations, some participants in traditional finance or banking will challenge regulators—due to their provision of exemption treatment to DeFi applications or crypto companies in the expansion of tokenized securities-related rules, rather than advancing comprehensive rule-making. — Alex Thorn (Head of Research, Galaxy Research)

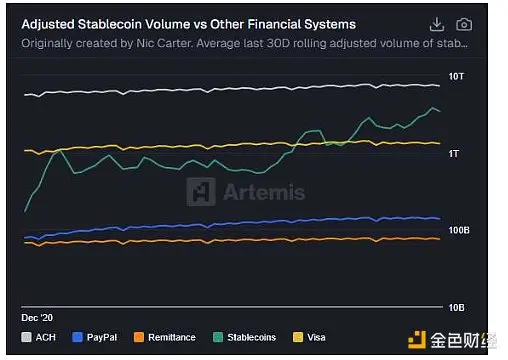

Prediction 9: Stablecoin transaction volume will surpass the Automated Clearing House (ACH).

Compared to traditional payment methods, the circulation speed of stablecoins has consistently remained significantly high. We have observed that the supply of stablecoins continues to grow at a compound annual growth rate of 30%-40%, with transaction volumes rising in tandem. Stablecoin transaction volumes have surpassed major credit card networks like Visa, currently processing about half the transaction volume of the ACH. With the details of the GENIUS Act expected to be clarified in early 2026, we are likely to see accelerated growth in stablecoins, surpassing their historical average compound annual growth rate—existing stablecoin scales continue to expand, and new participants will compete for the growing market share. — Thad Pinakiewicz (Vice President, Researcher, Galaxy Research)

Prediction 10: There will be consolidation of stablecoins working with traditional financial institutions.

Despite the emergence of many U.S. stablecoins in 2025, the market will struggle to support a large number of widely used options. Consumers and merchants will not use multiple digital dollars simultaneously; they will ultimately turn to one or two that have the broadest acceptance. We have seen this consolidation trend from the collaboration models of mainstream institutions: nine major banks—Goldman Sachs, Deutsche Bank, Bank of America, Santander, BNP Paribas, Citigroup, MUFG, TD Bank Group, and UBS—are exploring the issuance of stablecoins pegged to G7 currencies, while PayPal's joint launch of PYUSD with Paxos combines a global payment network with a regulated issuer. These cases indicate that success depends on distribution scale: the ability to access banks, payment processors, and enterprise platforms. More stablecoin issuers are expected to collaborate or integrate systems in the future to compete for meaningful market share. — Jianing Wu (Research Associate, Galaxy Research)

Prediction 11: A mainstream bank/broker will accept tokenized stocks as collateral.

Tokenized stocks are currently still on the fringes, mainly limited to DeFi experiments and private chain pilots led by large banks. However, core infrastructure providers in traditional finance are accelerating their migration to blockchain-based systems, and regulators are increasingly showing support. In the coming year, we are likely to see a mainstream bank or broker begin accepting on-chain tokenized stocks as deposits, treating them similarly to traditional securities processing. — Thad Pinakiewicz (Vice President, Researcher, Galaxy Research)

Prediction 12: Card networks will connect to public blockchain channels.

At least one of the top three global card networks will process over 10% of cross-border settlement volume through public chain stablecoins in 2026, although the vast majority of end users will not directly interact with a crypto interface. Issuers and acquirers will continue to display balances and debts in traditional formats, but in the background, a significant portion of net settlements between regional entities will be conducted using tokenized dollars to shorten cut-off times, reduce pre-funding requirements, and minimize correspondent bank risks. This advancement will position stablecoins as a core financial infrastructure of existing payment networks. — Christopher Rosa (Research Analyst, Galaxy Research)

4. DeFi

Prediction 13: By the end of 2026, decentralized exchanges will account for over 25% of total spot trading volume.

Although centralized exchanges (CEX) still dominate in terms of new user liquidity and deposit channels, several structural changes are driving an increasing amount of spot trading activity on-chain. The two most significant advantages of decentralized exchanges are the access routes that do not require KYC and a more cost-effective fee structure, both of which are generating growing appeal for users and market makers seeking lower friction and higher composability. Currently, decentralized exchanges account for approximately 15%-17% of spot trading volume, according to various data sources. — Will Owens (Research Analyst, Galaxy Research)

Prediction 14: DAO treasury assets worth over $500 million will be fully managed by a Futarchy governance mechanism.

