Written by: Glendon, Techub News

As the boundaries between traditional finance and the crypto world become increasingly blurred, prediction markets are rapidly reshaping the capital landscape.

Today, TechCrunch reported that the U.S. compliant prediction market platform Kalshi has completed a $1 billion funding round at a valuation of $11 billion, led jointly by Sequoia Capital and CapitalG, a growth investment firm under Alphabet, with participation from a16z, Paradigm, Anthos Capital, and Neo. Notably, just at the beginning of last month, Kalshi had completed a $300 million funding round led by Sequoia Capital and a16z at a valuation of $5 billion.

In just over a month, Kalshi's valuation has doubled, and with the significant entry of Google-affiliated CapitalG, this capital move has immediately attracted high market attention. Meanwhile, according to Bloomberg, Kalshi's main competitor Polymarket is also in talks for a new funding round at a valuation of $12 billion to $15 billion, with no updates on the funding progress disclosed yet. However, last month, Polymarket secured a strategic investment of $2 billion from the Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, at a valuation of $9 billion.

The consecutive acquisition of top-tier capital by these two prediction market platforms may indicate that the fierce battle in the prediction market space is on the brink of eruption.

Kalshi Ascends to the Prediction Market "Throne"

Kalshi is the first prediction market platform in the U.S. licensed and regulated by the Commodity Futures Trading Commission (CFTC), allowing users to trade real event outcomes with real money through Event Contracts. It has attracted a large user base in the U.S., covering various fields such as politics, sports, and economic data. The platform currently supports users from over 140 countries to bet on various future events.

Kalshi was founded in 2018 by Tarek Mansour and Luana Lopes Lara. Tarek Mansour previously worked at the Chicago Mercantile Exchange (CME) and has extensive quantitative trading experience; Luana Lopes Lara is a former emerging markets strategist at Morgan Stanley. Other team members include Chief Technology Officer (CTO) Eli Levine, Chief Financial Officer Tejwani, and product lead Sarah Chen, all from well-known tech companies like Google Cloud and Uber.

With the successful completion of this $1 billion funding round, Kalshi's development is set to reach new heights. In terms of valuation, Kalshi has entered the "billion-dollar club" alongside its competitor Polymarket.

Although Kalshi still has a significant gap in total funding compared to Polymarket, it has achieved a remarkable lead over Polymarket in several key dimensions, leveraging its first-mover advantage in regulatory compliance.

Kalshi's growth momentum is astonishing. According to The New York Times, as of mid-October, Kalshi's annualized trading volume reached $50 billion, a more than one-thousand-fold increase compared to last year's trading volume of about $300 million.

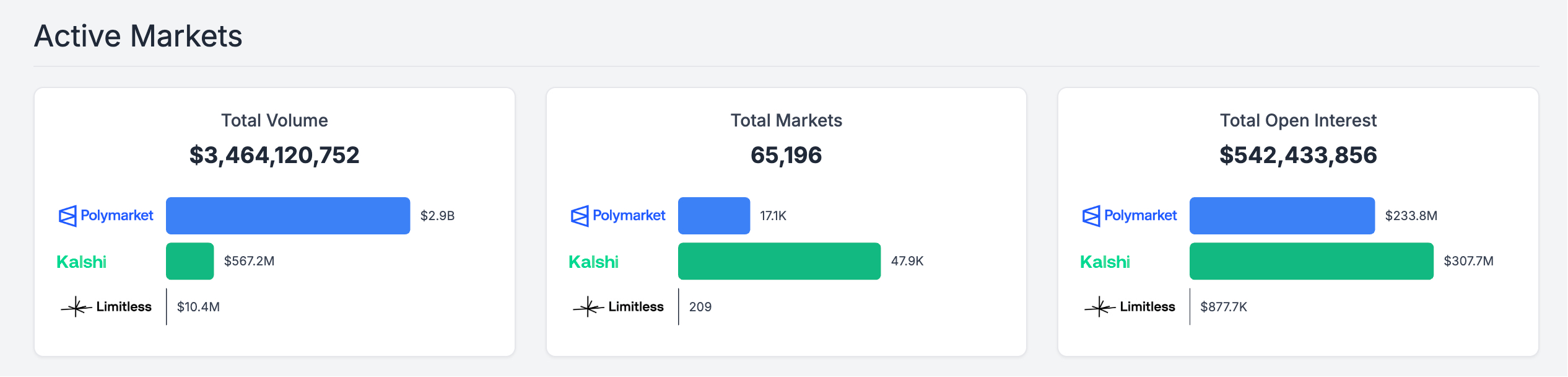

Additionally, according to Polymarket Analytics data, as of the time of writing, Kalshi's total trading volume is only $567 million, still significantly trailing Polymarket (approximately $2.886 billion). However, in terms of the total number of prediction markets and open contract volume, Kalshi has shown a clear advantage, with a total of 47,900 prediction markets and an open contract volume of $307 million, both surpassing Polymarket's 17,100 and $234 million.

