Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

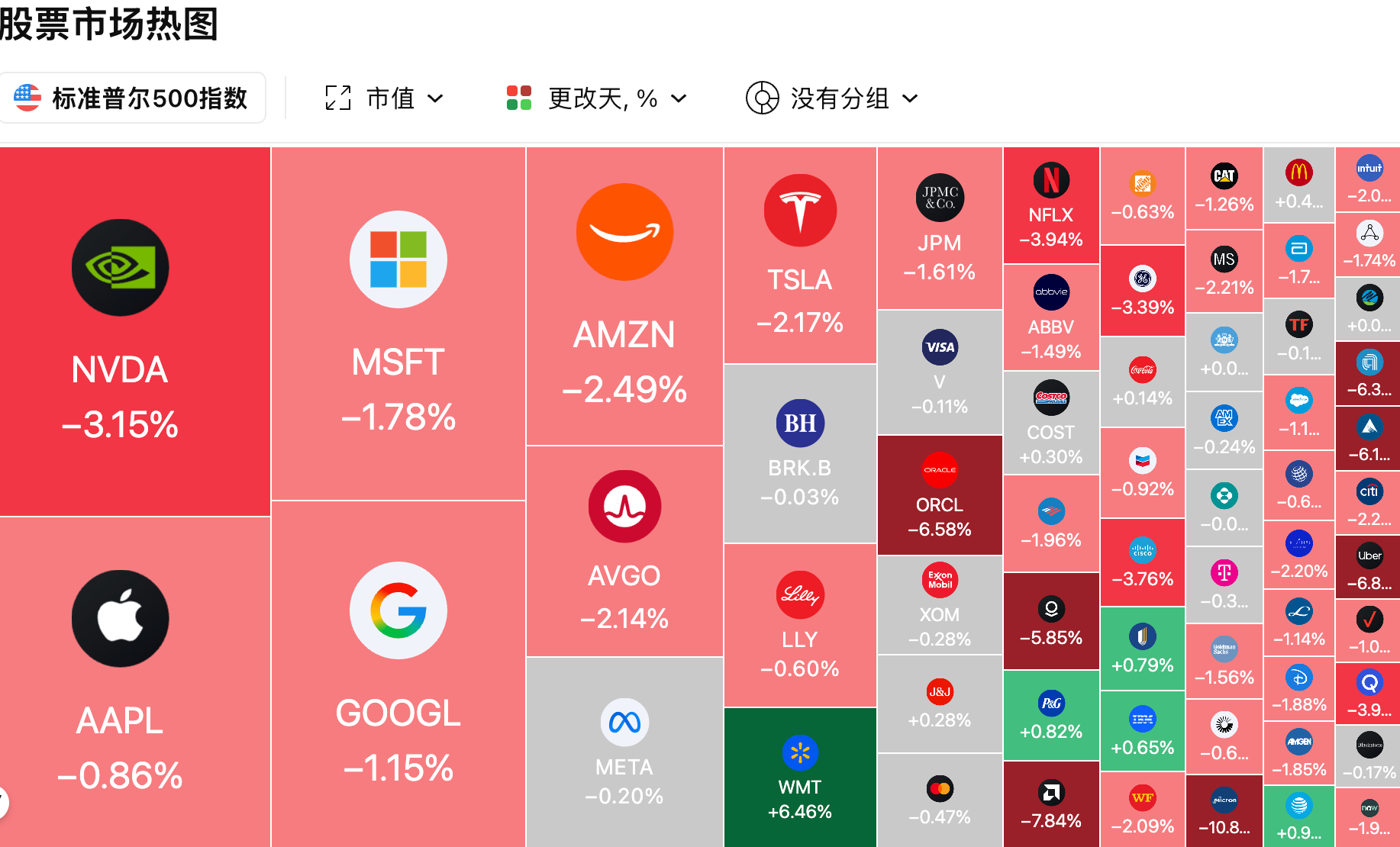

Despite Nvidia releasing better-than-expected earnings, and the U.S. September non-farm payroll report showing a surprising increase in jobs alongside an unemployment rate rising to 4.4%, which should have constituted a double positive, the market unexpectedly experienced the most astonishing intraday reversal since April. The S&P 500 index, which initially opened more than 1.4% higher, ultimately closed down, and Nvidia, which had risen over 4.5%, closed down nearly 3%, exacerbating the sell-off of risk assets. Analysts believe that when positive news fails to drive the market up, it itself constitutes a strong bearish signal.

