Recently, the cryptocurrency market has experienced significant volatility, with Bitcoin's price falling below the $90,000 mark, leading to a large outflow of funds from U.S. spot Bitcoin ETFs. However, executives from several mainstream institutions have stated that this pullback is a healthy adjustment for the market and expressed confidence in the long-term development of the industry.

1. Large-scale fund outflow, BlackRock leads the decline

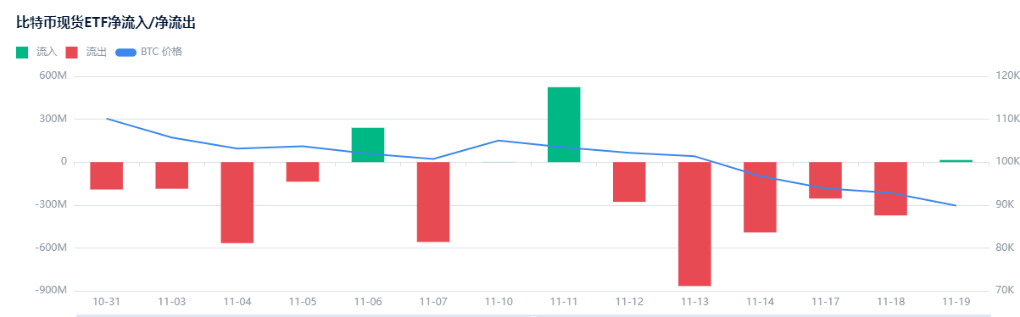

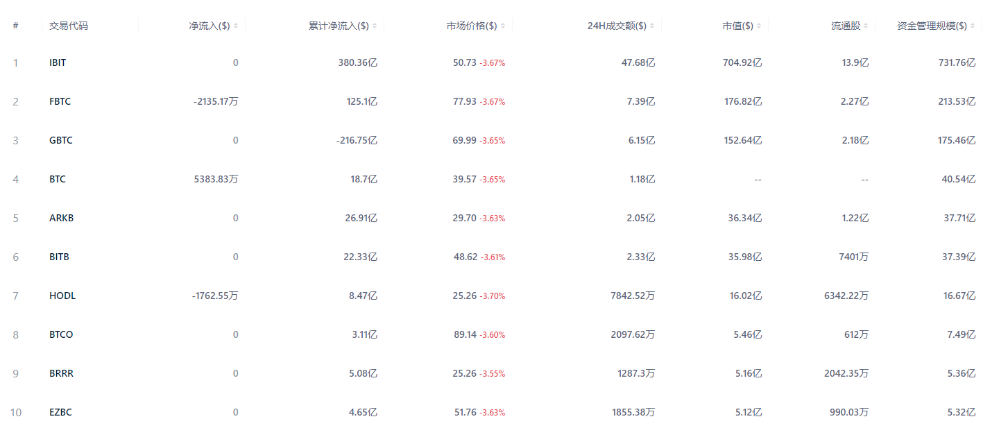

● The U.S. Bitcoin ETF market experienced a large-scale outflow in November, with a net outflow amounting to nearly $3 billion.

● BlackRock's iShares Bitcoin Trust (IBIT) saw a single-day net outflow of $523 million on November 19, setting a record for the largest single-day outflow since the fund's launch in January 2024.

● As the largest spot Bitcoin ETF currently, IBIT has been a core force in the boom of crypto ETFs since its listing, but its total outflow in November has reached $2.1 billion.

At the same time, other major institutional products are also facing pressure from fund withdrawals:

● Fidelity's Wise Origin Bitcoin Fund experienced a net outflow of $12 million,

● ARK 21Shares Bitcoin ETF had a single-day outflow of $29.7 million,

● VanEck Bitcoin Trust also recorded a net outflow of $23.3 million.

This synchronized outflow indicates that the current fund withdrawal is not an isolated case, but a concentrated reflection of institutional investors' general caution regarding the short-term outlook of the market.

