Written by: Will A-Wang

The rapid development of artificial intelligence and the AI agent economy is reshaping the internet economy. However, one of the biggest obstacles to achieving an autonomous AI economy is the lack of a payment system that allows AI agents to operate without human intervention. Traditional payment systems are costly, slow to settle, face chargeback risks, and require multiple layers of manual setup and authorization, making them ill-suited for AI-driven business scenarios.

The x402 protocol, jointly promoted by Coinbase and Cloudflare, is a product of the current era, and its significance goes far beyond being a new payment method. It uses blockchain and stablecoins as the payment infrastructure, with the underlying logic and driving scenarios provided by the AI business economy.

This protocol activates the long-dormant HTTP 402 - Payment Required status code, weaving a native value exchange layer directly into the fundamental structure of the internet by combining blockchain and AI. Through its convenient and elegant design, the protocol addresses the dual challenges of micro-payment feasibility and transaction friction, positioning itself as the default transaction protocol for the emerging AI economy (autonomous agent economy).

The x402 protocol revives the dormant web standards, projecting not only the Web3 crypto market or the narrowly defined AI agent market but also supporting the AI economy, transforming, reshaping, and disrupting the entire vast internet market, including its underlying business logic and the habits and experiences of user interactions.

Therefore, it is a great honor to engage in an in-depth conversation with Jordan, the founder of AIsa, to clarify the historical opportunities and strategic background of the x402 protocol's emergence, and to see how this internet-native payment standard, which has been silent for thirty years, responds to the call of the AI era, rather than being viewed merely as an isolated technological innovation.

Jordan is the founder of AIsa, a serial entrepreneur based in Singapore/Silicon Valley. AIsa is an infrastructure service provider specifically designed for the AI economy, aiming to redefine the transaction logic of AI-driven businesses. AIsa can help AI service providers achieve more efficient monetization through real-time micro-payments and programmable, fine-grained access control, covering content, data, APIs, GPUs, and large model tokens. The core team of AIsa consists of former machine learning research scientists from Meta (US), former token payment product experts from Visa (US), and leading core developers from major public chain L2 projects.

If blockchain and stablecoins are a transformation or supplement to real-world business, then the revival of the HTTP 402 protocol will be a reshaping or disruption of real-world business.

The full text is 15,000 words; let us embark on this journey together.

1. The Web Payment Protocol That Has Been Shelved for 30 Years

1.1. The Unfulfilled Promise of HTTP 402

The HTTP 402 - Payment Required status code was written into the web standards as early as the early 1990s, but it has been effectively dormant for the subsequent quarter-century. In the initial blueprint of internet pioneers, the web was supposed to have native payment capabilities, rather than relying on complex redirect payments. However, due to the lack of payment infrastructure at the time, the vision of HTTP 402 was sidelined by the shortcut of "HTTPS + credit card payments."

This has led to the current state of the internet: transmitting information rather than transmitting value.

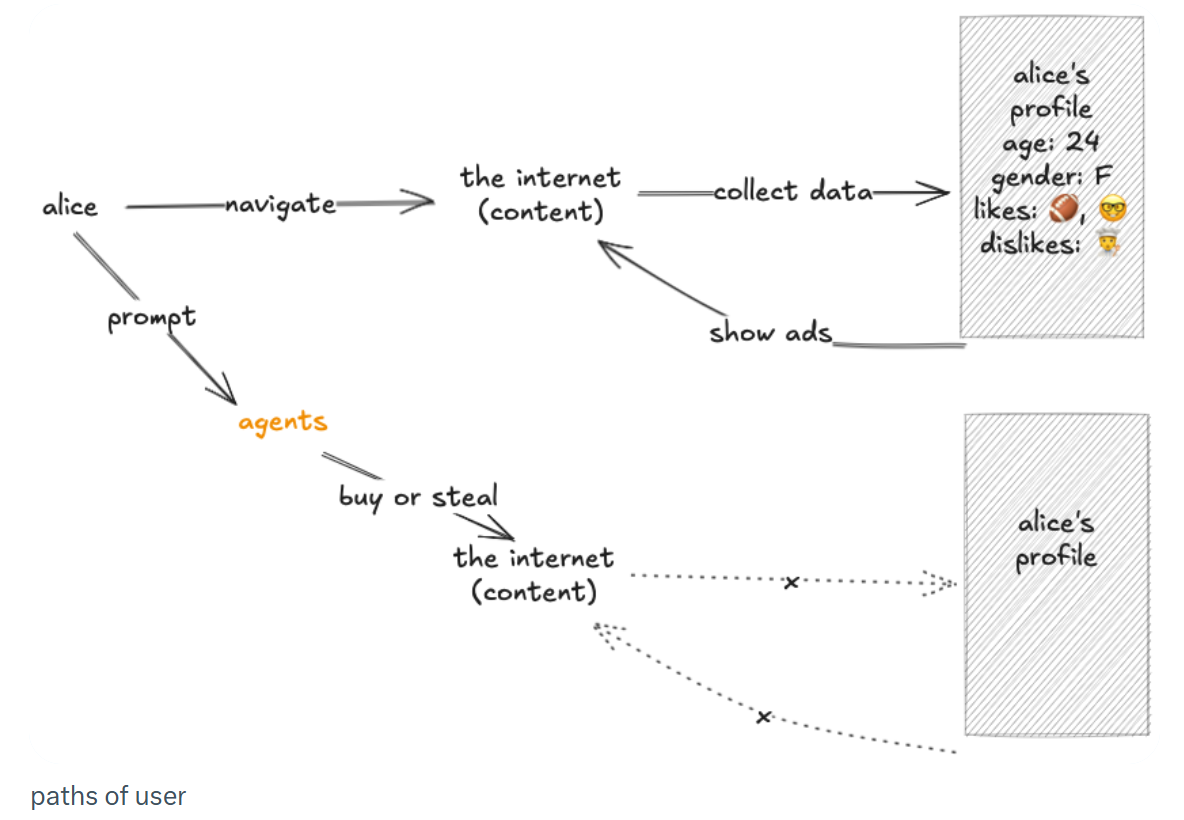

Behind this is a "patchwork" value circulation system that assumes "users are human," relying on registration, login, forms, and intermediaries, which is not suitable for today's autonomously operating software or machines.

To monetize content, developers have had to layer various external systems on top of the web protocol layer:

Redirecting credit card and gateway payments;

Binding one-for-all subscription accounts;

Using a monthly billing API key model;

The internet advertising business model where users sell "attention or data" to indirectly pay.

Understanding this initial history of HTTP 402 is crucial. Looking back, we can see the origin of the "most successful" business model of Web2 internet—advertising; looking at the present, we can see the enormous potential of blockchain and stablecoins as financial infrastructure integrated into the Web2 internet—the value transmission layer of the internet; looking forward, we can imagine how the autonomous AI economy will reshape or disrupt this internet business model.

At this moment, it feels as if the wind has risen at the end of the green apple, and the technological clock has finally reached the moment envisioned back then.

The current internet is entering a phase of "software as users," and we are moving towards a new interaction paradigm: the initiator of requests is not a person, but the software itself.

1.2 A Line of Code That Has Slept for Thirty Years

Web3 Lawyer Will:

Jordan, could you review the history of HTTP 402 for us, why it failed initially, and why it has been revived in the AI era?

AIsa Jordan:

We need to turn the time machine back thirty years to look at the original conception of internet protocols, why it subsequently deviated from its intended path, and its unfulfilled ideals over the past thirty years.

In 1996, in a dimly lit lab at the University of California, Irvine, a young Roy Fielding and his colleagues were engrossed in writing a document destined to change the world—the HTTP/1.1 protocol. It defined how browsers and servers communicate, determining how web pages load, how images are transmitted, and how forms are submitted. Without it, the World Wide Web would not exist. Yet, buried within these dry terms was an unusual "Easter egg": HTTP 402 – Payment Required.

In their vision, the future web would not need to fill pages with ads or require annual subscriptions. Instead, users could pay for exactly what they needed—a piece of writing, a photo, or even a data field. The browser would automatically settle a few cents in the background, seamlessly connecting access and payment, as naturally as a TCP/IP handshake. However, this vision was ultimately buried by the times. In the reality of the 1990s, there were no economic or technological conditions to support it.

