With just a tap on their phone, users can place bets on football matches, elections, and stock prices just hours in advance.

Written by: Lu Wang, Bloomberg

Translated by: Saoirse, Foresight News

In September, Mahesh Saha placed a high-risk bet on a volatile stock while on his way to a subway station in New York City. The 25-year-old law student opened a mobile app and spent $128 to buy call options — which means he had the right to purchase shares of uranium producer Cameco Corp. at $80 within a week. If the stock price exceeded that level, his profits could multiply several times his initial investment; if it didn’t reach that mark, the options would expire worthless, resulting in a total loss.

Saha noted that investor optimism for Cameco was rising that day, so less than 90 minutes later, he cashed out the options, making an 84% profit. On other days, he has also placed bets via his phone on the football game between Georgia Tech and the University of Colorado, the New York City mayoral primary, and whether President Donald Trump would establish a Bitcoin reserve. "My goal is to grow my funds," said Saha, a second-year student at Cardozo School of Law in Manhattan, "If I can grow it enough to cover my tuition, that would be great."

(Saha at Union Square in New York. Photographer: Kholood Eid for Bloomberg Markets)

Saha's "extracurricular activities" reflect the increasingly blurred lines between investing and gambling. A recent example is that in October, the Intercontinental Exchange, the parent company of the New York Stock Exchange, announced it would invest up to $2 billion in the cryptocurrency-based betting platform Polymarket. Meanwhile, derivatives market operator CME Group is also collaborating with online betting site FanDuel to launch financial contracts covering various assets, including sports events, economic indicators, and stock prices.

Since the outbreak of the COVID-19 pandemic, a new generation of traders has flooded the market with applications that combine brokerage services, betting features, and social media gimmicks. The tools they use emphasize speed, risk, and engagement: 0DTE (zero-day-to-expiration) stock options can yield thousands of percentage points of volatility within minutes; leveraged ETFs (leveraged exchange-traded funds) can amplify daily gains and losses by three times; "event contracts" allow users to bet on consumer price indices (CPI), corporate earnings calls, or NFL games; and there are also meme coins and tokenized stocks.

