The bear market is the opportunity for the poor to turn their fortunes around.

Author: Deep Tide TechFlow

In the early hours of February 6, when Bitcoin fell below $60,000, the entire crypto community fell into panic. From the historical high of $126,000 in October 2025, Bitcoin has already dropped by 52%.

But if you look at Bitcoin's 15-year price history, you'll find a harsh reality: a 52% drop can only be considered "a drizzle" in history.

The "Drop Code" of Bitcoin Bear Markets

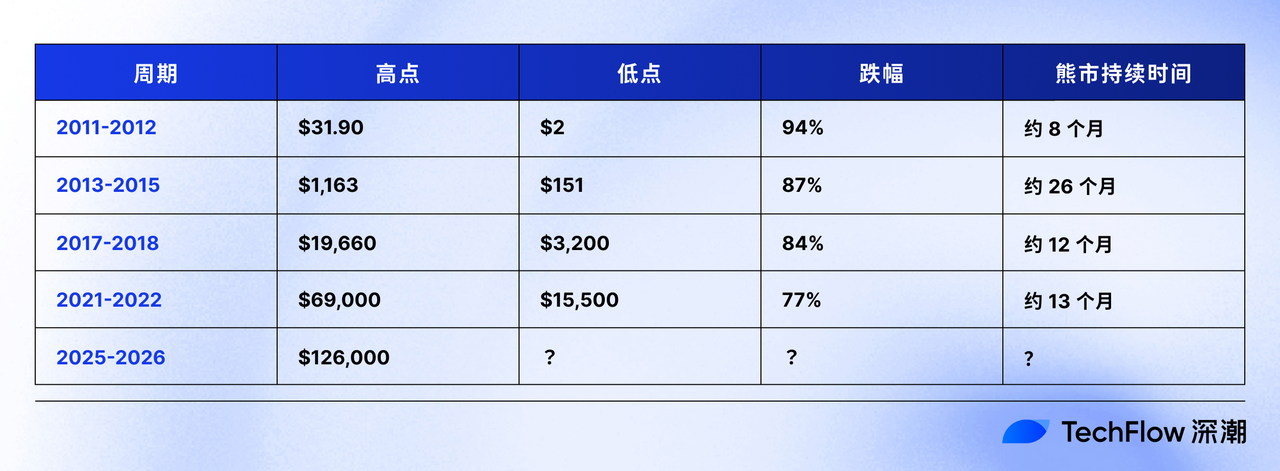

Let's first look at a set of data:

This table reveals a clear pattern: the maximum drop in each bear market is decreasing.

From 94% to 87%, then to 84% and 77%, Bitcoin's "bear market standard" is narrowing by 5-10 percentage points each cycle.

Looking more precisely at this decreasing pattern:

- 2011→2013: Decrease of 7 percentage points (94%→87%)

- 2013→2017: Decrease of 3 percentage points (87%→84%)

- 2017→2021: Decrease of 7 percentage points (84%→77%)

On average, each cycle decreases by about 5-7 percentage points.

Why?

The market capitalization base is growing, and volatility naturally decreases.

In 2011, Bitcoin's market cap was only a few tens of millions of dollars, and a single "whale" sell-off could cause a 94% price crash.

By 2026, even if Bitcoin halves from its peak to $60,000, its market cap still exceeds $1 trillion. To make a trillion-dollar asset drop another 30-40%, the required sell-off volume is thousands of times that of 2011.

Institutional entry provides a "liquidity buffer."

Before 2018, Bitcoin holders were mainly retail investors and early miners. Once panic set in, everyone would stampede, with no "buyers" to catch the fall.

After 2022, institutions like BlackRock, Fidelity, and Grayscale held hundreds of thousands of Bitcoins through ETFs. These institutions are unlikely to panic sell due to a single crash; their presence acts as a "safety net" in the market.

According to Bloomberg data, as of the end of January 2026, the total holdings of U.S. Bitcoin spot ETFs exceeded 900,000 BTC, worth over $7 billion. The "locking effect" of these holdings directly reduces the market's sellable supply.