1.3 Why It Failed Initially—The "Three Mountains" of the 90s

AIsa Jordan:

Fast forward to 1998. Jack opens The New York Times using the Netscape browser on a dial-up network. The gray progress bar on the screen crawls slowly, and the modem emits a piercing beep. Finally, the page loads, but just as he reads the second paragraph, a prompt pops up—"Payment Required: Please pay $0.05 to continue reading."

Jack hesitates for a moment, clicks confirm, but finds he must enter his credit card number and wait several seconds, ultimately paying nearly 35 cents. By the time the page refreshes, his patience has worn thin, and he closes the webpage, turning to another free portal.

This is precisely the predicament that HTTP 402 faced in the 90s. It was not that it was not advanced enough; it was that from the very beginning, it encountered three insurmountable "mountains."

The first mountain: The iron law of economics

Economist Coase's transaction cost theory has long pointed out that whether a transaction can be established depends on whether the cost is lower than the benefit. HTTP 402 imagined "5 cents for an article," but in the credit card-dominated era, the fixed transaction fee for each transaction was about 25–35 cents. In other words, to access 5 cents worth of content, users had to spend 35 cents. The transaction cost was six times greater than the transaction amount, making this logic inherently "unfeasible" in economics.

The second mountain: The fragmentation of experience

The charm of the internet lies in "instantaneity," while HTTP 402 introduced fragmented pauses. Each click could trigger a payment window, and each payment required entering a card number and waiting for dial-up. More critically, it forced users to frequently make decisions about "whether to pay for this content" without any preparation. This phenomenon is known in psychology as decision fatigue, and users quickly choose to give up. In contrast, while advertising is crude and subscriptions are clumsy, they at least maintain a continuous experience.

The third mountain: The technological void

HTTP 402 left a door open in the protocol but did not lead anywhere. Browsers lacked built-in wallets, websites lacked unified payment interfaces, and payment gateways had no scalable solutions. Microsoft attempted to promote "MSN Micropayments" in 1999 to facilitate instant payments for individual articles, but it quietly disappeared two years later due to a lack of ecosystem support. Early electronic currency attempts like DigiCash also failed due to a lack of standards and compatibility, leaving them isolated.

1.4 Why It Has Been Revived in the AI Era?

Web3 Lawyer Will:

Indeed, as Jordan mentioned, this traditional payment system was primarily designed for human interaction, rather than being natively integrated into the internet as originally envisioned, let alone in the current AI era.

The launch of ChatGPT in 2022 brought artificial intelligence to the forefront of public attention and presented clear opportunities for blockchain and stablecoins. From tracking content origins and intellectual property licensing to providing payment channels for autonomous AI agents, blockchain and stablecoins could become key solutions to some of the most pressing challenges in artificial intelligence.

As stated in the "a16z: Crypto Ecosystem Status Report 2025": "Protocol standards like x402 are rising, expected to become the financial backbone for autonomous AI agents, enabling them to conduct micro-payments, access APIs, and settle payments without intermediaries—Gartner estimates that by 2030, this economic scale could reach $30 trillion."

AIsa Jordan:

Today, AI agents are independently requesting data, invoking models, and executing tasks, with digital services shifting from subscription-based to "pay-per-call," charging for each API call, each inference, and each millisecond of computing power. In this scenario, traditional payment methods (credit cards, account top-ups) are completely ineffective. What AI agents need is a "payment mechanism embedded in internet protocols" that enables automatic settlement without human intervention.

The internet already has the bandwidth for communication between machines; now it needs the native capability for transactions between machines.

The traditional payment system is primarily designed for human interaction and cannot smoothly integrate into the AI business ecosystem. These obstacles create significant friction for AI-driven applications and machine-to-machine transactions, hindering the comprehensive realization of the autonomous digital economy. AI agents must obtain real-time contextual data, API services, and distributed computing power instantly and without friction to operate independently; they need to execute micro-payments dynamically and autonomously, without human intervention and without enduring the delays of traditional payments.

Browser-based APIs have attempted to meet some of the needs for agent payments, but they are still based on systems designed for humans, thus relying on manual UX navigation, credit cards, account verification, and other human-oriented processes, failing to achieve true agent automation.

Currently, several key technological trends are converging to create favorable conditions for the re-emergence of HTTP 402:

Stablecoins have become the native currency of the internet, providing AI agents with a globally accepted, programmable, and instant settlement medium for value exchange;

High-performance blockchains based on the internet make the "pay-per-request" micro-payment model economically viable, significantly reducing transaction costs.

AI agents are transforming from passive tools into active economic entities, capable of autonomously initiating transactions, purchasing services, and creating value.

The recently emerged x402 is a programmable micro-payment extension protocol developed based on the native HTTP 402 protocol, allowing AI agents to complete real-time deductions and settlements when requesting any content, data, or API, achieving a true "pay-per-call / pay-per-request" model.

Its fundamental goal is to unleash the full potential of the AI autonomous agent economy, building a more efficient, frictionless, and scalable digital economic toolchain. By supporting native payments, AI agents can autonomously discover and procure third-party cloud resources, contextual data, and API tools, achieving their optimization goals without human intervention, freeing developers, businesses, and consumers from payment friction, fostering innovation, and accelerating the realization and evolution of AI-driven commerce.

2. On-chain Payments: The Cornerstone of the AI Digital Economy

Let’s first briefly describe on-chain payments based on the internet—blockchain and stablecoins. This on-chain payment model is the cornerstone of the AI digital economy, enabling seamless global circulation of value on the internet. On this foundation, everything will seem logical.

2.1 On-chain Payments Based on Blockchain and Stablecoins

a16z's Chris Dixon released the book "Read Write Own" in early 2024, which serves as a declaration leading us into the third phase of the internet—the Web3 value internet. In the value internet of Web3, the concept of "Own" emphasizes autonomous ownership, allowing us to democratize and monetize information and achieve seamless global circulation of currency or value through blockchain technology.

The development of the internet has made the flow of information instantaneous, free, and globalized. However, why is the flow of funds/value still so difficult and expensive?

Chris Dixon believes that stablecoins based on blockchain networks are one answer. Stablecoins give us the first real opportunity to change currency in the same way that email changed communication: making it open, instant, and borderless. This is a "WhatsApp moment" for currency/value, where a global network built on blockchain and stablecoins can benefit everyone. (Stablecoin Payments and Global Fund Flow Models)

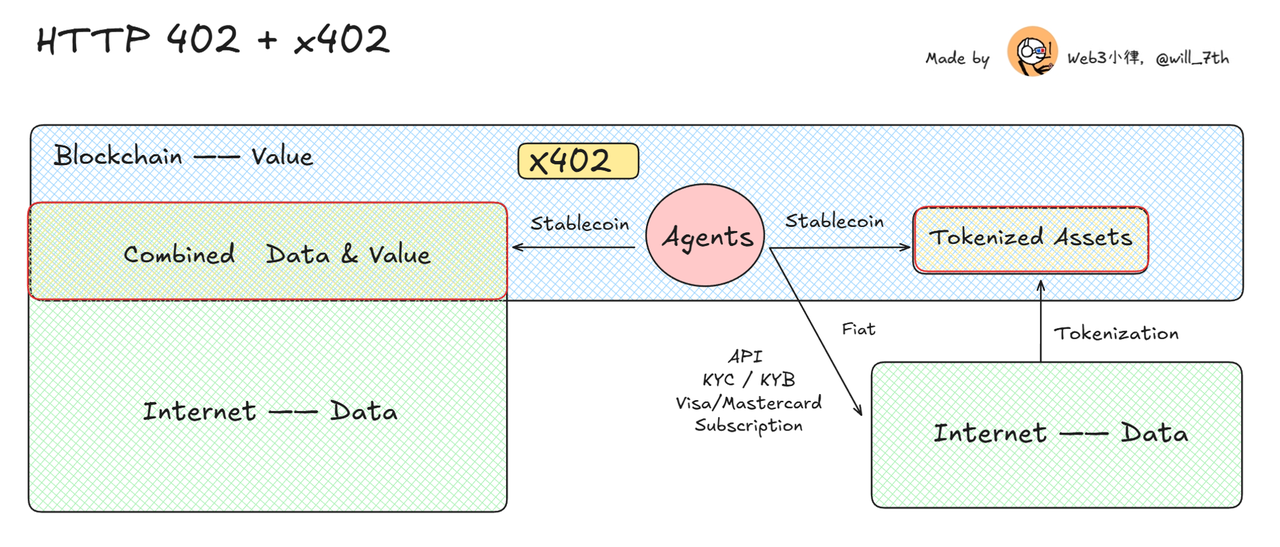

In the current landscape of on-chain commerce, the flow of value still operates along a bidirectional track of "fiat bank compliance entry (KYC/KYB) → blockchain → stablecoins."

