Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Despite the unexpected drop in the U.S. November CPI year-on-year to 2.7% and core CPI to 2.6%, marking a new low since 2021 and igniting market expectations for a faster rate cut by the Federal Reserve, the reliability of the report has been widely questioned due to data collection disruptions caused by the government shutdown. The market is swaying amidst complex signals; on one hand, White House officials believe the Fed has "ample room for rate cuts"; on the other hand, the Bank of Japan raised its benchmark interest rate to 0.75%, a 30-year high, continuing to tighten global liquidity. In terms of regulation, the "CLARITY Act," aimed at clarifying rules in the crypto market, is expected to enter Senate review in January next year, bringing positive expectations for the industry. However, the financial market is facing the largest quarterly derivatives settlement in history, with approximately $7.1 trillion in risk exposure potentially exacerbating volatility. Against this backdrop, Wall Street analysts are cautious about the close of 2025, but institutions like Goldman Sachs remain optimistic about the long-term performance of assets like gold, predicting that gold could rise to $4,900 by 2026. Although the crypto market has the conditions for a bull market, it is showing weakness, possibly indicating structural issues, and the overall outlook is filled with uncertainty.

The Bitcoin market is in a fragile consolidation phase, oscillating between a support level of around $81,000 and a selling pressure zone at $93,000. Glassnode data shows that high supply pressure, increased loss realization, and weakened demand are limiting its upside potential, indicating that if Bitcoin falls below $81,300, it may trigger more sell-offs. The market faces multiple pressures: first, long-term holders are experiencing the most intense sell-off in over five years, as confirmed by analyst James Check; second, the upcoming options expiration on December 19 and 26 (with a nominal value of up to $23.8 billion) is also suppressing prices, with the "maximum pain" price for December 26 set at $100,000. Analysts' opinions are significantly divided; Killa points out through the USDT.D chart that the bear market may continue, targeting $74,000 and $68,000; however, Mayne believes the current trend is similar to the bottom in late April, potentially testing $80,000 in the short term; AlphaBTC anticipates a "Santa Claus rally" near $100,000; Astronomer has even begun to establish a bullish position with a target of $112,000. For the long-term trend in 2026, analyst "Far Mountain Insight" predicts that the most likely scenario is that BTC will oscillate and build a bottom in the range of $70,000 to $100,000, with a probability of 60%, believing that this year is a time for accumulating chips rather than pursuing excessive profits.

Ethereum's performance is also under pressure, with the price facing a test of the critical $2,800 support level after failing to break through the downward trend line. Analyst Ted points out that if this price level can be maintained, a rebound to $3,000 is possible; if it fails, it may further drop to $2,500. Daan Crypto Trades even believes that falling below $2,800 will open the path to the next major support area at $2,100. However, in stark contrast to the market's pessimism, institutions are still actively accumulating. Data shows that an address suspected to be Bitmine has purchased at least $229 million in ETH this week.

2. Key Data (as of December 19, 13:00 HKT)

(Data source: GMGN, CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $87,058 (Year-to-date -7.1%), daily spot trading volume $6.257 billion

Ethereum: $2,920 (Year-to-date -12.33%), daily spot trading volume $3.559 billion

Fear and Greed Index: 16 (Extreme Fear)

Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei

Market share: BTC 58.5%, ETH 12.4%

Upbit 24-hour trading volume ranking: XRP, BTC, ETH, SOL, DOGE

24-hour BTC long-short ratio: 49.93% / 50.07%

Sector performance: The crypto market continues to decline, the AI sector down over 5%, NFT sector down 2.2%