The Federal Reserve's hawkish stance has once again blurred the expectations for interest rate cuts, with Chairman Powell stating that a rate cut in December is "far from a done deal." Meanwhile, the rapid development of artificial intelligence has raised concerns about the labor market and corporate capital expenditures. Bridgewater founder Dalio warned that the current huge gap between financial wealth and actual currency has placed the market in a bubble zone similar to 1929 and 2000, pointing out that the AI boom has exacerbated wealth inequality. Looking ahead, market sentiment is extremely fragile, with investors entering a "profit and loss protection mode" under multiple pressures of technical sell-offs, liquidity exhaustion, and massive options expirations, making them unusually sensitive to any minor fluctuations.

In the cryptocurrency market, Bitcoin is at the forefront, with its price fluctuations closely tied to the macro environment and market sentiment. After breaking below the psychological threshold of $90,000, it briefly fell below the several-month low of around $86,000. Regarding the future direction, the market is largely bearish, with 27-year Wall Street trader Gareth Soloway predicting that Bitcoin could drop to the range of $73,000 to $75,000 in the short term. He believes that Bitcoin's underperformance compared to tech stocks is due to its reduced volatility, decreased institutional buying, and the overall trend of de-risking in the market. Analyst Banmu Xia provided two hypotheses, both suggesting a short-term dip to the range of $78,000 to $81,000, and even if it rebounds to $110,000 to $120,000 early next year, it will not reach a new historical high. Ali pointed out a significant decrease in whale activity and provided a key support level of $82,045. However, there are also bullish and accumulation viewpoints; analyst Pentoshi believes that the rapid drop of over 30% has led to local overselling in the market, and the $83,000 to $85,000 area is a good opportunity for a rebound. CryptoQuant founder Ki Young Ju also stated that due to institutions like Strategy holding onto their assets without selling, the market is unlikely to return to the cyclical bottom of $56,000, and the current range is a reasonable long-term accumulation zone. Technically, Material Indicators noted that a large number of buy orders have accumulated in the $82,600 to $78,000 range, and historical data shows this usually indicates a price recovery. Bitwise analyst André Dragosch defined the range between BlackRock's IBIT cost price of $84,000 and Strategy's cost price of $73,000 as the market's "maximum pain" zone, which is also a potential "sell-off" bottoming area. Overall, market sentiment is generally bearish, and traders have differing views on the bottom position.

Ethereum is also under significant pressure, with its price dropping 30% over the past month, falling below the four-month low of $2,800. Veteran trader Gareth Soloway believes that the $2,700 to $2,800 range is an important support point for swing trading. However, the overall market sentiment is more pessimistic, with some analysts pointing out that a bear market fractal from 2022 is repeating, suggesting that ETH may further dip to the 200-week moving average of $2,450 to seek final support. Analyst EliZ emphasized that although the price has paused near the 0.75 Fibonacci level, this is more like a "breather" during a downtrend rather than a "serious rebound," and the continuously declining on-chain transaction volume indicates that real demand has yet to enter the market, making any narrative about the bottom premature. The significant weakening of institutional demand is a key factor in ETH's weakness, with data showing that global Ethereum investment products, including U.S. spot ETFs, have experienced the largest single-week outflow since February. More seriously, companies holding ETH as a reserve asset are facing huge unrealized losses, with their average investment return rate ranging from -25% to -48%, causing their market value relative to net asset value (mNAV) to fall below 1, weakening their refinancing ability. According to Ted's statistics, BlackRock has sold $1.1 billion worth of ETH this month, further intensifying the market's sell-off pressure.

