Wall Street opens its doors, but funds are gradually slowing down, and altcoin ETFs find themselves in the awkward position of being "well-received but underperforming." Since the beginning of this month, Solana, Ripple, Litecoin, and Hedera have successively received approval from the U.S. SEC to enter the Wall Street stage.

However, these newly listed ETF products generally face the challenge of limited capital inflow, with total net inflows of only about $700 million, falling far short of market expectations. Meanwhile, after the launch of these ETFs, the prices of various cryptocurrencies have not only failed to rise but have instead fallen, with SOL dropping over 30% since the ETF went live, and other cryptocurrencies also experiencing varying degrees of decline.

1. Current Status of the Altcoin ETF Market

With the U.S. SEC opening a fast track for crypto ETFs, the regulatory environment is becoming increasingly clear, prompting altcoins to attempt to step onto the Wall Street stage.

Quick Approval, Slow Capital Inflow

● Since last month, eight altcoin ETFs have been approved, covering the four crypto projects of Solana, Ripple, Litecoin, and Hedera.

● However, in the overall downtrend of the crypto market, these products have generally faced limited capital inflow after their launch, making it difficult to significantly boost coin prices in the short term. From the perspective of capital flow, overall attractiveness remains quite limited, with some ETFs experiencing several days of zero inflow.

Market Size and Insufficient Liquidity

● According to AiCoin data, as of November 19, Bitcoin's market share is close to 60%, and excluding ETH and stablecoins, other altcoins only account for 19.88% of the market share.

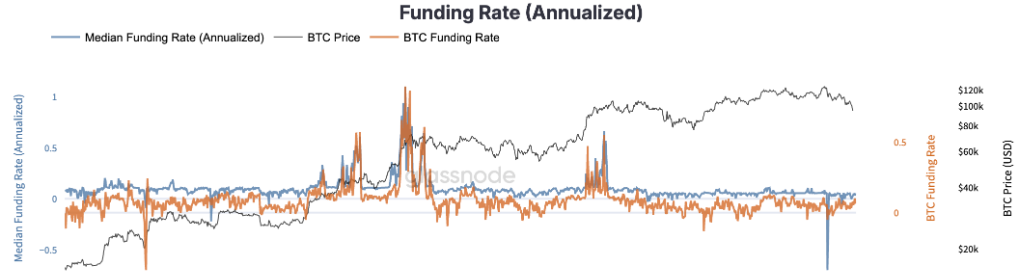

● This results in poor liquidity for the underlying assets of altcoin ETFs. Compared to Bitcoin and Ethereum, altcoins are more susceptible to short-term narratives, exhibiting higher volatility and being viewed as high-risk Beta assets.

● Since the beginning of this year, the relative profits of altcoins have mostly fallen into deep surrender territory, with a significant divergence emerging between Bitcoin and altcoins that is rarely seen in previous cycles.

2. Performance Analysis of the Four Major Altcoin ETFs

Solana ETF: High Opening, Low Closing

There are currently five U.S. Solana spot ETFs, issued by Bitwise, VanEck, Fidelity, Grayscale, and Canary.

● The total net inflow of U.S. Solana spot ETFs has reached approximately $420 million, with a total net asset value of $594 million. Among them, Bitwise's BSOL has contributed the majority of trading volume, with cumulative inflows of $388 million over three consecutive weeks, most of which came from an initial investment of nearly $230 million on the first day, after which inflows significantly slowed.

● Fidelity's FSOL had a net inflow of only $2.07 million on its first day of trading on November 18, Grayscale's GSOL has accumulated a net inflow of about $28.45 million, and Canary's SOLC had no net inflow on its first day.

● Notably, all spot ETF issuers support staking functions, which may provide some support for market demand. Since the first Solana spot ETF went live on October 28, the price of SOL has dropped by 31.34% to date.

XRP ETF: Explosive Growth the Next Day

For the U.S. XRP spot ETF, the only listed product is XRPC launched by Canary.

● Since its launch, XRPC has accumulated net inflows of over $270 million. The trading volume on the first day reached $59.22 million, but it did not generate net inflow; the next day saw a net inflow of $243 million.

● Since the first Ripple spot ETF was launched on November 13, the price of XRP has dropped by about 12.71% to date.

Litecoin and HBAR ETF: Weak Capital Inflow

At the end of October this year, Canary Capital officially launched the first U.S. ETF tracking Litecoin, LTCC.

● As of November 19, LTCC has accumulated net inflows of about $7.26 million. Daily net inflows are generally only in the hundreds of thousands of dollars, with several days of zero inflow. Since the first Litecoin spot ETF went live on October 28, the price of LTC has dropped by about 7.4% to date.

● The first U.S. ETF tracking HBAR, HBR, was also launched by Canary Capital at the end of last month. According to SoSoValue data, as of November 18, HBR has accumulated net inflows of about $74.71 million.

● Among these, nearly 60% of the funds concentrated in the first week, after which net inflows significantly declined, with single days even experiencing consecutive days of zero inflow. Since the first Hedera spot ETF went live on October 28, the price of HBAR has dropped by about 25.84% to date.

3. Multiple Dilemmas in Attracting Capital

Liquidity Pressure and Market Manipulation Risks

● Many altcoins lack sufficient liquidity, making them susceptible to price manipulation. The net asset value of ETFs relies on the prices of underlying assets; if altcoin prices are manipulated, it will directly affect the value of the ETF, potentially leading to legal risks or regulatory investigations.

