"Institutional-level sales" and "community-first" sales models will both persist, but they will no longer compete with each other; instead, they will serve different market needs.

Author: Stacy Muur

Translation: Deep Tide TechFlow

In 2026, token sale analysis became one of the important pillars of my work. Last year, I launched the Muur Score—a framework for evaluating the pre-phase protocols of token generation events (TGE)—and published in-depth analyses of several major sales in 2025, including Flying Tulip, YieldBasis, Almanak, Lombard, and Falcon.

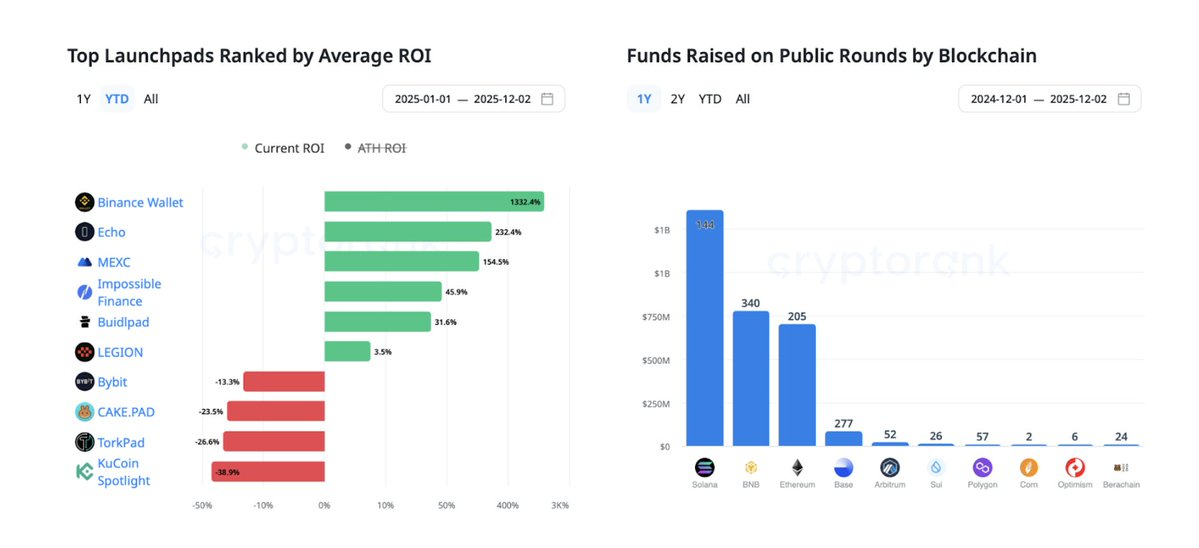

By mid-October 2025, the trends in token sales had become very clear. Issuances on @buidlpad, @echodotxyz, @legiondotcc, @MetaDAOProject, @BinanceWallet, @CoinList, and @MEXC_Official continued to perform strongly in terms of both participation and post-TGE return on investment (ROI). Although retail market attention has returned, it carries more of a "gambler" label rather than an "investor" identity.

In this report, I combined my firsthand research with predictions from the teams at @legiondotcc, @CoinList, @Chain_GPT, and @impossiblefi. The goal is clear: to describe the actual development direction of token sales in 2026, rather than pretending that everything will just "keep going up."

2026 Token Sale Predictions

1. Continuous Clearing Auctions (CCA) Move from Niche to Mainstream

Uniswap v4's CCA (Continuous Clearing Auctions), which gained significant attention through Aztec's $2.8 billion fully diluted valuation (FDV) public sale, has proven that on-chain transparent, non-custodial price discovery mechanisms can operate at scale. It is expected that 15-20 major projects will adopt similar mechanisms.

CCA directly addresses the following issues:

The recurring allegations of "manipulated allocations";

The black-box operations of offline order books;

Reputation issues like the FUD (fear, uncertainty, and doubt) triggered by Monad in the Coinbase sale.

The larger theme is: price discovery will shift from centralized exchanges to public infrastructure.

