This document answers the question "Who is HashKey?" but the question "How much is it worth?" will have to wait for the market to provide an answer.

Written by: David, Deep Tide TechFlow

HashKey is going public.

On December 1, this largest licensed cryptocurrency trading platform in Hong Kong officially entered the IPO sprint phase after passing the Hong Kong Stock Exchange hearing. JPMorgan Chase, Cathay Securities, and Guotai Junan International serve as joint sponsors.

The so-called "hearing" is a key node in the Hong Kong stock listing process. The listing committee reviews the company's application materials, and passing this means that the main regulatory obstacles have been cleared. The next steps are pricing, roadshows, and listing.

From an industry perspective, this will be the second cryptocurrency-related company to list on the Hong Kong stock market after OSL. However, the positioning of the two is different:

OSL is more focused on institutional custody and brokerage services, while HashKey started as a retail exchange, with a broader business line that directly faces the cyclical fluctuations of the cryptocurrency market.

The prospectus (post-hearing information package) is the most solid material for understanding a company. This article will break down the key information in this document from several dimensions, including revenue structure, financial performance, user data, and equity structure.

Business Overview: More Than Just an Exchange

Many people perceive HashKey as merely a "licensed exchange in Hong Kong," but the picture revealed by the prospectus is much more complex.

HashKey defines itself as a "comprehensive digital asset company," with its business structure revolving around three main lines: trading facilitation services, on-chain services, and asset management services.

Clearly, HashKey is attempting to build a digital asset ecosystem that covers the entire chain of "trading - custody - staking - asset management."

Trading facilitation is the foundation. This part includes the familiar spot exchange and OTC services aimed at large transactions.

As of September 2025, the platform has facilitated a total of 1.3 trillion Hong Kong dollars in spot trading, with platform assets reaching 19.9 billion Hong Kong dollars. Based on 2024 trading volume, HashKey is the largest licensed platform in Hong Kong, with a market share exceeding 75%, and is also the largest regional onshore platform in Asia.

On-chain services are where differentiation lies. This line includes three components: staking services, tokenization services, and the self-built HashKey Chain (an L2).

Among them, the staking business is the most substantial. As of September 2025, staking assets reached 29 billion Hong Kong dollars, making HashKey the largest staking service provider in Asia and the eighth largest globally.

The tokenization business focuses on bringing real-world assets (RWA) onto the chain, currently mainly financial assets, with plans to expand into precious metals, computing power, green energy, and other fields in the future.

Asset management is an extension of institutionalization. HashKey manages client assets through two flagship funds, with a management scale of 7.8 billion Hong Kong dollars since its inception as of September 2025, completing over 400 investments. This part of the business includes both venture capital for early-stage projects and active and passive strategies in the secondary market.

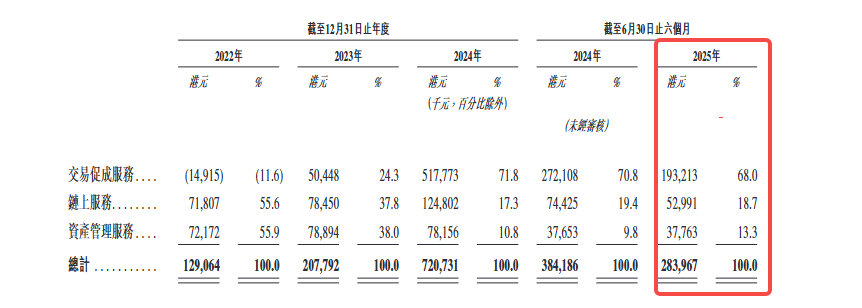

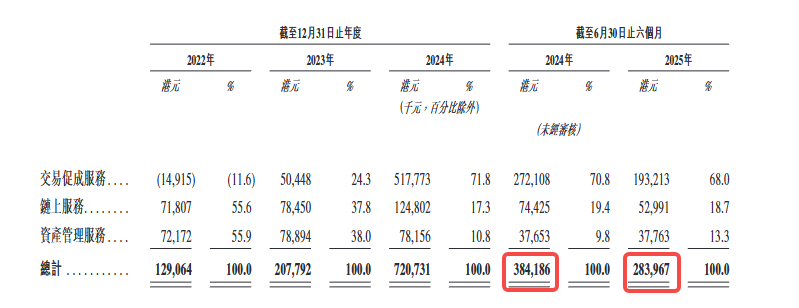

From the revenue structure, in the first half of 2025, trading facilitation contributed 68% of revenue, on-chain services accounted for 18.7%, and asset management made up 13.3%. Trading remains the core, but the proportion of on-chain and asset management is gradually increasing.

