Author: noveleader&0xatomist, Castle Labs

Compiled by: Tim, PANews

Aave is a foundational currency market in the DeFi space, known for its strong liquidity and high trustworthiness. The Aave protocol occupies over half of the lending market's TVL, making it the preferred platform for both institutions and retail investors. It expands liquidity through cross-chain capabilities, combining conservative risk management strategies to build a solid business moat while continuously innovating to strengthen its advantages. From the dual market structure of the V3 version to the upcoming V4's Liquidity Hub and Spokes, Aave not only solidifies its market position but is also gradually evolving into the infrastructure layer of on-chain capital markets.

Market Positioning

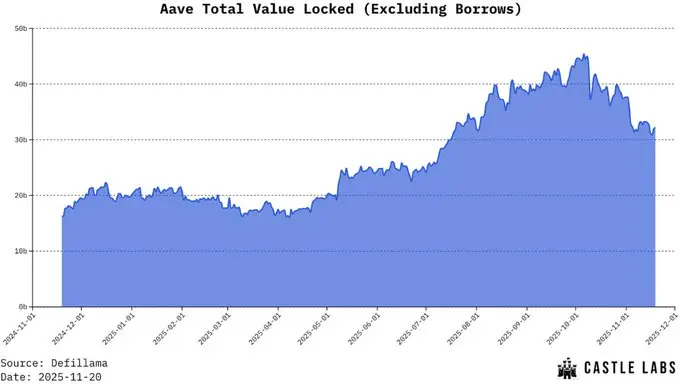

As the lending protocol with the largest TVL, Aave's leading advantage far exceeds its competitors. As of the writing of this article, Aave's TVL is approximately $54 billion, more than five times that of the second-largest lending protocol, Morpho (around $10.8 billion). This scale advantage creates a solid competitive barrier, allowing it to attract institutional capital while still providing a highly convenient participation channel for retail investors seeking passive income.

Aave's growth trend remains stable, with its TVL recently reaching an all-time high. This growth is attributed to its first-mover advantage, continuous product iteration, and extensive multi-chain strategy working in concert.

The Aave protocol is currently deployed on 19 chains, but the vast majority of its liquidity (over 80%) is still concentrated on Ethereum, followed by Plasma. Among the layer two networks, Arbitrum leads, followed by Linea and Base. This layout reflects Aave's strategic choice: prioritizing the liquidity depth and security of Ethereum, then cautiously expanding to layer two networks with continuously growing user activity.

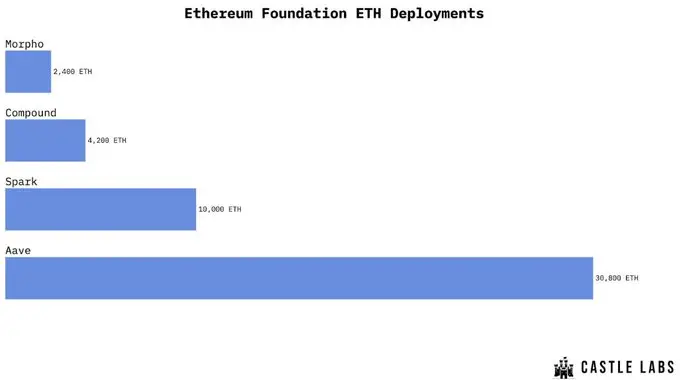

Aave's liquidity depth has unique appeal for high-net-worth individuals and institutional investors. These users can engage in large-scale borrowing without triggering significant spikes in borrowing rates. This advantage can be validated by the Ethereum Foundation's operation of depositing 30,800 ETH into Aave in February 2025.

Additionally, Aave is entering the RWA lending space through its Horizon market, which currently has a market size of about $600 million. Aave accepts collateral from issuers such as Superstate and Centrifuge, composed of tokenized money market funds. Aave is positioning itself as a bridge between traditional institutions and DeFi, which is part of a broader strategy to attract institutional funds, complementing its existing vast on-chain user base.

