The U.S. stock market is experiencing heightened risk aversion, with funds flowing out of technology stocks. The cryptocurrency market has entered a bear market.

Original author: Foresight Ventures

1. Market Dynamics

A. Macroeconomic Liquidity

- Monetary liquidity is tightening. Expectations for the Federal Reserve to cut interest rates at the December meeting have declined over the past few weeks, with the market-implied probability of a rate cut currently around 45%, down from 60% a week ago and significantly lower than 90% during the October meeting. The data blackout caused by the government shutdown has made it difficult to resolve the increasing divergence among policymakers. Several officials who previously supported rate cuts stated last week that they would oppose further cuts unless they see a deterioration in employment or an improvement in inflation. The U.S. stock market is experiencing heightened risk aversion, with funds flowing out of technology stocks. The cryptocurrency market has entered a bear market.

Recent significant events to watch:

- November 26, 2025: U.S. Q3 real GDP annualized quarter-on-quarter revision

- November 30, 2025: China’s official manufacturing PMI for November

- December 5, 2025: U.S. non-farm payroll change for November (in ten thousand)

B. Overall Market Trends

Top 300 by Market Cap Gainers:

This week, BTC continued to decline, erasing all gains made this year. Altcoins experienced widespread losses, and the U.S. stock market's DAT model has seen a significant slowdown in demand and valuation compression, with DAT being the largest buyer of altcoins over the past six months. The market overall lacks hotspots.

BTC: MicroStrategy may be removed from the index, and BlackRock continues to sell coins.

ASTER: A leading perp on the BNB chain, generating about $1.7 million in daily buybacks, valued at 1/4 of HYPE, having risen 50% since cz bought in at 0.9.

ZEC: One of the main catalysts for its recent revival is the improvement in usability. With Zashi integrating NEAR Intents, users can now simply declare the desired outcome to use ZEC for non-custodial exchanges and cross-chain operations, significantly enhancing its usability beyond the base chain.

C. On-Chain Data

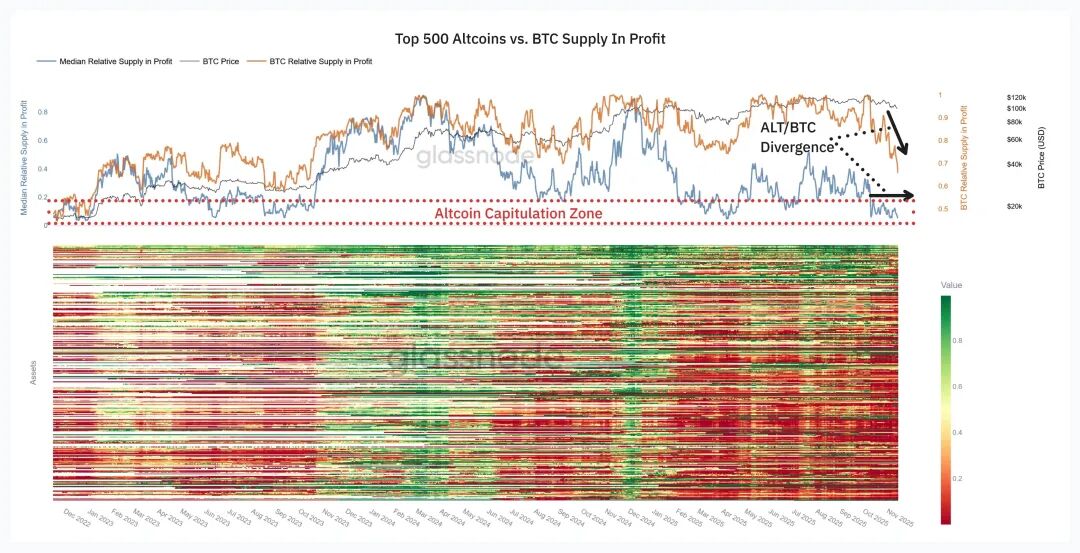

- The actual losses of short-term BTC holders have reached a two-year high, with panic selling peaking, now exceeding the loss levels seen at the two major lows before this cycle. Only about 5% of altcoin supply is in profit, and the profit ratio for BTC is beginning to decline sharply.