Revenue Structure: Trading Accounts for Nearly 70%, Volatility Follows

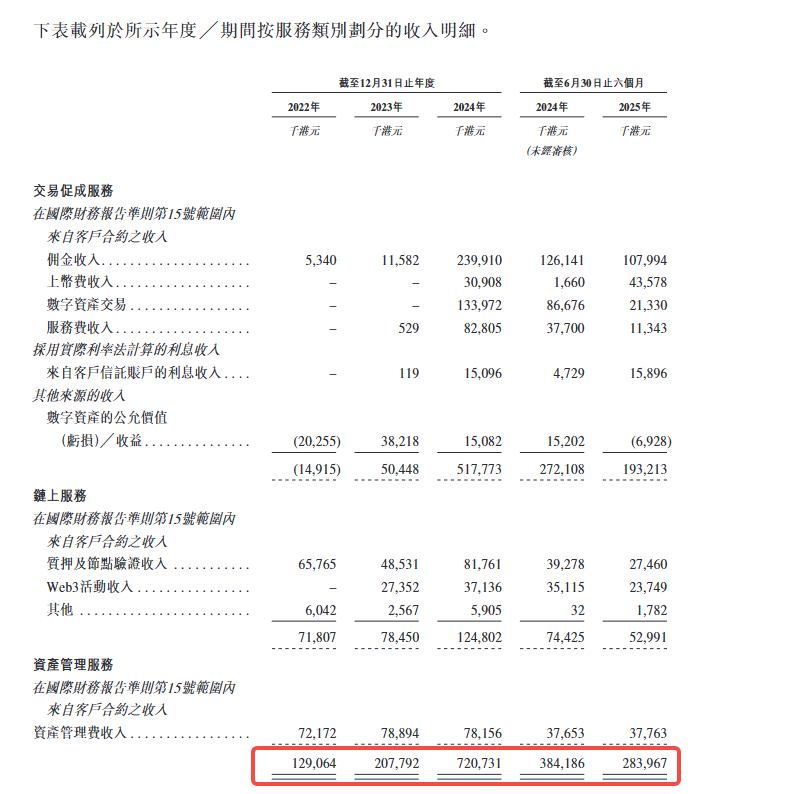

HashKey's revenue growth curve is quite steep. Revenue was 129 million Hong Kong dollars in 2022, increasing to 208 million in 2023 (a year-on-year growth of 61%), and soaring to 721 million in 2024 (a year-on-year growth of 247%).

This is a typical curve benefiting from a cryptocurrency bull market.

However, in the first half of 2025, growth came to a sudden halt. Revenue for this half year was 284 million Hong Kong dollars, a year-on-year decline of 26%. This turning point deserves further analysis.

We can break down the financial situation of HashKey's different businesses as follows:

- Trading business is the absolute mainstay of revenue.

In the first half of 2025, trading facilitation services contributed 68% of revenue, with specific sources including trading commissions, OTC spreads, and changes in the fair value of digital assets. Among these, commission fees mainly come from USDT, BTC, and fiat currency trading pairs.

