Original Title: Markets Are Broken: The Crypto Liquidity Crisis Explained

Original Author: Raoul Pal The Journey Man, Youtube

Translated by: Peggy, BlockBeats

Editor's Note: The crypto market in 2025 is at a delicate turning point: the approval of Bitcoin ETFs, the intertwining of liquidity cycles and debt refinancing cycles, the AI boom siphoning off funds, and traditional finance and tech giants accelerating their embrace of blockchain. In this context, market structures are exhibiting anomalies, with a lack of buying interest in long-tail assets, underperformance of high-performance public chains like Solana, and investor sentiment swinging between extreme optimism and panic.

In this episode of "The Journey Man," Raoul Pal (former global macro investment manager and founder of Real Vision) and Chris Burniske (partner at Placeholder) delve into market cycles, liquidity drivers, investment psychology, and structural changes in the industry.

Is the four-year cycle still valid? How do liquidity and macro frameworks affect crypto assets? How should investors build their cognition and strategies amid uncertainty? From Solana's unusual performance to the plight of long-tail assets, from ETF effects to the transformation of VC models, the two guests not only share their respective biases but also reveal how to construct robust investment strategies amid divergences.

The recording took place on November 13, and the following is the translated text:

Current Market Situation and Cycle Debate

Raoul Pal: Hello everyone, I’m Raoul Pal, and welcome to my show "The Journey Man." Here, we explore the intersection and understanding of macroeconomics, cryptocurrencies, and the tech index era. It’s a rare privilege for me to sit in this position, having such resources and networks, and to integrate this knowledge together.

Today, I have invited one of my favorite guests to converse with, Chris Burniske. He is one of the most insightful thinkers in this field and has always been a source of inspiration for me in how to deal with market volatility and how to invest.

A valuable conversation lies not only in discovering resonances in viewpoints but also in exploring divergences. Chris has a different perspective from mine; he believes this cycle may have ended, while I think the cycle is still ongoing. We are both thinking within a probabilistic framework, with no absolute certainties. Therefore, we will delve into these differences and how people can build their cognitive frameworks when faced with differing viewpoints.

Chris has a deep understanding of investment psychology, knowing how to think and manage portfolios for survival and prosperity. Now, let’s hear Chris’s thoughts.

Chris, it’s great to see you again, my friend.

Chris Burniske: Thank you for having me again.

Raoul Pal: Yes, today is November 13, and I guess this episode will air a week later. Well, right now the market, cryptocurrencies, Twitter—everything is in chaos, and everyone is trying to figure out where we actually stand. So, I think we should start with this topic and then dive into some more interesting things, like what you’ve seen recently.

So, how do you think about where we are in the cycle, in the market, or their structures?

Chris Burniske: Okay. As of today, Bitcoin has dropped about 20% from its peak, right? In traditional finance, this would be considered a bear market, right? In the crypto industry, this is either a "speed wobble" or it could drop deeper, right? I think we have to maintain enough respect because Bitcoin has always been the gravitational center for other crypto assets.

So, there are many ways to look at this issue, and I think that’s also where people feel pain. You and I might discuss different viewpoints, and we both know these viewpoints are probabilistically weighted in our minds, and we are both prepared to accept that we might be wrong, right? And that’s the subtlety that’s lost online because people either want you to be bullish or want you to be bearish. But I think every professional asset manager is always somewhat bullish and bearish, or bullish and paranoid, or bearish and paranoid, or some other combination.

Raoul Pal: Yes, generally speaking, if you have a very strong viewpoint, then your entire job is to remain paranoid about that viewpoint. That’s how I understand it.

Chris Burniske: Right. So, in the simplest framework, if you follow the four-year cycle framework, then Bitcoin is currently forming a top if you believe in this four-year framework, right? Then you would expect a bottom to form in about 12 months. You could say this is due to the halving, and I think this argument becomes increasingly questionable as Bitcoin's inflation rate declines. Especially when you really think about the core of the halving argument, the number of coins paid to miners, proof of work, the cost of producing Bitcoin, and so on.

So, there’s the halving argument and the liquidity argument, and you’ve done an excellent job educating everyone on understanding liquidity. Bitcoin aligns with the four-year business cycle, and then there’s a liquidity cycle above the business cycle. But the problem lies here because Bitcoin is somewhat misaligned with the liquidity cycle right now, right?

So I think we have to acknowledge that this is a point that makes me a bit anxious. I would think, hey, the liquidity cycle suggests Bitcoin should perform well at some point, but right now it’s struggling a bit. However, I also don’t dare to be overly confident in this viewpoint because if I’m under-allocated during a rise and the liquidity dynamics suddenly kick in, I could get slapped in the face.

Overall, I started to issue some cautious signals after the crash on October 10 because the market felt heavy to me. Someone commented on crypto Twitter that he views the market more like an organism rather than fixating on specific indicators. I’m not someone who particularly focuses on a specific point either, nor have I had the in-depth market detail training like you. So I try to step back and view the market as a whole, integrating various variables to see what the combination of these variables suggests.

For me, the market started to feel strange when Solana did not receive significant buying interest during the anticipated ETF launch. You see, Bitcoin's DAT buying drove the market, then shifted to Ethereum's DAT buying, along with Bitcoin and Ethereum ETFs, which were very favorable for both BTC and ETH. Logically, similar events should also benefit Solana since it is the high-risk asset I chose for this cycle. But that didn’t happen.