Focusing on the rapidly approaching AI economy: the value internet of Web3 must not only serve as a settlement layer for "humans" but must also accommodate billions of AI agents—these digital entities operating around the clock will replace humans, becoming the initiators and recipients of high-frequency, fragmented, real-time priced transactions.

In other words, the next stop in the on-chain world is to write "machines" into the economic ledger, allowing the AI autonomous agent ecosystem to gain a native, frictionless global value highway.

2.2 What is x402—Filling the Gap in the Internet Value Transfer Layer

x402 is an open-source payment protocol explicitly developed and advocated by the cryptocurrency exchange Coinbase. Its official white paper is expected to be released around May 2025, outlining the vision of creating a unique payment standard suitable for machines—something the internet has long needed.

This open payment standard allows AI agents and web services to autonomously pay for API calls, data, and digital services. It utilizes the long-preserved HTTP 402 "Payment Required" status code, eliminating the need for API keys, subscriptions, and manual payment processes, enabling machines to conduct real-time, native on-chain transactions using stablecoins like USDC.

Developers can integrate a "pay-per-use" monetization model with just one line of code, unlocking frictionless payments for contextual retrieval and third-party API calls in AI applications. x402 provides instant settlement, near-zero fees, and supports multiple chains, making it an ideal solution for AI-first commerce and machine-to-machine payments.

In short, x402 aims to formally activate the HTTP 402 - Payment Required status code, transforming it into a native payment mechanism for the internet, representing Coinbase's vision for the internet's native value layer. Unlike traditional payment models that require account creation, credit card binding, or preloading, x402 embeds payment requests directly into HTTP responses, allowing clients (whether human, robot, or AI agent) to automatically recognize payment information and complete settlements.

x402 enables an HTTP request to simultaneously possess the attributes of "data transmission" and "value transmission." Once payment is completed, access rights can be opened instantly, without the need for accounts or manual operations.

(x402 Official White Paper)

x402 can fill the gap in the internet value transfer layer, activating the internet's native payment layer, allowing AI agents and API providers to interact seamlessly through real-time, trustless payments—eliminating the friction of traditional billing systems and unlocking a new pay-per-use revenue model. This helps the internet of the digital economy era expand payment scale through blockchain and digital assets.

Compared to traditional payment tracks, on-chain transactions conducted through x402 can settle in about 200 milliseconds, providing API providers with instant payment finality. There are no rolling chargeback periods, no settlement delays—only real-time access and real-time payments. x402 is built on a permissionless blockchain infrastructure, globally available, without expensive currency conversion or reliance on traditional financial tracks.

x402 leverages stablecoins and blockchain Layer-2 scaling solutions to eliminate the aforementioned inefficiencies, achieving low-cost, instant, and automated transactions. The table below compares x402 with traditional payment methods, demonstrating why it is the optimal choice for AI-first, pay-per-use models.

Payment Track

Typical Fees

Settlement Finality

Chargeback Risk

Scalability

Credit Card

$0.3 + 2.9%

Days (Batch)

Yes, up to 120 days

65,000 TPS (Theoretical Peak)

PayPal

≈3% + Markup

Authorization Instant, Settlement Takes Days

Yes

Unknown

Stripe (Crypto Payments)

1.5%+

Depends on Blockchain

No - Non-reversible

Depends on Blockchain

Ethereum L1

$1-$5 + Gas

1-2 Minutes Confirmation

No - Non-reversible

15-20 TPS

x402 (Base Chain)

Free

200 milliseconds

No - Non-reversible

Hundreds to Thousands TPS

2.3 How x402 Works

x402 is an open payment protocol developed by Coinbase that enables AI agents to autonomously complete transactions. It relies on blockchain technology and digital currency to provide a lightweight, secure, and instant payment system, aiming to accelerate the adoption of machine-to-machine (M2M) payments and AI agent commerce.

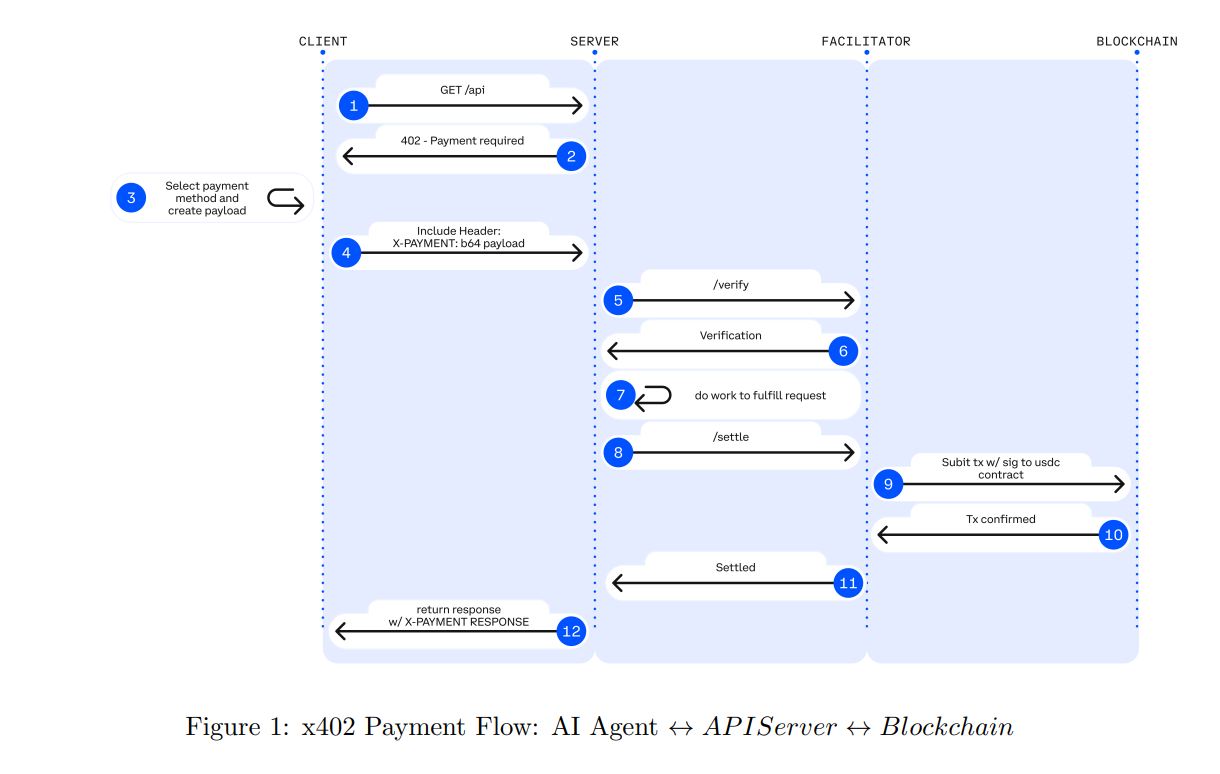

The x402 protocol retains the HTTP 402 "Payment Required" status code: when an API request is not accompanied by payment, the server returns HTTP 402, prompting the client to pay first before retrying. With this simple mechanism, x402 eliminates the complexities of API keys, accounts, and subscriptions. Any API or content provider can seamlessly accept pay-per-use payments by integrating lightweight middleware, without needing to overhaul existing infrastructure.

Core Payment Process:

Client Request. The AI agent or application initiates a request for access to an API or digital resource.

Payment Required (402). If the request does not include valid payment, the server returns HTTP 402 and provides pricing and payment details in the response.

Agent Submits Signed Payment Retry. The agent submits a signed payment authorization in the retry request.

Network Service Validates and Broadcasts Payment. The server verifies the payment's validity, broadcasts it on-chain, and then returns the API response.