2. Exchange-integrated Launch Platforms Consolidate Market Share

The partnership between Kraken and Legion, along with Coinbase's $375 million acquisition of Echo, indicates the direction of market development. Binance, OKX, and Bybit are almost certain to be the next participants.

It is expected that:

60%-70% of top sales will occur simultaneously on both exchange-native platforms and independent launch platforms;

A two-tier system will form:

Tier A: Exchange-supported, high liquidity, institutional allocation;

Tier B: Independent platforms, pursuing community-driven sales.

This trend favors distribution but is not friendly to those wanting to run small launch platforms in their own garages.

"Recent M&A activity showcases a clear direction: more platforms will integrate token sales as part of broader user acquisition channels.

We will see an increase in the number of vertically integrated 'islands', but a more interesting development will be the rise of global distribution networks. Imagine a cross-regional ecosystem encompassing exchanges, partners, and channels.

For example, the collaboration between Legion + Kraken + our upcoming Asian centralized exchange (CEX) partner—providing a chain-agnostic, platform-neutral global-scale token distribution model—will become the norm."

——@matty_, Founder of Legion @legiondotcc

3. Capability-based Allocation Replaces First-Come, First-Served

The first-come, first-served (FCFS) model has effectively "died" as bot armies have completely destroyed its fairness.

Legion's capability scoring (participation, reputation, alignment of values) is becoming the industry template. Other platforms will also introduce the following mechanisms:

On-chain historical records;

Long-term participation data;

Social graph scoring.

While this somewhat reduces the issue of Sybil attacks, it also brings new risks: systems similar to "crypto credit scoring" will reward early adopters while putting newcomers at a disadvantage.

Fairer, but absolutely not equal.

"By 2026, the token sale market will polarize around two dominant models: fully compliant professional launch platforms and permissionless 'meme' launch platforms. Platforms that are medium-sized and vaguely positioned will struggle, as distribution capability will become a key competitive advantage—project teams will choose those that can reliably bring real users, liquidity, and secondary market support."