Raoul Pal: I had also been paying attention to Solana before switching, but the logic is the same.

Chris Burniske: Right, we are both looking at high-performance Layer 1s with strong core engineering capabilities and interesting ecosystems. But when Solana performed poorly during the data expectations and ETF announcements, I felt something was very wrong. This indicates a lack of buying interest in the market, but rather a significant amount of selling.

Then came the crash on October 10, and the only time I’ve seen something similar was during the pandemic crash in March 2020. At that time, I watched my portfolio, and some assets dropped 60% to 90% in a single day; it was insane. I don’t like this situation because the market has been anxious about long-tail assets this cycle: where is the buying interest for long-tail assets? What is their fundamental value? How should they be valued? These are all questions we have long expected to resolve, such as the specialization of crypto asset valuation, and you and I have both done early explorations in this area. Now, this specialization is coming, but long-tail assets still lack buying interest. Meanwhile, there’s an AI bubble.

And the crash on October 10 revealed the true buying positions of many assets. My concern is whether we have to return to those crash lows? Because some of those lows suggest bear market levels, especially for long-tail assets.

Raoul Pal: Yes, it depends on which low you are looking at. If you use the lows from Binance, that’s pretty bad; if you use the lows from Coinbase, many assets are now basically back to that position.

Chris Burniske: Absolutely right. That’s also the subtlety. There are other signals, like the ones you mentioned about Binance and Coinbase. The Coinbase premium has disappeared, and now the coins on Coinbase are generally priced lower than those on Binance, indicating that buying interest in the U.S. is not as strong as it used to be. We are also seeing some very aggressive pricing in venture capital deals, even though there isn’t a real venture capital bubble in the crypto space.

Raoul Pal: Chris, back to that flash crash liquidation event, who was really hit hard in it? Because someone must have taken a significant loss, but it’s still unclear who. Most U.S. users are not highly leveraged.

Chris Burniske: Yes, people were clearly liquidated, but I feel we haven’t seen the full extent of the real damage yet. I don’t want to spread rumors; I believe everyone has seen some rumors on crypto Twitter, but I don’t have concrete information. However, there are indeed questions being raised about certain market makers.

Raoul Pal: What about retail investors? Were they liquidated, or were they just watching in panic? I wonder if this caused some psychological trauma for people, or if it was just like a flash crash in the stock market, leaving people bewildered?

Chris Burniske: I think anyone using leverage was hurt, especially those who leveraged based on Binance prices; they must have taken significant losses. So, some retail investors were indeed affected.

But the more significant damage is that the buying interest for long-tail assets was already paused, and this event exacerbated that pause. Because suddenly, even if there are price differences between exchanges, people will still ask: where is the buying interest for long-tail assets? Then this catastrophic event occurs, showing some extreme lows, which really makes people question whether those lows are the true buying positions. That’s the psychological shock.

Raoul Pal: There’s another question that I think is important but many people don’t realize: Is it because everyone believes in the "four-year cycle" that they collectively made it a reality?

Chris Burniske: Yes, that is indeed a tricky question. My usual principle is, "This time won’t be different unless there’s a strong enough reason for it to be different." We see this pattern in many scenarios because human nature has never changed, which you and I both know.

But this time there are indeed many reasons that could make the situation different, such as the clarification of U.S. legislation and regulation, traditional finance and tech giants embracing stablecoins and blockchain technology on a large scale, ETFs entering the market for the first time, and liquidity moving towards us.

So, there are many signs indicating that we might be approaching a turning point. I’m also prepared for it, like now BTC is at 98,000, ETH just over 3,000, and Solana at 140. I’m fully prepared for the market to reverse from here; it’s not impossible.

Raoul Pal: Yes, I remember 2021 was also a crazy year. Bitcoin dropped 50% and then quickly rebounded, which wasn't easy.

Chris Burniske: Right, now BTC has dropped 20% from its peak, ETH has fallen about 40%, and Solana has dropped about 50% from its high last December. I think this might be enough to wash out the weak hands. If we rebound from here, I can imagine it will be painful for many.

This is also a problem I see on crypto Twitter: the sentiment is too extreme, either fully leveraged or completely liquidated. In contrast, I shared my position a month ago, about 39% cash and 61% long-term capitalist assets, which includes a basket of assets, with cryptocurrencies being part of it.

So, I still have a majority position betting on capitalism because capitalism is designed to grow capital. Then, when the market is good, I gradually increase cash and deploy it when prices are attractive enough. Now, money market fund yields are higher than inflation, so slowly accumulating purchasing power, while not an amazing strategy, I really recommend that if you feel anxious about the market now, you can think in a more probabilistic and stepwise manner.

Raoul Pal: But the problem is, your entry point is very good, so you can take your money out early without Solana making new highs, which is actually your advantage. I would categorize this as "paranoia" because almost all assets, except Bitcoin, have not made new highs, and the entire market basically peaked in January, which is strange for this year.

But the problem is, most people don’t have significant gains because they never buy at the lows. You and I were vocal at the lows, but most people didn’t buy at the lows; they bought at some point in 2023 or 2024, and now they are basically flat.

Yes, it’s psychologically very uncomfortable. Because when you are flat, it’s very difficult to psychologically accept "reducing positions," especially when all your hopes and dreams are pinned on this trade. I can understand why everyone is struggling because it is indeed very hard.