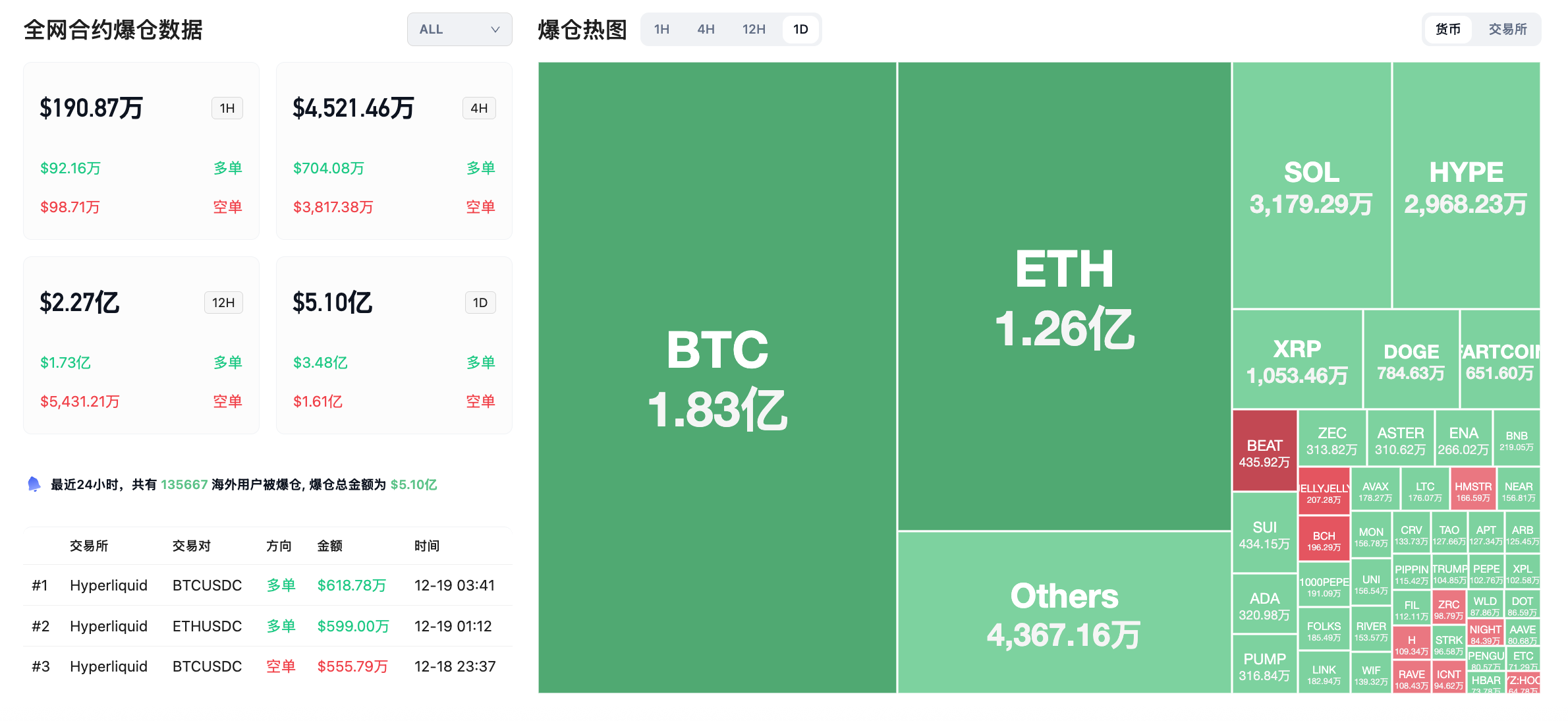

24-hour liquidation data: A total of 135,667 people were liquidated globally, with a total liquidation amount of $510 million, including $183 million in BTC liquidations, $126 million in ETH liquidations, and $31.79 million in SOL liquidations.

3. ETF Flows (as of December 18)

Bitcoin ETF: -$161 million, with only BlackRock's IBIT achieving net inflow

Ethereum ETF: -$96.616 million, continuing six days of net outflow

Solana ETF: +$13.16 million

XRP ETF: +$30.41 million

4. Today's Outlook

Binance will remove various spot trading pairs including AI/FDUSD, BICO/BTC on December 19

LayerZero community will initiate the third fee switch vote on December 20

LayerZero (ZRO) will unlock approximately 25.71 million tokens at 7 PM Beijing time on December 20, with a circulation ratio of 6.79%, valued at approximately $38.6 million;

Lista DAO (LISTA) will unlock approximately 33.44 million tokens at 5 PM Beijing time on December 20, with a circulation ratio of 6.85%, valued at approximately $5.5 million.