——@0xr100, Chief Marketing Officer of Impossible Finance @impossiblefi

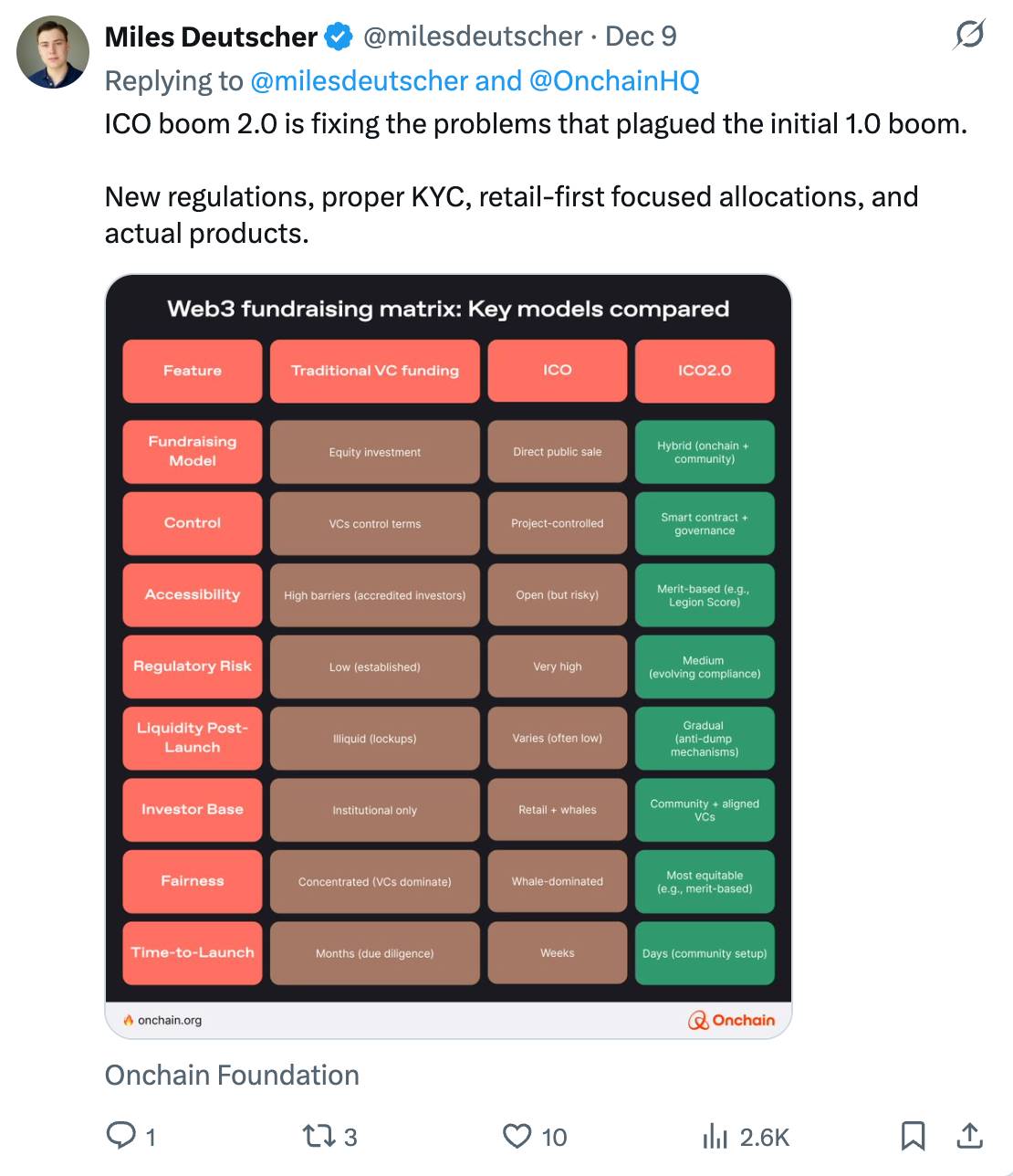

4. Institutional Allocations Will Become the Standardized Model

As traditional finance further delves into the tokenization space, it is expected that institutional allocation mechanisms will be formally introduced into the structure of token sales, including:

20%-30% allocation;

12-24 month lock-up periods;

Structured book-building processes.

This can be seen as a "lightweight version of an IPO on-chain."

Platforms like Legion are already positioning themselves as underwriters in the crypto industry, and 2026 will make this positioning the industry norm.

"We will see further deepening of integration between launch platforms and centralized exchanges (CEX), with specialized launch platforms evolving into modular infrastructure providers, offering KYC (identity verification), audited sale contracts, and embeddable sale widgets for project teams to host on their own websites. At the same time, on-chain and social data-based anti-Sybil attack filters will become standard, and lockdrop distribution will continue to gain more attention as a core distribution mechanism."**

——@0xr100, Chief Marketing Officer of Impossible Finance @impossiblefi

5. Multi-platform Issuance Becomes the Norm for Top Projects

WalletConnect raised $10 million simultaneously through CoinList, Bitget Launch X, and Echo, setting a benchmark for multi-platform issuance. For large projects:

Issuing simultaneously on 3-5 platforms will become standard;

Distribution efficiency will improve;

Risk concentration will decrease;

Coordination difficulty will increase (but this is a problem for the project team, not yours).

"I believe project teams will increasingly choose different issuance platforms based on varying needs and will generally collaborate with multiple platforms simultaneously. This is definitely not a 'no Coinbase, no deal' situation. The revival of ICOs began long before Coinbase entered the space, which is also why they decided to get involved."

——@AlexTops1, Marketing Director of CoinList

Projects that refuse multi-platform issuance will appear either underfunded or overly centralized.