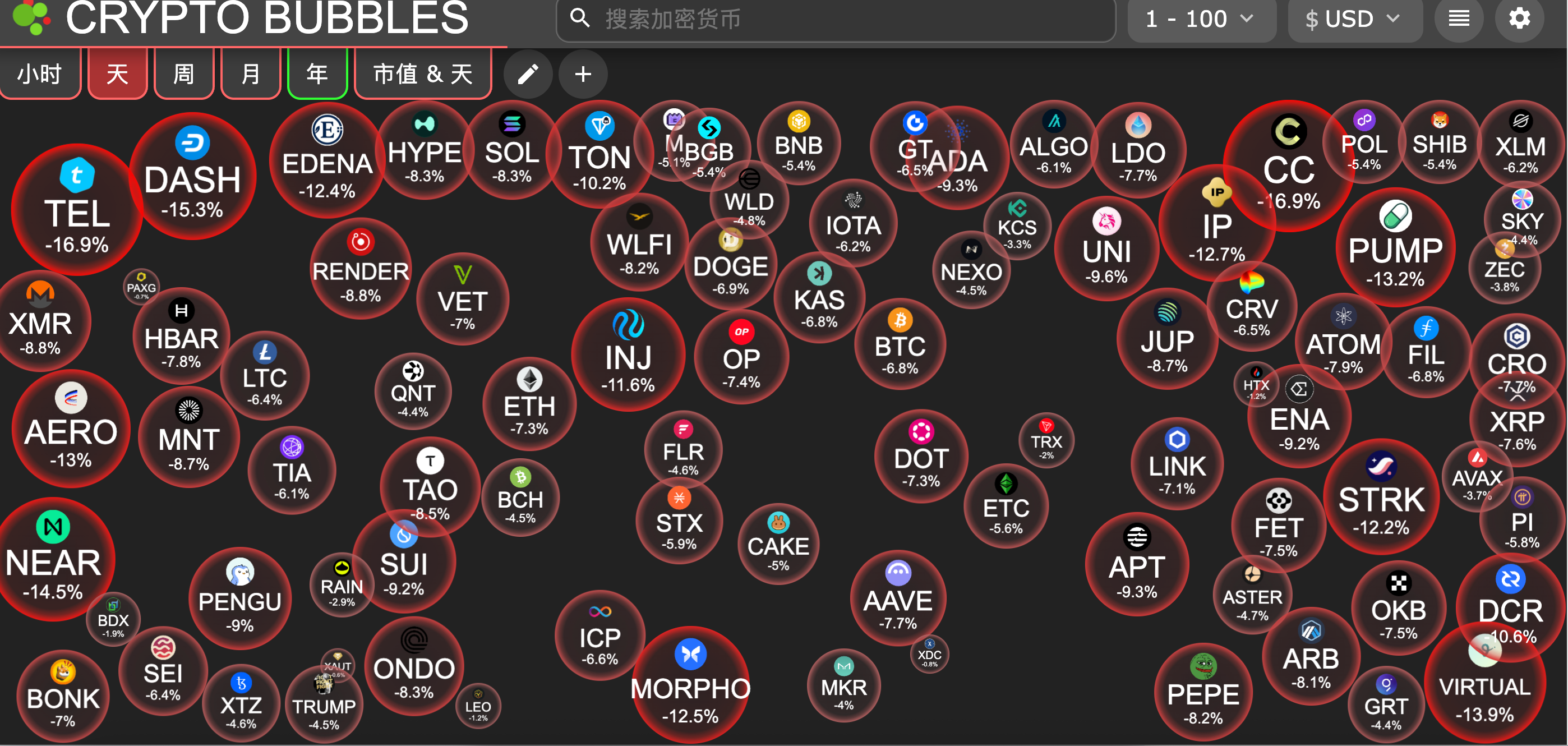

While some altcoins are still rising, the top 100 tokens by market capitalization have all surrendered and are in a downtrend. Notably, the price of Nillion tokens plummeted over 60% yesterday, with the project blaming an unauthorized sell-off by a market maker, and they have now used their treasury for buybacks and are preparing to take legal action. Additionally, the highly anticipated parallel EVM project MegaETH announced that it will launch a cross-chain bridge activity with a total cap of $250 million on November 25, aimed at attracting initial liquidity for the mainnet launch. Meanwhile, as market volatility intensifies, the crypto exchange Bullish has caught the attention of JPMorgan due to its better-than-expected third-quarter performance. Although the target price has been slightly adjusted, it is still considered to have significant upside potential, and Cathie Wood's Ark Invest has continued to buy Bullish stock for three consecutive days.

2. Key Data (as of November 21, 13:00 HKT)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $85,611 (YTD -8.46%), daily spot trading volume $100.9 billion

Ethereum: $2,792 (YTD -16.35%), daily spot trading volume $43.12 billion

Fear and Greed Index: 15 (Extreme Fear)