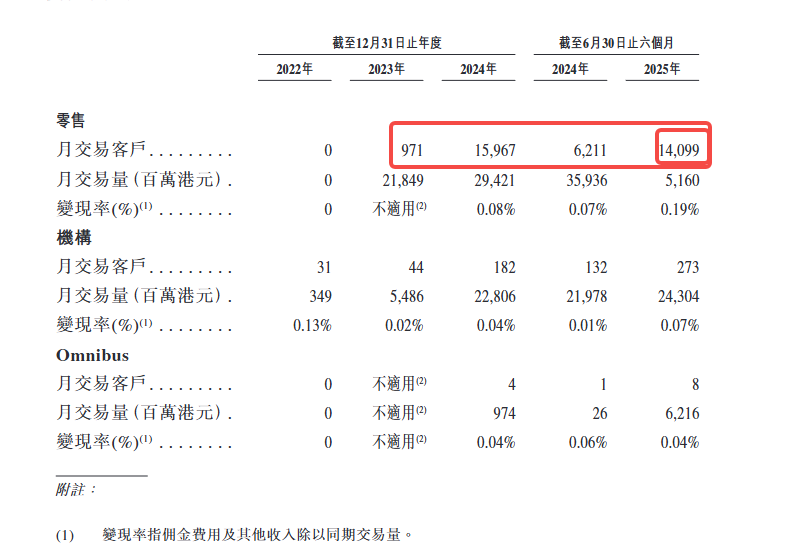

The prospectus disclosed two key metrics: monthly trading clients and monetization rate.

Looking at monthly trading clients, there were about 16,000 retail traders per month in 2024; by the first half of 2025, this number was around 14,000; this figure is not particularly high; on the other hand, while institutional clients are fewer than retail clients, their contribution to trading volume has been greater since the first half of 2025.

Another metric is the monetization rate, which is commission income/trading volume. The monetization rate for institutional clients is about 0.07%, for retail clients about 0.19%, and for omnibus clients (clients accessed through partners) about 0.04%.

This figure directly reflects HashKey's pricing ability and client structure. Retail clients, although they have smaller transaction volumes, pay higher fees; institutional clients have large transaction volumes but are charged much lower fees.

- Fluctuations in trading volume directly translate to revenue.

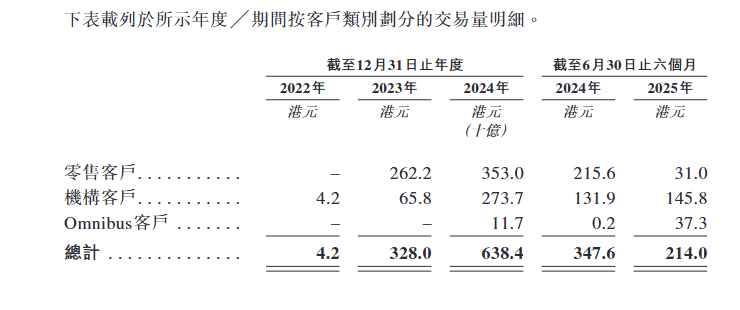

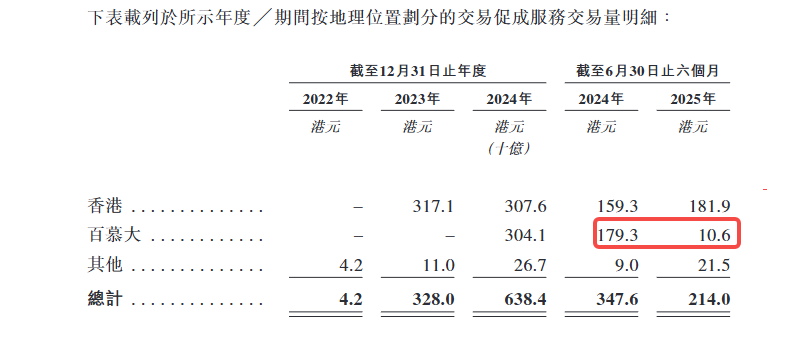

In the first half of 2024, HashKey's trading volume reached 347.6 billion Hong Kong dollars, but in the first half of 2025, it plummeted to 214 billion.

This decline has two reasons: first, the overall market is sluggish, and second, HashKey actively reduced its business in Bermuda (due to the lack of fiat currency deposit and withdrawal channels), refocusing its strategic efforts back to Hong Kong.

- The proportion of on-chain services and asset management is increasing.