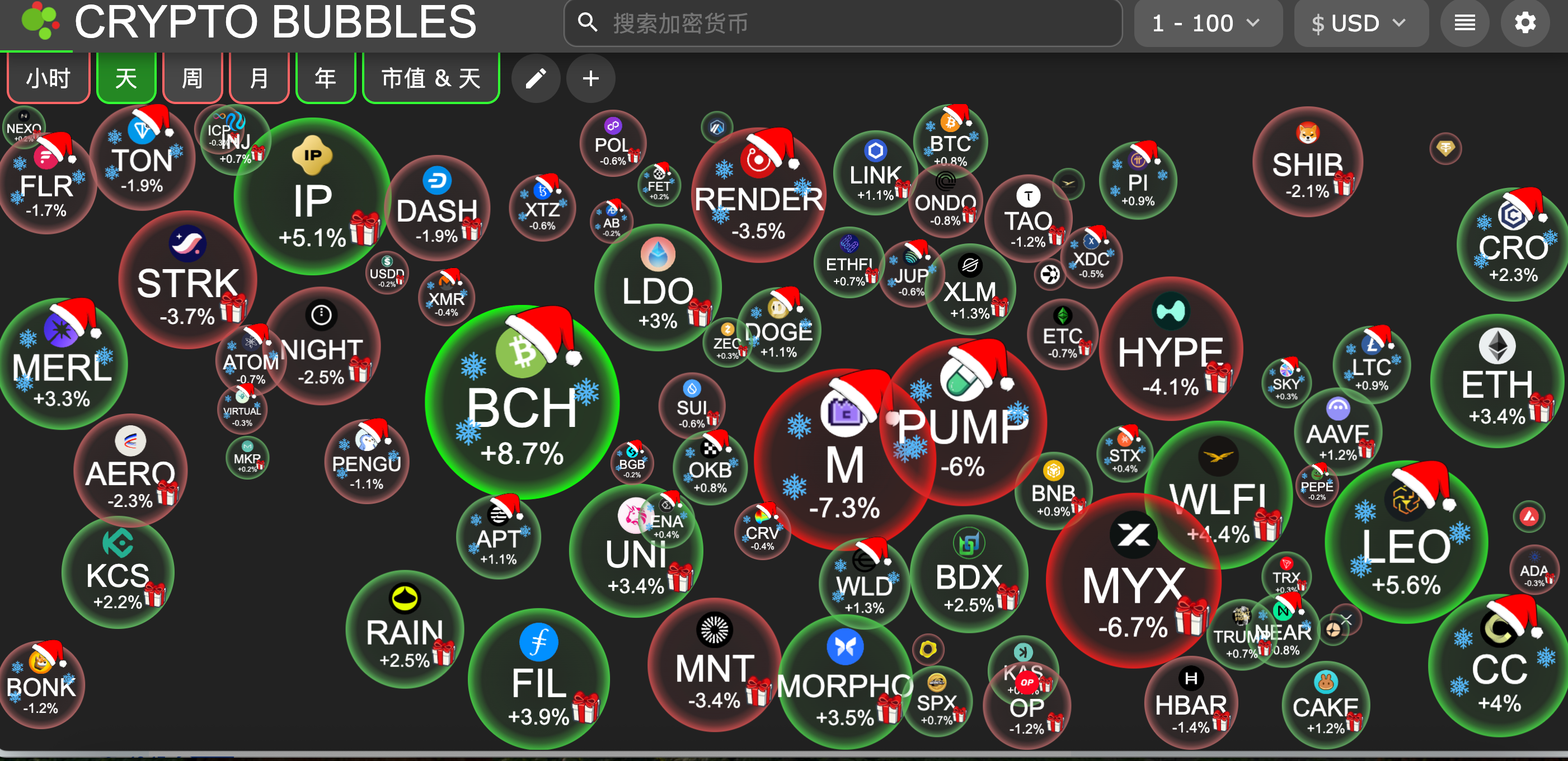

Today, the top gainers among the top 100 cryptocurrencies by market capitalization: Bitcoin Cash up 8.7%, LEO Token up 5.6%, Story up 5.1%, World Liberty Financial up 4.4%, Canton Network up 4%.

5. Hot News

Arthur Hayes: Maelstrom is aggressively bottom-fishing quality altcoins

Lido's new proposal suggests investing $60 million in 2026 to implement the GOOSE-3 plan

U.S. November unadjusted CPI year-on-year at 2.7%, core CPI year-on-year at 2.6%

Trump Media Technology Group's pre-market gains expand to 37.5%

Taiwan's Ministry of Justice announces the seizure of a total of 210.45 Bitcoins

JPMorgan deploys JPM Coin on the Base public chain, limited to transfers between whitelisted users

Uniswap submits the UNIfication proposal, planning to burn 100 million UNI

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。