In the coming years, the pressure of not being able to sell tokens without limits will drive more DeFi projects to develop actual revenue sources and tie their tokens to these revenue streams.

Author: Patrick Scott | Dynamo DeFi

Translation: Deep Tide TechFlow

The liquidation day for the crypto industry has finally arrived.

Over the past five years, tokens have enjoyed a state that I would politely call "speculative demand far exceeding fundamentals." Less politely, they have been severely overvalued.

The reason is quite simple: there are not many liquid assets in the crypto industry with solid fundamentals. Therefore, investors can only gain exposure through the assets they can access, which are often Bitcoin or altcoins. Coupled with retail investors who have heard stories of "Bitcoin millionaires," they hope to replicate such returns by investing in newer, smaller tokens.

This has led to a demand for altcoins that far exceeds the supply of those with solid fundamentals.

First-order effect

When market sentiment hits rock bottom, you can buy any asset and see astonishing returns years later.

Second-order effect

Most business models in the industry (if you can call them business models) revolve around selling their own tokens, rather than relying on actual revenue sources tied to their products.

In the past two years, the altcoin market has experienced three catastrophic events:

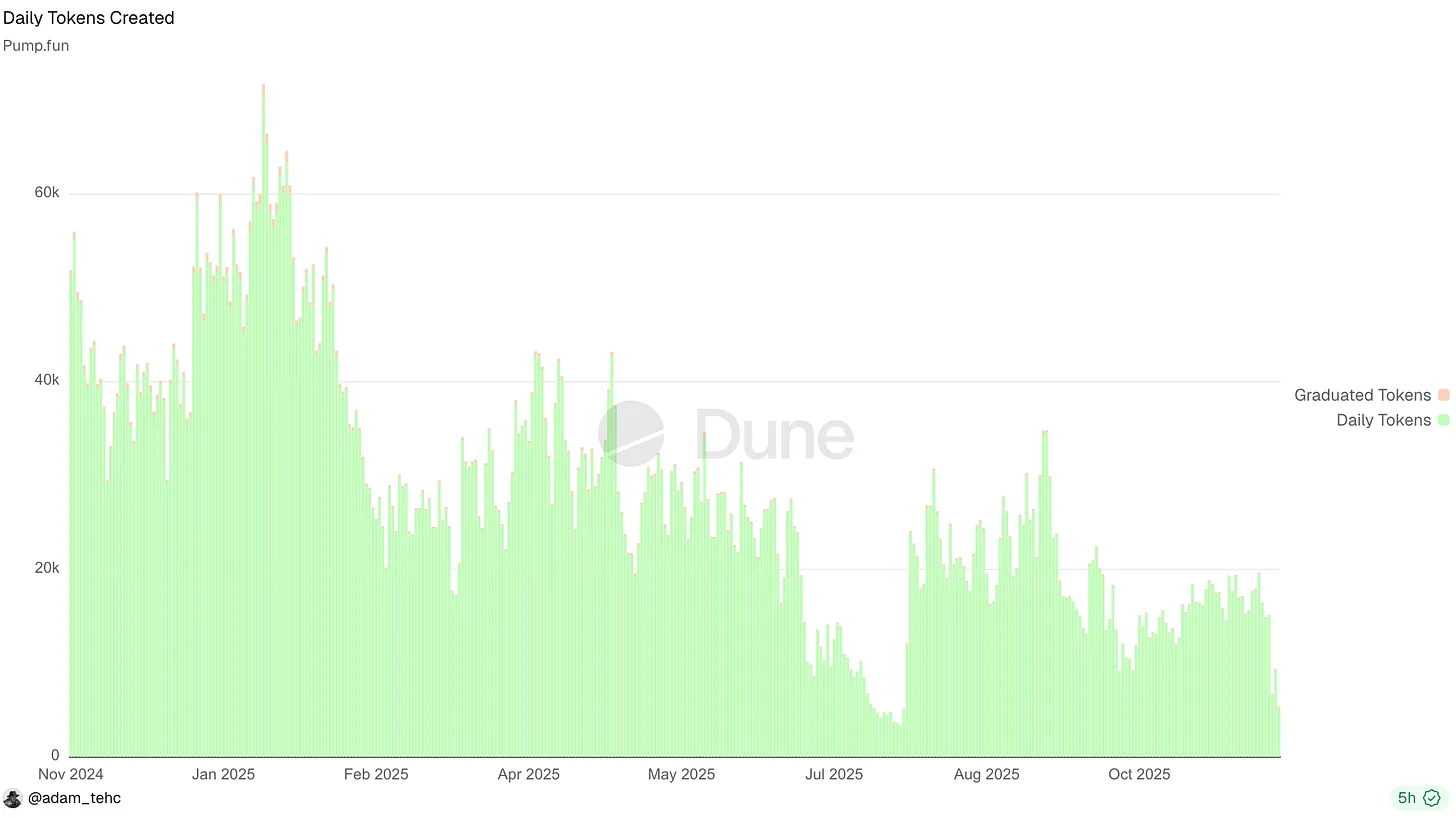

- The rise of "Pump fun" and other token issuance platforms

These platforms have "commoditized" the issuance of new tokens (i.e., made it too commonplace), leading to attention being dispersed across millions of assets. This dispersion effect has prevented the top few thousand tokens from continuing to attract concentrated capital inflows and has disrupted the wealth effect that Bitcoin halving usually brings.

On many days earlier this year, Pump platforms had over 50,000 tokens launched daily.