(x402 Official White Paper)

2.4 x402 Achieves Frictionless Payments & Comparison with Traditional Payment Processes

x402 eliminates the account creation and billing steps in traditional payments, truly achieving "pay-per-use" without subscriptions, prepayment limits, or manual invoicing. Both AI agents and human users can access digital services instantly using x402.

In comparison: x402 does not create a new website, but it makes "secure communication" a native capability of the internet; similarly, x402 is not a new application, but it embeds "payments" into the internet protocol layer, making the flow of value as fundamental a function of the internet as the flow of data.

Traditional Payment Process (User Operation)

x402 Payment Process (Agent Operation)

Create an account with the new API provider

(Time Setting)

AI Agent sends an HTTP request and receives a 402 (Payment Required)

(No account setup required, instant access)

Add payment method to the API provider

(Requires KYC → Delayed access, requires approval)

AI Agent seamlessly pays with stablecoins, no registration or approval needed

Purchase credits/subscriptions (prepaid commitment → overpayment or depletion of funds)

Grant API access (no manual approval needed, no management of API keys)

Manage API keys (security risks → must store and rotate keys)

Make payments (slow transactions, potential chargebacks and fees)

Scenario

Traditional Process

Using x402

AI Agent:

Autonomous Research Assistant

Needs to subscribe to multiple accounts for inference and data access

Designed for humans to manually create accounts and configure API keys

May require API whitelisting or approval before use

AI Agent requests market data API

API returns HTTP 402 Payment Required and fee information

AI Agent attaches USDC payment and retries

Instantly gains API access, contextual data is immediately retrieved

Human User:

Pay-per-article news reading

Needs to register an account and fill in payment information

Forced into a subscription model, even if the user only wants to read one article

Must manually cancel, otherwise continuous charges occur

User clicks on the paid article

HTTP 402 Payment Required displays USDC price

User confirms payment in crypto wallet

Article is immediately unlocked, no need to store credit card information

3. Why Do We Need HTTP 402 and AI Agent Payments?

Web3 Lawyer Will:

This on-chain payment system: blockchain binds information and value on the internet, stablecoins provide a medium for value exchange on the internet, and combined with the HTTP 402 protocol, we can seamlessly achieve native internet payment transactions. The resulting "pay-per-use" model, which requires no subscriptions, no prepayment limits, and no manual invoicing, will be highly disruptive, greatly aiding the development of the AI digital economy, reshaping the consumption logic of the AI economy, and transforming the entire business model of the internet.

Although the outlook is promising, let's return to first principles: why do we need HTTP 402 and AI Agent payments?

3.1 Advertising is the Original Sin of the Internet

In the 1990s, HTTP 402 was doomed to fail. Economically, the transaction costs were higher than the transaction amounts; experientially, fragmented interactions were unacceptable; and technically, there was a lack of infrastructure support. The internet ultimately chose advertising and subscriptions over micropayments.

HTTP 402 has been silent for thirty years, until the collapse of the structure.

Alsa Jordan:

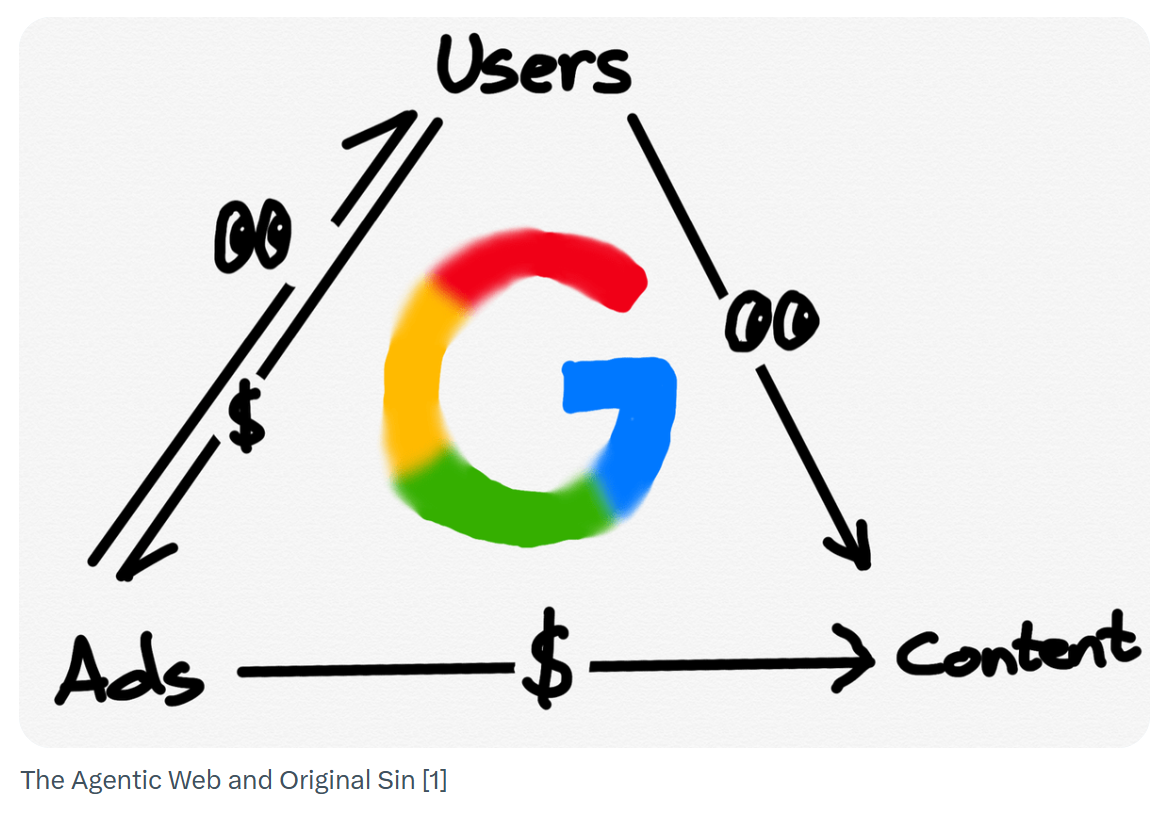

For the past twenty years, the most "great" yet "original sin" business logic of the internet has been: users for free, advertising charged. The entire internet began to operate around the "attention economy." Every piece of information we scroll through daily is meticulously arranged by algorithms, advertisers, and data intermediaries. Advertising is the "only fuel" that keeps the internet alive:

Users enjoy a vast amount of free content;

Content providers earn revenue through advertising;

Advertisers reach previously unreachable audiences at extremely low costs.

Although the advertising model is a victory of economies of scale, supporting an advertising empire worth over a trillion dollars, it has also sown long-term risks. As someone said, "Advertising is the original sin of the internet." We replaced the possibility of micropayments with users' attention.

This model is facing collapse with the rise of AI. After all, advertising needs attention, and AI has no attention.

(x402 solves the original sin of the internet: ads)

The reason AI Agents refuse "recharge + subscription" and insist on paying per use, per field, or even per token on-site is fundamentally due to "cognitive load" and "accounting ability":

Human bandwidth is limited. We are satisfied with just looking at the top 10 results on Google, and we prefer a flat monthly phone bill of 200 yuan—too lazy to keep track of every minute or megabyte, and if we can't calculate it, we use "all-inclusive" for psychological comfort.

Agent bandwidth is unlimited. It can scan thousands of long-tail data sources in milliseconds, accurately calculating "record 307 is worth 0.017 yuan, satellite image 4 is worth 0.8 cents," breaking down orders to an atomic level without additional psychological costs.

Subscriptions are a waste for Agents. If you prepay 50 yuan monthly for 50 obscure APIs, totaling 2500 yuan, but actual usage only costs 1.4 cents, the difference is four orders of magnitude; the Agent's accounting module will immediately reject such sunk costs.

No brand loyalty, no emotional accounts. Once the task is completed, the value returns to zero; next time it will re-evaluate prices and switch to cheaper suppliers at any time, without needing to "worry about service interruption" or "be too lazy to switch."

Business conclusion. Since it can be calculated, Agents will only accept "pay-as-you-go, leave when done"—humans seek convenience, Agents seek precision; micropayment is not sentiment, it is mathematical instinct.

Thus, in the future AI world, do we really still need advertising?