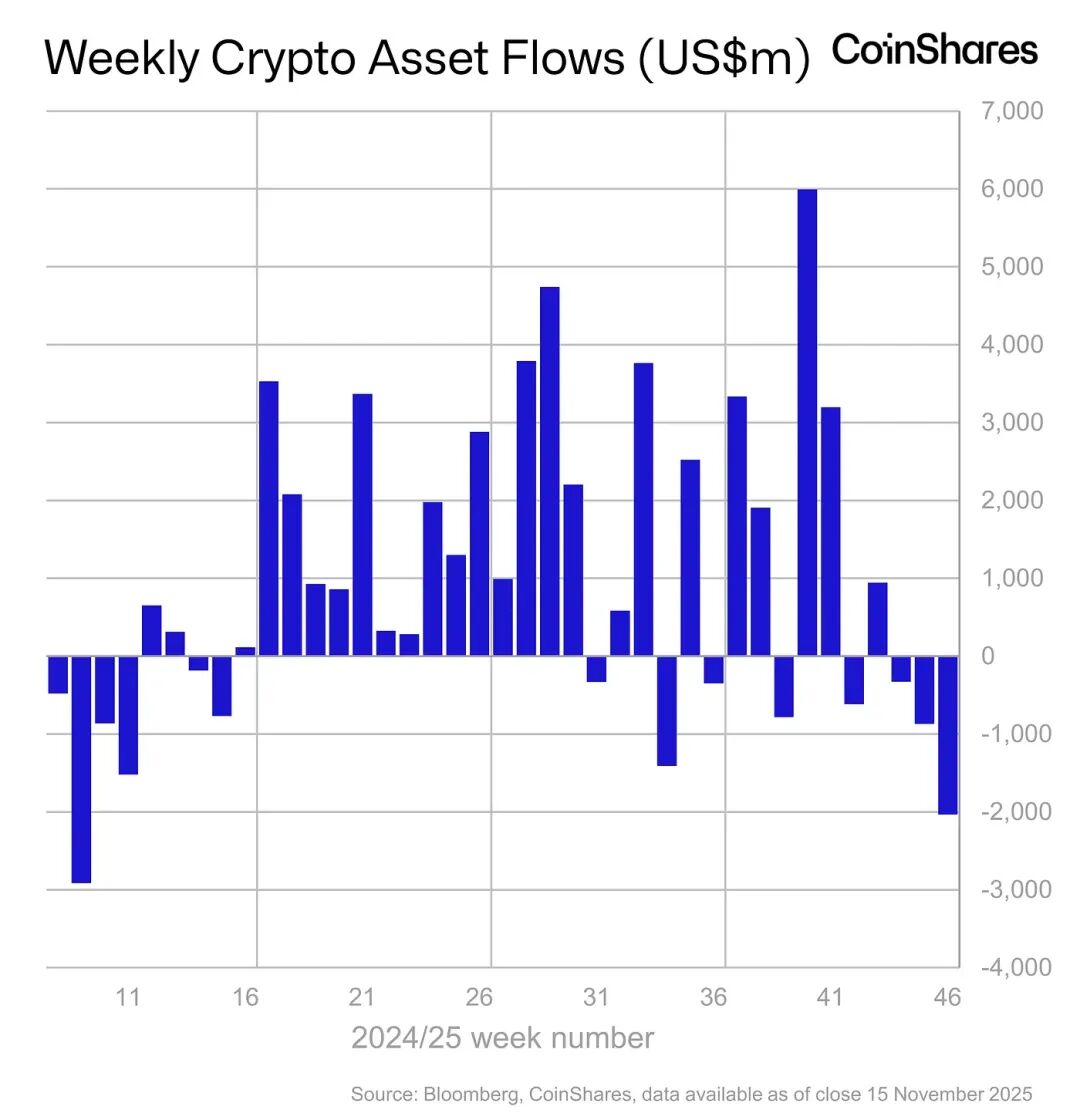

- Institutional funds continue to flow out, with the largest single-week outflow since February.

E. Spot Market Trends

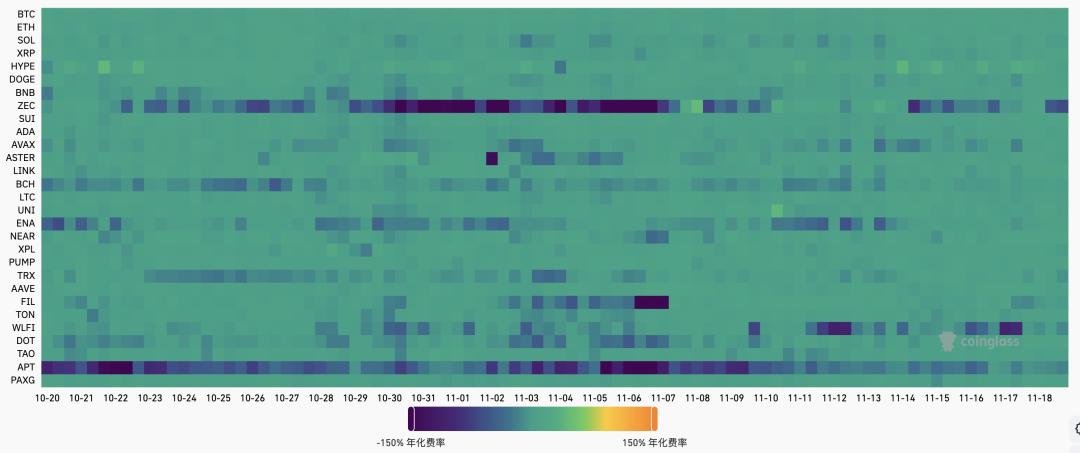

- Futures funding rate: This week, the rate is 0.01%, neutral. A rate of 0.05-0.1% indicates a lot of long leverage, marking a short-term market top; a rate of -0.1-0% indicates a lot of short leverage, marking a short-term market bottom.