Some crypto assets began to exhibit real fundamentals

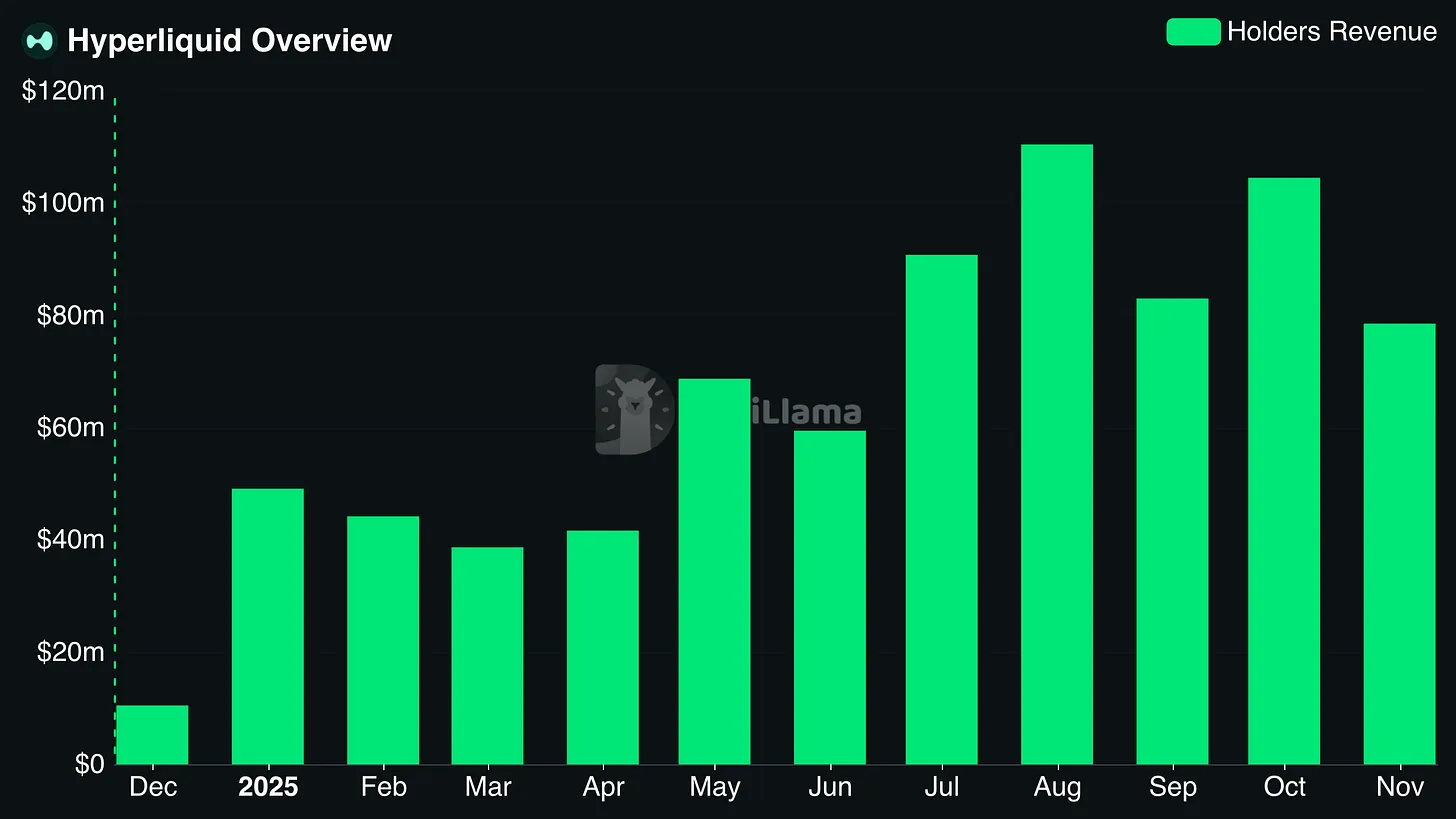

Some tokens (like HYPE) and new IPO projects (like CRCL) started to show real fundamentals. Once assets supported by fundamentals appeared in the market, it became difficult to bet on tokens that were only supported by white papers.

Hyperliquid holders often earn over $100 million monthly.

- Meanwhile, tech stocks have outperformed the crypto market. In many cases, stocks related to artificial intelligence, robotics, biotechnology, and quantum computing have yielded better returns than the crypto market. This has led retail investors to wonder: why take the risk of investing in altcoins when "real" companies offer higher returns and seemingly lower risks? Even the NASDAQ has outperformed Bitcoin and altcoins this year.

What are the results?

Underperforming altcoins have become a "graveyard";

Teams are fiercely competing for increasingly scarce pools of capital;

Experienced crypto investors have also become at a loss, flailing around like headless chickens searching for investment directions.

Ultimately, tokens either represent an equity stake in a business or are worthless. They are not a magical new thing that gains value simply by existing.

If you stop viewing tokens as something difficult to understand and instead see them as assets representing a business's future cash flows, everything becomes clearer.

But you might protest, "Dynamo, some tokens do not confer rights to future cash flows! Some tokens are utility tokens! Some protocols have both tokens and equity!" But you are mistaken. These tokens still represent future cash flows; it’s just that the cash flows they are associated with happen to be $0.

In the end, tokens either provide equity in a business or are worthless. They do not automatically gain value due to "existence" or "community" (as many believe).

It is important to note that this view does not apply to network coins like Bitcoin (BTC), as they are closer to the characteristics of commodities; this discussion pertains to protocol tokens.

In the near future, the only DeFi tokens with actual value will be those that exist as pseudo-equity and meet the following two conditions:

Claims to protocol revenue;

That protocol revenue is sufficient to make it an attractive value proposition.

Retail Investors "Break Up" with the Crypto Market

Retail investors have temporarily bid farewell to the crypto market.

Some leading KOLs shout "crime is legal," yet are surprised that people are unwilling to become victims of "crime."

As it stands, retail investors have lost interest in the vast majority of tokens.

In addition to the reasons mentioned earlier, another important factor is: people are tired of losing money.

Overinflated promises: The value of many tokens is built on unfulfilled promises.