Raoul Pal: Yes, people will overlook your entry in venture capital, but many of your positions were also bought in the public market.

How to Build the Right Investment Framework in the Crypto Space?

Investor Psychology

Raoul Pal: For example, your Solana was bought in the public market, and it was done openly in front of everyone.

Chris Burniske: Yes, I always tell those who are new to the crypto market that if they are flat at the end of the first cycle, that is actually a victory because they learned a lot and experienced painful volatility in the process.

So, if someone has no gains now and is just flat but has learned a lot, that is a kind of victory. Of course, if they are flat at this price level, I can understand that it would be uncomfortable.

I have been encouraging friends to think with a framework, and these friends all have their own portfolios. When we chat, I share some of what I think are the best methods.

The framework is as follows: Assume you sell now, how happy would you be if the price drops? How sad would you be if the price rises? Now assume you don’t sell, how happy would you be if the price rises? How sad would you be if the price drops?

Use this four-quadrant comparison to evaluate emotional responses in different scenarios, anticipate future feelings in advance, and avoid making foolish decisions.

Raoul Pal: I think this method is very helpful for rational investors, especially those who seriously think about how to accumulate wealth. But the problem is, young investors can’t buy houses; they feel this is the only opportunity, a chance to change their fate.

This emotion is too strong; they pin all their hopes and dreams on a single trade, which is clearly not the right investment approach. But they cannot bear the pain of missing out on the rise, nor can they bear the risk of a decline. These two forces intertwining really drive people crazy.

Chris Burniske: Yes, that’s indeed the case. However, I want to add a point about the demand for instant gratification. Because when I entered this industry as a professional in 2014, I had less than $10,000 to my name, no savings, and the industry was completely different, with different opportunities.

I started by buying some very small positions, learning gradually, and accumulating step by step. Later, at the end of 2016, I experienced a hack that nearly wiped out my assets. At that time, I had just started writing crypto-related articles, and then I entered 2017.

Raoul Pal: By the way, how did you adjust psychologically?

Chris Burniske: It was terrible. I was one of the early victims of SIM swap attacks. They first shut down my account with one carrier, then opened a new account with another carrier, reset my Gmail with that account, and then reset my Apple account with Gmail, ultimately locking me out of all my devices.

It was a very bad experience. Now my security measures are much better, and I’m grateful for that, but it was really painful at the time. The feeling of being emptied psychologically was like having my sails completely blown away. Moreover, when you experience a cyber attack, it’s hard to determine whether those people have really left your "digital house." If someone breaks into your physical house, it’s easy to know they have left, but in the digital world, that sense of security is hard to obtain.

However, everything has its pros and cons; I learned a lot about cybersecurity from it.

Raoul Pal: So how did you adjust your mindset and get back on your feet? Because I think this is great advice for many people, learning how to rebuild after failure.

Chris Burniske: I think failure is the best teacher; it helps you grow more than success. For me, there was no choice. You can sit there and complain, shifting the blame to others, or you can say, "Yes, this happened to me, and it’s terrible."

Some things are fate, and some are my responsibility. I have to improve the parts I am responsible for, then roll up my sleeves and start over. That’s what I want to say to young people: Yes, the world is tough right now, and I can feel the anxiety, but in many ways, modern life is much easier than in the past. It is indeed psychologically difficult, but you must keep moving forward.

Raoul Pal: You lost everything and then could only say, "Well, I have to keep living." After that, did you change your trading style and become more conservative? What impact did this have on your psychology during the process of rebuilding wealth? Because we see many people who have experienced liquidation, whether from hacks, investment mistakes, or leveraged liquidations. Some might be sitting in front of their computers at 26, having just lost $50,000 in this cycle, thinking, "How do I start over?"

Chris Burniske: I think I was lucky because Ethereum was in a downtrend after the DAO attack at that time. The DAO attack happened in the summer of 2016, if I remember correctly, and then Ethereum dropped all the way down to the end of the year. So I was able to buy back a lot of ETH. Looking back, the biggest loss I had was in ETH because I entered very early on ETH, while Bitcoin was relatively later. As a young person, my purchasing power was more significant in ETH because it was only a few dollars at that time, while Bitcoin was already hundreds of dollars. So I accumulated some ETH again, which helped me a lot in 2017.

Then we experienced the ICO frenzy, and I invested in almost every ICO, but in terms of ETH, I lost money. You would feel like you were making money, thinking everything was great; in 2017, everything you touched was profitable, but by 2018 and 2019, everything collapsed again. Looking back at those trades, I would think, "Oh my God, I lost so much ETH, thinking I was a genius, but I was actually a fool."

So, I went through many foolish moments and then recovered.

Raoul Pal: I even set a rule for myself: I would allow a maximum of 10% of my position to go into those "foolish" high-risk investments, like meme coins or other ultra-high-risk things, because sometimes you just want to participate, otherwise, I basically don’t do short-term trading. Recently, I checked and found that every single investment in this high-risk position has lost money.

Chris Burniske: Haha, yes.

Raoul Pal: Every single one has lost money. I actually did this on purpose because I wanted to prove to myself that most of the time, these investments are losing. If I had just held Solana or made some reasonable adjustments, the results would have been much better.