- Futures open interest: This week, BTC open interest has significantly declined, with market leaders retreating.

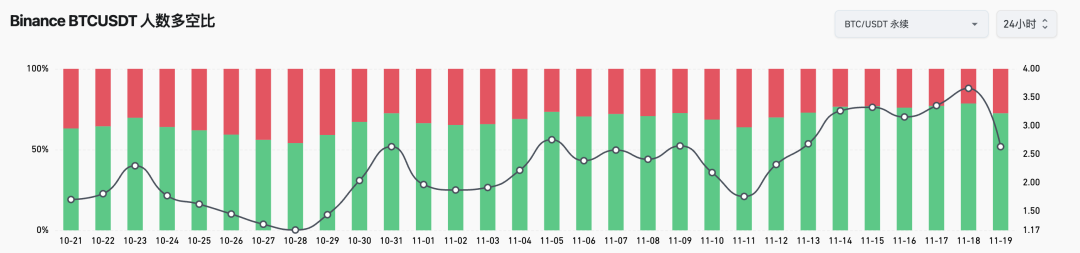

- Futures long-short ratio: 2.4, indicating market sentiment is greedy. Retail sentiment often serves as a contrarian indicator; below 0.7 indicates fear, above 2.0 indicates greed. The long-short ratio data is highly volatile, reducing its reference significance.

F. Stablecoin Trends

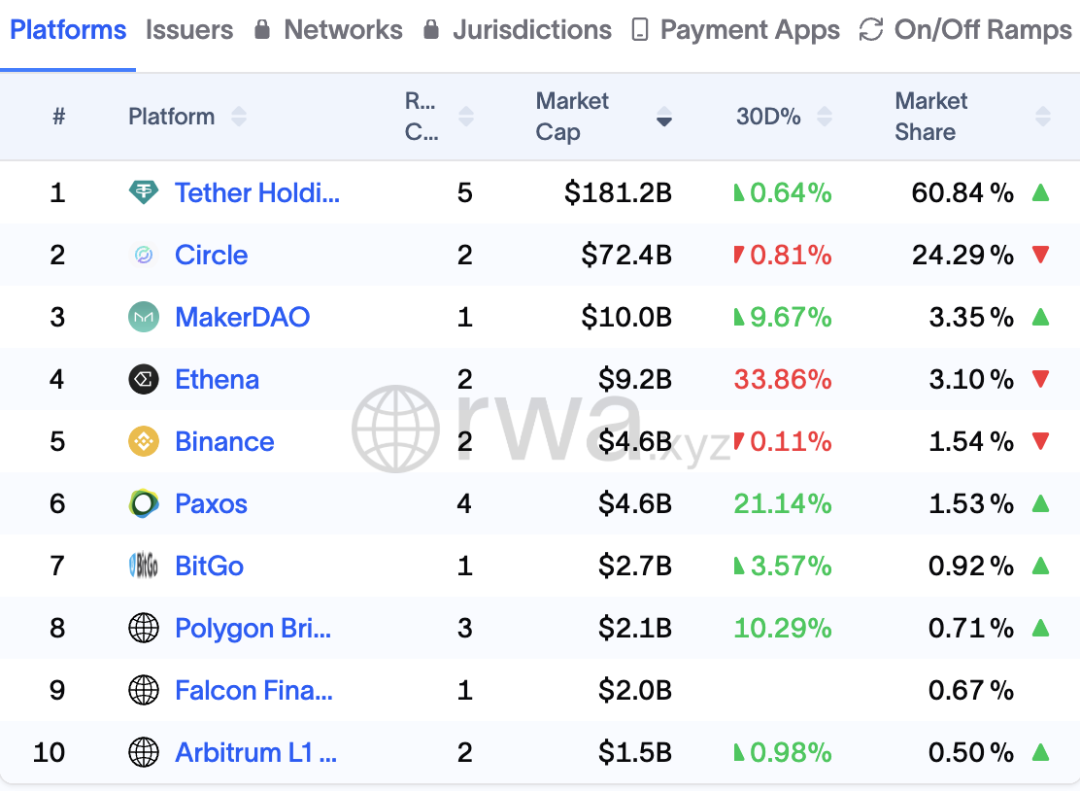

Global Mainstream Stablecoin Market Cap

Total global stablecoin supply: $303.5B, a week-on-week decrease of 0.5%, marking a continuous decline for a month. In terms of market share, USDT accounts for 61%, and USDC accounts for 24%.