Oversupply of tokens: Due to the rise of memecoin issuance platforms, there is a severe oversupply of tokens in the market.

Predatory token economics: The industry's tolerance for worthless tokens has led retail investors to rightly believe they are destined to "take the bag."

What are the results? Those who would have purchased crypto assets are now seeking other outlets to satisfy their "gambling desires," such as: sports betting, prediction markets, and stock options. These choices may not be wise, but buying most altcoins is hardly a good idea either.

But can we blame these people?

Some KOLs discuss "crime is legal" while being surprised that people are unwilling to be victims.

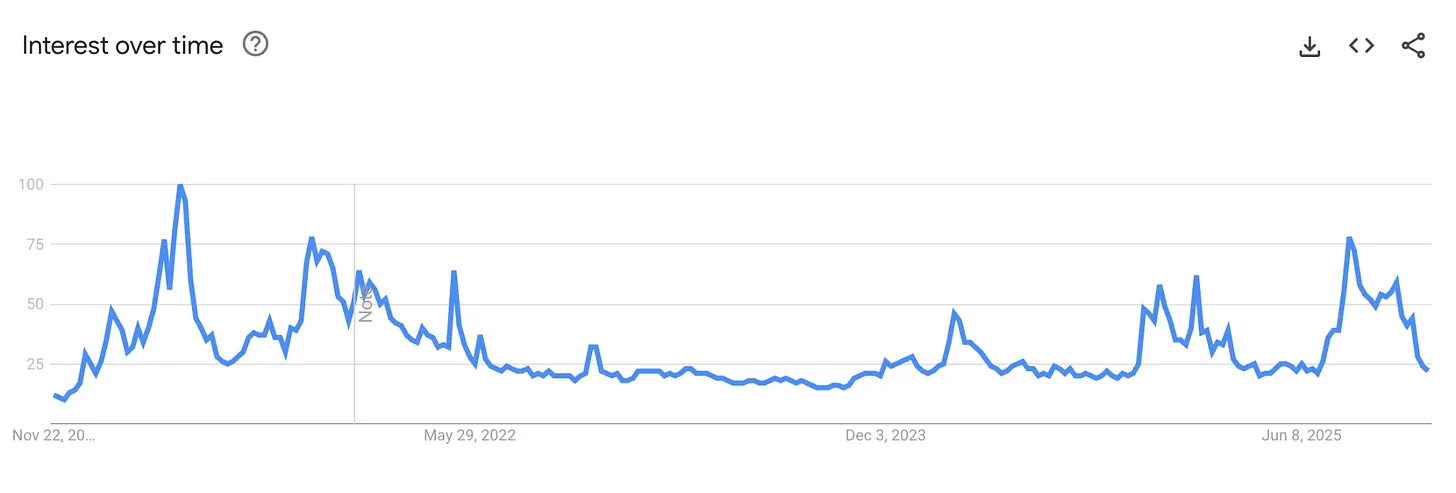

This public indifference towards the crypto market is also reflected in the interest in the industry. This year's enthusiasm has not reached the heights of 2021, even though the current fundamentals are better than ever and regulatory risks are lower than ever.

I also believe that ChatGPT and the subsequent AI boom have diminished people's enthusiasm for cryptocurrencies, as it has shown a new generation what a true "killer app" looks like.

For the past decade, crypto enthusiasts have been talking about the crypto industry as a new "Dot-Com Moment." However, when people can see AI reshaping their world in a more intuitive and obvious way every day, this claim becomes harder to convince.

In terms of search engine interest, the gap between crypto and AI is evident. The last time cryptocurrency surpassed AI in search interest on Google was during the FTX collapse:

Will retail investors return to the crypto market?

The answer is: yes.

It can be said that retail investors have returned to some form of prediction market today, but they are buying binary options on "when the government shutdown will end," not altcoins. If they are to buy altcoins en masse again, they need to feel they have a reasonable chance of making a profit.