Average GAS: BTC: 1.02 sat/vB, ETH: 0.067 Gwei

Market share: BTC 58.7%, ETH 11.9%

Upbit 24-hour trading volume ranking: BTC, XRP, ETH, SOL, DOGE

24-hour BTC long-short ratio: 48.18% / 51.82%

Sector performance: SocialFi sector down 9.88%, L2 sector down 8.4%

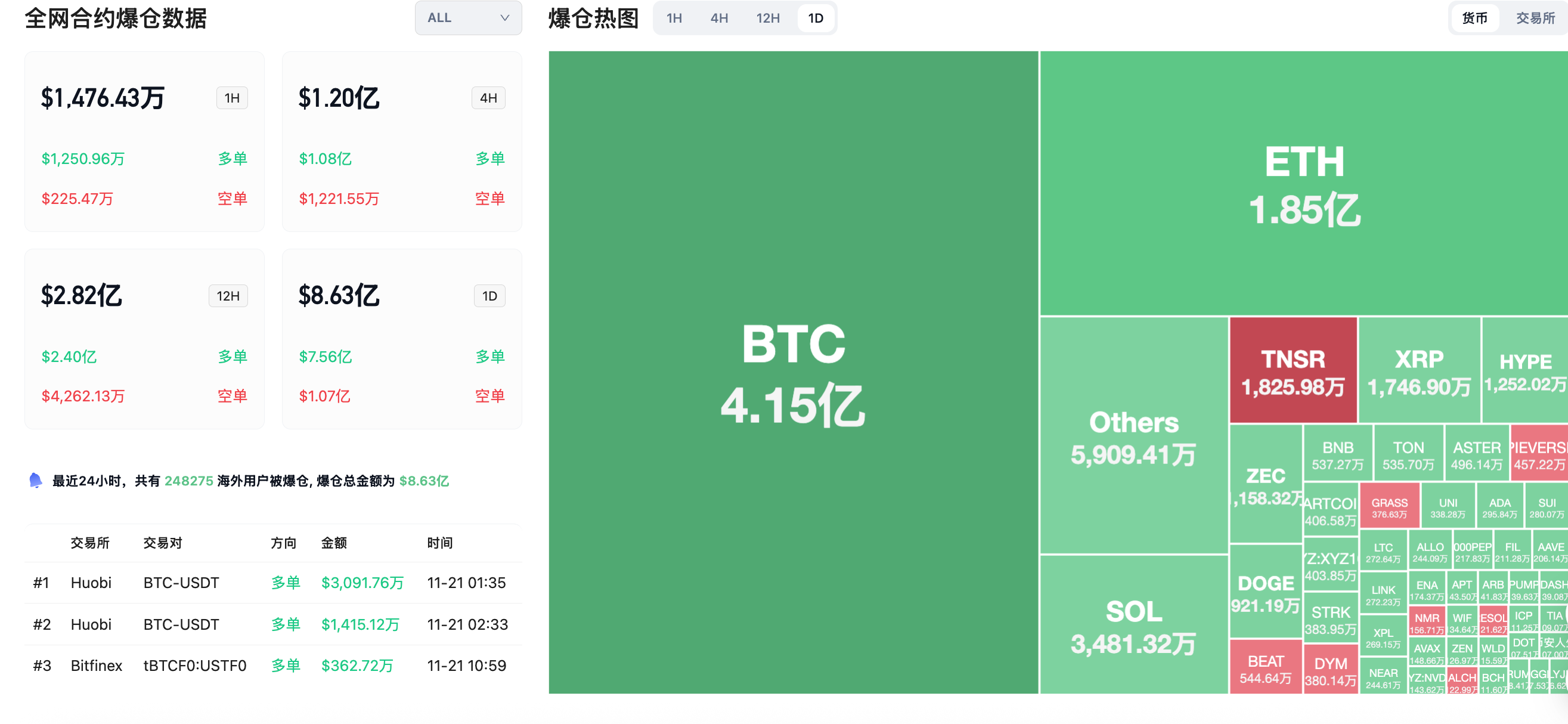

24-hour liquidation data: A total of 248,275 people were liquidated globally, with a total liquidation amount of $863 million, including $415 million in BTC liquidations, $185 million in ETH liquidations, and $34.81 million in SOL liquidations.

3. ETF Flows (as of November 20)

Bitcoin ETF: -$903 million, the second highest in history

Ethereum ETF: -$262 million, continuing 8 days of net outflows

Solana ETF: +$23.66 million

XRP ETF: +$118 million

4. Today's Outlook

Binance will delist XCN, FLM, PERP perpetual contracts on November 21

Binance will delist LA/FDUSD, SAHARA/BNB and other spot trading pairs on November 21

Binance Alpha will launch ULTILAND (ARTX), MineD and Kyuzo’s Friends

Today's largest declines among the top 100 cryptocurrencies by market capitalization: Telcoin down 16.9%, Canton Network down 16.1%, Dash down 15.2%, NEAR Protocol down 14.3%, Virtuals Protocol down 13.7%.

5. Hot News

Irys announces IRYS tokenomics: 20% initial circulation, 8% for airdrops and future incentives

A Bitcoin whale shorts with unrealized gains exceeding $57 million

MOVE repurchase tokens continue to flow back, Movement transfers another 50 million to Binance

Bitmine purchases another 17,242 ETH, worth approximately $49.07 million

U.S. publicly listed company ANPA plans to purchase up to $50 million in EDU tokens within 24 months

ETHZilla discloses it currently holds 94,060 ETH, valued at $285 million

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。