Bitcoin is evolving from a "speculative asset" to an "asset class."

From 2011 to 2013, Bitcoin was still a toy for geeks, with prices driven entirely by emotions.

From 2017 to 2021, Bitcoin began to be viewed as "digital gold," but still lacked a clear valuation anchor.

After 2025, with the approval of Bitcoin ETFs, the GENIUS Act promoting stablecoin legislation, and Trump's proposed "strategic reserve" plan, regardless of whether these policies are truly implemented, Bitcoin has transitioned from a "marginal asset" to "part of the mainstream financial system."

This evolution results in reduced volatility.

The supply shock from halving cycles is weakening.

In the past, Bitcoin's price was mainly influenced by the four-year halving cycle, where the new supply decreased by 50% every four years.

During the first halving in 2012, daily new output dropped from 7,200 to 3,600, causing a massive supply shock.

After the fourth halving in 2024, daily new output will drop from 900 to 450. Although the percentage is the same, the absolute reduction is much smaller, and its impact on the market is decreasing.

The "deflationary effect" on the supply side is weakening, and the "speculative frenzy" on the demand side is cooling, both contributing to reduced volatility.

If history repeats itself, where is the "bottom" this time?

Based on the historical pattern of "each cycle decreasing," we can project three scenarios:

Scenario 1: Optimistic assumption, drop narrows to 65%

If the maximum drop in this cycle is 65% (12 percentage points lower than the last cycle's 77%, slightly above the historical average decrease):

Bottom price = 126,000 × (1 - 65%) = $44,100

From $60,000 to $44,100, there is still 26% of downside potential.

Supporting reasons:

Institutional holdings are at an all-time high, and ETFs provide strong "buy support."

Although the Federal Reserve is hawkish, the market has moved the interest rate cut expectations from July to June 2026.

Trump's cryptocurrency summit at the White House on March 7 may release favorable policies.

Although stablecoins are experiencing negative growth, the TVL (Total Value Locked) remains stable at over $23 billion.

Risk factors:

High-leverage holders like Strategy may trigger a chain reaction if forced to sell.

Trump's "strategic reserve" promise has yet to be fulfilled, and the market may lose patience.

If you believe in this scenario: You should start accumulating in batches below $50,000, and increase your position around $45,000.

Scenario 2: Neutral assumption - drop of 70-72%

If the maximum drop in this cycle is 70-72% (strictly following the historical pattern of "decreasing by 5-7 percentage points"):

Bottom price (70%) = 126,000 × (1 - 70%) = $37,800

Bottom price (72%) = 126,000 × (1 - 72%) = $35,280

From $60,000 to $35,000-$37,800, there is still 37-41% of downside potential.

Supporting reasons:

Perfectly aligns with historical patterns, neither overly optimistic nor overly pessimistic.

The current macro environment (interest rate cut expectations + concerns about balance sheet reduction) is complex, comparable to 2018.

$35,000-$38,000 corresponds to Bitcoin's "200-week moving average," which has historically been a strong support level.

Risk factors:

If the U.S. economy falls into recession, all risk assets will face indiscriminate selling.

If the AI bubble bursts, a tech stock crash could drag Bitcoin down.

If you believe in this scenario: You should keep most of your capital for below $40,000, with $35,000-$45,000 being your "heavy buying range."

Scenario 3: Pessimistic assumption - drop returns to 75-80%

If this time "really is different," and a structural collapse in the market leads to a drop returning to the average level of 2017-2022:

Bottom price (75%) = 126,000 × (1 - 75%) = $31,500

Bottom price (80%) = 126,000 × (1 - 80%) = $25,200

From the current $70,000 to $25,000-$31,500, it would be a 50% slaughter.

Supporting reasons:

The "triple kill" on February 6 (U.S. stocks, gold, and Bitcoin all plummeting simultaneously) shows that Bitcoin's "safe-haven attribute" has completely collapsed.

Although ETFs have absorbed a large amount of chips, it also means institutions can "sell at the push of a button."