Circle has launched a foreign exchange settlement engine, StableFX, to eliminate T+2 and cross-time zone delays with on-chain atomic settlements, releasing approximately $27 trillion in idle funds and building a programmable liquidity layer for the foreign exchange market.

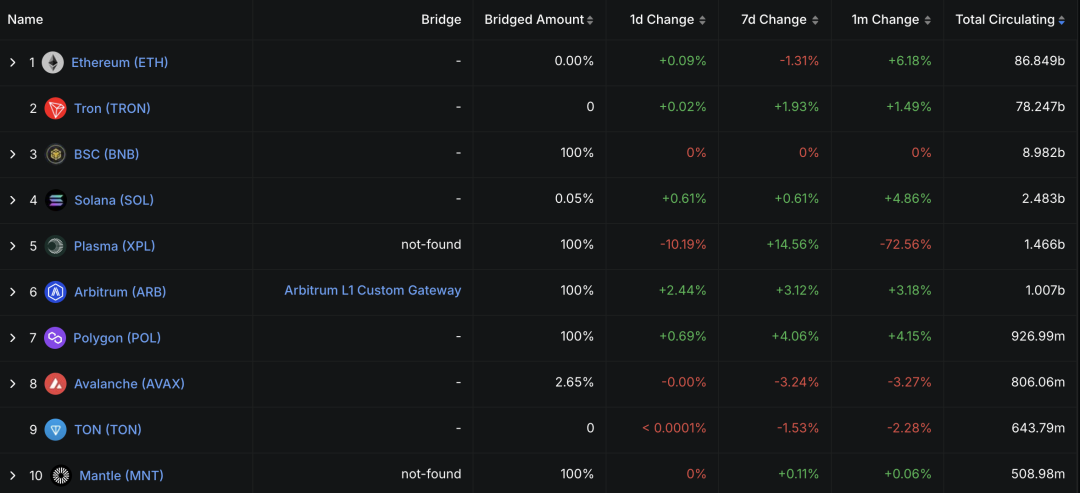

Stablecoins on Various Public Chains

In the past 30 days, USDT has seen a significant increase on the ETH chain, at 6%, primarily driven by on-chain DeFi investment demand.

Block's payment platform CashApp announced it will provide stablecoin support for its 58 million users in early 2026, with each user receiving a blockchain address where received stablecoins are automatically converted to USD, and sent USD is automatically converted to stablecoins.

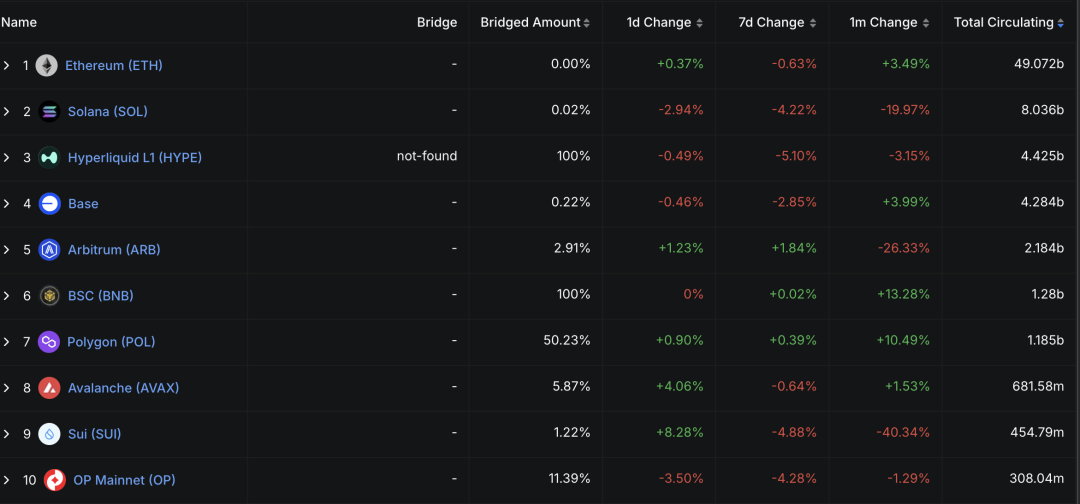

In the past 30 days, USDC has seen significant increases on the POL chain and BNB chain, at 10% and 13%, respectively, mainly driven by on-chain prediction market demand.

JPMorgan has launched a deposit token, JPM Coin, on the Base public chain to achieve 24/7 clearing efficiency through bank credit and compliance systems.

Coinbase has launched a regulated GBP savings account in the UK, offering an annual interest rate of 3.75%, managed by ClearBank and providing FSCS deposit insurance.