Core Functions and Architecture Design

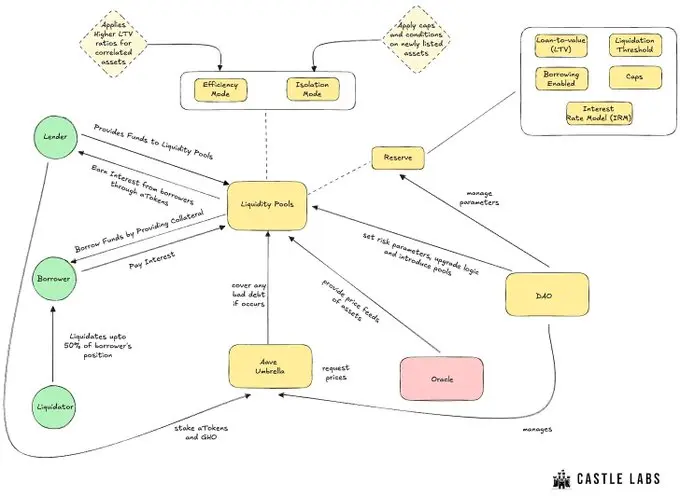

At its core, Aave operates on a liquidity pool model, meaning users deposit assets into a shared liquidity pool, and depositors receive aTokens that represent their positions. These tokens accumulate interest over time and can be used as collateral for borrowing assets.

The Aave V3 platform introduced two distinct lending markets, each serving unique functions.

- The Aave Prime market is optimized for capital efficiency and only supports blue-chip assets. Its signature feature, "Efficient Mode," allows highly correlated assets (such as wstETH and WETH) to have a maximum loan-to-value ratio of up to 95%, with a liquidation threshold of 96.5%. The current market size is approximately $1.17 billion.

- The Aave Core market has a broader scope, exceeding $42 billion, and supports a variety of assets. Aave Core prioritizes risk control by limiting exposure to high-risk assets through an "Isolation Mode" and implementing stricter loan-to-value ratio limits, typically below 85%.

This dual market structure reflects Aave's pursuit of a balance between capital efficiency and system security. However, this structure can also lead to fragmentation of funds, as liquidity cannot flow freely between the Prime and Core markets. Addressing this issue is a key focus of the upcoming V4 version.

The diagram below illustrates the various components within the Aave system, which operate efficiently in synergy, making Aave a leading money market protocol.

Liquidity Pools and Reserves

Each token market on Aave has reserves, with parameters managed by the DAO:

- Loan-to-Value Ratio: The percentage of the collateral value that can be borrowed. For example, an 85% LTV allows for a loan of $850 based on $1,000 worth of ETH collateral.

- Liquidation Threshold: The level at which the collateral value may trigger liquidation. This is typically set slightly above the loan-to-value ratio to establish a safety buffer.

- Borrowing Function Switch: Determines whether the reserves are open for borrowing.

- Limits: Controls the upper limits on supply or borrowing amounts, aimed at preventing the system from being overly exposed to the risks of volatile assets.

- Interest Rate Model: Dynamically adjusts borrowing costs based on capital utilization rates. High utilization rates push up interest rates, incentivizing repayments or increasing capital supply.

These parameters collectively build an adaptive and decentralized risk framework for Aave, with a continuous updating mechanism driven by community governance, capable of reflecting market changes in real-time.

Aave Umbrella

Aave's Umbrella system (formerly known as the Safety Module) provides a critical safeguard mechanism. Users can stake aTokens or GHO to earn rewards, while these staked assets also serve as backup collateral for the protocol's bad debts. In the event of insolvency, the staked assets will be liquidated to cover losses. The corresponding sub-DAO has provided an initial bad debt guarantee of up to $100,000, creating an effective insurance layer for the protocol.

Liquidation Mechanism

The liquidation mechanism is another key pillar ensuring the robust operation of the Aave protocol. Each lending position is monitored in real-time by a health factor, calculated as follows:

Health Factor = (Collateral Asset Value × Liquidation Threshold) / Loan Value

When the health factor falls below 1, the position enters a liquidatable state. For example, if $1,000 worth of ETH is deposited as collateral and $800 USDC is borrowed at an 88% liquidation threshold, the health factor is 1.1. If the ETH price drops to $900, the health factor will fall to 0.99, triggering the liquidation mechanism.

