On December 2nd, Dubai time, the "Integration, Growth, and New Crypto Cycle" themed forum, co-hosted by RootData in collaboration with ChainCatcher and Klickl, and jointly sponsored by UXLINK, USDD, 0G, Olaxbt, Oops Panda, Tron, Sunpump, Tencent Cloud, and others, successfully concluded.

At the event, global industry leaders, investment institutions, and opinion leaders, including Bill Qian, co-founder of Cypher Capital, Fisher Yu, co-founder of Babylon Labs, Michael Zhao, founder of Klickl Group, Dermot Mayes, CEO of Klickl International, Jeff, CEO of Solayer, JT Song, head of 0G Asia-Pacific, Jason Chan, founder of Olaxbt, Yvonne Chia, communications director of USDD, Emma, COO of Oops Panda, and Ye Wang, chief product manager of RootData, gathered to discuss the future landscape of the new crypto cycle.

Additionally, RootData officially launched the industry's first multidimensional real-time exchange ranking on-site, using "information transparency" as the core evaluation dimension, establishing disclosure standards covering seven dimensions, including token unlocking, project events, and team information. This system aims to transform transparency into quantifiable competitive indicators, promoting exchanges to improve information disclosure within a compliance framework. RootData stated that it will work with exchanges to enhance project information disclosure mechanisms, helping investors make rational decisions and effectively extend the investment lifecycle of crypto retail investors.

1. Highlights Review

Opening Insight: The Next Generation Currency Operating System

The forum kicked off with a presentation from Klickl. Michael Zhao, founder of Klickl Group, and Dermot Mayes, CEO of Klickl International, delivered keynote speeches, systematically elaborating on Klickl's deep judgment on the future evolution of the global financial system and proposing their overall vision of a "Currency Operating System for Future Money," providing a framework for the next stage of digital financial infrastructure development.

Michael Zhao pointed out that the core contradiction of today's global financial system has evolved from localized efficiency issues to structural imbalances. He emphasized, "Future financial upgrades will no longer be about localized optimization or single-point innovation, but rather about moving towards a unified, regulatory-compliant, programmable integrated infrastructure. Only in this way can traditional finance and Web3 truly achieve integration."

Klickl International CEO Dermot Mayes further noted from the perspective of Middle Eastern business practices that the core competitiveness of digital finance is shifting from technological advantages to the maturity of regulatory systems. "Regulation-Native" will become the basic standard for future financial infrastructure—structures need to be inherently adaptable to the regulatory logic of different jurisdictions rather than being supplemented afterward.

Navigating Cycles: Three Core Investment Principles

Subsequently, Bill Qian, co-founder and managing partner of Cypher Capital, delivered a keynote speech titled "No Matter the Cycle, What Matters Always." He systematically outlined three core investment principles that he believes are applicable in various market environments:

Focus on the Leaders: Investment returns follow a power law distribution rather than a normal distribution. He cited data indicating that 72 companies contributed to 50% of the total value of 28,114 listed companies; in the crypto market, 63% of historical total market value is contributed by leading assets. Therefore, investors should strive to identify and hold potential "leading winners" for the long term.

Embrace Rotation: The market's "Alpha" (excess returns) will rotate among different sectors and will not permanently stay in any specific track. Investors need to maintain a diversified portfolio and an open mindset to capture emerging opportunities in different cycles.

Leverage Volatility: Volatility is an inevitable cost and entry opportunity for achieving long-term high returns; Buffett himself experienced five drawdowns of over 30% in his lifetime. For long-term investors, market declines should not be viewed as risks but as strategic opportunities to accumulate quality assets at better prices.

Unlocking Potential: The Key to Bitcoin DeFi Breakthrough

Fisher Yu, co-founder of Babylon Labs, delivered a presentation on "The Future of Bitcoin DeFi," analyzing the current bottlenecks and solutions. He pointed out that the DeFi market craves Bitcoin liquidity, but less than 1% of Bitcoin participates through cross-chain bridges, primarily because users must trust centralized custodians. He emphasized that the key to breaking through lies in achieving trustless participation of native Bitcoin.

To this end, Babylon proposed a "Trustless Bitcoin Vault" solution based on technologies like BitVM. This solution allows Bitcoin holders to use native BTC as collateral without transferring asset custody, directly accessing mainstream DeFi protocols like Aave and Morpho on Ethereum and other chains for lending and other operations, thereby unlocking the financial utility of Bitcoin without introducing trust risks.

Fisher Yu envisions that such infrastructure will give rise to a series of innovative products, including Bitcoin collateralized lending, derivatives trading, and stablecoins, aiming to activate billions of dollars of Bitcoin into DeFi and build a truly "Bitcoin-powered crypto economy."