Major Applications of Stablecoins

In the past 30 days, the most notable growth in stablecoin deposits has been seen on OKX and MakerDAO, primarily driven by on-chain DeFi investment demand.

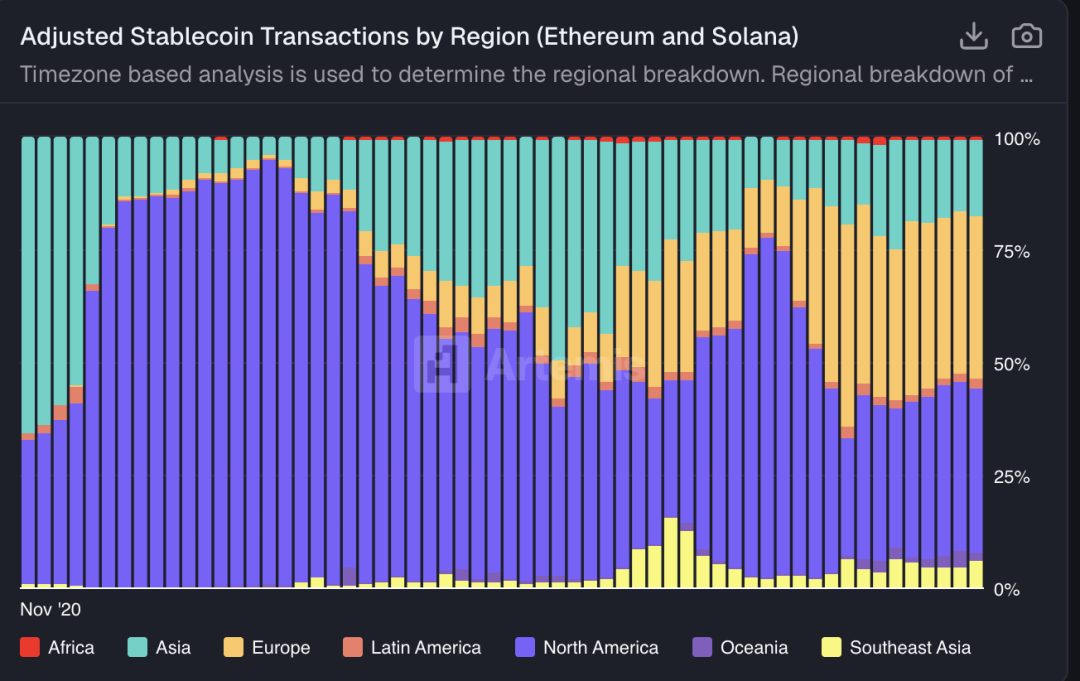

Geographic Distribution of Stablecoin Usage

North America (37%), Europe (36%), and Asia (17%) remain the primary markets, with no significant changes in other regions.

2. Stablecoins and Payments

A. Progress of Stablecoin-Related Projects

Crypto incubation platform Obex completes $37 million financing to support yield-bearing stablecoin development led by Sky ecosystem

According to CoinDesk, the crypto incubation platform Obex has completed $37 million in financing to support the development of yield-bearing stablecoins led by Framework Ventures, LayerZero, and the Sky ecosystem. The plan aims to invest in and fund projects that bring real-world asset-backed strategies on-chain, introducing institutional-level risk control and underwriting practices into the rapidly evolving industry.

Obex will become the latest capital allocator for Sky, which was formerly MakerDAO, the entity behind the DAI and USDS stablecoins, with a total market cap of $9 billion. Obex will fund projects to enable them to leverage the protocol's reserves for expansion and gain returns from their strategies. Teams that pass risk and governance reviews may qualify for additional funding from Sky, which recently authorized up to $2.5 billion in USDS for the Obex project in a governance vote.

Circle launches interoperability infrastructure Circle xReserve

- Circle announced the launch of Circle xReserve, a new interoperability infrastructure that allows blockchain teams to deploy USDC-backed stablecoins that are fully interoperable with USDC. xReserve provides xReserve certification services, enabling developers and users to seamlessly transfer value between USDC-backed stablecoins and USDC on supported blockchains without relying on third-party cross-chain services. Circle has announced partnerships with blockchain companies Canton and Stacks, which will integrate with xReserve in the coming weeks.

B. Regulatory Trends

U.S.: Kraken and Grayscale submit listing applications, Fidelity and Canary's two Solana spot ETFs listed

Kraken has submitted an IPO registration statement draft to the U.S. SEC

https://www.cnbc.com/2025/11/19/kraken-confidentially-files-for-ipo-following-800-million-raise.html

https://blog.kraken.com/news/800-million-raise-to-advance-strategic-roadmap

On November 19, Kraken announced that it has submitted an S-1 registration statement draft to the U.S. Securities and Exchange Commission, intending to issue common stock, with the number of shares and price range yet to be determined. The initial public offering is expected to take place after the SEC completes its review process, with the specific timing depending on market conditions and other factors.

