The era of getting rich quickly is over, and it may not work now.

Author: Picolas Cage

Translated by: Deep Tide TechFlow

Some thoughts on the market and suggestions on how to profit from it or cope with it.

In the past two years, the market has undergone significant changes, gradually maturing and attracting more institutional funds and adoption.

1) As a retail "small fish," you may not be able to earn life-changing wealth from Bitcoin. I believe that Bitcoin has become too large as an asset to have that kind of radical upside potential again. I once bought Bitcoin at $6,000, and in 2018, I had the opportunity to achieve a 20x return.

To achieve another 20x return from here? That would mean Bitcoin's price needs to reach $1.8 million—this, in my view, would require far more than 8 years.

I think a more appropriate perspective for retail investors is to view Bitcoin as a value storage tool with sustained demand. The downside is that you can't just buy the "safest" asset in cryptocurrency (like Bitcoin, which ranks first) and expect to achieve life-changing returns with just a few thousand dollars.

But the good news is that when I first entered the market, holding Bitcoin was almost torturous. March 2020? A 40% drop in a single day. Imagine Bitcoin dropping to $54,000 in a day. Such extreme volatility makes it hard to stay exposed to the crypto market continuously.

Therefore, the good news is (this might be a bit risky) that the likelihood of Bitcoin experiencing such a drastic drop in a single day is very low—it might take a week, but that gives you enough time to adjust and rethink your strategy.

2) Due to the reasons mentioned in the first point, making money from cryptocurrency has become more difficult, and you must extend further along the risk curve. This means investing in altcoins or, more recently, the trend of meme coins. Meme coins are the altcoins of this cycle—the meme coin frenzy is what I consider the "altcoin season."

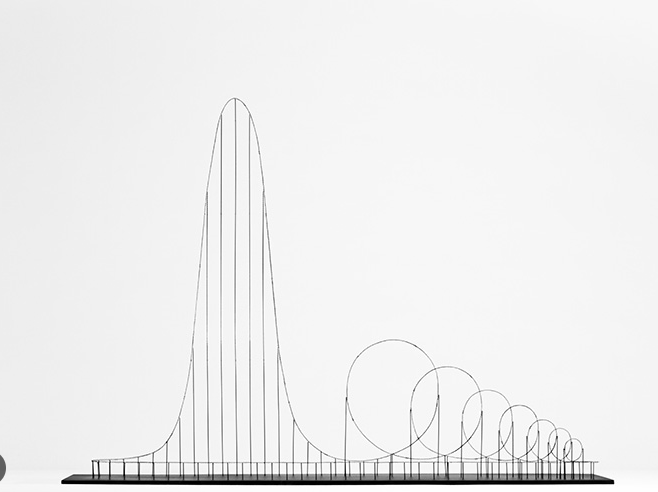

The problem is that meme coins, by definition, are not worth long-term trust or holding, so they complete the notorious "roller coaster" pattern much more quickly.

The proliferation of meme culture, combined with the reality that Bitcoin can no longer create massive wealth, has fostered a widespread short-termism mentality among retail investors and young people.

I believe this short-termism is further amplified among Gen Z or younger groups by a "high dopamine culture." TikTok, YouTube Shorts, Instagram Reels—combined with modern gaming, everything is in pursuit of instant dopamine hits.

When this pleasure-seeking mentality is applied to investing or trading, the result is that 99% of people will be "harvested" (suffer significant losses)—the facts prove this, as meme coins have indeed led most people to be "harvested."

Even popular coins like ETH (Ethereum) and SOL (Solana) have not performed well unless you can accurately time the bottom of the bear market. These factors have collectively driven the popularity of the "get rich quick" mindset in the market.

3) The era of getting rich quickly is over, and it may not work now.

As I explained, there was indeed a chance to get rich quickly by trading mainstream coins (like BTC or ETH) in the past, but with the entry of institutional investors, that possibility has basically disappeared. I have outlined the pros and cons of this change, as well as what it inevitably leads to (short-termism, instant gratification, gambling-style investing, blind following, etc.).