In the first half of 2025, on-chain services contributed 18.7% of revenue, and asset management contributed 13.3%. Revenue from on-chain services mainly comes from staking rewards and tokenization service fees, while asset management revenue comes from management fees and performance commissions.

These two business segments have relatively high gross margins, but their scale is still insufficient to offset the fluctuations in trading business.

The revenue structure reveals a core contradiction: HashKey's growth is highly dependent on trading volume, which in turn is highly dependent on market conditions. This is the fate of all exchanges, but for a company about to go public, this dependency means weak predictability of performance.

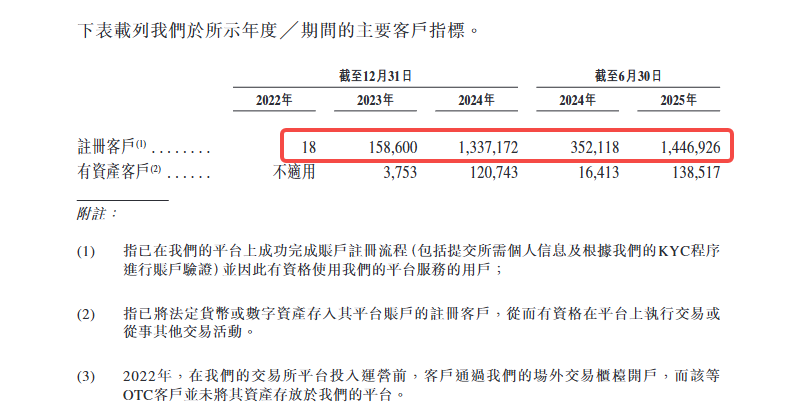

User Data: In 3 Years, Registered Users Grew from 18 to 1.446 Million

HashKey's user growth rate shows a clear acceleration in the later stages.

At the end of 2022, the platform had only 18 registered users; by the end of 2023, this number had risen to 158,600; by the end of 2024, it surged to 1,337,200; and by June 2025, it further increased to 1,446,900. In two and a half years, the user base grew by 80,000 times.

However, registered users are just the surface; what truly matters is the "asset-holding clients," meaning users who hold digital assets or fiat currency on the platform.

By the end of 2023, there were only 3,753 asset-holding clients; this number increased to 120,700 by the end of 2024; and reached 138,500 by June 2025. The conversion rate (asset-holding clients/registered users) dropped from 2.4% at the end of 2023 to 9.6% by June 2025, indicating that a large number of newly registered users completed KYC and remained on the platform.

The prospectus disclosed a key metric: the retention rate of asset-holding clients is as high as 99.9%.

This figure looks impressive, but it is important to note that this is the retention of "asset-holding clients," not the retention of active trading clients. In other words, users may keep their assets on the platform but may not trade frequently.

At the same time, the change in client structure is more noteworthy.

HashKey categorizes clients into three types: institutional clients, retail clients, and omnibus clients (clients accessed through partners).

In terms of trading volume share, the proportion of institutional clients is continuously increasing: in the second half of 2024, it accounted for 62%, and in the first half of 2025, it further rose to 68%. Meanwhile, the trading volume of retail clients significantly declined in the first half of 2025, plummeting from 215.6 billion Hong Kong dollars to 31 billion Hong Kong dollars.

This change reflects both the cooling of market sentiment and HashKey's conscious shift towards institutionalization.

Omnibus clients are also an interesting increment. In the second half of 2024, the trading volume of this client segment was only 200 million Hong Kong dollars, but it surged to 37.3 billion Hong Kong dollars in the first half of 2025. This indicates that HashKey is rapidly expanding by collaborating with other platforms or institutions through a B2B2C model, indirectly serving end users.

In terms of regional distribution, the Hong Kong market has maintained stable growth, but the Bermuda market significantly shrank in the first half of 2025; the reason is the lack of fiat currency deposit and withdrawal channels, leading to a decline in user activity. This is also the direct reason for HashKey's strategic reduction of its Bermuda business.

From user data, HashKey is shifting from a retail-driven model to an institutional-driven one, moving from direct customer acquisition to partner-based customer acquisition.

This is a typical path for a compliant exchange, but it also means that the activity and stickiness of the retail side still need to be validated.