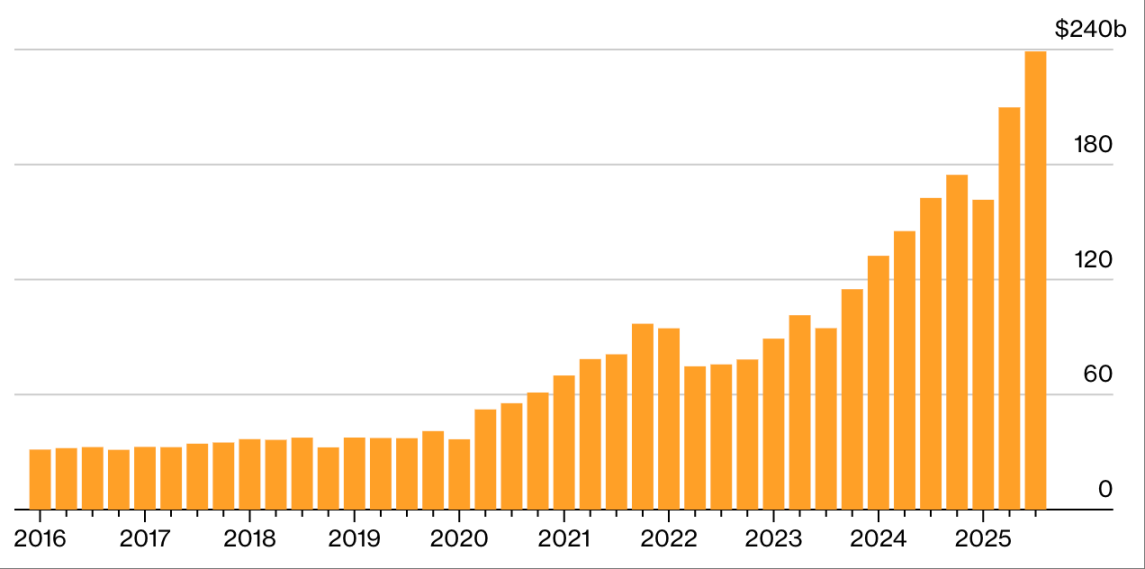

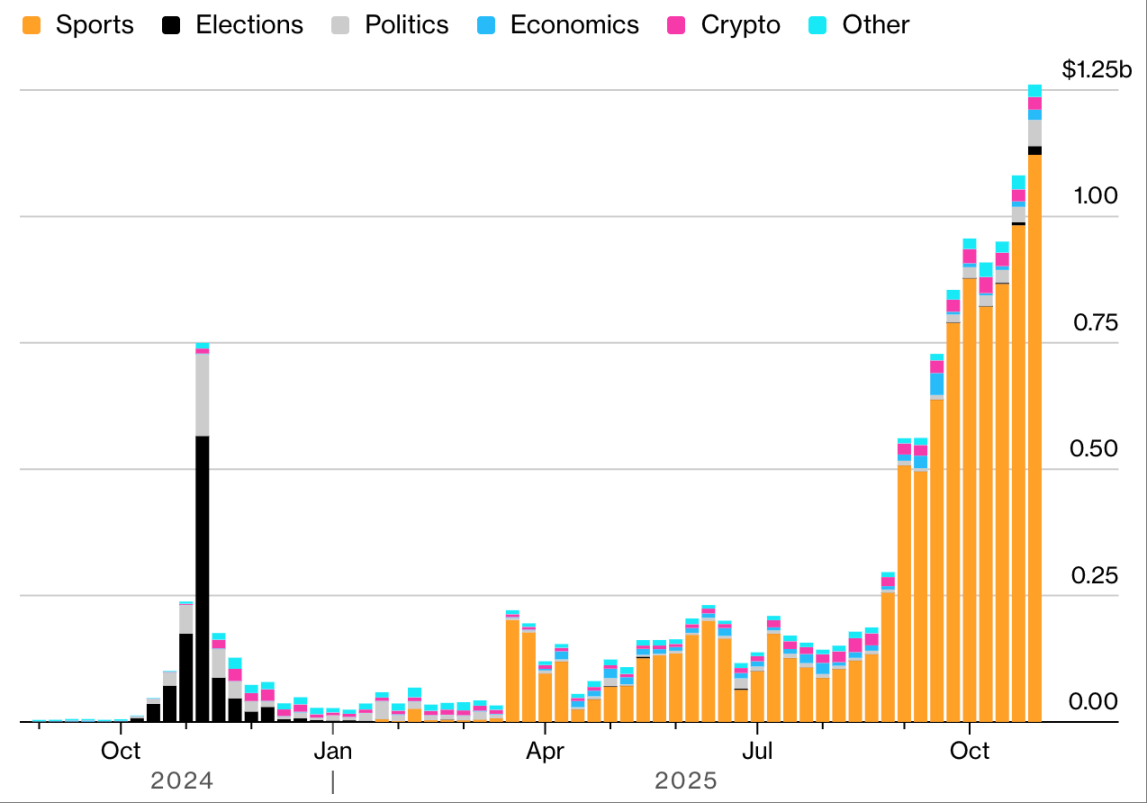

Today, more than half of the daily options trading volume in the S&P 500 index comes from 0DTE options — a type of tool that barely existed five years ago. Since the pandemic began, the assets under management in leveraged ETFs have surged sixfold to $240 billion. Sports event contracts are essentially a form of gambling; during the opening week of the NFL season, the trading volume on one of the largest prediction markets, Kalshi, reached $507 million. Day after day, Wall Street, which prides itself on "risk management," continues to create new ways to take risks: more tradable assets, more "winning" opportunities, and more dopamine stimulation.

Chasing Thrills

Quarterly assets under management in leveraged ETFs:

Source: Bloomberg

Note: The third quarter of 2025 does not include assets from funds established on September 30, 2025.

In the past, the process of going to a physical casino or withdrawing cash from a bank somewhat hindered gambling behavior; but now, such barriers have disappeared — mobile apps allow people to bet on anything, anytime, anywhere. Lin Sternlicht, co-founder of a New York addiction specialist agency, points out that the gambling problem patients she sees are getting younger, and the financial losses they incur are also greater. "They think they are investing because they are not going to a physical casino, but what they are doing is no different from gambling, and sometimes even worse — after all, this method is so accessible and can be operated 24/7," she said.

For regulators, the current risks are not just financial but also concern "fundamental positioning": if every interface becomes a casino, who is responsible? Is it the traders, the technology providers, or the system itself? During the Biden administration, the Commodity Futures Trading Commission (CFTC), which oversees the derivatives market, attempted to halt contracts related to elections and sports.

(Published in Bloomberg Markets December/January issue. Illustration: Arif Qazi for Bloomberg Markets)

However, prediction market platform Kalshi and another similar platform, PredictIt, filed lawsuits to block the agency's move. Kalshi claims its contracts help businesses hedge real risks, such as a company worried about a politician advocating for tax increases being elected, or an ice cream shop concerned about cold weather affecting sales. The operator of PredictIt, Aristotle International, describes its data as "a clear public service resource." Similarly, Polymarket states that its product performance can outperform polls and assist in decision-making. All three platforms position their services as "tools to help the public predict trends and manage risks."