A Kraken spokesperson also stated that it recently completed a round of $800 million in financing, with a valuation of $20 billion. This round of financing was led by institutional investors such as Citadel Securities, Jane Street, HSG, Oppenheimer Alternative Investment Management, and Tribe Capital, co-founded by Kraken's co-CEO Arjun Sethi. Last September, it completed a $600 million financing round with a valuation of $15 billion, with investors including Jane Street, DRW, Sequoia China, Oppenheimer, Tribe Capital, and Arjun Sethi's family office. Within less than two months, it completed two rounds of financing, with a valuation increase of 33%.

Fidelity and Canary's two Solana spot ETFs listed on the NYSE and NASDAQ

Fidelity Solana Fund (Ticker: FSOL): Launched on November 18, with a management fee of 0.25%. This ETF tracks the Fidelity Solana Reference Index (FIDSOLP) and includes staking rewards for SOL.

Canary Marinade Solana ETF (Ticker: SOLC)

Fidelity's Solana Fund (Ticker: FSOL) and Canary's Marinade Solana ETF (Ticker: SOLC) have been listed on the NYSE and NASDAQ, respectively, both supporting staking features.

Grayscale officially submits IPO application, plans to list on the NYSE

https://www.coindesk.com/business/2025/11/13/crypto-asset-manager-grayscale-files-for-ipo-in-the-u-s

Grayscale Investments officially submitted its IPO application on November 13, seeking to list its Class A common stock on the New York Stock Exchange under the ticker "GRAY."

The number of shares to be issued and the price range have yet to be determined. Morgan Stanley, Bank of America Securities, Jefferies, and Cantor are acting as lead underwriters. Wells Fargo Securities, Canaccord Genuity, Piper Sandler, Keefe, Bruyette & Woods (a Stifel company), and Needham & Company are serving as other underwriters. Benchmark Company and Compass Point are acting as co-managers.

Asia: The Hong Kong Securities and Futures Commission urges licensed institutions to detect and prevent potential layering trading activities used for money laundering, the Singapore Exchange will launch Bitcoin and Ethereum perpetual futures, and Japan is considering new cryptocurrency regulatory rules

The Hong Kong Securities and Futures Commission urges licensed institutions to detect and prevent potential layering trading activities used for money laundering

https://apps.sfc.hk/edistributionWeb/gateway/TC/circular/aml/doc?refNo=25EC62

The Hong Kong Securities and Futures Commission issued a circular urging licensed corporations and virtual asset trading platforms to remain vigilant against suspicious fund transfers showing signs of layering trading activities to prevent money laundering.

The circular noted a rising trend of criminals using licensed institutions for layering trading activities, with some individuals attempting to disguise the source and destination of illegal funds to launder proceeds from fraud and deception cases. Common warning signs of layering trading activities involve a series of suspicious behaviors, including frequent, rapid, and organized deposits into customer accounts, followed by immediate withdrawals in the form of funds or virtual assets. The Hong Kong Securities and Futures Commission reiterated its strict standards for licensed institutions to detect and prevent layering trading activities.

The Singapore Exchange will launch Bitcoin and Ethereum perpetual futures on November 24

https://www.straitstimes.com/business/companies-markets/sgx-to-launch-bitcoin-ethereum-perpetual-futures-on-nov-24

The Singapore Exchange announced it will launch Bitcoin and Ethereum perpetual futures on November 24.

Bitcoin and Ethereum perpetual futures will only be available to qualified institutional investors, settled in USDT, and will offer 24/7 trading, a dynamic funding rate mechanism, and an institutional-grade risk management framework.

Japan is considering new cryptocurrency regulatory rules

https://www.agenzianova.com/en/news/Japan-considers-introducing-new-cryptocurrency-regulations/

According to Asahi Shimbun, sources revealed that Japan's Financial Services Agency is considering regulations that would define cryptocurrencies as financial products subject to insider trading rules and lower their profit tax rates. Profits from cryptocurrency trading will be subject to a 20% tax rate, equal to the stock trading tax rate, significantly down from the current maximum rate of 55%. The regulations will apply to the 105 cryptocurrencies currently circulating in Japan, such as Bitcoin and Ethereum, and will require exchange service providers to disclose information about price volatility risks.

Banks and insurance companies will be allowed to sell cryptocurrencies to depositors and policyholders through their securities subsidiaries.

The Financial Services Agency hopes to pass relevant legislation during the regular National Assembly session next year.