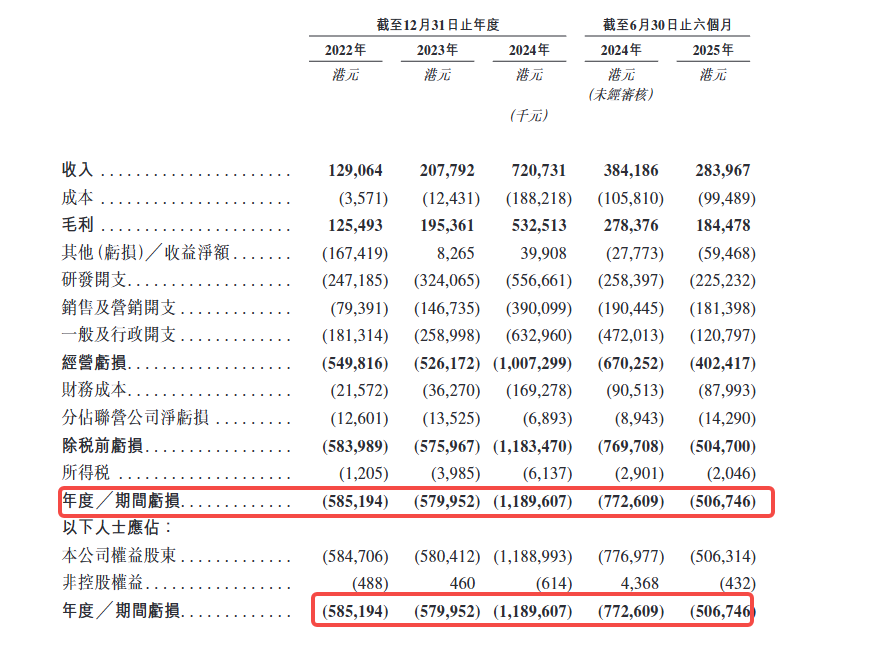

Financial Reality: Losses Narrowed, But Not Profitable

HashKey's financial situation is improving, but it is still far from being truly profitable.

From the consolidated income statement, HashKey's losses show a clear three-stage pattern: a loss of 585 million Hong Kong dollars in 2022, approximately flat at 580 million Hong Kong dollars in 2023, and a sharp increase to 1.19 billion Hong Kong dollars in 2024, nearly doubling.

In the first half of 2025, there was a turning point, with a loss of 506.3 million Hong Kong dollars, narrowing by 35% compared to 770 million Hong Kong dollars in the same period of 2024.

The prospectus reveals that the massive loss in 2024 mainly came from: first, operating losses expanded from 526.2 million to 1.0073 billion, an increase of 480 million;

Second, financial costs skyrocketed from 36.27 million to 169.3 million, an increase of 130 million;

Third, "other net losses" turned from a gain of 8.265 million in 2023 to a loss of 399.1 million, resulting in a 400 million difference. The last item mainly comes from "changes in the fair value of digital assets." When the market fluctuates violently, the book value of market-making and proprietary-held digital assets significantly shrinks.

Revenue Declined by 26%, Trading Business is the Main Drag

In 2024, total revenue was 720.7 million Hong Kong dollars, which is 3.5 times that of 2023. However, in the first half of 2025, revenue was 284 million Hong Kong dollars, a 26% decrease from 384.2 million Hong Kong dollars in the same period of 2024. The decline almost entirely came from the trading business: commission income fell from 126.1 million to 108 million, and digital asset trading income plummeted from 86.68 million to 21.33 million, a drop of 75%. The only bright spot was that listing fees surged from 1.66 million to 43.58 million.

The prospectus attributes this to a slowdown in market trading activity and the active contraction of the Bermuda market.

Gross Margin Dropped from 72.5% to 65.0%

The gross margin for the same period in 2024 was 72.5%, dropping to 65.0% in the first half of 2025. The reason is that the gross margin of digital asset trading and market-making business is highly dependent on market conditions: when the market declines, trading volume shrinks, and holding assets can also incur book losses, putting double pressure on gross margin.