3.2 Evolution of the AI Tech Stack

Alsa Jordan:

From another perspective, if we simply break down the entire AI Stack vertically, the bottom layer is the Model, responsible for thinking; above that is the Framework, responsible for setting strategies; and at the top is the Runtime, responsible for execution.

Six months ago: every step had to bounce back to ask humans, interacting once to move once. Now: the runtime and framework have matured, allowing Agents to run continuously in a sandbox/virtual machine for 30-60 minutes, autonomously completing 3-5-10 steps or even fifty or sixty steps in a chain, without interrupting humans in the process.

Thus, "multi-step autonomy" has become a core metric for measuring Agent capability: the model determines how smart it is, while the Framework + Runtime determine how far it can run without looking back.

When AI Agents can complete dozens of steps in one go, they will choose data sources themselves—free or paid? If paid, they will immediately apply to their owner or directly deduct from the owner's reserved quota, making "why not let each data source recharge first, but pay-per-use" the key: AI Agents' consumption behavior is inherently fragmented, instantaneous, and task-driven; only per-use settlement matches their autonomous rhythm.

3.3 Consumption Logic of AI Commerce

Alsa Jordan:

The emergence of AI Agents is tearing apart this old system. In the future, more and more people will not "go online" themselves. Their AI assistants will replace them in searching, reading, and summarizing information.

The problem is: AI will not be swayed by advertising, nor will it "pay." No matter how precise the advertisers are, they cannot "influence" a model.

When AI becomes a content consumer, the advertising economy naturally collapses. Thus, AI has two choices:

Scrape content—stolen data that no one is willing to share;

Buy content—then there must be a way to "pay per use."

Thus, a new internet logic begins to emerge: humans no longer watch ads, AI buys content with micropayments.

(x402 solves the original sin of the internet: ads)

The collapse of the advertising model is not accidental; it is brutally pierced by the consumption logic of AI.

A. Consumption Atomization

Human consumption habits are "packaged"—subscribing for a month, buying a whole book, which reduces decision burden. The advertising model relies on this: giving away content for free and selling attention to advertisers. But AI has no "attention" to sell; it only needs to buy the specific piece it wants: one API call is worth 0.0001 dollars; one stock price data is worth 0.01 dollars; one image editing function is worth 0.05 dollars.

In the past, these fragmented values could not enter the market, but now they are the natural consumption units for AI. Advertising bypassed the micropayment dilemma, but AI cannot escape it.

B. Decision Flow

Humans can wait a few seconds to confirm payment, or even a few minutes to reconcile; the advertising model can also tolerate "getting on first and paying later." But AI's brain has no patience—it can complete hundreds of calls in milliseconds. Humans drive thinking by burning calories, while AI consumes computing power, bandwidth, and tokens.

If payments still rely on the "click to confirm—monthly settlement" logic, such calls cannot occur at all. What AI wants is not a bill, but a data stream.

C. Dehumanization of Subjects

When HTTP 402 was written into the protocol, the payers were only humans; today, machines are about to start paying for machines. Models settle for calling data, AI Agents pay for GPU computing power, and robots place orders for samples on cross-border e-commerce platforms. Humans will only receive a simple notification afterward: "Today, 27 payments were completed, totaling 12.4 dollars."

4. Unlocking a New HTTP 402 Business Model: From API to Artificial Intelligence

Web3 Lawyer Will:

As Jordan stated above, we can see the logic of AI consumption: the counterpart of transactions is no longer the human eye but the machine's computing power and data. The attention economy is ineffective, and value returns to atomic payments themselves. This AI consumption logic is no longer the pillar business model of the internet—advertising and subscriptions. They are collapsing in the AI era.

4.1 Micropayments and Pay-per-Use

Alsa Jordan:

The two payment methods formed for the AI economy will find numerous applications in future real-world scenarios:

A. Practical Micropayments

The traditional payment track adopts an account model, requiring both parties to bear a certain degree of trust/credit risk. These tracks are designed for humans and cannot handle small, high-frequency services like API requests. Transaction fees can be as high as $0.30, making micropayments unfeasible—forcing businesses to rely on subscriptions and bundled pricing, which deters a large number of potential users.

As a payment protocol, x402 supports pay-per-use, pay-per-service, and pay-per-second billing. This allows businesses to achieve profitability at the micropayment level for the first time, creating new monetization opportunities for AI-driven platforms.

Near-zero cost: single transactions can be as low as $0.0001;

True pay-as-you-go: APIs, AI inference, and on-demand content can all be priced per use;

Machine-to-machine transactions: IoT devices and AI Agents can autonomously pay for resources.

B. Pay-per-use

Traditional online payment collection means mandatory registration, managing API keys, and manual billing cycles. x402 eliminates these barriers, meaning higher revenue, lower costs, and an extremely smooth payment experience for developers and businesses.

Seamless pay-per-use—no subscriptions, no prepayments, no lock-in;

Instant transaction completion—no chargebacks, no fraud, no intermediaries;

AI-native monetization—both AI Agents and human users can make dynamic payments without pre-approval or API keys.

4.2 Real-world Applications of HTTP 402

We are seeing more and more projects adopting the x402 protocol. Specific cases include: AI image generation: platforms like Freepik utilize x402 to provide pay-per-use AI image generation services. On-demand computing resources: companies like Hyperbolic enable AI Agents to autonomously pay for GPU inference counts. AI Agent infrastructure and markets: projects like Questflow, AurraCloud, and Daydreams are building infrastructure and markets for AI Agents, allowing transactions between agents. Real-time data and content: real-time news platforms like Gloria AI and IPFS storage services like Pinata have also integrated x402 payments.

These specific cases demonstrate that x402 is moving from a theoretical standard to practical application. The diversity of its use cases—from creative AI to data services to infrastructure—shows its broad applicability.

Several scenarios mentioned in the x402 white paper can serve as references:

A. AI Agents calling APIs on demand

Research platforms launch "pay-per-article," removing bundled payment walls, allowing AI tools to only pay for the articles they need.

Video streaming services charge by the second, replacing traditional monthly subscriptions.

Trading AI spends $0.02 each time to obtain real-time market data, paying only when needed.

B. Pay-per-use billing for AI model inference

Computer vision API: $0.005 per image classification, no need for a fixed enterprise license.

Synthetic voice AI: $0.10 per audio segment, flexible monetization.

C. Agents paying for cloud computing power and storage

Autonomous agents purchase GPU on demand at $0.50 per minute, paying per compute cycle.

Goal-driven models dynamically expand cloud storage based on training progress, paying per GB of storage.

D. Context retrieval for agents

Financial AI assistants: $0.25 per in-depth news article, pay as much as used.

Legal research agents: $0.10 per judgment document, avoiding the need for a full database subscription.

E. Micropayments for human content

Substack authors charge $0.25 per article for casual readers, no full subscription required.

Top journals charge for white paper downloads, eliminating annual membership thresholds.

High-quality podcasts charge per episode, no longer requiring mandatory monthly fees.

Games charge per session, avoiding large buyouts or reliance on advertising.

These real-world scenarios are upgrading the internet from an "information transmission network" to a "machine economic value transmission network"—a commercial ecosystem composed of AI Agents that can natively complete payments, purchases, and coordination of services at the internet protocol layer.

4.3 When the Future Meets Reality

Web3 Lawyer Will:

If in the previous chapters we have sorted out the consumption logic and business models of AI, then next, can Jordan describe a scene in reality for us?

Alsa Jordan:

In fact, HTTP 402 has not been revived as an "awkward payment pop-up," but has quietly integrated into the backend of the AI economy in a more subtle and natural way.