According to U.S. law, betting on baseball games is illegal in some states; but betting on the fluctuations of Dogecoin based solely on "intuition" is completely compliant. "One thing must be clear: we are all 'gambling,'" says Isaac Rose-Berman. He is a professional sports gambler and a researcher at the American Institute for Boys and Men, a think tank dedicated to improving male well-being, as men are a high-risk group for gambling problems. "The difference is just the degree of 'gambling.'"

However, most experts believe that some behaviors clearly fall under "investment": for example, buying and holding diversified mutual funds (especially those tracking mainstream stock indices) or Warren Buffett's long-term holdings in companies like Coca-Cola and Apple.

During Trump's administration, the CFTC changed its stance: it not only ended its legal dispute with Kalshi but also authorized PredictIt to become a "regulated exchange." This decision sent a signal to the market: the definition of "qualified investment" is gradually moving away from federal and state control.

The current situation has historical precedents. In the late 19th century, so-called "bucket shops" (illegal or unregulated financial betting venues) allowed retail investors to bet on stock prices without owning the stocks — quotes were transmitted via telegraph and often delayed, creating the illusion of "participating in the market" while allowing the house to profit from that slight delay. This was a speculative behavior disguised as "investment," amplified by the technology of the time. Investors often ended up losing everything, and after the stock market crash of 1929, the U.S. SEC enacted regulations to protect investors' rights.

Since then, the cycle of "deregulation → financial disaster → tightening rules → relaxation after a period" has repeated itself. In the 1990s, the advent of the internet lowered the barriers to personal trading and increased convenience, sparking another wave of speculation: as the market shifted from paper trading to electronic trading, low-priced stocks surged, day traders began operating from home, and over-the-counter trading systems flourished. At the beginning of the next decade, the internet stock crash occurred, but soon other hot assets took their place. Then, seasoned investors leveraged derivatives to bet on real estate, fueling the real estate bubble — which ultimately burst in 2008, nearly collapsing the global financial system and leading to another round of regulatory tightening.

A World Full of Bets

Weekly nominal trading volume on Kalshi platform by category:

Source: Dune, Kalshi

Note: The weekly statistical period is from Monday to Sunday.

Today's trading tools are faster and more elaborate: speculative instincts are not only triggered but also "meticulously designed." For example, the "meme stock frenzy" where day traders collectively drove up the stock prices of companies like GameStop, and the cryptocurrency boom, are reminiscent of earlier speculative crazes. But the difference today is "institutionalization" — the casino is no longer across the street from the exchange but coexists in the same building.

In the sports betting world, retail participants are often referred to as "novices" — most of them bet for entertainment or due to "team loyalty," making them easily attracted to "event contracts" launched by platforms like Robinhood. Meanwhile, seasoned players can easily exploit these retail investors.

Chris Dierkes is a professional sports gambler who previously worked as an analyst at billionaire Stan Druckenmiller's family office and now oversees trading operations at Novig, a prediction market company focused on sports. He knows that in options trading, he cannot compete with large firms like Citadel Securities and Jane Street; however, the situation is completely different in sports betting. "I don't want to compete with smart people; I want to compete with 'fools,'" he says, "The markets with the highest trading volume on the Robinhood platform often correspond to the most 'blind' customers — and that's where I want to establish my roots."

If the lines between gambling and investing continue to blur, how should regulators redefine them? Ilya Beylin, a law professor at Carnegie Mellon University who studies financial regulation, attempts to provide a scientific answer. In his recent paper, "Exchanges Are Using Federal Derivatives Law to Offer Gambling Products to Retail Traders: A Descriptive Report with Regulatory Intervention Suggestions," he proposed a formula:

P = E - C + M

This framework aims to quantify "trading intent," taking into account economic value, costs, and motivations: trading outcome (P) = expected value (E) - costs (C) + psychological experience (M). If trading is driven by "return potential," it is considered "investment"; if the "thrill of gambling" becomes central, it is considered "gambling." By this standard, buying and holding shares of AI chip manufacturer Nvidia is "investment," while frequently entering and exiting "ETFs that amplify daily returns by 3 to 5 times" is "gambling."

However, Karl Lockhart, a professor at DePaul University studying securities regulation, points out that many of the so-called "distinctions" do not hold up under scrutiny. For example, the claim that "investment returns are diligent, while gambling does not yield returns": although roulette is entirely based on luck and the profit margin in blackjack is limited, disciplined gamblers in political and sports betting may find clearer advantages than in stock investing.