"We are moving from isolated one-time issuances to coordinated multi-platform financing. Launch platforms will collaborate more frequently with centralized exchanges (CEX), and the market will differentiate into two clear categories:

Institutional sales, larger amounts, longer lock-up periods, and strict compliance requirements;

Community-first sales, smaller amounts, capability-based access mechanisms, and usage-driven scoring systems.

Buyers will also begin to demand standardized safeguards: minimum liquidity and market maker commitments, clearer retail lock-up mechanisms, and even refund or recourse clauses in case results fall significantly short of expectations. Less of 'just list it and pray for success', more structured financing that is reasonable for both project teams and buyers—not just based on gut feeling, but backed by evidence."**

——@CEOGuy, CEO and Founder of Chain_GPT

6. Compliance Becomes a Competitive Barrier

The structure launched by Legion that complies with MiCA (EU's Markets in Crypto-Assets Regulation) and ongoing discussions with the U.S. Securities and Exchange Commission (SEC) mark a shift in the industry:

Compliance is no longer an optional "signal," but a business model.

The following trends are expected to emerge:

"Compliance-first" launch platforms will emerge;

Comprehensive KYC (Know Your Customer) and AML (Anti-Money Laundering) will become basic requirements;

Exchanges will adopt a zero-tolerance attitude towards non-compliant sales;

Demand for zero-knowledge proof (ZK) identity technologies will rise (finally, there are practical use cases beyond "anonymous Discord users proving they are human").

Projects issued on non-compliant platforms will face faster delisting risks and reduced institutional demand.

"To date, most crypto financing has been limited to native digital assets—such as fuel tokens, utility tokens, and those designed to avoid being classified as securities.

With the SEC working group expected to launch 'innovation exemptions', 'crypto projects', and possibly the Clarity Act in early 2026, we will see new asset classes attempting on-chain distribution.

This includes early forms of tokenized equity at the startup stage."