● Some altcoins may also be classified as unregistered securities; the current U.S. SEC is promoting a token classification plan to distinguish whether cryptocurrencies fall under the category of securities.

Unfavorable Macroeconomic Environment

● The uncertainty of the macroeconomic environment has also intensified investors' risk aversion. In an overall low-confidence situation, investors are more inclined to allocate to traditional assets like U.S. stocks and gold.

● This liquidity tightening situation is also reflected in traditional markets. Recently, gold and U.S. stocks have fallen in sync, signaling tight market liquidity, forcing investors to sell profitable assets to cover losses in other holdings.

Lack of Institutional Endorsement

● At the same time, altcoin ETFs lack the recognition and market acceptance of Bitcoin or Ethereum spot ETFs, especially the absence of endorsements from large institutions like BlackRock.

● The distribution networks, brand effects, and market trust brought by leading issuers are difficult to replicate, further weakening the attractiveness of altcoin ETFs in the current environment.

4. Future Trends of Altcoin ETFs

Regulatory Environment Gradually Clarifying

● As the U.S. regulatory environment gradually clarifies, it may drive a new round of expansion in crypto ETF applications. The U.S. SEC has approved general listing standards for crypto ETFs and recently released new guidelines allowing crypto ETF issuers to expedite the effectiveness of their filing documents.

● At the same time, the U.S. SEC has significantly removed the previously routine special chapters on cryptocurrencies from its latest fiscal year review focus document. This contrasts with the period under former Chairman Gary Gensler, when cryptocurrencies were explicitly listed as a review focus, particularly naming spot Bitcoin and Ethereum ETFs.

● The acceleration of the regulatory framework's formation and the rapid expansion of ETF products are occurring simultaneously. The U.S. Securities and Exchange Commission has begun considering establishing a "token taxonomy" framework to clarify the legal attributes of different categories of digital assets.

● The significance of this change cannot be underestimated. For a long time, U.S. regulation of the crypto industry has relied more on enforcement actions. As regulatory agencies shift towards establishing an operable rule system, crypto assets are expected to be genuinely incorporated into the traditional financial regulatory framework.

Staking Function May Become a Breakthrough

● The introduction of staking functions is believed to stimulate institutional investor demand, thereby attracting more issuers to join the ETF application queue. Research from Swiss crypto bank Sygnum shows that despite the recent significant market correction, institutional investors' confidence in crypto assets remains strong.

● Over 80% of institutions express interest in crypto ETFs beyond Bitcoin and Ethereum, with 70% stating that if ETFs can provide staking returns, they will start or increase their investments.

● Additionally, there have been positive signals regarding ETF staking at the policy level. Recently, U.S. Treasury Secretary Scott Bessent made a new statement indicating that he will work with the IRS to update guidance to provide regulatory support for crypto ETPs that include staking functions.

This move is seen as potentially accelerating the approval timeline for Ethereum staking ETPs while paving the way for multi-chain staking products for networks like Solana, Avalanche, and Cosmos.

More Altcoin ETFs Still in Progress

● In addition to the above projects, spot ETFs for crypto assets such as DOGE, ADA, INJ, AVAX, BONK, and LINK are still in progress, with Bloomberg analyst Eric Balchunas predicting that Grayscale's Dogecoin ETF will launch on November 24.

● Currently, there are 155 ETP (exchange-traded product) applications in the crypto market, covering 35 digital assets, including Bitcoin, Ethereum, Solana, XRP, and LTC, showing a land-grab growth pattern. With the end of the U.S. government shutdown, the approval process for these ETFs is expected to accelerate.

5. Challenges and Opportunities Coexist

Changes in Market Structure

The current bull market led by Bitcoin ETFs has difficulty transmitting liquidity to the altcoin market, making a broad rally unlikely.

● A harsh reality is that most of the funds flowing into Bitcoin are through ETF channels, and these massive capital amounts are locked within the traditional financial system. This directly breaks the historical "trickle-down effect," leaving the altcoin market, which traditionally relies on BTC profit reinvestment, facing liquidity shortages.

● Even more critically, there are nearly 42 million types of altcoins in the market now, with liquidity dispersed to the extreme. The traditional broad rally model is almost impossible to replicate.

Investor Strategy Shift

● Investors may be more inclined to adopt a diversified, decentralized portfolio of altcoin ETFs to reduce risk and enhance potential returns.

At the market level, recent crypto asset prices have experienced volatile adjustments. Some ETFs have shown signs of capital outflow, while on-chain activity and trading demand have not significantly improved.

● Although a systematic path is being paved, short-term liquidity tightening and market sentiment fluctuations will still affect asset prices. In other words, regulatory benefits will not immediately lead to a one-sided market; instead, it may create a phase of "policy expectations mismatched with actual liquidity."

● In such an environment, investment strategies must be more robust and flexible. First, mainstream assets and compliant ETFs should be core allocations to reduce policy risks and compliance uncertainties. Second, maintaining a moderate amount of cash and high liquidity assets can help maintain responsiveness during market fluctuations. Furthermore, diversification in terms of geography and asset types is also crucial.

Bitcoin's market share in the crypto market remains close to 60%, while excluding ETH and stablecoins, all other altcoins only account for 19.88% of the market share. This stark disparity clearly explains why Wall Street is cautious about altcoin ETFs.

In the future, as more altcoin ETFs are approved, the market will be reshuffled, and only those tokens with actual utility, clear value propositions, and strong liquidity will stand out in the wave of institutionalization.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。