Huaxia Hong Kong achieves tokenized fund subscription in the Hong Kong Monetary Authority's Ensemble project

Huaxia Asset Management (Hong Kong) Limited, under the pilot program of the Hong Kong Monetary Authority's Ensemble project, has completed a real application scenario of tokenized fund subscription in collaboration with Bank of China Hong Kong, Futu Securities, and Standard Chartered Hong Kong.

This commercial pilot completed the end-to-end transaction process: initiated by Futu, a tokenized deposit was transferred between banks from Bank of China Hong Kong to Standard Chartered Hong Kong, successfully subscribing to the tokenized money market fund under Huaxia Asset Management (Hong Kong). The fund shares are custodied by Standard Chartered Hong Kong, and the entire process was seamlessly settled in the HKMA Ensemble[TX] pilot environment.

The Ensemble project is now in the pilot phase, aiming to promote tokenized deposits and real-price trading of digital assets.

Starry Chain is ordered to suspend trading by the Hong Kong Stock Exchange, with stock prices plummeting 70%

According to Caixin, cryptocurrency concept stock Starry Chain (00399.HK) announced before the market opened on November 17, 2025, that it was ordered to suspend trading on November 26 by the Hong Kong Stock Exchange due to the exchange's concerns that the company failed to meet the ongoing listing requirements. The stock plummeted 73% on November 17, closing at HKD 0.064 per share, having evaporated 91% from its peak price at the end of July.

The Hong Kong Stock Exchange pointed out that under Listing Rule 13.24, Starry Chain failed to maintain sufficient operational levels and does not have sufficiently valuable assets to support its operations, which would allow its shares to continue to maintain listing status, thus requiring it to suspend trading from November 26. Starry Chain responded in the announcement that it has decided to apply for a review by the Listing Committee of the Stock Exchange.

Previously, in September 2025, Navigating Medical Biotechnology changed its name to Starry Chain Group Limited and signed a memorandum of understanding with Starcoin Foundation on October 13, 2025, planning to issue Starcoin tokens. Shareholders will receive one Starcoin token for every ten shares of the company's existing shares held on the record date, with the tokens to be deployed on the Conflux eSpace public blockchain. The announcement stated that this token issuance still requires further negotiation and is not legally binding.

Europe: Aave Labs subsidiary receives authorization as a crypto asset service provider under MiCAR, Czech central bank becomes the first central bank to purchase Bitcoin

Aave Labs subsidiary receives authorization as a crypto asset service provider under MiCAR

https://aave.com/blog/aave-micar-approval

Aave Labs announced that its subsidiary Push has received authorization as a Crypto Asset Service Provider (CASP) from the Central Bank of Ireland under MiCAR.

Aave Labs will soon launch regulated, zero-interest GHO and other stablecoin deposit and withdrawal channels integrated into Aave Labs products in the European Economic Area (EEA) through its new service Push.

Czech central bank becomes the first central bank to purchase Bitcoin, creating a $1 million crypto test investment portfolio

https://www.cnb.cz/en/cnb-news/press-releases/The-CNB-creates-a-test-portfolio-of-digital-assets/#:~:text=Through%20this%20USD%201%20million,tokenised%20deposit%20on%20the%20blockchain.

According to CoinDesk, the Czech National Bank (CNB) announced the creation of a $1 million cryptocurrency test investment portfolio, which includes Bitcoin (BTC), US dollar stablecoins, and tokenized deposits.

The pilot project aims to test the processes related to the purchase, holding, and management of blockchain-based assets, with the bank planning to share its experiences over the next 2-3 years. The bank stated that the total investment will not be actively increased, and this acquisition does not utilize the bank's existing international reserves.

South America: Brazil considers taxing international payments made with cryptocurrencies

Insiders: Brazil considers taxing international payments made with cryptocurrencies

- > https://www.reuters.com/world/americas/brazil-eyes-taxing-crypto-cross-border-payments-sources-say-2025-11-18/https://cryptorank.io/news/feed/f3b28-brazil-tax-cross-border-crypto-payments

According to Reuters, citing two informed officials, Brazil is considering taxing international payments made with cryptocurrencies. One insider revealed that the country's Ministry of Finance is considering expanding the scope of the financial transaction tax to include certain cross-border transfers made using virtual assets and stablecoins, which have been classified as foreign exchange transactions by the country's central bank.

The Brazilian Ministry of Finance declined to comment on the matter to Reuters.