Chris Burniske: I completely agree. So, the process of getting back on your feet is actually about continuous learning and adjustment. You just reminded me of an article Lyn Alden wrote titled "Most Investments Are Bad Investments." If you were liquidated, maybe it’s an opportunity to rid yourself of a bunch of bad investments, learn the lessons, and then concentrate your funds on truly quality assets.

Because the history of crypto asset investment tells us that there are only a few dozen true big winners, and even fewer assets that can grow sustainably across multiple cycles. Most other things are "one-time miracles" that ultimately become distractions. If you don’t time these "one-time miracles" well, you will lose money. So, in the long run, you should focus on accumulating the assets you are most optimistic about and ensure that its performance can prove it is creating value. In other words, the chart should show that it maintains higher lows in every bear market, with an overall upward trend.

Capturing Long-Tail Assets

Raoul Pal: Another issue is long-tail assets.

Chris Burniske: Yes, the long tail is getting longer because there are too many issuances. People always think long-tail assets are their opportunity for 100x or 1000x returns, only to miss the major trades.

The main trade over the past three years has actually been Solana, and the logic is very clear: active on-chain activity, a thriving developer ecosystem, and obvious opportunities. But many people missed it because they wanted to venture further out on the risk curve. Now the long-tail assets are oversaturated, with too many tokens, and it’s even impossible to measure them with a power law distribution because the numbers are too large.

Raoul Pal: I completely agree. The current issuances come from the VC industrial system, along with a large number of meme coins; we are simply inundated with tokens.

Chris Burniske: If we look back over the entire cycle, most assets bottomed around December 2022, then performed relatively weakly in 2023 until they started to gain momentum in October.

From October 2023 to the end of the fourth quarter, the market saw a strong rise, which was the "alt season" for most tokens. Then in the first quarter of 2024, Bitcoin ETFs were approved, Bitcoin performed well, and the entire market was optimistic, with everyone thinking, "Wow, this will happen again just like last time." But that was actually the peak, occurring at the end of the first quarter of 2024.

It was also at that time that meme coins became popular, with a surge in issuances, and then people began to worry about FDV (fully diluted valuation) and VC selling pressure. I think this is a good thing, indicating that people are educating themselves. The result is that starting from the peak in the first quarter of 2024, most assets entered a painful bear market, declining all the way down.

Now, I think we are in a consolidation process where everyone needs to readjust their portfolios and accept necessary losses. Many people feel that you and I never lose money, but the truth is, we also often incur losses. The key is how to handle these losses, offset them against profits, settle annual returns, pay taxes, and then start over.

I understand that many people start with only $500, $1,000, $5,000, or $10,000, which can make progress feel too slow. But I want to say that the compounding accumulation of wealth is a tedious process. Take Buffett, for example; he is not the most exciting person in the world, but he is one of the richest because his method is stable, consistent, and methodical. In contrast, Musk represents another extreme—high risk and boldness, which many young people admire more.

But the problem is that many young people are immersed in gaming and adrenaline culture from a young age, and the internet is filled with dopamine, so they are naturally attracted to traders on Twitter. Those traders post screenshots of buy and sell transactions with 10x returns, which feels very exciting.

However, we all know that very few traders can make money in the long term; trading is extremely difficult. People are attracted because they see someone making 10x on a certain coin and want that result for themselves. But in reality, slow accumulation is the way to go. Extend your time horizon; doing nothing actually makes it less likely to make mistakes. Especially if you hold a larger Layer 1 asset, the probability of making a big mistake is very low.

Raoul Pal: I completely agree. And I think there is a problem in trading culture where people like to flaunt profits, which creates unrealistic expectations about returns. I even suspect that a lot of the boasting is fake; it’s too easy to fake screenshots with Photoshop or AI. So, this false information is mixed in. I would even say that for most people just entering the crypto market, they should allocate at least 50% of their position to Bitcoin, and then use the remaining 50% to try other assets.

If you buy Bitcoin at the right time, like near the 200-week moving average, you can basically "never sell," holding it long-term as an anchor asset. This way, you are always bullish on the industry, can remain calm, follow the cyclical fluctuations, and continue to learn.

If Bitcoin returns to the 200-week moving average, you can add to your position and then consider other assets like Solana, Ethereum, Sui, etc. When the market is overheated, you can reduce your position, accumulate cash, and wait to buy back when Bitcoin approaches the 200-week moving average again or shows signs of pressure.

Raoul Pal: I have also been teaching everyone a principle—don’t mess things up. Specifically, long-tail assets should only occupy a small proportion. If you adopt a barbell strategy, allocating 50% to Bitcoin, you won’t go wrong; then take 10% to try and learn, which might lead to a success that makes you feel like a genius, but most of the time you will learn some painful lessons.

The middle positions should not take too much risk; you can choose some slightly higher-risk assets that still have fundamentals, like ETH or Solana, but don’t go too far because that will lead to a lot of regrets. The portfolio with the least regret is: mostly Bitcoin, a little long-tail, and some middle assets that have growth potential but no survival risk.

Chris Burniske: Yes, if you anchor with Bitcoin, you can maintain a stable mindset in each cycle, knowing where you stand, your exposure, and whether the market is at a low or high point. So, I hope everyone can achieve this. Of course, Bitcoin also has some supplementary assets, like Zcash, which has performed strongly recently.