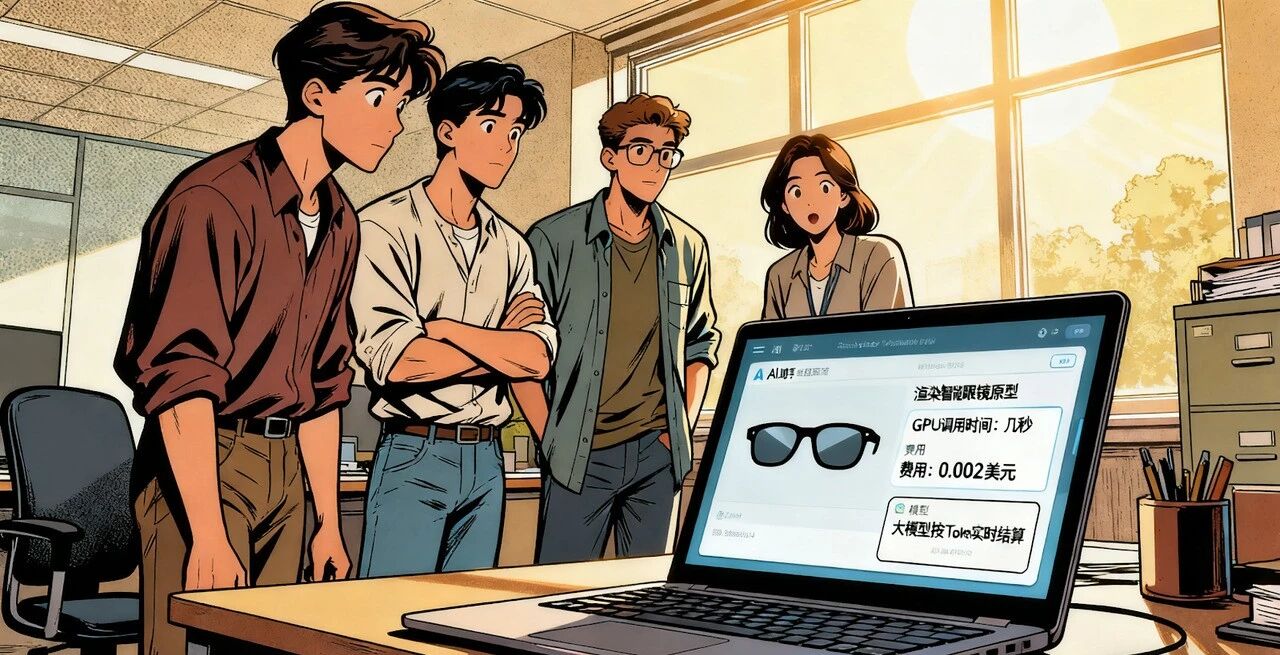

Imagine the daily routine of a young startup team. They are preparing a smart glasses product but have neither a large budget nor a global team. Yet, within just a week, they complete research, design, procurement, and market testing. The secret is not overtime work, but delegating most of the tasks to an AI assistant.

In the morning, the AI assistant pulls up data.

In the past, this meant annual subscriptions costing thousands of dollars, such as the Bloomberg terminal, which can be as high as $20,000 per year. Now, the assistant only spends $0.01 to buy a stock price record and another $0.05 to retrieve two summaries from a market report. Those previously dormant niche data points are awakened for the first time as tradable units.

It is worth noting that by 2024, the global data market size has surpassed $300 billion, with more than half of that value never utilized. HTTP 402 acts like a sorting machine here, pushing dormant value back into the market.

At noon, the AI assistant switches to computing power.

It needs to render a prototype, but instead of renting a cloud server (AWS A100 costs about $4 per hour), it only calls a few seconds of GPU, costing just $0.002. Immediately after, it calls two large models, with costs settled in real-time by token.

This "second-level payment" logic fundamentally changes the computing power market. McKinsey's research shows that global data center GPU utilization has consistently been below 30%. Micropayments activate these fragmented resources for the first time, making computing power no longer exclusive to giants, but flowing on demand like electricity.

In the evening, the AI assistant completes cross-border testing.

It places sample orders on the 1688 platform and initiates small orders on Southeast Asian e-commerce platforms to collect feedback. There is no manual confirmation, no three-day settlement delay, but instant payment through on-chain settlement units. Traditional cross-border payment fees can be as high as 2%–6%, with settlement cycles lasting 3–5 days; for small orders under $10, this is nearly "unfeasible." But today, settlement is as light as sending a message.

The founders seem to have had an ordinary day: just checking a few data points, rendering a prototype, and running a few orders. Yet in the background, the AI assistant has completed thousands of micropayments, each possibly only a few cents, but cumulatively supporting the entire business cycle.

This is what HTTP 402 looks like today. It is no longer the awkward "pop-up payment" of the 1990s, but a tacit action embedded deep within the system: it returns value to its source, reactivates idle resources, and enables global supply chains to complete settlements in milliseconds.

5. Alsa's Practical Implementation

Web3 Lawyer Will:

Our previous discussions have moved from the dusting off and awakening of HTTP 402 to the cornerstone of the AI digital economy—on-chain payments, as well as the logic of AI consumption and the reshaping of future internet business models. After the theoretical discussions, we ultimately need to bring it into practice, which is actually the point I care about the most.

So I want to ask Jordan, what stage is the practical implementation of AI Agents currently at? What steps still need to be taken to achieve practical implementation?

5.1 Payment + Network Suitable for AI Agents

Alsa Jordan:

Let’s start with a real case from our clients.

We serve "true AI, true Web" companies. For example, a project focused on AI interviews currently has 50,000 to 60,000 paying users. They have a huge demand for data: continuously scraping job advertisements, salary trends, and other information, some of which is free and some paid, to provide precise job analysis for job seekers. Such a team needs to manage hundreds of APIs, each of which is constantly updated. The client team consists of only six or seven people, yet they have to maintain hundreds of API interfaces and connect with twenty to thirty platforms; every time the API documentation is updated, they have to synchronize it themselves, which is extremely cumbersome and a core pain point for small teams.

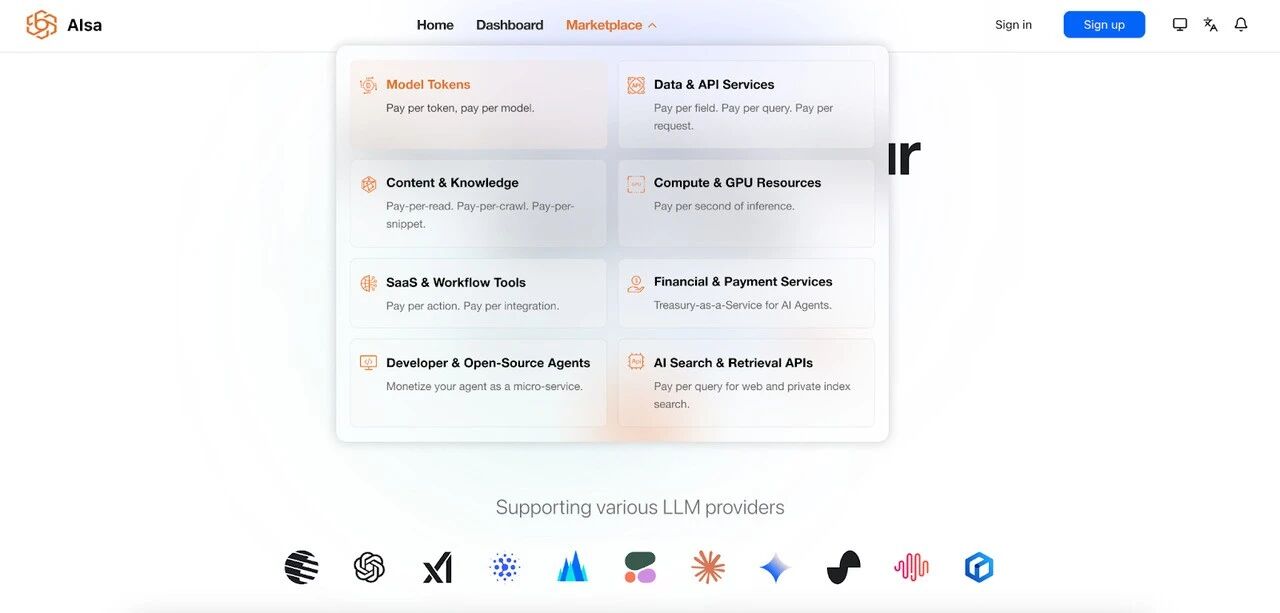

The solution we provide is called "Payment Network," which includes two main components:

A. Payment

A complete set of payment components suitable for AI Agents, including underlying clearing and settlement, on-chain and off-chain liquidity, risk control, acquiring, account systems, pricing, permissions, and cash registers.

The payment methods for Agents are completely different from human payments: they can initiate thousands of requests in a second, with very small amounts (1–2 cents), but at a very high frequency (often millions of TPS). Traditional Visa/MasterCard and existing Layer 1/2 risk control and throughput cannot support this and will be directly banned.