Trump's tariff policies have triggered a global trade war, potentially leading to a worldwide recession.

The loss of talent in the crypto industry and the exit of VCs (such as Multicoin co-founder Kyle Samani announcing his departure) indicate a collapse of confidence in the industry.

If you believe in this scenario: You should liquidate your position now and wait for a complete crash below $30,000, or only keep 10-20% of your position as a "gamble," withdrawing the rest to observe.

Don't be afraid of missing out

Some people always worry about what to do if they miss the buying opportunity at the bottom of this bear market.

The answer is simple: chase the rise or wait for the next cycle.

Cryptocurrency is not the only opportunity for you to turn your life around. If you think it is, you have already lost.

In 2015, those who missed buying at $150 still had a chance at $3,200 in 2018.

In 2018, those who missed buying at $3,200 still had a chance at $15,000 in 2022.

But the premise is: you have to live to the next cycle.

Don't completely leave this market just because of one failed all-in bet.

Moreover, most people only care about "at what price to buy," but overlook "when to sell."

Here are three cases:

Case 1:

Old Zhang heavily bought Bitcoin at $3,200 in December 2018. By June 2019, Bitcoin rose to $13,000, and Old Zhang thought "the bull market has arrived," so he didn't sell. By December 2019, Bitcoin fell back to $7,000, and Old Zhang thought "it's over," so he cut his losses and exited.

The final outcome: profit of less than 1x, and he was washed out, missing the $69,000 peak in 2021.

Case 2:

Little Li also bought in at $3,200, but he set a rule for himself: "I won't sell until it reaches $50,000." He remained unaffected by all fluctuations from 2019 to 2020. In April 2021, when Bitcoin reached $63,000, Little Li sold 50%, locking in a 15x profit. He held the remaining 50% until the $69,000 peak in November 2021, ultimately selling.

Outcome: average profit of 18x.

Case 3:

Old Wang started dollar-cost averaging $1,000 every month from December 2018, regardless of price fluctuations. He persisted for 3 years and stopped in December 2021.

His average cost was about $12,000 (because he bought cheaply in the early stages and more expensively later). When Bitcoin was at $69,000 in November 2021, he sold everything, making a profit of about 4.7x.

Outcome: although not as good as Little Li, he didn't need to "time the market," making it the simplest execution.

These three cases tell us that catching the bottom is not important; holding on is what matters.

If you don't have the mindset of holding Bitcoin for life from the start, then setting a "profit-taking plan" in advance is essential. Dollar-cost averaging, while not glamorous, is the most suitable method for ordinary people. The vast majority cannot buy at the bottom and sell at the top; buying and selling in batches is always a relatively better approach.

In conclusion: The bear market is the opportunity for the poor to turn their fortunes around

In 2011, those who bought Bitcoin at $2 have now achieved a 30,000x return (even when calculated at the recent bottom of $60,000).

In 2015, those who bought at $150 now have a 400x return.

In 2018, those who bought at $3,200 now have an 18.75x return.

In 2022, those who bought at $15,000 now have a 4x return.

Every bear market is a redistribution of wealth.

Those who chased prices at the highs were washed out during the bear market; those who panic sold at the lows handed their chips to others.

And the ones who truly make money are always those who dare to accumulate in batches when everyone else is in despair.

As long as you believe that Bitcoin's price will rise again, it will go even higher.

In 2018, when Bitcoin fell to $3,200, some said, "Bitcoin is dead."

In 2022, when Bitcoin fell to $15,000, many exclaimed that the end of cryptocurrency was near.

In February 2026, when Bitcoin fell below $60,000, the whole world was asking, "Is this time really different?"

If you believe that "history will repeat itself," then the next 6-12 months is one of the few times in your life when you can buy the "future" at a "relatively low price."

Whether you believe it or not, that is your choice.

Disclaimer: This article is for historical data reference only and does not constitute investment advice. Cryptocurrency investment is highly risky; please make decisions cautiously based on your own situation. The author and Deep Tide TechFlow are not responsible for any investment losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。