——@matty_, Founder of Legion @legiondotcc

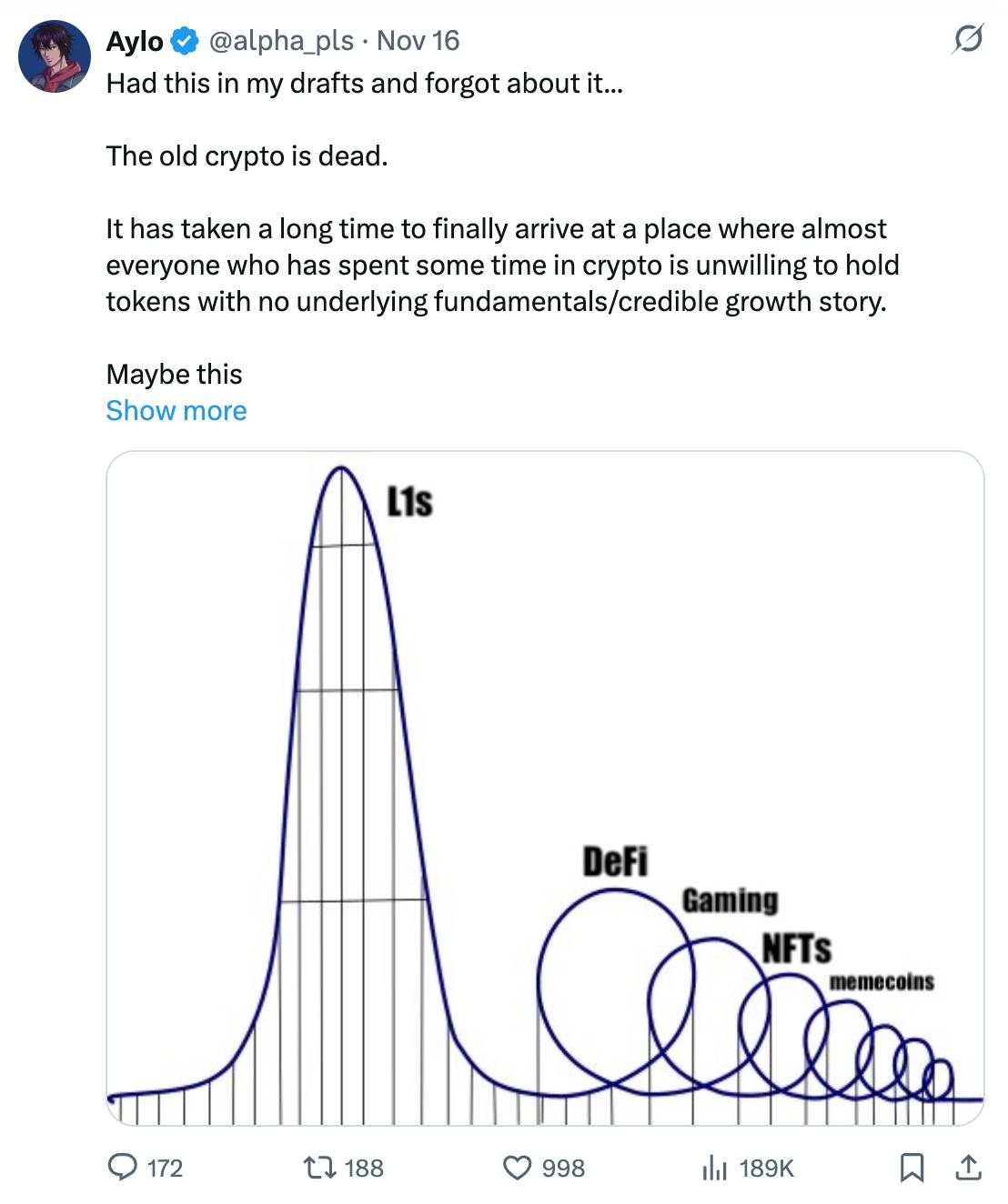

7. Bear Market Pressure Drives "Quality Over Quantity"

The market performance at the end of 2025 brought:

Strong bearish sentiment;

Approximately $4 billion in ETF outflows;

Decreased liquidity of mainstream tokens.

If this trend continues into 2026, we will see:

The number of token issuances drop from 500+ to 150-200;

Average financing scale increase by 3-5 times;

Low-quality, meme-driven sales disappear;

Infrastructure and projects with real products dominate.

This is a typical cycle of "migration to quality assets"—fewer winners, but larger in scale.

"Both extremes of 2025 failed.

On one hand, there were projects with high FDV (fully diluted valuation) and high financing amounts, but their underlying products could not support these valuations—the market immediately corrected them after the TGE.

On the other hand, there were low FDV projects that lacked liquidity, had poor market-making capabilities, and weak exchange support—crashing for completely opposite reasons.

In 2026, we will shift from rough issuances to carefully designed ones. Serious buyers will focus on the fundamentals that truly determine outcomes: the match between FDV and progress, real user adoption rates, liquidity depth, market maker quality, and platform reliability. Quality projects will still be able to raise substantial funds, but they will not attempt to drain the entire funding pool on the first day.

Launch platforms and CEX will compete on downside protection, minimum liquidity standards, clear market-making commitments, and simple security or refund mechanisms—not just relying on hype."

——@CEOGuy, CEO and Founder of Chain_GPT

8. Dynamic Pricing Replaces Fixed FDV (Fully Diluted Valuation)

The success of Continuous Clearing Auctions (CCA) has reignited market interest in fairer pricing. It is expected that:

Dutch auctions with soft floor prices will emerge;

Bonding curves with circuit breakers will be introduced;

Demand pricing driven by machine learning/AI systems will be implemented.

"The era of 'This is our $4 billion FDV, please applaud' is over.

Fixed valuations will be replaced by price ranges—while this reduces post-TGE sell-off pressure, it also diminishes retail excitement (after all, no one will brag about their auction closing price at a party).

"ICOs are no longer just a means of financing.

They are a way for projects to attract new users, expand awareness, and achieve network decentralization.

If buyers of the Coinbase ICO never left the platform or sold their tokens the next day, how much real value did that create for the project?

