After the noise of traffic and narrative, only those projects that can clearly and fairly return growth dividends to users can traverse cycles and build a truly solid moat.

The competition among decentralized contract exchanges has entered a heated stage. In the early days, Hyperliquid's "airdrop wealth effect" sparked a wave of interaction with decentralized contract exchanges; subsequently, various platforms launched their tokens for TGE, and the influx of funds into the new narrative once drove a surge across the sector. However, as the market cooled, these wealth effects gradually faded, and the focus of competition began to shift towards the underlying capabilities such as liquidity, depth, and capital efficiency. Nevertheless, optimizing these underlying capabilities empowers the user trading experience but does not directly provide value to users in the short term, nor does it create wealth effects for them.

With the early dividends disappearing, even the leading players in the sector cannot escape user attrition. Therefore, to maintain a foothold in the market, it is essential to genuinely implement measures that can benefit users.

Sun Wukong Creates Real Value for SUN through Buyback and Burn

As a latecomer in the decentralized contract sector, the Sun Wukong platform has demonstrated remarkable growth momentum in just two months, thanks to a precise and differentiated set of strategies. By offering zero gas fees and the lowest trading rates in the market, it directly addresses the biggest pain points for high-frequency traders; at the same time, leveraging the robust ecosystem of TRON, it provides a rich array of high-yield investment options, establishing a strong foundation for user retention.

The recently launched "trading mining" limited-time event marks a shift in its strategy from mere product optimization to proactive value creation. This event features: full refund of transaction fees + additional SUN token rewards (maker order reward ratio of 110%, taker order reward ratio of 107%). Not only does it stimulate trading activity with real monetary incentives, but it also deeply ties the platform's fee income to the value growth of the ecological token SUN. By publicly committing to use the income for buybacks and burning SUN, Sun Wukong is transforming a short-term market activity into a strong engine driving the long-term, positive cycle of its ecological value, fundamentally injecting sustainable value expectations into SUN.

You can imagine a clear chain of events:

You make a transaction on the Sun Wukong platform and pay a very low fee.

The platform pools this fee income to buy SUN tokens on the open market.

The purchased SUN tokens are immediately sent to a burn address.

As transactions continue, the buyback and burn mechanism keeps the total supply of SUN consistently decreasing, and the scarcity directly catalyzes the value increase of SUN. This greatly enhances the sense of belonging and confidence among token holders, binding the interests of users, the platform, and the token more deeply.

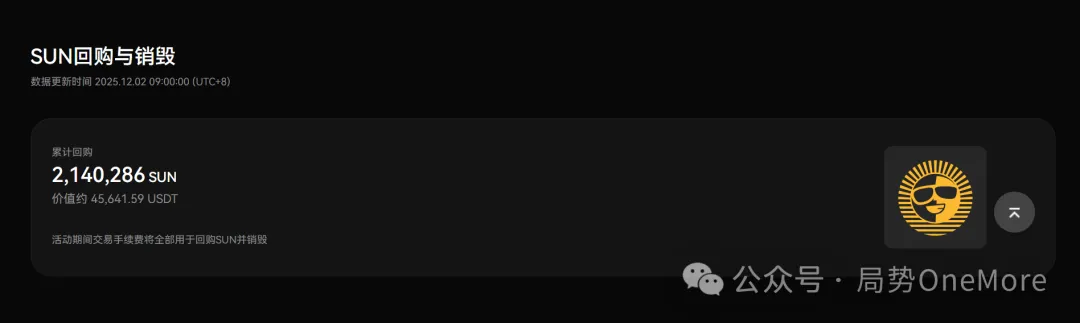

As of now, according to its official data, the number of SUN tokens repurchased is 2,140,286.

Dual Empowerment: From User Retention to Ecological Trust

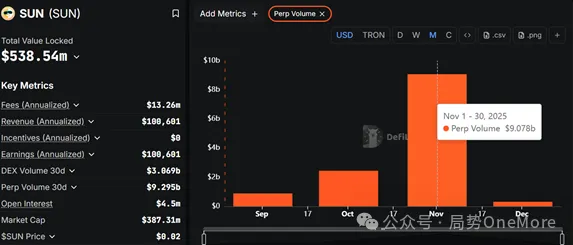

In the short term, the high incentives from Sun Wukong have attracted a massive influx of traders, solidifying the liquidity depth of designated trading pairs and directly boosting the platform's contract trading volume. According to data from DeFiLlama, in November, Sun Wukong's contract trading volume reached $9.078 billion, a 271% increase from October.

In the medium term, users transitioning from "arbitrageurs" to "habitual users" in high-frequency trading also deposits real liquidity and trading depth for the platform.

In the long term, when users realize that each transaction is contributing to the deflation of the SUN token, their role will elevate from "platform users" to "ecological co-builders." This deep binding of interests and sense of belonging is the best strategy to resist user attrition.

Therefore, paying attention to SUN is not just about monitoring the price fluctuations of a token; it represents a trend: after the noise of traffic and narrative, only those projects that can clearly and fairly return growth dividends to users can traverse cycles and build a truly solid moat.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。