Equity Structure: Who is Sharing the Pie?

In HashKey's equity structure, there are three key questions: Who controls the company? Who will benefit from the listing? And who will ultimately convert those redeemable debts into equity?

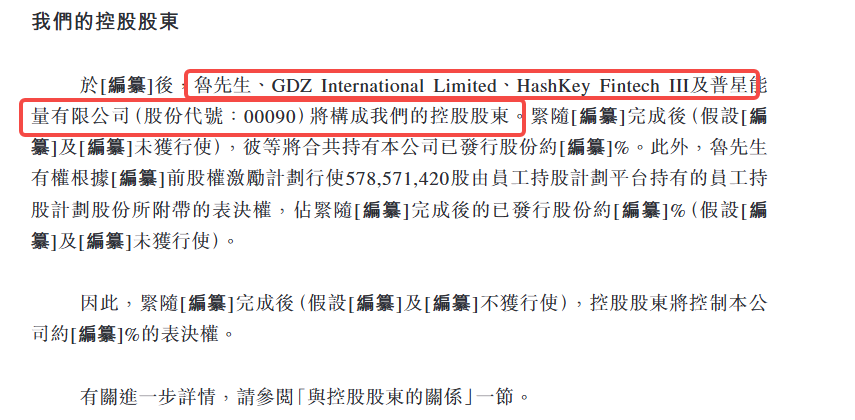

The prospectus reveals that HashKey will be controlled by four parties:

Lu Weiding: Non-executive director, actual controller of Wanxiang Group

GDZ International Limited: Related entity

HashKey Fintech III: A subsidiary fund of the company

Puxing Energy Limited (stock code: 00090)

As the prospectus has not yet been finalized, the specific shareholding ratios of these four parties have not been disclosed, marked in the document as "[to be supplemented]".

In HashKey's power structure, two names must be mentioned:

Xiao Feng: Executive director, chairman, and CEO. The prospectus lists him as Dr. Xiao. He is an early promoter of the blockchain industry in China, having served as the general manager of Bosera Asset Management and founded Wanxiang Blockchain Lab in 2015. In HashKey's narrative, Xiao Feng is the spiritual leader and strategic designer.

Lu Weiding: Non-executive director, referred to as Mr. Lu in the prospectus. Chairman of Wanxiang Group. Wanxiang Group is one of the largest automotive parts suppliers in China and an important shareholder of HashKey. Lu Weiding effectively controls a significant amount of voting rights in the company through direct shareholding and employee stock ownership platform voting rights.

Lu Weiding also has a special right: he has the authority to exercise the voting rights attached to 578.6 million shares held by the employee stock ownership plan platform according to the pre-listing equity incentive plan. The prospectus discloses that the proportion of these shares in the total issued shares post-listing is also pending final determination.

In other words, the controlling shareholder not only holds shares directly but also indirectly controls a large number of voting rights through the employee stock ownership platform. The prospectus clearly states:

Following the completion of [to be supplemented] (assuming [to be supplemented] and [to be supplemented] are not exercised), the controlling shareholder will control approximately [to be supplemented]% of the voting rights of the company.

This is a relatively concentrated equity structure, which also means that the governance of the company post-listing will heavily rely on the will of the controlling shareholder.

The prospectus also reveals a noteworthy detail:

During the performance record period, HashKey Fintech III, GDZ International Limited, and HashKey Fintech II were all among the company's top five clients and were related parties of the controlling shareholders.

This indicates that HashKey's early revenue heavily relied on transactions with related parties. Although this proportion is decreasing, it still raises a question: how much of the company's commercialization ability is truly independent?

There are similar situations on the supplier side. The prospectus discloses that Wanxiang Blockchain entities were among the top five suppliers in 2022, 2023, 2024, and for the six months ending June 30, 2025, and were related parties of a company shareholder.

