In the crypto industry, we often shout "disrupt the banks," but in reality, the fastest way to start over is actually through compatibility.

Written by: Web3 Farmer Frank

The concept of "financial equality" is something that can often only be truly felt through personal experience.

Recently, while in Japan, as someone who is already accustomed to QR codes being ubiquitous, I indeed felt that there was too much cash, card wear and tear, and that opening and recharging a Suica card was a bit troublesome (the pain of using an Android phone). However, at least, there is always Alipay and Visa/Mastercard as a safety net, so payments are never difficult to sustain.

But when we shift the map slightly south to many countries in Africa, Southeast Asia, and Latin America, the issues are completely different. In many of those countries, payment is not just a tool, but a "survival skill":

The penetration rate of bank cards is extremely low, with many people not even having an account. The fees for small interbank transfers are not low, the arrival times are unstable, and there may not even be cross-border services from commonly used banks. Even if there are, the fees for cross-border payments are often shockingly high.

In these places, "payment itself" is no longer a basic infrastructure like water and electricity, but has become a privilege.

1. The World is Folded: From Tokyo to Lagos

Living in East Asia (like China and Japan) or in Europe and America, our perception of payment is often one of "overabundance."

The smoothness of WeChat Pay, the omnipotence of Alipay, and even the one-touch experience of Suica in Japan make us feel that the flow of funds should be like this.

But the world is not flat, and different people's financial experiences are also folded.

Just like the three physically separated spaces in the sci-fi novel "Beijing Folding," there are insurmountable gaps in global finance. For example, people in the first space are already discussing where to enjoy double-digit annualized returns from DeFi, while people in the third space are still worrying about how to safely bring their hard-earned money home every day.

Interestingly, it is also in this context that a "counterintuitive" truth in the data is often overlooked—although the overall stereotype of Africa is often "backward," if you shift your gaze to emerging markets like Nigeria, you will find that they are not uninterested in digital payments, but rather trapped by infrastructure:

According to the latest data from the Central Bank of Nigeria (CBN), Internet Transfers account for an astonishing 51.91% of the market share (by transaction count), while POS transactions account for 28.53%. Together, they account for over 80%, while cash withdrawals (ATM), which we think should occupy the highest proportion, only account for 2.21%.

This means that Nigerians actually rely heavily on digital payments, especially direct bank transfers. In simple terms, this is also because physical payment infrastructures like bank branches are, in fact, more costly and harder to achieve compared to seemingly advanced options like electronic banking.

Therefore, in places like Nigeria, you do not need to consider teaching someone what an "e-wallet" is or how to use an "e-wallet" step by step, because under the pressure of real-world factors, they have long been accustomed to completing almost all transfers via their mobile phones, which is quite similar to how Axie Infinity gained traction in Southeast Asia back in the day.

The only pain point lies in "connection." After all, for a freelancer in Lagos, Nigeria, or a worker overseas needing to remit money back home, an average waiting time of 15 minutes or even longer, along with layers of exploitative exchange rates, remains a huge black box.

They rely heavily on digital payments, but they lack stable, low-cost, globally connected payment infrastructures. It is against this backdrop that Web3 has truly shown people a new path that does not rely on the banking system for the first time.

2. Web3 Payments Should "Surround the City from the Countryside"

This is also why I have always felt that the revolutionary significance and immense potential of Web3 and stablecoins in marginal areas like Africa and Latin America, through a "surrounding the city from the countryside" approach, have been largely overlooked by mainstream narratives for a long time.

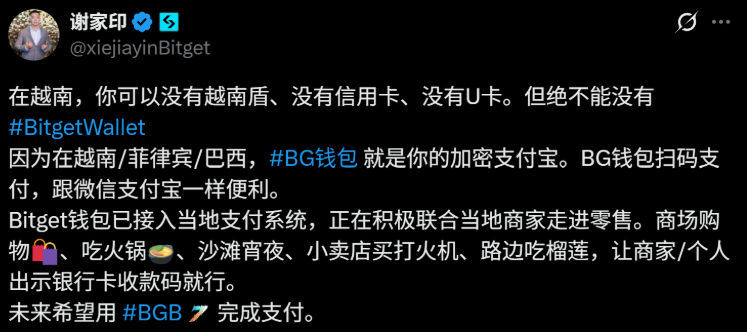

Recently, a video of Xie Jiayin using stablecoins for payment in Vietnam sparked quite a bit of discussion, and to be honest, it was quite impactful for me at the time.

The key point is that the payment was completed directly through a cryptocurrency wallet transfer, without needing to go through a U card as an intermediary.

Although in China, this kind of QR code transfer is commonplace, it is built on highly mature, closed electronic payment channels like Alipay and WeChat—that is a unique national condition of China and the accumulation of twenty years of internet development, which is hard to replicate.

The model showcased in the video is completely different: in Vietnam, using Bitget Wallet to scan the VietQR QR code, the front-end experience is very similar to Alipay, but behind it, the cryptocurrency transfer is completed through the Solana network, and then instantly converted into fiat currency into the merchant's account via an intermediary protocol.