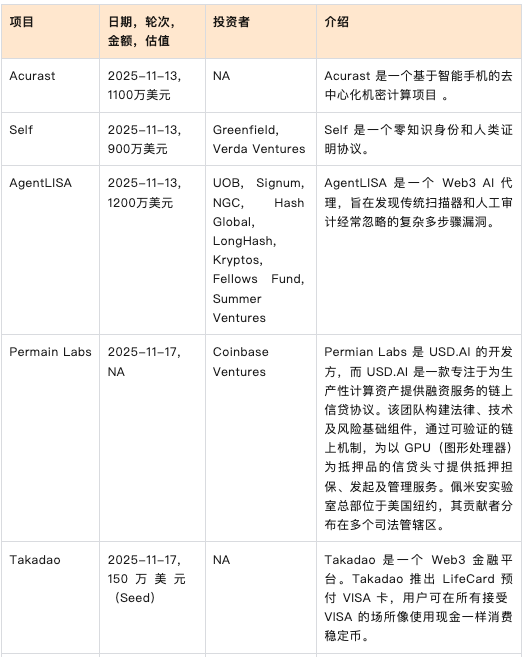

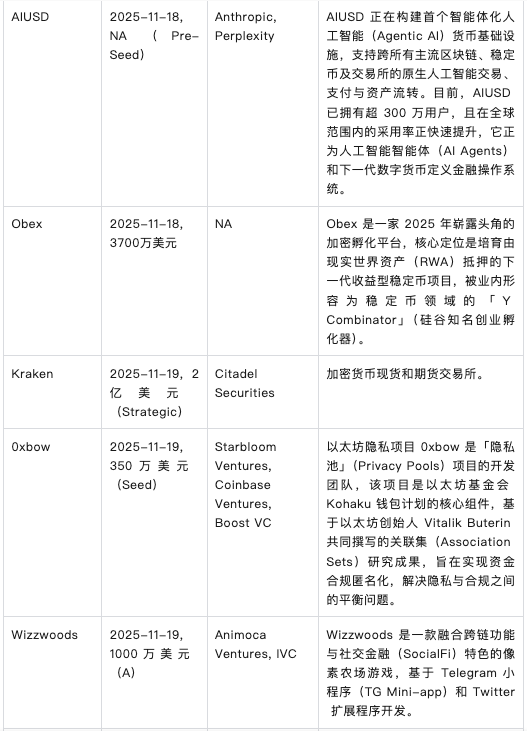

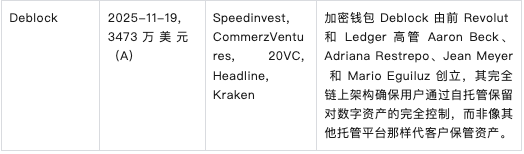

3. Financing Trends

4. Project Progress

Movement——Infrastructure

On November 19, the Movement Foundation stated that it has been four months since fulfilling its buyback commitment, and to enhance the transparency of tokens in the buyback wallet, it plans to transfer some tokens from the MOVE strategic reserve on the Ethereum mainnet to the strategic reserve on the native Movement Network to support ecosystem projects and incentives. Movement indicated that it will continue to regularly send ERC-20 tokens to exchanges to supplement and rebalance the token supply, thereby re-enabling withdrawal functions.

Bio Protocol——DeSci

Bio Protocol announced on the 19th that BioXP Season 2 will launch significant upgrades, changing the way users earn rewards in the Bio ecosystem. The new BioXP system requires users to stake BIO to generate veBIO in order to earn experience points (XP) through staking ecosystem tokens. Additionally, veBIO holders will automatically receive airdrops of new tokens upon their launch. The new mechanism includes three types of multipliers: BIO staking multiplier, level multiplier, and new token multiplier, with a maximum yield of 10 times. The first launch sale of Season 2 is imminent, and BioXP over 14 days will immediately expire.

Olderly——Infrastructure

Orderly Network launched a four-week UCC trading championship on the 19th, with a total prize pool of $200,000, where participants will be ranked by PnL to receive rewards. This event supports platforms such as WOOFi, Aegis DEX, WHAT Exchange, SalsaDEX, ZoomerOracle, and Taiki DEX.

Among them, users trading with the Aegis stablecoin YUSD will receive additional rewards equivalent to 0.3% of the total amount of Aegis tokens. Kodiak added an additional $50,000 in rewards.

Morph——Infrastructure

On November 8, the Morph Foundation announced its latest allocation plan for the 220 million BGB it holds and officially launched a new BGB quarterly burn mechanism. This mechanism directly links the supply of BGB to the actual usage of the Morph network, with the scale of burns determined by ecosystem fees, average prices, and community governance parameters. With the Viridian upgrade and support for EIP-7702, BGB will be directly usable for paying Morph network Gas, becoming one of the ERC-20 tokens that can serve as native Gas on Layer 2.

Zama——Infrastructure

FHE cryptography company Zama's founder Rand announced on the 18th that Zama has launched testnet v2. This testnet version serves as a candidate for the upcoming mainnet, featuring all the functionalities that the mainnet will have, allowing users to build and deploy applications on this testnet. The team is currently conducting stress tests on testnet v2, and after multiple rounds of testing and feedback, the Zama mainnet test version will be deployed. Additionally, the mainnet will initially run on Ethereum, with other chains being integrated gradually in 2026.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。