No matter how many on-chain assets one has, if they cannot be consumed in the real world, they remain a "proletarian" without means of production.

Written by: Kean

For a long time, I have found it difficult to explain my identity when introducing myself to friends outside the Crypto industry.

Most of the time, I jokingly say I work in a "scam industry," because the essence of Crypto projects is issuing tokens + finding someone to take over, and the term "crypto circle" is stigmatized in both legal and social contexts.

So, the phrase I often use is: "I am a true proletarian."

The reason is simple—

Although I can make money on-chain, trade, and receive my salary in U, once I leave my wallet and step into the real world, these Us become worthless and cannot be spent anywhere. Moreover, Crypto companies often do not provide social security for their employees.

I remember the first card I bound was the OneKey Card. I believe many people feel the same way as I do: when binding a crypto payment card to WeChat/Alipay, the first time I successfully made a payment, my heart raced, and then I sighed in relief. At that moment, I just wanted to say: "Finally, I can live legally."

Before that, every month, my living expenses felt like a psychological battle: USDT OTC → worrying about risk control → worrying about my card being frozen → worrying about the bank calling to ask about the source. A small expense felt like a dark operation.

However, the shutdown of the OneKey Card left me long denied access to U cards, making me once again a "proletarian" in the real world. After all, Crypto users are not only active on-chain; as subjects with daily capabilities, they must also live in the real world.

It wasn't until the Token2049 event, influenced by a friend's intense persuasion, that I tried the newly launched Bitget Wallet card and experienced the smooth payment process from U to fiat, which sparked new thoughts about "crypto payments."

U Card Payments: The Breakthrough for the "Crypto Proletariat"

As we all know, U cards are a non-profitable business. They are not purely decentralized payments but rather part of the traditional card industry's profit chain.

Its upstream and downstream links are lengthy, including card organizations (Visa/Mastercard/UnionPay, etc.), BIN providers (licensed banks/card issuers), issuing institutions (providing underlying accounts and risk control systems), card program managers (U card project parties like Bitget Wallet), OTC merchants (handling Crypto-Fiat exchanges), and card manufacturers.

In this long chain, U card project parties only have a say with Crypto users but lack the ability to change the complete business model of the traditional card industry's profit chain. The profit sources of traditional card businesses include foreign exchange fees, exchange rate differences, merchant fees, annual fees/card issuance fees/management fees, lending services, and so on. To date, the U card business has become highly competitive: 0 card issuance fees, 0 annual fees, 0 recharge/exchange fees… even real-time exchange rates, while also bearing compliance costs.

However, the U card is still the most user-friendly solution for connecting Crypto to the real world and offers the strongest real-world usage scenarios. In other words, whoever controls the user's payment entry can achieve user retention. Who wouldn't want a massive flow of users?

Because of this, U card project parties know that this business is not profitable but still continue to invest in it. Why? From the perspective of Maslow's hierarchy of needs, you will find that Crypto payments are not just a function, but a right to exist.

A very real question faces all Crypto users: how can the money on-chain enter real life? The best solution, of course, is for sovereign countries to accept cryptocurrencies as a payment tool. But if that doesn't happen, you are a proletarian; what should you do in daily life?

No matter how many assets you have on-chain, if you cannot use them in life, cannot be recognized by banks, and cannot participate in the real-world financial order, you remain a "proletarian" without means of production.

In Marx's theoretical framework, the "proletariat" refers to those who do not own means of production and must rely on selling their labor to survive. In summary: the "lack" of the proletariat is not the absence of money, but the absence of resources that allow life to operate independently.

In today's financial system, means of production include bank accounts, credit systems, payment tools, currency usage rights, and global capital flow channels, etc. The assets of crypto users exist on-chain but cannot be recognized in the mainstream banking system, cannot be freely paid, and are excluded from the mainstream financial system, fundamentally depriving them of means of production.

Therefore, I propose this new concept: the crypto proletariat.