Based on our prediction from a year ago—that prediction market governance mechanisms would gain broader adoption as a governance model—we believe this mechanism has now demonstrated sufficient practical effectiveness for decentralized autonomous organizations (DAOs) to begin using it as the sole decision-making system for capital allocation and strategic direction. Therefore, we expect that by the end of 2026, the self-managed funds of DAOs governed by prediction market mechanisms will exceed $500 million. Currently, approximately $47 million of DAO treasury funds are fully managed by this mechanism. We believe that growth will primarily come from newly established prediction market governance DAOs, but the expansion of existing such DAO treasury sizes will also play a role. — Zack Pokorny (Research Associate, Galaxy Research)

Prediction 15: The total outstanding loans based on cryptocurrencies (calculated at quarter-end snapshots) will exceed $90 billion.

Building on the growth momentum of 2025, the total outstanding loans for cryptocurrency staking in the DeFi and CeFi sectors will continue to expand in 2026. As institutional participants increasingly rely on DeFi protocols for lending activities, the on-chain dominance (i.e., the share of loans originating from decentralized platforms) will continue to rise. — Zack Pokorny (Research Associate, Galaxy Research)

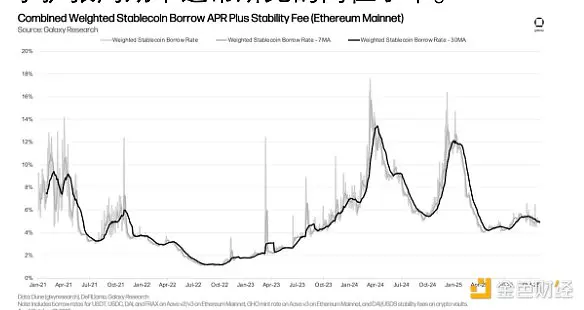

Prediction 16: Stablecoin interest rate fluctuations will remain moderate, with borrowing costs through DeFi applications not exceeding 10%.

As institutional participation in the on-chain lending market increases, we expect interest rate fluctuations to significantly decrease due to deeper liquidity and enhanced capital stickiness (lower turnover). At the same time, arbitrage operations between on-chain and off-chain interest rates are becoming increasingly convenient, while the barriers to accessing DeFi are rising. With off-chain interest rates expected to trend downward in 2026, even in a bull market environment, on-chain lending rates should remain low—off-chain rates will provide critical bottom support. The core logic is: (1) Institutional capital brings stability and sustainability to the DeFi market; (2) The downward off-chain interest rate environment will anchor on-chain rates, keeping them below the high levels typically seen during expansion cycles. — Zack Pokorny (Research Associate, Galaxy Research)

Prediction 17: By the end of 2026, the total market capitalization of privacy coins will exceed $100 billion.

Privacy coins gained significant market attention in Q4 2025. As investors leave more funds on-chain, on-chain privacy issues have become a focal point. Among the top three privacy coins, Zcash saw an approximately 800% increase that quarter, Railgun rose about 204%, and Monero achieved a more moderate 53% increase. Early Bitcoin developers, including the anonymous creator Satoshi Nakamoto, explored options for making transactions more private or even completely shielded, but practical zero-knowledge technology was not yet mature or widespread at that time. As more funds remain on-chain, users (especially institutions) are beginning to question whether they truly want to make their entire crypto asset balances fully public. Whether a fully shielded design or a mixing scheme ultimately prevails, we expect the total market capitalization of privacy coins to grow from the current estimated $63 billion on CoinMarketCap to over $100 billion. — Christopher Rosa (Research Analyst, Galaxy Research)

Prediction 18: Polymarket's weekly trading volume will continue to exceed $1.5 billion in 2026.

Prediction markets have become one of the fastest-growing categories in the cryptocurrency space, with Polymarket's weekly nominal trading volume nearing $1 billion. We expect that as new layers of capital efficiency deepen liquidity and AI-driven order flow increases trading frequency, this figure will continue to exceed $1.5 billion in 2026. Polymarket's continuously optimized distribution channels will also accelerate the influx of funds. — Will Owens (Research Analyst, Galaxy Research)

5. Traditional Finance

Prediction 19: The U.S. will launch over 50 spot altcoin ETFs, along with another 50 crypto asset ETFs (excluding single-asset products).