In simple terms, the difference lies in "replicability"—this model in Vietnam can theoretically be transferred to any country with a local Instant Payment System.

Especially in underdeveloped regions like Africa and Latin America, where smartphones and e-wallets have a certain level of penetration, but traditional financial infrastructures are lacking.

This also reveals a core demand: users do not care about what ERC-20 is or what Gas Fees are; they only care about "can I pay like I scan a code."

If we review the evolution of stablecoins in the dimension of Web3 payments, we have roughly gone through three stages:

Pure On-Chain Transfers: A geek's toy, almost impossible to use in real life except for buying NFTs and DeFi;

The "U Card" Era: Using card issuers to load cryptocurrency onto Visa/Mastercard, although convenient, the barriers are extremely high (tedious KYC, expensive card fees, high transaction fees), and essentially still working for traditional card organizations;

Direct-to-Bank Connections: Attempting to connect on-chain accounts, stablecoin assets, and merchant payment endpoints, bypassing the card issuers and card organizations in traditional payment chains, which is currently the most exciting exploration;

In this direction, payment giants have already begun to cast their votes.

From Circle launching Programmable Wallets and CCTP (Cross-Chain USDC Settlement), to global payment giant Stripe investing $1.1 billion last year to acquire stablecoin API service provider Bridge, all are efforts towards the third stage.

Including the recent launch of the bank transfer feature on Bitget Wallet in Nigeria, which is also supported by Aeon Pay, creating a "third choice" beyond large banks and P2P:

Decentralized and No KYC: Unlike traditional exchanges that require tedious identity verification, it retains the anti-censorship properties of Web3 wallets;

Lightning-Fast Experience: Compared to the 10-15 minutes of P2P markets, this direct connection transfer can be completed in 5-10 seconds;

Low-Risk Channel: Funds no longer pass through unfamiliar individual merchants (P2P Merchants), but enter the banking system directly through compliant payment gateways, greatly reducing the risk of frozen cards;

This also means that Web3 wallets are no longer just asset browsers, but are beginning to directly connect to the central bank payment systems of various countries (like Nigeria's NIBSS Instant Payment) through APIs.

From this perspective, the previously and still mainstream U card is destined to be replaced in the future—traditional financial institutions will more actively embed Web3 payment paths and usage scenarios, ensuring compliance while completing the full-link connection of user wallets, merchant collections, and asset inflows and outflows through bank accounts, payment channels, and settlement systems.

3. The Ultimate Form of PayFi: When Wallets Become "Invisible Banks"

This also raises an extremely practical landing question: At this stage, Web3 does not need to reinvent a physical payment network, but rather to let wallets "penetrate" existing payment networks.

I have always believed that the ultimate form of PayFi may be a completely independent payment network that does not rely on Visa/Mastercard or even SWIFT:

Merchant Side: Directly accept stablecoin payments without mandatory conversion to fiat;

User Side: Directly initiate transactions from non-custodial wallets, with self-custody of funds, and instant on-chain settlement;

Backend: Supported by compliant stablecoin issuers and on-chain clearing and settlement networks, eliminating the need for Visa/Mastercard or SWIFT channels, completely removing the "toll fees" of traditional card organizations;

But this is still an ideal state. Before a complete transformation of the payment system occurs, the most robust, realistic, and sustainable path remains to connect directly to local bank networks through stablecoin payment gateways.

After all, TradFi excels in compliance regulation, account architecture, and risk control systems, while Crypto has inherent advantages in asset openness, global liquidity, and trustless execution. The combination of the two is the optimal solution for the current "compliance" and "flexibility."

In fact, this trend is already happening.

As mentioned earlier, the practice of Bitget Wallet in Nigeria, if stripped of the "Crypto" technical shell, is essentially disguising itself as an "offshore banking app with global liquidity":

Imagine, for an ordinary user in Lagos, when they open Bitget Wallet, they receive not just an on-chain asset management tool, but a super Alipay that can store dollars (stablecoins) and can instantly transfer money to the neighboring grocery store owner (local bank account).

This is perhaps the embryonic form of PayFi's killer application scenario in emerging markets.

Objectively speaking, when Web3 wallets can seamlessly connect to real-time payment systems in various countries (like Nigeria's NIBSS, Brazil's PIX, India's UPI) through compliant channels, this system is likely to truly bypass the high costs and low efficiency bottlenecks of the traditional SWIFT system.

In the near future, products like Bitget Wallet may even surpass existing cross-border payment solutions like Airwallex and Wise in terms of cost and experience.

In Conclusion

Payments are the starting point for stablecoins, and "global payments" represent a larger future for them in the global financial infrastructure.

The integration of QR payments in Vietnam and bank transfer chains in Nigeria actually highlights where stablecoins can play a greater role—not necessarily to replace banks, but to fill in the gaps that the banking system cannot address.

I also hope that in the future, there will be more wallets and more Web3 projects willing to continue experimenting and delving into these complex local scenarios.

Only in this way can "global payments" become not just a narrative, but a tangible reality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。