Raoul Pal: Okay, let’s return to the previous topic. Looking at the market structure, overall feel, and nuances, you think the trading conditions are poor, some places don’t align, and there may be some kind of "self-fulfilling" four-year cycle effect causing everyone to push this outcome together. We see some OGs selling coins because why not sell? They bought in at $10 and are now selling at $100,000, which is a round number, and they have always sold at this time in the past, and it has always worked. Coupled with the structural collapse in October, it may have caused more damage than we currently see.

Chris Burniske: Yes, so from a probabilistic perspective, we might be at a top position. The opinions in the market are almost 50/50, with half believing we have peaked and the other half believing we have not.

Raoul Pal: Right, and this is not a euphoric top; it feels more like a "distribution top."

Chris Burniske: Exactly.

Raoul Pal: There’s also a strange aspect; if we return to the "paranoia point" you mentioned, I find it interesting. The opposite of your viewpoint is: we haven’t seen new historical highs, gold is skyrocketing, liquidity is coming to us, but most assets peaked in January, not at the end of the year. These are all reasons that make me paranoid about your viewpoint.

Chris Burniske: Yes, that’s also my concern. Although Bitcoin made new highs in the second half of the year, this is the first time this has happened without other markets following.

Raoul Pal: If that’s the case, it would be the first time such a structural difference has occurred.

Chris Burniske: Yes, but we also have to remember that each cycle breaks some old rules. For example, in the last bear market, Bitcoin broke above the previous bull market high for the first time, which had never happened in history. So, there will always be some nuances that render old rules ineffective.

When I think about whether ETH and Solana can return to previous highs, I conclude that the entire market is now focused on "fundamentals." By fundamentals, I don’t mean valuation, but rather cash flow, buybacks, and the structure supporting asset valuations.

So, the market’s obsession with fundamentals now leads to projects like Hype performing well because they have strong buybacks and profitability. But people don’t realize that this obsession not only impacts long-tail assets but also affects ETH and Solana. In 2021, ETH and Solana were completely exempt from fundamental considerations, but if you look at ETH now, measured by transaction fee multiples, it is much more expensive than in 2021.

Raoul Pal: We’ve talked about this before. I believe Layer 1 can be exempt because they follow Metcalfe's Law; the value does not come from cash flow at the protocol level but from economic activity on the network. When I backtrack with this logic, I find the valuations more reasonable. But for DeFi, measuring by transaction fee multiples makes complete sense.

Chris Burniske: I think ultimately everything will come down to yield. These staked assets will eventually behave like the bonds of a digital nation, with the yield market pricing based on real transaction fees rather than inflation rewards. I believe that with the widespread use of stablecoins, this model will become more stable, reducing severe cyclical volatility.

My expectation is that if Ethereum, as a more mature and widely used network, can provide a 5% real staking yield (from transaction fees, not inflation), then I hope Solana can at least provide 7%, and Sui at least 9%. Asset prices will recalibrate to match these yield levels. This is the simplest logic; ultimately, the value of an asset is determined by the yield expectations of its holders, and these holders are always the stakers.

Raoul Pal: That makes sense, but it feels like we’re not at that stage yet; the market still cannot stabilize pricing.

Chris Burniske: I feel we are approaching that stage. If we really enter a bear market, it will be a kind of "liquidation," as long-tail assets have been in the bear market for a long time, starting from the first quarter of 2024. This is the canary in the coal mine. I believe that valuation pressure will soon transmit to assets like ETH, Solana, BNB, and Sui. The more mature the asset, the more it will be priced as a "digital national bond," and the yield will become increasingly important.

Raoul Pal: If we really enter a bear market, what do you think the probability is? For example, traditionally, we might experience a 12-month decline; how likely do you think this scenario is?

Chris Burniske: About 65% to 70%.

Raoul Pal: Okay, so you basically think this possibility is quite high. In your framework, will this bear market be as deep as in the past?

Chris Burniske: No.

Raoul Pal: Oh, that’s interesting.

Chris Burniske: Yes, that’s also what complicates the situation. If I look at Bitcoin, its 200-week moving average is around $55,000, which is the extreme level I first focus on. Bitcoin has respected this moving average during 2015, 2019, and the pandemic crash. It briefly fell below during the FTX collapse, but overall, the 200-week moving average is a good reference.

If it drops to $55,000, that means a 56% retracement from the high of $125,000, which is much smaller than past retracements. Previous retracements were about 80%, and before that, 85%. So this time might be shallower; I can even see a 50% retracement, around $62,500, or $70,000 to $75,000, basically holding the tariff low point. If that position holds, that would only be a 40% retracement, which hardly counts as a bear market for crypto.

Raoul Pal: Right, don’t forget that in past cycles, we’ve experienced seven 30% pullbacks.

Chris Burniske: Yes, if we rebound from that position, you could even say Bitcoin is still in a bull market. The frustrating thing is that whether you are bullish or bearish completely depends on the time frame.

If you give me a 10-year time frame, I’m definitely bullish. But if you ask me about the opportunities from the past month to the next 3 to 9 months, I would be a bit more cautious, but that doesn’t mean I’m completely bearish.

So, I’m very focused on the bottom positions of ETH and Solana and how they perform relative to previous lows.

Raoul Pal: There’s also a strange aspect in this cycle; Bitcoin’s dominance hasn’t changed as much as usual.

Chris Burniske: Yes, that’s also a confusing aspect. It’s not that "this time is different," but there are many structural differences. While the four-year cycle logic is still there, most of the structure has changed, which is also possible. We always encounter such situations, but it does feel strange.