Following the SEC's approval of universal listing standards, we expect the pace of spot altcoin ETF listings to accelerate in 2026. In 2025, we have already seen over 15 spot ETFs based on Solana, XRP, Hedera, Dogecoin, Litecoin, and Chainlink come to market. We anticipate that the remaining major assets we have identified will also follow suit and submit their spot ETF applications. In addition to single-asset products, we also expect multi-asset crypto ETFs and leveraged crypto ETFs to be launched. Given that there are currently over 100 applications in the queue, we expect a continuous influx of new products in 2026. — Jianing Wu (Research Associate, Galaxy Research)

Prediction 20: Net inflows into U.S. spot crypto ETFs will exceed $50 billion.

With $23 billion in net inflows achieved in 2025, we expect this figure to accelerate in 2026 as institutional adoption deepens. As major integrated brokerages lift restrictions on investment advisors recommending such products, and large platforms (like Vanguard) that have previously taken a wait-and-see approach begin to include crypto funds, the inflow of funds from just Bitcoin and Ethereum ETFs into more investor portfolios should exceed 2025 levels. Additionally, the launch of a large number of new crypto ETFs, especially spot altcoin products, will unleash pent-up demand and drive incremental fund inflows, particularly in the early stages of distribution. — Jianing Wu (Research Associate, Galaxy Research)

Prediction 21: A mainstream asset allocation platform will include Bitcoin in its standard model portfolio.

After three of the four major integrated brokerages (Wells Fargo, Morgan Stanley, and Bank of America) lifted restrictions on investment advisors recommending Bitcoin and recognized a 1%-4% allocation, the next step is to include Bitcoin products in their recommended lists and enter formal research coverage, which will significantly enhance their clients' awareness of Bitcoin. The final step is to enter model portfolios, which typically require higher assets under management (AUM) and sustained liquidity, but we expect Bitcoin funds to cross these thresholds and enter model portfolios with a strategic weight of 1%-2%. — Jianing Wu (Research Associate, Galaxy Research)

Prediction 22: More than 15 crypto companies will conduct initial public offerings (IPOs) or uplist in the U.S.

In 2025, 10 crypto-related companies (including Galaxy) successfully completed IPOs or uplistings in the U.S. Since 2018, over 290 crypto and blockchain companies have completed private financing of over $50 million, and we believe that a significant portion of these companies are now in a position to seek listings in the U.S. to gain access to the U.S. capital markets, especially as the regulatory environment becomes more favorable. Among the most likely candidates, we expect CoinShares (if completed by the end of 2025), BitGo (which has submitted an application), Chainalysis, and FalconX to advance their IPO or uplisting processes in 2026. — Jianing Wu (Research Associate, Galaxy Research)

Prediction 23: Five or more digital asset treasury companies (DATs) will be forced to sell assets, be acquired, or shut down completely.

In the second quarter of 2025, we witnessed a surge in the establishment of Digital Asset Treasuries (DATs). Starting in October, their market price to net asset value multiples began to compress. As of the writing of this article, the average trading price-to-net asset ratio of Bitcoin, Ethereum, and Solana DATs has fallen below 1. After the initial wave of companies transforming into DATs to take advantage of favorable market financing conditions, the next phase will distinguish between DATs that possess sustainable competitiveness and those lacking clear strategies or asset management capabilities. To succeed in 2026, DATs will need a sound capital structure, innovative liquidity management and yield generation methods, as well as close collaboration with relevant protocols (if such relationships have not yet been established). Scale advantages (such as Strategy holding a large amount of Bitcoin) or jurisdictional positioning (like Japan's Metaplanet) may provide additional benefits. However, many DATs that rushed into the market during the initial hype lack substantial strategic planning. These DATs will struggle to maintain their price-to-net asset ratios and may therefore be forced to liquidate assets, be acquired by larger participants, or, in the worst-case scenario, shut down completely. — Jianing Wu (Research Associate, Galaxy Research)

6. Policy

Prediction 24: Some Democrats will use "de-banking" as a topic—potentially viewing cryptocurrency as a solution.