2. Multiple factors combined, triggering market pullback

The recent adjustment in the cryptocurrency market is caused by multiple factors, with changes in the macroeconomic environment being the primary factor.

● Bitcoin experienced its fourth "death cross" of this cycle last week (where the short-term price momentum indicator falls below the long-term trend). Although this is seen as a bearish technical signal, historically, this signal has sometimes indicated a macro bottom before a strong reversal.

● Market expectations for a Federal Reserve interest rate cut have significantly weakened recently, with the probability of a rate cut in December dropping from about 94% a month ago to around 33%. This shift in expectations has affected the attractiveness of risk assets, including Bitcoin.

● According to Kraken's global economist Thomas Perfumo, the crypto market has been losing momentum since August, with a significant portion of previous demand coming from leveraged funds. At the same time, profit-taking by long-term holders has also intensified market pressure.

3. Institutional figures view rationally, calling the pullback healthy

In the face of severe market volatility, several executives from mainstream cryptocurrency institutions expressed relatively calm and optimistic views.

● John D'Agostino, Coinbase's Head of Institutional Strategy, believes that the current Bitcoin sell-off is "healthy." He pointed out that compared to Bitcoin's historical declines of 70%-80%, this pullback is relatively mild.

● D'Agostino emphasized that since the bullish environment in September, the fundamentals of cryptocurrency have not deteriorated; rather, some important positive factors have strengthened:

A central bank in the Eurozone purchased Bitcoin;

Harvard University's endowment fund increased its Bitcoin exposure;

Several mainstream banks launched new stablecoins;

Multiple new ETFs were approved for listing, including the Solana ETF.

He stated, "If you like this asset, then you should like it when it's on sale."

● Michael Sonnenshein, CEO of Grayscale, also mentioned that it may be too early to talk about a "crypto winter," and what we are currently seeing is a very healthy pullback in cryptocurrency prices.

● Sonnenshein believes that there is too much irrational exuberance in certain areas of the crypto ecosystem, and the current pullback is beneficial for the industry to reset and consolidate in the long term, making the ecosystem stronger after facing various challenges.

4. Regulation and innovation as the cornerstone of long-term confidence

Despite the poor short-term market performance, industry leaders are confident about the long-term future of cryptocurrencies.

● Zach Pandl, Head of Research at Grayscale, expressed a long-term optimistic outlook, predicting that cryptocurrency technology and assets will become part of the global financial system within the next 10 to 20 years.

● Brian Armstrong, CEO of Coinbase, is focused on promoting a positive regulatory environment. He recently advocated for cryptocurrency market structure legislation in Washington and noted that he has seen "many positive developments."

● Armstrong hopes that the CLARITY Act will enter deliberation in December and be submitted for presidential signature as soon as possible. He believes that this act will provide clearer rules for the U.S. crypto industry, helping to unlock the industry's potential, protect users, and support business development.

5. Market outlook and investment perspectives

Regarding the future direction of the market, analysts provide different perspectives.

● Lacie Zhang, a research analyst at Bitget Wallet, pointed out that while the "death cross" is seen as a bearish signal, in the context of liquidity just beginning to stabilize, it may also indicate the formation of a macro bottom.

● According to data from Nansen, "smart money" traders have increased their short positions in the past 24 hours, indicating that they expect short-term declines.

● Pseudonymous analyst Bitcoiner noted that when the ratio of Bitcoin reserves on exchanges to stablecoins sharply declines, it historically often indicates a significant rebound.

Currently, this ratio is at a historical low, suggesting that a large amount of capital is waiting off-exchange to enter, a setup that has previously marked strong upward trends for Bitcoin.

Short-term market fluctuations are inevitable, but the construction of industry infrastructure and regulatory frameworks is gradually improving. As Grayscale CEO Michael Sonnenshein said, "Price does not always reflect the health of Bitcoin or other cryptocurrencies." In this severe market adjustment, focusing on fundamental indicators provides better insight into the true direction of the industry than focusing on price itself.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。