For example, when booking a flight on Ctrip, if an AI Agent frequently scrapes data or places orders, traditional risk control will immediately ban it. Therefore, the entire link from sourcing and discovery to final purchase for AI Agents must rewrite a risk control system that adapts to high-frequency, low-value transactions. Thus, we are building an AI-native payment channel, reconstructing risk control and performance from the ground up to support the massive transaction demands of AI Agents for high-frequency, low-value transactions.

B. Network

For the payment network to come alive, the key is not the "payment" itself, but the "Network." Where there is spending, there must be receiving; both ends must be in place for the channel to be meaningful. For AI Agents, the high-frequency spending scenarios are actually just two:

Large model inference: its "water and electricity," every run requires computing power/Token;

External digital resources: Twitter API, GPU computing power, weather/financial/HR data interfaces, etc.

We first aggregate these two types of demand to create an "AI Resource Market" as a customer acquisition scenario, then embed it into our self-built AI Agent payment settlement system:

Aggregated over 600 large models, billed in real-time by token;

Packaged difficult APIs like Twitter, LinkedIn, market data, satellite imagery into a unified interface, allowing developers to call with one click;

Customers only need one account to purchase 90% of "essential" resources, starting from 0.01 yuan, with instant billing.

First, let developers "use it" → transaction flows naturally enter the channel → network effects arise, and any AI Agent wanting to access resources will have to use this "highway," where we collect tolls.

5.2 Alsa's Agent Payment Components

Web3 Lawyer Will:

Traditional payment tracks are both expensive and slow, requiring repeated "identity verification," which is inherently misaligned with the millisecond and nanosecond demands of AI Agents; blockchain + stablecoins merely pave the way for AI Agents. What kind of payment components do we need to achieve a complete payment loop for the entire AI Agent ecosystem?

Alsa Jordan:

Let’s imagine a scenario: an AI assistant retrieves a report in the background, calls a GPU for a few seconds of rendering, and places a sample order on an e-commerce platform. Throughout the process, no payment pop-up interrupts you. All settlements flow in the background like electricity, and by evening, you see a notification on your phone: "37 transactions completed today, totaling $42.8."

This is the frictionless experience envisioned for HTTP 402. To make it a reality, Alsa will fill in the four missing pieces from back then: identity, risk control, calling interfaces, and settlement. This is the most critical link in the AI economy.

Identity—Wallet & Account

One important reason HTTP 402 did not take off in the 1990s was that browsers lacked wallets, and there was no unified account system between users and websites. Today, the payment subject has shifted from humans to AI Agents, and blockchain provides a unified account system for any entity on the internet; they must have independent economic identities. The role of Wallet & Account is to give AI a "wallet as identity": capable of holding on-chain settlement units and connecting to fiat accounts.

Risk Control—AgentPayGuard

When AI truly has a wallet, risks arise: will it consume without limits? Will it be abused? An Agent can initiate tens of thousands of requests in a second; how do we manage risk? AgentPayGuard provides this layer of protection. Limits, whitelisting mechanisms, rate control, manual approval—these risk control measures are directly written into the protocol, ensuring that payments remain traceable and intervenable. AI can settle autonomously, but it will never "run amok." This is a necessary condition for turning romance into reality.

Similarly, risk control on the data side is crucial. Resources are layered by sensitivity: data like weather and exchange rates that are "harmless" are completely open; data involving privacy, commercial, or compliance risks must have legal-level access controls set by the provider. Data source providers set their own prices and can finely configure access controls like writing code:

Which types of Agents can read/write

Whether it can be used for large model training

How long access logs are retained

Whether it can be stored again

The platform only provides tools; the rules are written in by the provider with one click.

Calling Interface—AgentPayWall-402

The romantic intention of HTTP 402 was "pay as you go," but in the 1990s, it could only turn into an awkward payment pop-up. AgentPayWall-402 solves this experiential dilemma: payment is no longer an additional action but integrated with access itself. Calling a piece of data, renting a few seconds of GPU, unlocking an image—payment and access are completed simultaneously. For users, the experience is seamless; for providers, calling is no longer "free-riding," but real-time compensation.

Settlement—AlsaNet

When transaction amounts shrink to $0.0001, the $0.30 fee from credit cards makes micropayments almost a joke. The value of AlsaNet lies in flattening the cost curve completely. It is a high-frequency micropayment settlement network that supports billions of TPS and can connect to multiple channels established by other high-performance distributed systems simultaneously. In the background, the Treasury module is responsible for intelligent settlement between fiat and on-chain settlement units, as well as between different on-chain settlement units. Thus, a piece of data you click on in Shanghai can have the provider in San Francisco receive payment within milliseconds.

Alsa's goal is not to create a faster chain but to reconstruct the payment protocol layer, making transactions of $0.0001 truly cost-effective, controllable, and feasible.

6. Stages of Development for AI Agent Payment

Web3 Lawyer Will:

Currently, the on-chain payment system built with blockchain and stablecoins is transforming parts of real-world commerce. For large consumer transactions—tens, hundreds, thousands, or even tens of thousands of yuan—existing traditional payment networks + Layer 2 can handle these scenarios well. This is our intuitive perception at present.

However, AI Agent payments and their commerce will not happen overnight. How does Jordan view the future development stages of this market?

Alsa Jordan:

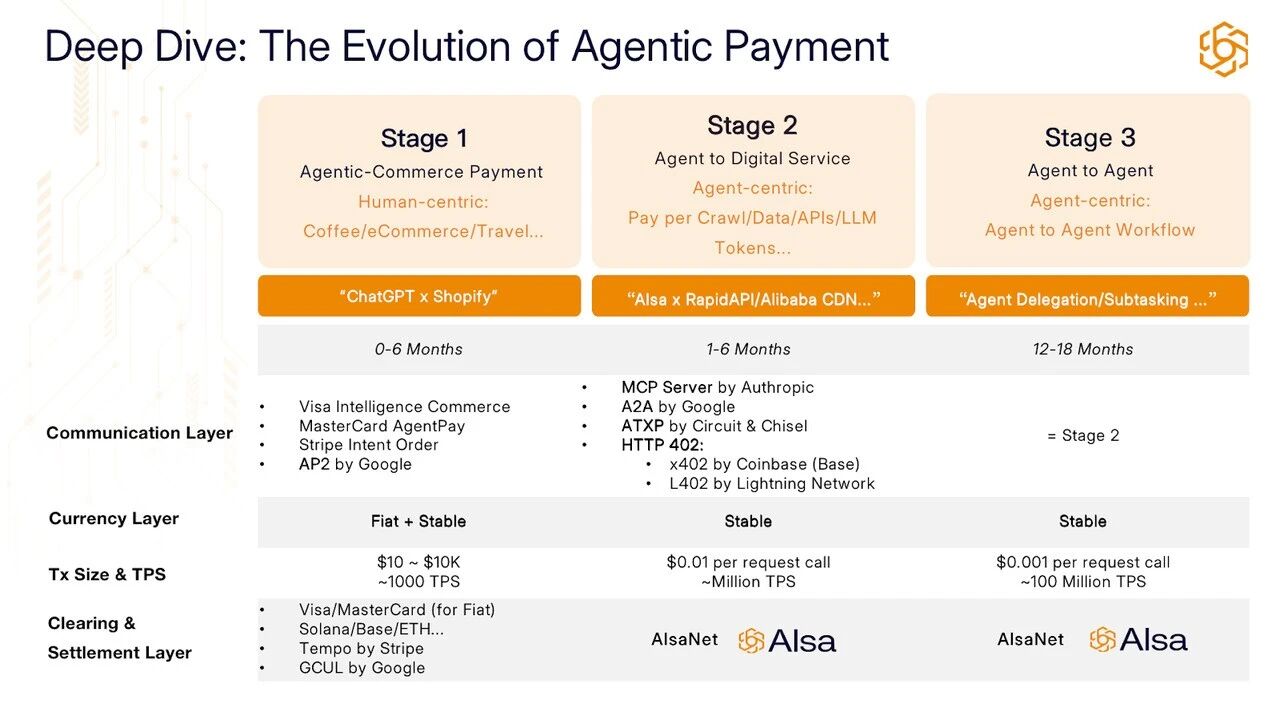

Today, the giants are competing for this trillion-dollar cake centered around "humans": business travel, e-commerce, OTA, etc., where the core competition is for users, traffic, entry points, and channels. In Alsa's view, this is not an opportunity for entrepreneurs: OpenAI can easily integrate PayPal, Shopify, Amazon, and Expedia into GPT; the digital wallet space is a red ocean, and any connection is trivial, with no barriers. Therefore, we clearly break down "AI Agent payments" into three stages, focusing on the AI-native, high-frequency, low-value incremental battlefield, rather than competing with humans for existing value.

