Selected News

Bitcoin falls below $82,000 again, 24-hour decline expands to 8.9%

Independent researcher claims $610 billion AI Ponzi scheme has collapsed

“Binance Life” market cap falls below $100 million, 24-hour decline exceeds 26%

Selected Articles

Over the past two months, ZEC has surged nearly tenfold and has been the focal point of the market with its independent trend. The discussions surrounding ZEC have gradually evolved from early endorsements by figures like Naval, Arthur Hayes, and Ansem focusing on the privacy concept, to a more nuanced view that considers actual demand in the privacy sector and a bearish perspective based on mining power and profitability. So, outside of the endorsements from well-known figures, what are the detailed arguments from both the bullish and bearish sides regarding ZEC?

The 2025 crypto market is at a delicate turning point: Bitcoin ETF approval, intertwining liquidity cycles and debt refinancing cycles, the AI boom siphoning off funds, and traditional finance and tech giants accelerating their embrace of blockchain. Against this backdrop, the market structure has become abnormal, with a lack of buying in long-tail assets, and high-performance public chains like Solana showing weak performance. Investor sentiment swings between extreme optimism and panic. In this episode of “The Journey Man,” Raoul Pal (former global macro investment manager and founder of Real Vision) and Chris Burniske (partner at Placeholder) delve into market cycles, liquidity drivers, investment psychology, and structural changes in the industry.

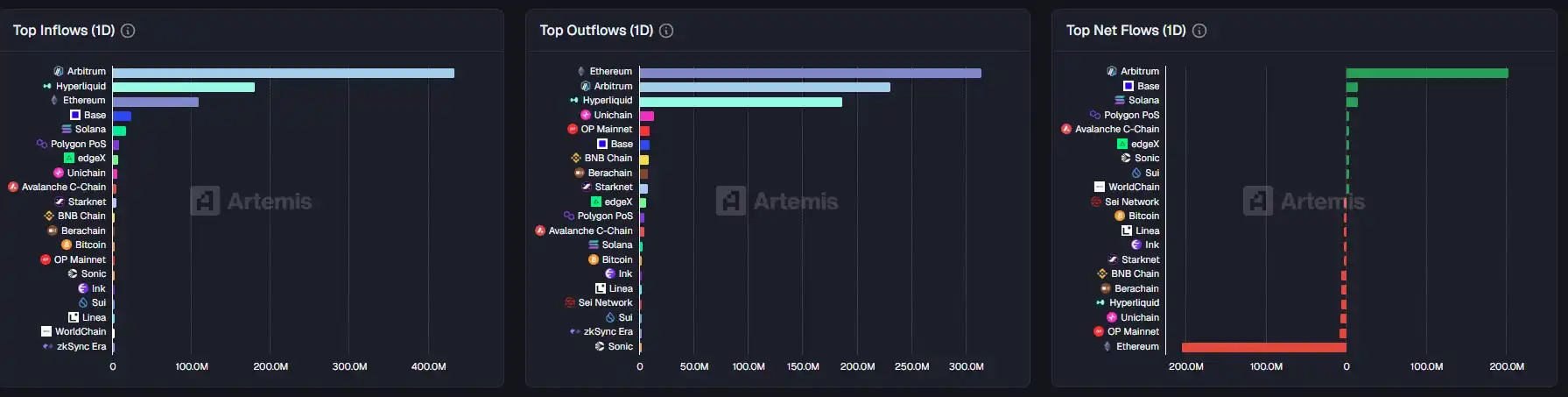

On-chain Data

On-chain capital flow situation for the week of November 21

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。