Overall, the main beneficiaries of HashKey's listing include:

Controlling Shareholders: Highest shareholding ratio (specific ratio pending final disclosure), and control additional voting rights through the employee stock ownership platform

Pre-listing Investors: After redeemable debts convert to equity, they will become significant shareholders, and the listing is a key exit window for them

Employees: Hold 578.6 million shares through the employee stock ownership plan

Management: The prospectus discloses that the company confirmed 566.2 million Hong Kong dollars in equity incentive expenses in 2024, which is a one-time large-scale grant.

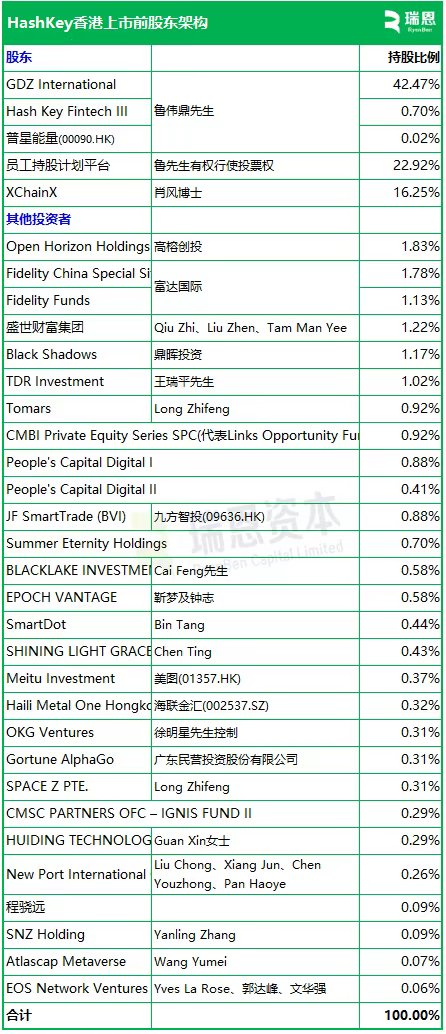

Outside the prospectus, the shareholding ratios disclosed by Ryan Capital provide more detailed insights and can serve as a cross-reference.

This table confirms the previous judgment: the controlling rights are highly concentrated. GDZ International holds 42.47%, plus the employee stock ownership platform (22.92%, with voting rights exercised by Lu Weiding) and XChainX (16.25%, held by Xiao Feng), totaling over 80%. The actual circulating market post-listing will be very small.

Notably, there are several types of roles in the shareholder list:

First, traditional asset management institutions. Fidelity holds about 2.9% through two funds, which is uncommon in the shareholder lists of crypto companies, indicating that HashKey's "compliance narrative" is attractive to traditional institutions.

Second, listed companies on the Hong Kong and A-shares. Meitu (01357.HK), Jiufang Zhitu (09636.HK), and Hailian Jinhui (002537.SZ) are all included. For these companies, investing in HashKey is a way to gain exposure to digital assets.

Third, first-tier RMB funds. Gao Rong Venture Capital and Dinghui Investment are early investors. The listing is their main exit window.

It is worth mentioning that in the crypto industry, OKX and EOS also participated in the investment.

What to Watch Next

After passing the hearing, HashKey enters the pricing and roadshow phase. According to the Hong Kong stock process, the formal offering to listing usually takes two to three weeks. At that time, the price range, cornerstone investor list, and specific allocation of fundraising purposes will be clarified.

There are several numbers worth tracking:

First, valuation. Bloomberg previously reported that the fundraising would not exceed 500 million dollars, but how many times this corresponds to the price-to-sales ratio, and whether it is at a premium or discount relative to OSL, will have to wait for the pricing to be determined.

Second, the composition of cornerstone investors. If traditional financial institutions (banks, brokerages, asset management) are willing to be cornerstone investors, it indicates that institutions are buying into the narrative of "compliant digital assets"; if it is mainly crypto-native funds or related parties, that tells a different story.

Third, trading volume and stock price performance post-listing. OSL's stock price fluctuated dramatically after listing, with average liquidity. HashKey is larger, but the pricing ability of the Hong Kong stock market for digital asset targets remains unknown.

The prospectus is static, while the market is dynamic. This document answers the question "Who is HashKey?" but the question "How much is it worth?" will have to wait for the market to provide an answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。