So, what should we do now? As a boring "old uncle," I want to tell you that slowly getting rich over the next 5-10 years is absolutely worth it.

For reference, true wealth is not having assets over $5 million and living on a yacht; true wealth is not being unable to escape so-called "government oppression," but having more free time to pursue interests and hobbies on Earth, being able to spend quality time with friends, partners, or children, rather than being suffocated by financial stress—that is true wealth.

For example, having a small loan or mortgage—these things can genuinely improve your quality of life. Don't be attracted by the nonsense of "Rolex and luxury sports cars"—these are designed to keep you poor and trapped in the system. If you think that owning luxury cars, watches, and material wealth is the key to happiness, then you are still trapped in the "Matrix" (@Tate brothers).

I've said enough; here are some practical guidelines:

Laddering in: Yes, while Bitcoin's volatility has decreased, it still has volatility. Be patient, pay attention to market sentiment, and wait to buy in batches when the market experiences a "blow-up." I'm not telling you to time the bottom precisely; that's too difficult and risky. I'm saying to be patient, keep some cash on hand, and invest more as prices go lower, using a laddering strategy.

Dollar Cost Average (DCA):

Invest a fixed amount you can afford each month, like $250—buy an equivalent amount of Bitcoin each month (buying $62.5 weekly would be better).

This is a boring but effective strategy because you are effectively always buying at lower points. When Bitcoin's price rises, you don't even need to wait for a new all-time high (ATH) to achieve decent returns. Moreover, as we discussed earlier, Bitcoin is almost certain to continue existing over the next decade, making holding Bitcoin as an asset easier—this is what Cobie means by "the simple path is $100,000 to $250,000."

Farm Airdrops:

Yes, airdrop activities have decreased now, but they still happen occasionally. This is free money, and remember to set aside a portion for taxes once you receive it.

Learn about crypto and continue researching:

Use your free time to learn about cryptocurrency and build your account. Once your account size is established, look for InfoFi (information finance) collaboration opportunities (if they still exist) or collaborate with respected and trustworthy projects as a KOL. But don't promote junk projects for quick profits; this is not only unethical but will also damage your personal brand in the long run. Remember, your friends are not your "exit liquidity."

Don't quit your job:

I cannot emphasize this enough. Investing is like a roller coaster—you can't get off halfway until the ride is over. If your funds are tied up in long-term multi-year investments (like ETH or BTC), you can't withdraw them just because you need money midway.

Consider the invested money as already "disappeared"—so only invest what you can afford to lose. Don't over-invest, don't invest or trade emotionally. Build your investment logic and cultivate a resilient mindset (avoid panic selling). Don't do foolish things like building a 5-10 year investment plan around something like AIDogecoinNFTclubwifhat, please.

Save money, be frugal:

If you use the money you've just earned to buy flashy things, you are doing the following:

"We use unnecessary things, with money we don't have, to impress people we don't like."

"Oh, but I do have money." Trust me, brother, you don't. You will need that money later. I am 36 this year; believe me, you will need it. Life is expensive, really expensive—especially when you have a family to support.

Most young men buy luxury goods to impress girls or friends because they lack security, which is completely understandable. I went through that age too; it was tough and not easy—but that's not an acceptable excuse.

The smartest thing I did to cope with this issue when I was young was to make myself strong and fit. I took advantage of my high testosterone levels at the time and focused on working out. This made me feel confident and even superior when I walked into any room because my physique was always strong and well-proportioned.

I don't need to wear an expensive watch to prove anything; my body has already done that for me. I also don't need to wear any luxury brand clothes. Even if you wear a $10,000 shirt, I still look better than you in a plain T-shirt because it fits my body and showcases my athletic lines.

In summary, this is just my two cents of advice and personal opinion; some may disagree, and that's perfectly normal. I've said enough; I could go on, but let's leave it here.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。