The likelihood of this prediction coming true is low, but consider the following context: In late November, the U.S. Financial Crimes Enforcement Network (FinCEN) urged financial institutions to "remain vigilant in monitoring, identifying, and reporting suspicious activities involving cross-border fund transfers related to illegal immigration." While FinCEN's alert emphasized risks such as human trafficking and drug smuggling, it also pointed out that the responsibility of money services businesses (MSBs) to submit suspicious activity reports (SARs) "includes cross-border fund transfers arising from illegal employment." This could involve remittances from undocumented plumbers, farm workers, or waitstaff—immigrant groups whose hiring practices violate federal law but garner sympathy from left-leaning voters. Prior to this alert, FinCEN had issued a geographic targeting order (GTO) earlier in the year requiring MSBs to automatically report cash transactions as low as $1,000 in designated border counties (far below the $10,000 threshold mandated by the Currency Transaction Reporting Act). These measures have expanded the range of everyday financial behaviors that could trigger federal reporting, increasing the likelihood that immigrants and low-wage workers will encounter fund freezes, denials, or other forms of financial exclusion. Therefore, this may lead some pro-immigrant Democrats to resonate more with the issue of "de-banking" (which has primarily been a concern of the right in recent years) and become more open to permissionless, censorship-resistant financial networks. Conversely, for the same reasons, populist, pro-bank Republicans emphasizing law and order may begin to adopt a negative stance toward cryptocurrency—despite strong support for the industry from the Trump administration and reform-minded factions within the Republican Party. The ongoing push by federal banking regulators to modernize the Bank Secrecy Act and anti-money laundering compliance requirements will only further highlight the inherent contradictions between the two major policy goals of financial inclusion and crime reduction—different political factions will prioritize these contradictions differently. If this political realignment comes to fruition, it will demonstrate that blockchain does not have a fixed political base. Its permissionless design means that acceptance or opposition to it is not based on ideology but rather depends on how it influences the political priorities of different groups at different times. — Marc Hochstein (Vice President, Editor, Galaxy Research)

Prediction 25: There will be federal investigations into insider trading or match-fixing behavior in prediction markets.

As U.S. regulators greenlight on-chain prediction markets, their trading volume and open interest have surged significantly. Meanwhile, several scandals involving alleged insider trading have emerged, along with federal raids targeting match-fixing rings in major sports leagues. Because traders can participate anonymously rather than through KYC-verified betting platforms, insiders now face a greater temptation to abuse privileged information or manipulate the market. Therefore, we are likely to see investigations triggered by abnormal price fluctuations in on-chain prediction markets, rather than traditional monitoring of regulated sports betting platforms. — Thad Pinakiewicz (Vice President, Researcher, Galaxy Research)

7. AI

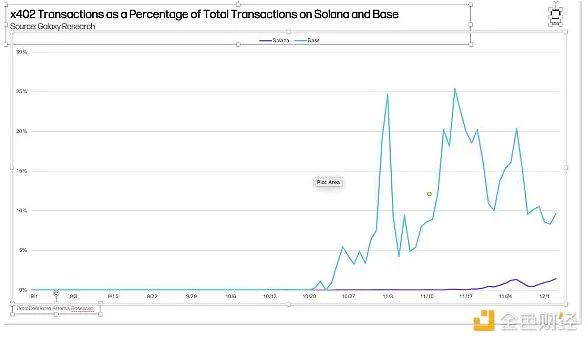

Prediction 26: Payments using the x402 standard will account for 30% of daily transactions on the Base chain and 5% of non-voting transactions on the Solana chain by 2026, marking a broader use of on-chain channels in agent interactions.

The enhancement of agent capabilities, the continued proliferation of stablecoins, and improvements in developer tools will open the door for x402 and other agent payment standards to drive a larger share of on-chain activity. As AI agents increasingly engage in autonomous trading across different services, standardized payment primitives will become a core component of the execution layer. Base and Solana have emerged as leading public chains in this vertical—Base benefiting from Coinbase's role in creating and promoting the x402 standard, while Solana boasts a large developer community and user base. Additionally, as agent-driven commercial activities grow, we expect emerging public chains focused on payments, such as Tempo and Arc, to also experience rapid growth. — Lucas Tcheyan (Research Associate, Galaxy Research)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。