My preparation now is like this: Remember 2021? Back then, everyone said Bitcoin was a "pet rock," and no one was optimistic about it because its performance in 2021 was relatively flat.

From the high in 2017 to the high in 2021, Bitcoin only tripled, while from the bear market low to the high in 2021, it increased about 20 times. But this time is different; Bitcoin is very popular now, and it may even underperform in the next cycle. If it follows a flatter logarithmic channel, the return rate will significantly decline.

I'm worried that people are over-allocating to Bitcoin in this bear market because they feel that "Bitcoin is the safe choice." I still believe that if you're in the crypto market, you should hold a significant amount of Bitcoin, but we must consider another possibility: that MicroStrategy or some Bitcoin-related structures encounter problems, leading Bitcoin to underperform compared to ETH, MicroStrategy, or other assets.

So, I think there is a possibility that Bitcoin could go from being the "darling of the market" to "out of favor," and the real high returns might come from some unexpected crypto assets.

Raoul Pal: Let me share my framework; this is one of my biggest lessons: every time I let emotions overturn my macro framework, the results have been very poor. 2009 was my worst year because I made that mistake. So, I established a very robust framework called "Everything Code," which is also probabilistic because I acknowledge that there are many other possible outcomes.

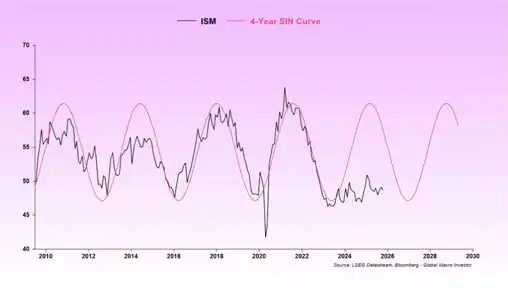

But I found an interesting phenomenon: ISM (the business cycle indicator) has historically been a perfect four-year cycle until it suddenly failed recently. I thought, what happened? Why is this cycle no longer effective? After recalculating, I found that this is a debt maturity cycle.

After the 2008 financial crisis, we experienced a debt "reset," where everyone postponed interest payments for three to five years and restructured their debts, creating a three to five-year cycle. This is the root of the Bitcoin halving cycle. Then suddenly, it stopped.

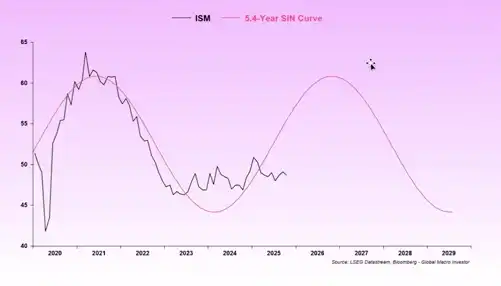

After recalculating, I found that in 2021 and 2022, because interest rates returned to zero, the cycle was extended to about 5.4 years. So, when I put it back into a sine wave model, everything made sense again. We are still at the trough of the cycle, and we should soon enter the growth phase of the business cycle because we haven't seen it truly grow yet.

Then I used liquidity as the core driving factor because it determines debt financing. Here are the interest payments due, and here is the liquidity that matches it. This is the total liquidity in the U.S., including the Fed's net liquidity, banks, and M2. I found that financial conditions (dollars, interest rates, commodities) lead total liquidity by six months, while total liquidity leads ISM by three to six months. So we have a nine-month leading indicator suggesting that liquidity should rebound, and the business cycle will also recover. This is the framework I have been using, and it has been very effective.

When I compared the Bitcoin trend with ISM, they were almost perfectly aligned. This tells us that Bitcoin is weak now because the business cycle is weak. The reason the business cycle is weak is that this year is not a debt reset year; next year is. So, the debt reset year is the key factor.

Then I looked at global liquidity, which is highly correlated with the total market cap of the crypto market (excluding Bitcoin), with a correlation of 90% to 97.5%. This means liquidity is the strongest macro factor in history, driven by the debt refinancing cycle, while the business cycle is just one component of it.

So the question is: will liquidity rise due to the debt reset? If it does rise, then ignoring this factor means ignoring the strongest macro driver in history, and any prediction will not work. Coupled with fiscal stimulus and election factors, the government needs to make "Main Street" profitable, not just Wall Street, which means the business cycle must recover, and corporate profits and household incomes must increase, not just the "seven giants."

That's why I find it hard to abandon this framework, even though I also see poor market structure, weak trading, and the issues you mentioned.

Chris Burniske: Yes, that's your "paranoia point," and my paranoia point is exactly the opposite.

Raoul Pal: That's also why I wanted to talk to you because I need to hear that voice whispering in my head: "Raoul, you might be wrong." That is the most important voice.

Chris Burniske: I think you might be right; it's just a bit early in timing. For example, your framework is based on the debt refinancing cycle, and the real peak of debt refinancing is in 2026.

Raoul Pal: Yes, that's my point. So, I find it hard to believe we will enter a deep bear market unless all liquidity is drained away, like flowing into other areas such as the AI bubble.

Chris Burniske: I understand what you mean. The problem is that the pace of crypto Twitter is too fast, which is one of the reasons I've reduced my Twitter usage recently. It's not only unhealthy for me personally, but it also affects my investment judgment because when you seem "wrong," even if it's just a timing mismatch, the pressure can be immense. I experienced this in 2021 when the market was crazy, but I didn't make many risky investments because I felt valuations were too high. As a result, I endured a lot of pressure, and some even questioned whether I was still in the market and whether I still had "influence."