The Core Source of Token Value: Protocol Revenue

In a world where tokens cannot rely on a continuous stream of buyers driven by speculation, they must stand on their own intrinsic value.

After five years of experimentation, the painful truth has emerged: the only meaningful form of token value accumulation is claims to protocol revenue (whether past, present, or future).

All these various forms of real value accumulation ultimately boil down to claims on protocol revenue or assets:

Dividends

Buybacks

Fee Burns

Treasury Control

This does not mean that a protocol must implement these measures today to have value. In the past, I have been criticized for expressing a desire for protocols I favor to reinvest revenue rather than use it for buybacks. But protocols need to have the ability to initiate these value accumulation mechanisms in the future, ideally triggered by governance voting or meeting clear standards. Vague promises are no longer sufficient.

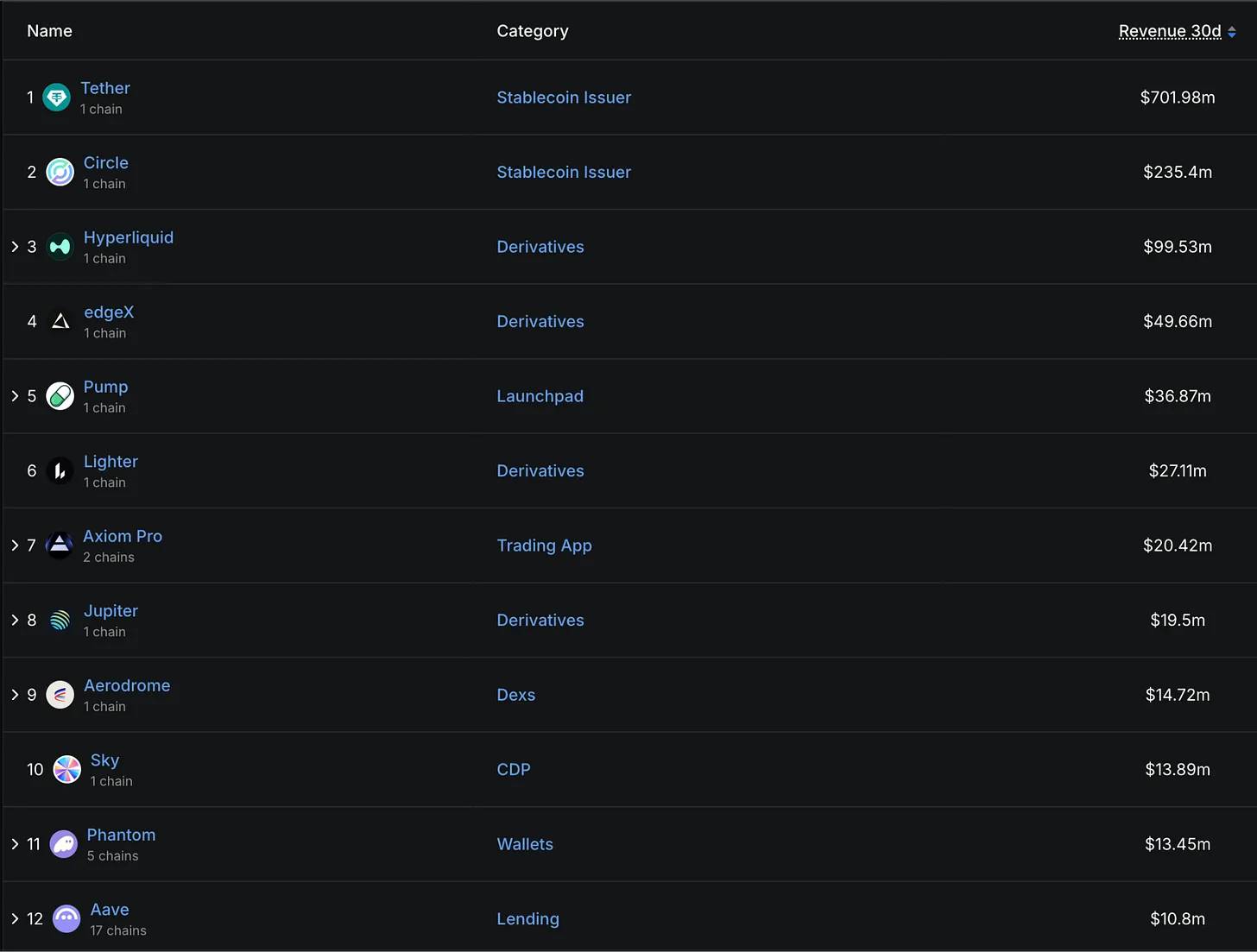

Fortunately, for savvy investors, this fundamental data is readily available on platforms like DefiLlama, covering thousands of protocols.

A quick glance at the top protocols ranked by revenue over the past 30 days reveals a clear pattern: stablecoin issuers and derivatives platforms dominate, while Launchpads, trading applications, CDPs, wallets, decentralized exchanges (DEXs), and lending protocols also perform well.

Key Conclusions to Note:

Stablecoins and perpetual contracts are the two most profitable businesses in the current crypto industry

Trading-related businesses remain very profitable

- Overall, businesses supporting trading are highly profitable. However, if the market enters a prolonged bear phase, revenues from trading-related activities may face significant risks unless protocols can pivot to trading real-world assets (RWAs), as Hyperliquid attempts to do.

Controlling distribution channels is as important as building underlying protocols

- I suspect that some hardcore DeFi users will strongly oppose trading applications or wallets becoming top revenue sources, as users can directly use protocols to save costs. However, in reality, applications like Axiom and Phantom are extremely profitable.

Some crypto applications can generate tens of millions of dollars in revenue each month. If the protocol you are focused on has not yet reached this level, that’s okay. As someone responsible for DefiLlama's revenue, I understand that developing a product that the market is willing to pay for takes time. But the key is that there must be a path to profitability.

The era of play is over.

A Value-Oriented Crypto World: An Investment Framework Analysis

When looking for investment tokens in the coming years, strong-performing tokens must meet the following criteria:

Claims to protocol revenue or a clear and transparent path to revenue claims

Stable and consistently growing revenue and earnings

Market capitalization within a reasonable multiple range compared to past revenue

Instead of discussing theories, let’s look at some concrete examples:

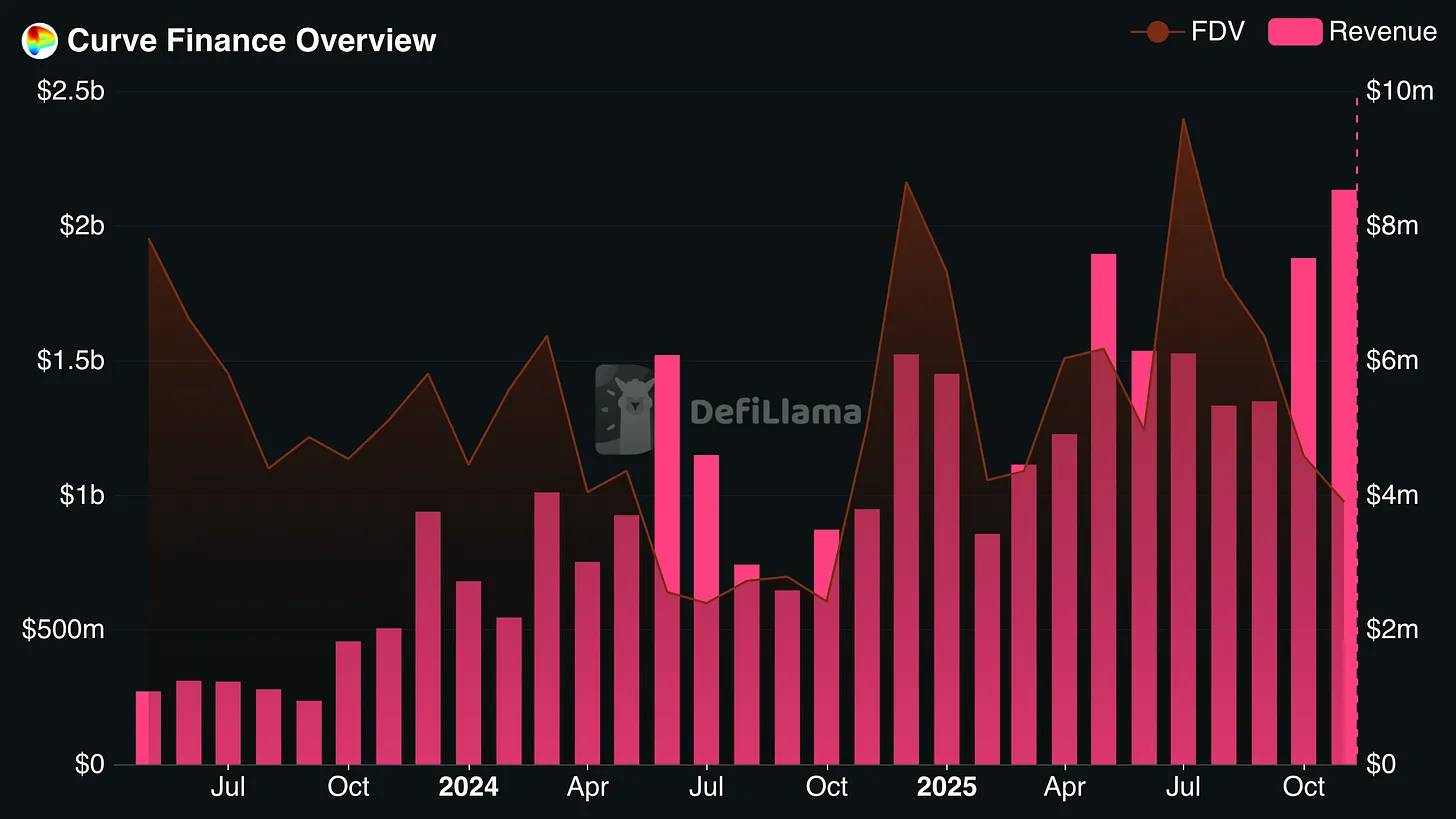

Curve Finance

Curve Finance has achieved stable and consistent revenue growth over the past three years, even as its fully diluted valuation (FDV) has declined. Ultimately, its FDV has dropped to less than 8 times Curve's annualized revenue from the past month.

Since holders of locked Curve tokens can earn bribe rewards, coupled with a long token release cycle, the actual yield of the tokens is much higher. The next thing to watch is whether Curve can maintain its revenue levels in the coming months.