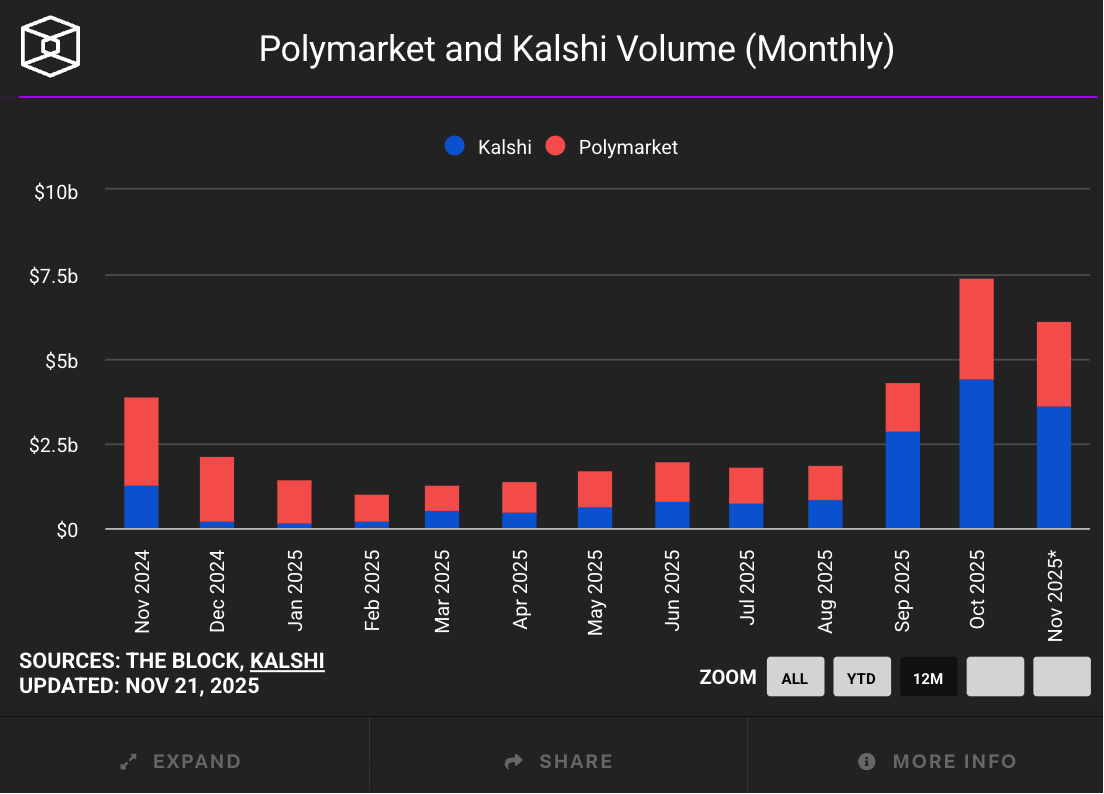

In fact, according to The Block's monitoring, since September, Kalshi's monthly trading volume has exceeded that of Polymarket.

Although Polymarket experienced explosive growth in October, with monthly active users soaring to 477,900, a 93.7% increase from September, and its monthly trading volume rising to $3.02 billion, both setting historical highs, Kalshi's trading volume in October reached $4.4 billion, not only remaining ahead of Polymarket but further solidifying its dominant position in the market.

As of the time of writing, Kalshi's November trading volume has reached $3.62 billion, while Polymarket's stands at $2.48 billion. If no special circumstances arise, Kalshi will surpass Polymarket in trading volume for three consecutive months.

Moreover, Kalshi continues to lead in market activity. On November 16, Kalshi's daily active prediction markets exceeded 237,000, setting a new historical high. Excluding other prediction markets, Kalshi's current market share has reached 59.23%, while Polymarket's market share is 40.77%.

However, adding to Polymarket's woes, a recent study from Columbia University indicates that nearly 25% of Polymarket's trading volume may involve fake trades, where users quickly buy and sell contracts, often trading with themselves or colluding accounts to artificially inflate trading activity metrics without changing their net market position.

The study further reveals that Polymarket's fake trading volume peaked in December 2024, accounting for nearly 60% of weekly trading volume, and this phenomenon persisted until October 2025, with sports and election markets being the most affected. Researchers believe that the purpose of these fake trades may not be for profit but to manipulate future incentive mechanisms.

The above data and research clearly illustrate that the gap between the two is becoming increasingly significant. To date, Kalshi not only occupies the vast majority of the U.S. market share but has also surpassed Polymarket in the overall market, officially ascending to the "throne" of prediction markets.

The Market Battle is Set to Begin

In terms of ecosystem construction and expansion, Kalshi's cryptocurrency head John Wang stated at the Token2049 conference in Singapore in early October that Kalshi plans to launch on "every major cryptocurrency application and exchange" within the next 12 months. Its on-chain plan is building a utility-focused diversified builder ecosystem, including real-time event data pushed to the blockchain for developers to use, enabling them to build complex data dashboards, AI agents, and new information arbitrage platforms.