But it turned out my choice was correct; it just took until the end of 2022 for that correctness to manifest, a full two years. And when I was preparing to buy Solana at the end of 2022, those who questioned me in 2021 didn't have the courage to buy at the lows. That's the problem; Twitter is the worst because anyone can comment freely, and that pressure can lead people away from long-term correct decisions.

Raoul Pal: Yes, it's really difficult. I often suffer a lot of attacks for trying to help others. You see, I guess your investment style has a preference where you tend to reduce positions earlier but also buy back earlier at the bottom because it's easier to grasp the bottom than the top. I feel that's your structural preference.

Chris Burniske: You're right.

Raoul Pal: Achieving that is actually not easy; for me, I'm better at buying at the bottom than selling at the top. The top is really hard to grasp, so I prefer to reduce positions early to alleviate psychological pressure.

Chris Burniske: I understand what you mean; I have a few structural preferences. For example, I have two friends who are excellent traders, and their strategy is to only pursue "above the shoulders in a bull market" and "below the knees in a bear market."

In other words, they don't pursue tops and bottoms; as long as they can sell at a high point in the middle of a bull market and buy at a low point in the middle of a bear market, that's enough. If you can sell ETH between $3,500 and $5,000 while buying it between $1,000 and $2,000, that's already very good, and this logic can be applied to other assets.

Another example is that my partner Joel reminded me that JP Morgan was once asked, "How have you achieved such success in life?" His answer was, "By selling too early." This statement impressed me because he has experienced many market booms and busts. I'm sure he faced a lot of questioning when he sold, with others saying, "I've made so much money; why aren't you participating?" But he continuously cashed out during others' euphoria, accumulating cash so that when the market was bad, he had funds to reposition. This is actually a very simple but effective strategy.

I have similar feelings myself. For example, when ETH was skyrocketing, and Tom Lee announced a $20 billion OTC trading facility, that was last summer, a very crazy moment. I would step back and remind myself, "Wow, I feel good, and everyone around me feels good; people on Twitter are even more excited." That was the signal to take profits. Of course, if I shared this viewpoint on Twitter, people would criticize me: "Are you an idiot? ETH is going to $20,000!" But you have to endure that pressure.

Asset Rotation: Zcash and Privacy Coins

Raoul Pal: If you looked at the liquidity charts at that time, you would have drawn the same conclusion: liquidity was not rising quickly, and the market could not continue to accelerate.

Chris Burniske: Right, that's the red inflection point you showed, where prices exceeded liquidity support.

Raoul Pal: Exactly, the reason is that starting in July, the M2 chart decoupled, and all indicators decoupled. We were thinking, "What exactly happened?" Later we found that the explanation was that the Treasury began to rebuild the TGA (Treasury General Account), which drained liquidity, and there was no more space for reverse repos to release. So suddenly, a significant event occurred, coupled with the government shutdown, causing the market to lose momentum.

Your intuition at that moment was very accurate because prices had reached the upper range, but there was no fuel to continue rising, resulting in a crash, and Solana was the same. Without these factors, we might have just continued rotating within the crypto market, like "passing the parcel." Now I'm wondering if the rise of Zcash is just part of this rotation or a truly meaningful signal? It's really hard to judge.

Chris Burniske: The recent rise of Zcash is indeed interesting, but not just it; older privacy coins like Dash, Monero, and Decred are also rising, with Zcash rising the most. This indicates it has a certain differentiated advantage, but overall, the privacy coin sector is moving. I've heard some Bitcoin OGs say that some whales use these privacy coins to hide profits at the end of cycles or to seek some extra gains. I don't have solid data on such rumors, nor do I participate, but this might explain why privacy coins tend to rise collectively at the end of each cycle.

However, the real signal will only become clear when the bear market arrives. If Dash, Monero, and Decred return to previous lows during the bear market while Zcash holds a significantly higher low, that would be a strong positive signal. Right now, I'm focused on its 50-week moving average, which is around $50.

Raoul Pal: If your hypothesis is wrong, and the cycle hasn't ended but continues to rise, what will you do? For example, if you firmly believe Zcash is a long-term big opportunity, and its market cap should gradually increase because the demand for privacy will grow, I completely understand that logic. But if the market continues to rise, how will you handle it? Will you continue to hold long-term, or will you adjust your strategy?

Chris Burniske: I would do this: I have a portion of my Zcash position that is "never to be sold," just like my attitude towards Bitcoin. History tells us that only those who bought Bitcoin at $1, $10, and $100 and held it long-term achieved incredible returns. So, I will treat a portion of Zcash as a long-term holding that I will never sell. As for other positions, I will decide based on Bitcoin's performance. If Bitcoin confirms a bottom, I will consider increasing my positions in other quality assets, including Zcash.

I will make decisions based on Bitcoin's performance. This goes back to the logic I mentioned earlier about "anchoring to Bitcoin." Bitcoin is the tide; the tide must turn first before other assets follow. Perhaps a better analogy is ocean currents: the macro environment is like deep-sea currents, Bitcoin is the mainstream flowing through the coral reefs, and the market's microstructure consists of those small eddies and undercurrents. Therefore, you must first focus on the macro, then observe Bitcoin's changes within it, and finally look for opportunities in other assets.