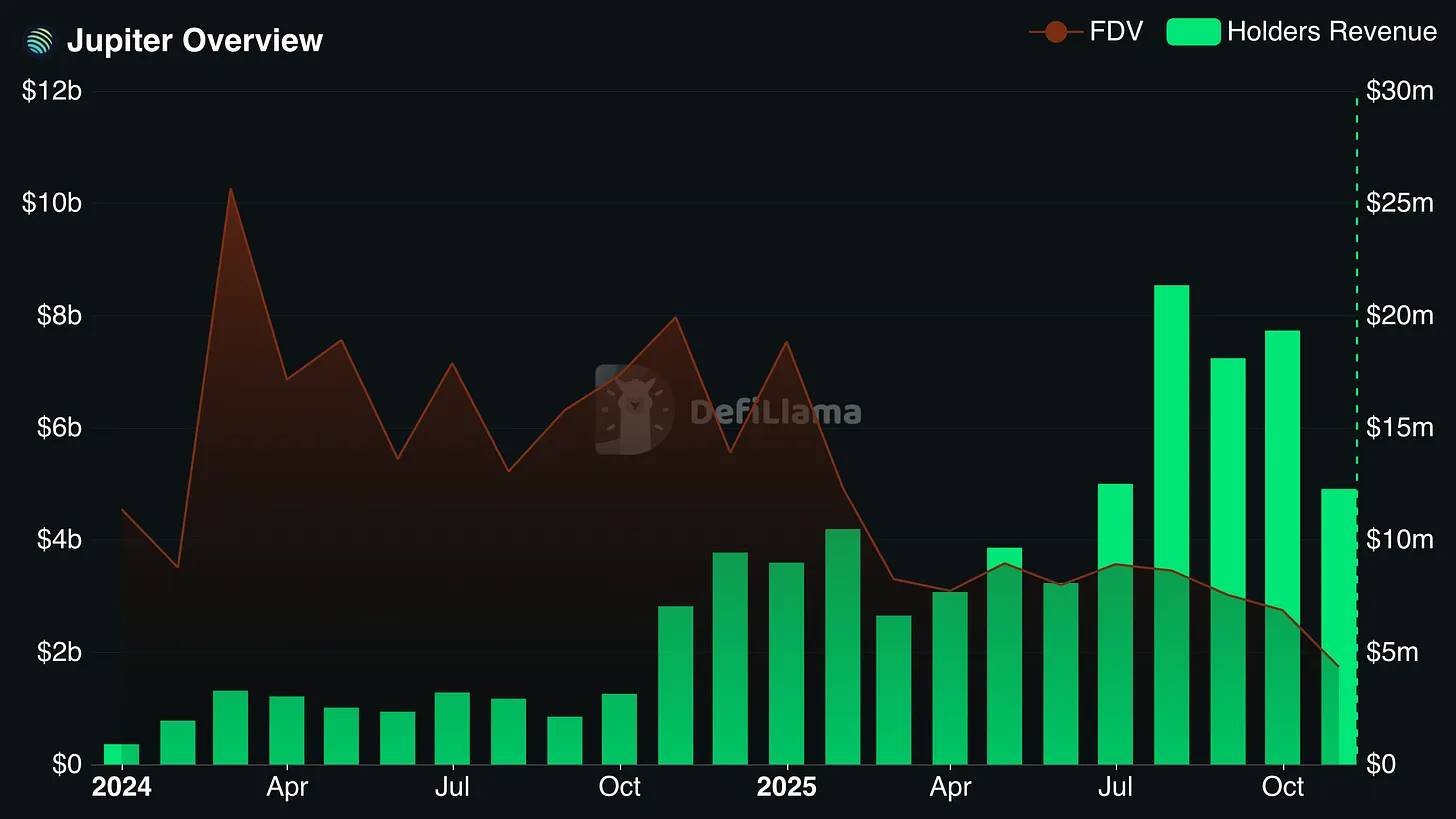

Jupiter

Jupiter has firmly established itself as one of the main beneficiaries of the thriving Solana ecosystem. It is the most widely used DEX aggregator and perpetual decentralized exchange (perp DEX) on the Solana chain.

Additionally, Jupiter has made several strategic acquisitions, allowing it to leverage its distribution channels to expand into markets on other chains.

Notably, the annualized revenue allocated to token holders by Jupiter is quite substantial, approximately 25% of the circulating market cap, and exceeds 10% of the FDV (fully diluted valuation).

Other protocols that meet the criteria: Hyperliquid, Sky, Aerodrome, and Pendle

Positive Signals: A Ray of Hope

The good news is that teams that genuinely care about their survival are quickly realizing this. I expect that in the coming years, the pressure of not being able to sell tokens without limits will drive more DeFi projects to develop actual revenue sources and tie their tokens to these revenue streams.

If you know where to look, the future will be full of hope.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。