The first stage: Agentic Commerce (acting as a purchasing agent for humans). In this stage, AI Agents purchase goods or services on behalf of humans, with transaction amounts ranging from a few yuan to tens of thousands, requiring low TPS, and the scenarios are concentrated in e-commerce, business travel, etc., which belong to the market where existing internet giants "share the cake."

The second stage: Agents self-procuring digital services (Alsa's positioning). In this stage, AI Agents actively procure purely digital services to complete their tasks, with the core being paying externally for data.

Task-driven: Whenever an AI Agent is assigned a task, it faces a choice between "free or paid"; free data is available to everyone, with varying quality, while paid data (real-time market data from Bloomberg, Barclays, salary databases, weather APIs, etc.) ensures output accuracy.

Business model: AI Agents must spend money to buy high-quality data, which will become a necessity; Alsa is targeting this "AI Agent self-procurement" market, focusing solely on digital services and not physical goods.

The third stage: Interaction between Agents.

Web3 Lawyer Will:

So why does Alsa position itself in the second stage?

Alsa Jordan:

We are anchored in the "second stage"—AI Agents purchasing paid data externally to complete tasks, with core needs and pain points centered on the "settlement layer":

Demand appears "cliff-like": today there is almost none → tomorrow it could be millions or even billions of transactions per day, with no gradual process from 10,000 to 50,000 to 100,000 TPS, leading to a direct break in traditional payment networks.

Existing payment infrastructure cannot support this: every API call going on-chain for transactions and paying gas fees would immediately block the system; although Layer 2 solutions like the Lightning Network still settle back on-chain, they would also face congestion at millions of TPS.

Thus, we are building an AI-native settlement network:

Target TPS: from millions to billions

Drawing on the "channel + batch settlement" concept of Lightning, but keeping payment proofs off-chain, only going on-chain in case of disputes or at the end of the day/batch, with zero gas and millisecond confirmation

Using off-chain billing trees + zero-knowledge proofs for final compression, allowing a single on-chain transaction to settle hundreds of thousands of micropayments from AI Agents

Enabling AI Agents to buy a piece of data for 0.01 yuan or even 0.001 yuan, with instant payment and no congestion, low cost, and auditable

We are betting everything on the "second stage"—allowing AI Agents to spend their own money to purchase digital resources, and the reasons are simple:

Giants are too busy. Today, all major companies are still focused on the "first stage" of placing orders for e-commerce and business travel, which is a ready-made cake worth trillions; the global market for AI Agents self-procuring resources is only a few hundred million dollars, and achieving 1–2 billion in three years would be optimistic; the market is too small for giants to bother turning around.

The window of opportunity is only 2–3 years. Our internal goal: to achieve an annual recurring revenue (ARR) of $100–120 million in three years; as long as we can reach $100 million first and then replicate 10–20 verticals, we can grow into an invisible champion; by the time giants react, the channels and settlement standards will have already been occupied by us.

The second stage is the "pass" to the third stage. True A2A (agent-to-agent) collaboration, invocation, and bidding require each agent to have a "bank card + resource map"—able to pay for itself and find its own sources. Skipping this step means agents are "thinking blind people," unable to form an economic loop with other intelligent entities. The industry will have to wait at least another year for large-scale A2A; before that, we will deeply and thoroughly develop the "one-click payment for external resources," essentially building highways, as all intelligent entities will need to pay to use them in the future.

7. Strategic Potential for the Future

The ultimate goal of HTTP 402 is to attempt to complete the "value exchange" protocol above the TCP/IP layer, becoming the foundation for the next generation of programmable economies, thereby unlocking two layers of strategic leaps at once.

7.1 Autonomous AI Agent Economy—Payment as Authentication

Web3 Lawyer Will:

Embedding wallets into AI Agents → they can make real-time micropayments for data, computing power, and any services without human intervention. Static tools thus upgrade to self-circulating economic entities, with M2M transaction scales exponentially magnifying, giving rise to a self-organizing digital economy.

In this transition of payment subjects from "humans" to "AI Agents," a logic from the on-chain economic system DeFi is adopted—over-collateralized lending. DeFi does not verify the creditworthiness of users but verifies the assets of accounts. Similarly, in the context of AI, this gives rise to AI Agent payments—"payment as authentication": a paradigm shift beyond accounts and API keys.

Most current internet access models are identity-based, especially in traditional payment scenarios: users gain access by proving "who you are" (through login or API keys). The bottleneck has always been "proving you are yourself" and how to connect accounts with APIs, leading to the construction of complex risk control systems involving anti-money laundering, anti-fraud, identity verification, facial recognition, etc. This not only creates significant data silos but also brings privacy risks and payment friction.

Alsa Jordan:

In contrast, HTTP 402 proposes a capability-based model: users only need to prove "you have the ability to pay" for the required resources. The server does not need to know who the client is; it only needs to confirm that the transaction requirements are met.

However, having a protocol alone is not enough; Alsa's Agent payment components are needed to ensure that access rights are granted based on the successful verification of payment credentials through cryptographic signatures, making the payment action itself a credential. This eliminates the need for user accounts, passwords, email verification, API keys, and complex OAuth processes.

This design represents a paradigm shift in digital access rights, moving from "identity" to "capability," which has profound implications for the autonomous agent economy. Although an AI Agent does not have a human-like "identity," its exercisable rights should depend on verifiable economic capability rather than centralized identity registration. HTTP 402 provides a stateless, instant settlement native language for machine-to-machine (M2M) commercial interactions, significantly reducing protocol overhead and trust costs, marking a shift in the web from a "session-state" architecture to a "transaction-driven" architecture.

7.2 From Subscription to On-Demand Payment—Unlocking the Internet Data Wave

Web3 Lawyer Will:

The HTTP 402 payment protocol naturally supports "per use, per token, per millisecond" settlement, aligning costs and value at an atomic level. Consumers no longer pay for idle subscriptions, while businesses gain pricing granularity down to 0.001 cents, reshaping the revenue curve for digital goods.

This unlocks the entire massive data market built on the internet.

Currently, the ability to monetize data assets in the market is quite limited, whether through various data exchange markets or tokenizing data assets, all aimed at making vast amounts of non-circulating data assets tradable. The HTTP 402 protocol can help AI Agents achieve on-demand payment capabilities.

The market potential here is limitless, and it is the endpoint we are exploring, enabling data monetization through AI Agents in one step. This particularly requires market pioneers like Alsa to explore.

8. Outlook

Although HTTP 402 is still in its early stages, the current market interest in it has a certain speculative nature. However, this short-term sentiment cannot obscure the underlying structural transformation it represents: for the first time, payments can be achieved on the same protocol layer as data transmission, allowing autonomous intelligent agents to complete transactions natively on the internet without account systems, intermediaries, or manual authorization.

The long-term value of HTTP 402 lies not in the standard itself but in the entire new infrastructure it activates: including AI Agent identity standards, programmable wallets, low-latency settlement networks, and coordination protocols between machines, as well as the vast data market behind it. It has initiated an irreversible direction— the internet is evolving from "providing information for humans" to "driving economic activities through software."

Just like the essence of payment, currency only generates value when it flows. Similarly, data assets will create more value through the HTTP 402 protocol and the flow of AI Agents.

Reference:

[1] "HTTP 402 and Micropayments: A Code That Has Been Asleep for Thirty Years Awakens in the AI Era"

[2] "In-Depth Analysis of the x402 Protocol"

[3] "x402 Official White Paper"

[4] "x402 Solves the Original Sin of the Internet: Ads"

[5] "IOSG Weekly Brief|x402 - A New Standard for Cryptographic Payments for Digital Agents"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。