I am also watching some risks, such as leverage being mostly cleared, but there are still hidden dangers. For example, the DAT (Digital Asset Trust) we discussed earlier; we still don't know how they will perform in a bear market, especially when they are trading at significant discounts. Another risk is those "yield-bearing stablecoins." We have already seen them decouple on Binance, which worries me because we have seen this story before. I estimate that the major players combined may have a scale of about $18 billion, essentially risk arbitrage funds, but they are not prominent in the market, which raises my alert. If someone theoretically has a lot of leverage or positions, but it is not visible in the market, that is a red flag.

Raoul Pal: Yes, we have seen this before.

Chris Burniske: I am even more inclined to call them "yield instruments" rather than stablecoins. I think it would be better if the industry referred to them as "stable but risky yield instruments" instead of "stablecoins," as this would imply the risks involved.

Raoul Pal: Okay, the last question. My argument is that we have hardly seen any capital flowing into the crypto space from VCs or hedge funds; the only inflow comes from ETFs, and there is almost no other channel. Why is that? I know the AI boom has siphoned off a lot of capital, but why hasn't crypto attracted capital like it used to? In the past, you were always overwhelmed in the VC space, but now almost no one is raising funds.

Chris Burniske: First of all, the bubble is indeed in AI, which has absorbed all the hot money. I think this is healthy for the overall crypto industry. At the same time, we have also talked about the issue of token oversupply. I believe the "token industrial complex" has reached its end, and people are starting to realize how it operates and its problems. I used to be a bit naive about this, and now I have to correct that thinking.

Now, the alarm bells for valuations have rung, and everything must prove its reasonableness. This is not just a valuation issue; it also involves capital flow. For example, I often discuss with the Celestia team that they need to achieve this: as unlocking completes and inflation decreases, their inflation rate may drop to 0.25%. If the demand for data availability is strong enough, it can create structural buying pressure. BNB has performed well across multiple cycles because it has structural buying pressure, and the same goes for Hype, Bitcoin, and Ethereum. So, the future focus is on finding assets with structural capital flows.

Returning to VCs, many crypto VCs used to bet on new concepts and models, but now these models face structural selling pressure due to the way tokens are issued. So, everyone must return to the starting point and rethink the models. For example, should tokens be issued at lower valuations? I have always been an advocate for issuing at low valuations. Or, in a better regulatory environment, could 100% of the supply be made available from day one, like Solana did at the end of 2020? They unlocked about 80% of the supply in one day, and from then on, Solana had a crazy year because the market achieved true price discovery.

Overall, I believe the crypto token VC model that has been popular over the past decade is now under pressure, and everyone must redesign it. We will see more investments in "truly profitable companies," such as in the stablecoin sector, or in more mature "traditionalized" sectors, or investing at smaller, undervalued scales. Another important trend is that the distribution channels for blockchain technology are being monopolized by big tech and big finance companies because they have tens of millions or even hundreds of millions of users who can directly funnel into these protocols.

We originally expected crypto-native distributors, but in reality, there are only a few, like Coinbase, Robinhood, MetaMask, and Phantom, with limited scale. Now, the distribution advantage is shifting to big tech and big finance, which is squeezing the opportunities for crypto VCs.

Raoul Pal: Will these middle-layer projects be acquired? For example, if you invested at a $20 million valuation early on, they might be acquired for $100 million or $200 million, rather than the tens of billions like before. Just like how Coinbase recently acquired the Kobe project.

Chris Burniske: Yes, that will happen. I saw Arthur Hayes recently raising a fund that seems to be specifically for acquiring distressed assets. I'm not sure, but I guess his logic is that there are many mid-sized companies in the market that are not making enough money to be expensive acquisitions, and they can be bought cheaply, then integrated or repackaged for traditional finance. This could lead to a "crypto version of private equity" that specializes in acquiring distressed assets.

There is no doubt that the season has changed, and strategies have changed. I am now more inclined to build large positions in liquid, high-performing crypto assets. Venture capital can indeed bring incredible multiples, but in terms of cash returns, the biggest gains often come from buying and selling large liquid assets at the right time, concentrated in a very short time window. My long-term view has always been that if you can time it well, the returns from liquid assets can even be higher than from venture capital, and the cycles are shorter.

Raoul Pal: I completely agree, and these opportunities are open to everyone. But the problem is that people must accept the fact that this strategy is quite "boring." For example, Bitcoin is already considered a high-risk asset for those who are not Gen Z or Millennials. Therefore, holding Bitcoin and a few of its friends, allowing value to grow slowly through compounding, is the best strategy.

I believe the key is always to maintain a certain exposure to Bitcoin while dynamically adjusting the cash ratio based on market opportunities, establishing a cash buffer that can be entered or exited at any time.

I have tried both approaches. I have gone through the entire cycle. For example, in the 2013 cycle, I held all the way to the peak and then back down to the low, and then continued to hold until 2017. That time, I reduced my position too early, really too early; I sold Bitcoin when it was at $2,000, and it went all the way up to $20,000. In the last cycle, I hardly reduced my position and instead aggressively increased my holdings at the lows, which worked out very well.

In this cycle, I might reduce some positions, but I will never sell off the majority because my time frame is long, and I believe Bitcoin is the best wealth compounding tool, and I cannot mess that up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。