The crypto proletariat is not because they lack money, but because they lack payment rights in reality. Whether an on-chain asset can be used for payment is often not determined by itself, but by whether the real world allows it to become "money."

The successful KYC of the Bitget Wallet Card also made me, as a Crypto user, feel for the first time that I was truly "accepted" by the compliant financial system.

Payment Equality: Farewell to the Era of High Wear and Tear

Objectively speaking, the current U card market has entered a stage of "homogeneous competition"—after years of elimination, the remaining U card products in the market are actually built in cooperation with licensed financial institutions for their underlying bank account structures and issuing channels.

For example, Fiat24 is one of the early entrants in this field and has been widely adopted in the industry as a technology and compliance service provider. It can even be said that Fiat24 has now taken over half of the U card business: besides a series of old projects like OneKey Card, Dupuy, and Infini that have exited the stage, the remaining SafePal, imToken, and Bitget Wallet are all based on Fiat24's compliant Swiss banking services.

This also means that the underlying account structures and issuing channels of various products are highly similar, with differentiation focusing more on stability, specific service experiences, and fee wear and tear.

During Token2049, a video circulated on social media showing Xie Jiayin using the Bitget Wallet for offline direct QR code payments in Vietnam, which greatly moved me. The true endgame of Web3 payments may be like this, directly taking over the acquiring end with wallets. Although this feature currently only covers parts of Southeast Asia, it is an important signal.

Of course, for now, U cards are still mainstream, and for U cards, whether they are good to use ultimately comes down to two points: stability and cost.

When it comes to stability, an open secret in the industry is that U card businesses are often subject to banks, with the risk of being cut off at any time. This is why there were rumors last year that Bitget strategically acquired the licensed institution DCS in Singapore, which explains why this product has recently appeared more aggressive and stable in terms of risk control and funding channels—it's not just about "having money," but completing vertical integration from wallet to issuing bank.

With autonomy over the underlying channels, cost advantages become possible.

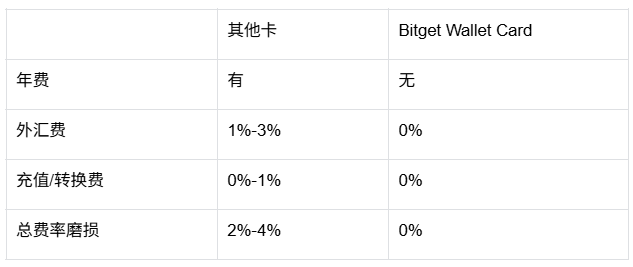

After all, the biggest pain point of U cards in the past was "wear and tear": charging incurs a fee, exchanging incurs a fee, and spending incurs a fee, with total losses often reaching 2%–4%. The current trend is that to compete for users as the "main account," everyone is striving to lower fees.

For instance, the Bitget Wallet Card currently promotes a strategy of no fees, no foreign exchange fees, and aligning with Google’s real-time exchange rates, effectively bringing Crypto payments back from "noble services" to "common consumption."

For example, in the past, using a U card to pay for coffee, book flights, or pay for hotels would incur an additional 2%–4% fee. However, they now offer users a lifetime exemption from fees for the first 400U spent each month, with zero foreign exchange fees, recharge fees, and conversion fees, while ensuring that the settlement rate aligns with Google’s real-time rates, truly achieving 0 hidden costs and 0 wear and tear, making daily consumption payments sufficient!

If the previous U cards addressed the question of "can on-chain assets be used for payment," then now that everyone is based on Fiat24's underlying architecture, the Bitget Wallet Card is solving the issue of "can on-chain assets enter real life with minimal cost, maximum stability, and in the broadest scenarios."

When a U card can finally be used without discrimination against users, regions, or relying on fees for profit, and can guarantee long-term operation, it truly has the significance of popularization. Its significance is no longer just a card, but a signal of a turning point in the industry, a historical node regarding how "crypto life" is shaped, practiced, and recognized by society.

In summary: Crypto users are living not just on-chain for the first time, but as subjects with daily capabilities, living in the world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。