Liquidators can obtain discounted collateral assets as a reward by repaying up to 50% of the borrower's debt. This mechanism maintains the solvency of the Aave protocol while also creating market opportunities for arbitrageurs and professional liquidation bots.

Efficient Mode and Isolation Mode

Efficient Mode maximizes borrowing capacity through highly correlated assets (such as staked ETH derivatives). This mode supports recursive borrowing, cyclical strategies, and leveraged staking, among other capital-efficient operations.

Isolation Mode effectively reduces the associated risks of new or highly volatile tokens by limiting the types of assets that can be borrowed and setting exposure limits.

These mechanisms embody Aave's core philosophy: continuously enhancing capital efficiency in controllable risk areas while always adhering to the principle of cautious expansion.

Aave V4 and Aave App

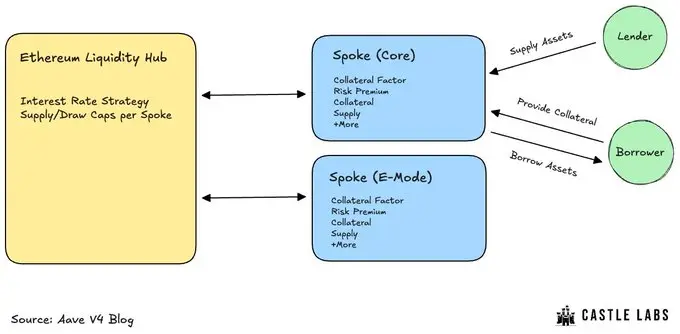

The recently launched testnet for Aave V4 aims to address liquidity fragmentation issues and promote its development into a modular lending infrastructure.

The core of V4 is the Liquidity Hub, which aggregates liquidity from both the Prime and Core markets. Funds will dynamically flow to where they are needed, rather than being locked in silos, thereby improving efficiency and reducing idle deposits.

Another complementary innovation is Spokes, a specialized market instance that connects to the Liquidity Hub. Each Spoke can independently set parameters, such as supporting long-tail assets and establishing supply and borrowing limits, while the Liquidity Hub ensures that all parameters operate within system rules. The design of Spokes allows for marginal innovation while ensuring the security of the core system.

Overall, these upgrades signify Aave's evolution from a single lending protocol to the foundational layer of on-chain capital markets. Through liquidity integration and modular design, Aave V4 is laying the groundwork to continue serving as the cornerstone of DeFi lending for the coming years.

Another significant update from Aave this week is the launch of the Aave App, a product that helps retail investors earn up to 6.5% annualized yield, with a balance protection of up to $1 million.

This is undoubtedly a major leap, as it will help many retail investors access the previously hard-to-reach DeFi space. The Aave App also provides on-chain and off-chain services, further optimizing the user experience. Its annualized yield is highly competitive, surpassing traditional investment channels such as bonds and bank deposits, offering ordinary users a quality alternative.

Conclusion

Aave is solidifying its leading position as an on-chain bank, with the recent announcement of two significant developments aligning closely with its growth blueprint. The latest upgraded version, Aave V4 (currently in the testnet phase), marks its transformation towards a more flexible and modular direction, while the Aave App will attract a "new user demographic" into the DeFi ecosystem. Additionally, its RWA market, Horizon, enhances the utilization of tokenized assets, allowing users to conveniently use them as collateral for borrowing funds.

As a leader in on-chain lending, Aave has established a dominant market position, becoming one of the preferred platforms for institutions, whales, and ordinary DeFi users to store stablecoins on-chain. With its scale advantage and robust risk control mechanisms, this leading position is expected to continue in the foreseeable future.

Ultimately, multiple protocols will emerge in the lending space, with some already carving out niche markets and continuing to deepen their focus, while Aave, as a benchmark in this vertical field, continues to build its moat based on liquidity and scale advantages, driving industry innovation forward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。