Another point of contention is "purpose": investment should be a tool for "hedging real risks." From this perspective, commodity futures and prediction markets can be categorized as "tools to mitigate adverse outcomes"; however, most users are actually "pure speculators without hedging intentions" — which means these products essentially operate within the "gambling realm."

In his paper "Betting It All," published in the Boston College Law Review in October 2025, Lockhart warns that given the increasing overlap between investment and gambling, the current legal framework distinguishing the two is becoming untenable. Regulators may ultimately prohibit "political betting deemed contrary to the public interest," while allowing traders to bet on meme coins and 0DTE options — even those who are not libertarians can see the contradiction in this.

Beylin suggests that the CFTC should more rigorously review new products and prevent exchanges from listing products that "cannot effectively advance hedging or pricing objectives"; at the same time, participation thresholds should be set based on traders' income, wealth, or "professional level"; additionally, the approval standards for derivatives should be raised, access to high-risk products tightened, and the positioning of each platform clarified — is it for "price discovery" or for "speculative entertainment"? "I don't believe people have the 'right to go bankrupt,'" Beylin says, "because when people go bankrupt, the social safety net bears the burden. Everyone is shouting 'freedom,' but they don't actually know what they want to 'freely do.'"

Some companies have begun to actively draw the line. Investment giant and index fund pioneer Vanguard Group Inc. has removed 0DTE options from its brokerage services and refused to engage in leveraged ETFs; at the same time, the company also flags clients who are "chasing hot stocks" or "trading too frequently." "If we compare options trading to a 'gambling target,' then 0DTE is the 'bullseye,'" says James Martielli, head of investment products for Vanguard's personal investor business.

The nature of short-term options dictates that huge profits can be realized quickly, but they can also vanish in an instant — you are betting on "whether a particular stock can reach a specific price on the day of the contract trade." This type of bet can yield astonishing returns, but it can also become worthless within minutes or hours (the latter being more common for ordinary people). An academic paper published in 2023 estimated that retail traders incur daily losses totaling $358,000 on 0DTE options.

Psychologist and bestselling author Maria Konnikova, who spent a year becoming a world-class poker player, believes that the notion of "investment as a rational behavior" is often an "illusion" — merely an excuse that market participants use to justify "luck." In her view, many investors are chasing the "illusion of control," and some even become obsessed with this illusion. "If you think that 'banning gambling will eliminate gambling behavior,' that's self-deception," she says, "I don't believe that 'the environment creates addicts': some people will develop a gambling addiction; if they had never been exposed to gambling, they might not be like that, but they could also become addicted to other things."

(Konnikova (center) at the 2018 World Series of Poker in Las Vegas. Photographer: John Locher / AP)

Konnikova referenced the research of the late Nobel laureate in economics and psychologist Daniel Kahneman — Kahneman questioned the concept of the "rational economic man." His research shows that even professionals are often misled by "randomness": mistaking short-term gains for "ability" and "correlation" for "causation." Kahneman wrote that the performance of most fund managers is "indistinguishable from random results." In today's market, which is accelerating towards "gamification," the logic of "relying on luck rather than research" is awkwardly becoming the core of modern investing. "Trading 0DTE options is gambling," says billionaire John Arnold, a former energy trader turned philanthropist, "In my view, this is definitely not investing — this is clear in the 'black and white' category, but there remains a lot of gray area in the industry, and that is the challenge the CFTC faces."

Saha, the law student, grew up in a blue-collar family in Queens, New York City. During the pandemic, he began to dabble in options trading and meme stock investing due to difficulty finding part-time work; since then, he has gradually developed his own system for building an investment portfolio. Saha browses the websites of sports betting companies like FanDuel and DraftKings Inc. through online platforms, looking for opportunities with "pricing anomalies," and then profits from these anomalies through betting.

In terms of stock investing, Saha follows nearly 70 accounts on the social platform X. After identifying a particular stock, he studies its price charts to determine buy and sell points; he avoids companies with a market capitalization below $1 billion and typically does not trade during the first hour of trading — he believes that market volatility is often greater during that time. Saha states that he has not recently tracked his performance in "event betting," but as of mid-November, his stock portfolio had a return rate exceeding 70% (he declined to disclose the total investment amount). "I am trying to control risk in a strategic and quantitative way," he says, "If I can manage risk and ensure that returns always exceed risks, then ultimately, this leans more towards investing rather than gambling."

Perhaps it is so, or perhaps it is not.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。