Just the day before, researcher Jane Manchun Wong tweeted that Coinbase is developing a prediction market service powered by Kalshi, which will cover betting options on Federal Reserve decisions, cryptocurrency prices, and news events. Earlier, Kalshi's prediction market had chosen Coinbase to custody USDC in event-based contracts, secured by Coinbase Custody.

Additionally, on October 13, Pyth Network announced a partnership with Kalshi to bring prediction market data to over 100 blockchain networks; on October 22, the Solana ecosystem DEX Jupiter launched a test version of the Jupiter Prediction Market, also supported by Kalshi's liquidity; on October 23, Kalshi partnered with oracle service provider RedStone to connect Kalshi's platform to over 110 blockchain networks, allowing developers to access real-time event data across numerous blockchain networks.

These examples indicate that Kalshi is steadily advancing its on-chain plans, aiming to become the backend service provider for prediction markets for other applications, further solidifying its leading position in the prediction market space.

However, in the face of Kalshi's strong rise, Polymarket clearly has no intention of conceding defeat and is preparing to fight back in this fierce market battle.

Previously, Polymarket was expelled from the U.S. market due to compliance controversies. In July of this year, Polymarket spent $112 million to acquire the small exchange QCX, planning to re-enter the U.S. market legally. In early September, Polymarket CEO Shayne Coplan tweeted that Polymarket had received approval from the CFTC to launch in the U.S. The CFTC has issued a no-action letter to the company, allowing it to resume operations in the U.S.

According to Bloomberg, Polymarket has begun real-time testing in the U.S., quietly opening to select users and facilitating trades in preparation for its planned re-launch in the U.S. gambling market. Insiders revealed that Polymarket is expected to initiate preliminary trading by the end of November, but it will not be fully open to everyone. Polymarket's timing for this launch may be aimed at capturing more trading volume during the peak of U.S. football and basketball events.

Currently, Polymarket has opened a user registration waiting list and will soon open registration. The prediction platform states that the exchange is fully functional, and some users have already begun betting on real contracts, working to complete the final steps needed for opening.

Furthermore, Polymarket also plans to launch the POLY token.

Polymarket's Chief Marketing Officer Matthew Modabber confirmed last month the plans for the POLY token and its airdrop, stating, "We want it to be a truly practical, lasting, and ever-present token." Modabber emphasized that the priority will be to launch the U.S. version of the application, and there is no rush to release the token. After the application goes live, the focus will shift to the token launch and ensuring a smooth rollout. In contrast, Kalshi has not yet mentioned any plans to launch a token.

With Polymarket's return to the U.S. market and the launch of the POLY token, the battle for prediction markets may truly begin.

However, it is important to clarify that prediction markets are still in a relatively early stage. Despite the attention garnered by platforms like Kalshi and Polymarket, they still face multiple core issues such as low liquidity, difficulties in market discovery, poor user experience, and limited expression (for specifics, see: “Highlights and Concerns: Five Bottlenecks in the Prosperity of Prediction Markets”).

Additionally, it is noteworthy that many tech and financial companies are planning to enter the prediction market space, as evidenced by CapitalG leading Kalshi's recent funding round. Earlier this month, Google announced partnerships with Kalshi and Polymarket to integrate data from both prediction market platforms into Google Finance; Robinhood partnered with Kalshi to launch prediction market services back in March; furthermore, the Chicago Mercantile Exchange Group announced plans in mid-October to launch financial contracts linked to sports events and economic indicators by the end of the year, directly competing with Kalshi and Polymarket. More companies, such as Truth Social under Trump and Crypto.com, are also launching similar products.

The entry of these tech and financial giants may accelerate the differentiation and reshuffling of the industry. Meanwhile, in the crypto space, more competitors have emerged in the prediction market arena, such as Limitless, which focuses on financial prediction markets on the Base chain, Opinion on the BNB Chain, and Azuro, a prediction layer on the Polygon chain.

In the future, these new players may leverage their technological advantages and differentiated strategies to launch strong challenges against Kalshi and Polymarket's market shares. For instance, Opinion achieved a trading volume of $169.2 million in a single day shortly after briefly opening on October 25, surpassing Polymarket's $163.7 million, topping the daily trading chart for on-chain prediction markets.

Driven by technological iteration and capital influx, prediction markets will undoubtedly continue to differentiate and deepen into vertical fields such as finance and politics, shifting towards more refined operational models. For leading platforms to maintain their competitive edge, breakthroughs in compliance, user experience, and ecosystem development will be essential. Whether Kalshi can firmly hold its "throne" or if the "duopoly" of Polymarket and Kalshi can be sustained will depend on their ability to truly address the core issue of liquidity bottlenecks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。