As demonstrated by Aztec's highly successful token sale, many teams hope these users will enter their applications and want their token sale mechanisms and distribution to be fully decentralized on-chain.

The market is shifting towards verifiable on-chain finance, where users hold their own private keys. CoinList is meeting this demand by becoming more crypto-native and closer to users. The ideals of cypherpunks are returning. It's time."

——@AlexTops1, Marketing Director of @CoinList

9. Post-Issuance Liquidity Guarantees Become Industry Standards

After the FUD (fear, uncertainty, and doubt) incident triggered by Monad's false trading, platforms realized that no matter how good the issuance mechanism is, it is useless if post-issuance liquidity collapses.

By 2026, the following trends are expected:

Mandatory 6 to 12-month market-making commitments;

Platforms providing standardized liquidity service level agreements (SLAs);

New post-TGE stability metrics.

Projects without professional liquidity providers will struggle to raise funds.

Today, retail investors' focus on liquidity guarantees has surpassed their interest in token code (this change is welcome).

10. Community Lockups Replace Instant Unlocks

Coinbase's "early sell → future penalties" model is evolving into:

3-6 month lock-up periods for retail investors;

Unlock curves similar to team/seed rounds;

Transferable "lock-up rights" (yes, a whole new secondary market will quickly emerge).

This model reduces sell-off pressure but also brings the risk of "lock-up fatigue"—the market may see a large number of poorly priced lock-up assets.

It is expected that by the end of 2026, about half of issuances will adopt community lock-up models.

Market Structure Impact

Token sales will split into two major ecosystems:

1. Institutional-Level Sales

Multi-platform issuance, integrating exchanges;

Financing scale over $50 million;

Highly compliant;

12-24 month lock-up periods;

Professional market-making services.

2. Community-First Sales

Single platform + capability-based scoring;

Financing scale between $5 million and $20 million;

Partially compliant;

3-6 month lock-up periods;

Social graph-based participation mechanisms.

Both models will persist, but they will no longer compete with each other; instead, they will serve different market needs.

Key Risks to Watch

Regulatory actions against non-compliant platforms may lead to market fragmentation;

A prolonged bear market may shrink all forecasts by about 50%;

Over-concentration on Coinbase and Kraken may weaken market competition;

Lock-up overload may lead to chaos in the gray market for lock-up rights.

What Token Sale Experts Are Saying?

Which protocols can raise funds most effectively?

@matty_, Founder of Legion @legiondotcc: Revenue-related consumer applications and B2B tokens will continue to perform well.

"We will see the current performance trends further amplified.

Consumer DeFi and applications that users genuinely like—especially those with clear revenue paths or buyback logic, even if smaller in scale—will continue to lead the market.

In the institutional space, B2B tokens (which can bring actual revenue streams to token holders) will remain one of the strongest performing categories."

@CEOGuy, CEO of @Chain_GPT: Fundamentals will become more important.

"Projects that can effectively raise funds are those that look like real business models, not just stories packaged in tokens.

This boils down to three points:

Real users and use cases, not just testnets and a business plan;

Clear product differentiation that can significantly outperform existing alternatives;

Coherent token utility with obvious and credible value capture capabilities.

Combined with reasonable FDV, clear sales structures, and the founding team's real track record in big tech companies or previous crypto projects—even in a cold market, funds will not trickle in slowly but will rush into the financing round."

@0xr100, Chief Marketing Officer of Impossible Finance @impossiblefi: High-growth projects and infrastructure solutions will dominate financing.

"It will be those applications with clear growth data (revenue, real users, meaningful TVL) and real distribution capabilities that stand out—not just the 'top VCs' label, but those that can drive adoption.

Infrastructure will still be a strong financing category, but applications with real users and revenue will increasingly surpass projects that rely solely on narratives.

The hot combination will be 'hot narratives + infrastructure angles', covering areas like prediction markets, artificial intelligence (especially robotics), and RWA (real-world assets), typically presented in forms of lockdrop and data-driven distribution."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。