Roundtable Discussion: Exploring Future Industry Trends Together

In the roundtable discussion themed "Crypto: Next Big Things," hosted by Ye Wang, chief product manager of RootData, participants included Jeff, CEO of Solayer, JT Song, head of 0G Asia-Pacific, Jason Chan, founder of Olaxbt, and Emma, COO of Oops Panda. The guests engaged in a forward-looking in-depth dialogue from diverse perspectives, discussing key tracks and innovative opportunities that may emerge in the next cycle, covering Layer 2 expansion, modular blockchains, emerging asset forms, and community development.

Stablecoin Evolution: Exploring the Fusion of Yield and Stability

Yvonne Chia, communications director of USDD, delivered a speech on the topic of "Is Yield-Generating Stablecoin Truly Possible?" systematically outlining the realization path of yield-generating stablecoins.

In her speech, she pointed out that traditional stablecoins have long faced the contradiction of "yield and stability cannot coexist." USDD makes it possible for stablecoins to be both stable and yield-generating by building stable yield sources, expanding application scenarios, flexible infrastructure, and full-chain transparency. The sUSDD supports a dual yield mechanism of "holding yield + liquidity provision," and will integrate various scenarios such as lending in the future to continuously expand yield boundaries.

At the infrastructure level, USDD has completed the protocol upgrade from 1.0 to 2.0, allowing users to mint autonomously through CDP and introducing a pegged stability module (PSM) to enhance volatility resistance. Additionally, through full-chain financial transparency, third-party audits, and real-time data dashboards, a verifiable trust system for users is established.

RootData Initiative: Reshaping the Foundation of Trust with Transparency

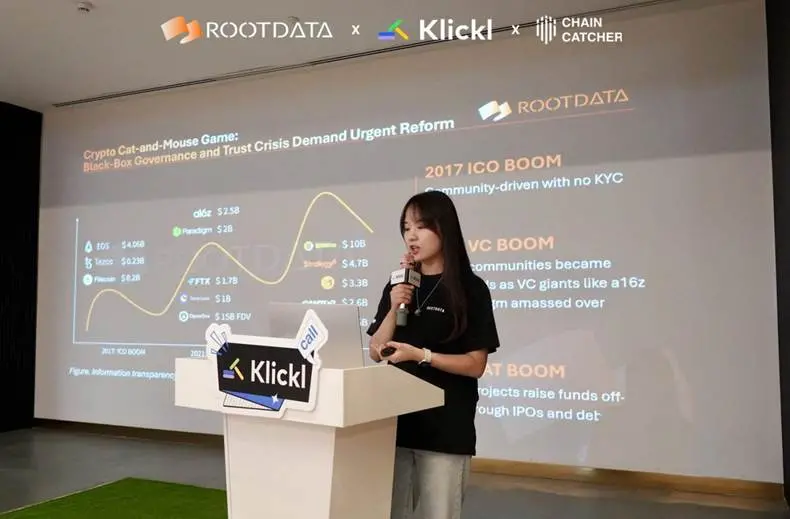

After the roundtable discussion, Ye Wang, chief product manager of RootData, released the "2025 Cryptocurrency Industry Transparency Insight Report" and announced the official launch of the industry's first multidimensional real-time exchange ranking by RootData. The report pointed out that the cryptocurrency industry is facing a systemic trust crisis caused by "information black boxes," and establishing a quantifiable, verifiable transparency system is key to the industry's standardization and maturity.

Ye Wang analyzed that the issue of industry transparency has evolved from the information asymmetry of the ICO era to the current new contradiction of disconnection between off-chain financing and on-chain data. Especially in the token economy, the "dull knife cutting meat" style of continuous unlocking and opaque selling has suppressed asset value and market confidence.

To address this, RootData's new ranking will use "information transparency" as the core evaluation dimension, establishing disclosure standards covering seven dimensions, including token unlocking, project events, and team information. The aim is to break the inertia of "volume-only" ratings, transforming transparency into quantifiable competitive indicators, promoting exchanges to improve information disclosure within a compliance framework, and ultimately helping investors make rational decisions and effectively extend their investment lifecycle.

2. Free Exchange: Ideas Collide, Atmosphere is Lively

The final segment of the event was a free exchange. Attendees and the audience continued to discuss in a relaxed atmosphere, engaging in more direct and in-depth exchanges and idea collisions regarding industry pain points, innovative solutions, and future trends touched upon in the speeches. The on-site interaction was frequent, and the atmosphere was lively, bringing a vibrant conclusion to this rich forum.

This forum not only gathered cutting-edge thoughts across dimensions such as investment, infrastructure, data services, and asset issuance but also clearly conveyed a consensus: transparency, compliance innovation, and user-centered trust building will be the core cornerstones leading the crypto industry through cycles and achieving sustainable growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。