Author: Jsquare Investment Team

Prediction markets (also known as event derivatives) are markets where participants buy and sell contracts based on the outcomes of future events. In these markets, contract prices reflect the public's judgment of the probability of a certain event occurring. Prediction markets aggregate dispersed information, allowing a large number of independent traders to collectively form highly accurate predictions, often outperforming individual experts or traditional polls. A typical form is binary options, where a fixed amount (e.g., $1) is paid if the event occurs, otherwise $0 is paid; thus, the trading price of the option, quoted in cents, directly represents the market's view on the probability of the event occurring.

This mechanism provides a real-time updated odds indicator that instantly reflects market expectations as news changes, making the price discovery process for political, sports, financial, and other events more efficient and continuous.

The Development of Prediction Markets

Historically, betting exchanges like Betfair (established in 2000) set a precedent by allowing users to bet on sports events or political outcomes in a peer-to-peer manner, without having to bet against a bookmaker. As early as 1988, academic projects like the Iowa Electronic Markets had already validated this concept, accurately predicting U.S. election outcomes through small-scale trading. By the 2000s, Ireland-based InTrade became a popular real-money market for political and other events, but the platform was forced to shut down in 2013 due to regulatory issues.

Early decentralized platforms, such as Augur (the first prediction protocol based on Ethereum, launched in 2018), demonstrated the potential for trading events without trust, offering binary, multi-choice, and scalar markets on an open network. However, Augur's on-chain design faced issues such as slow speed, low liquidity, and poor usability, limiting its adoption. In recent years, emerging platforms like Polymarket have focused more on user experience (fast trading, simple interface) and low fees, gaining broader user acceptance. As a result, prediction markets gradually entered the mainstream between 2024 and 2025, attracting hundreds of thousands of users and achieving trading volumes in the billions of dollars.

Evolution of Trading Volume

Modern prediction markets have experienced significant growth from niche to large-scale development. Early examples were small in scale: the Iowa Electronic Markets had an investment cap of only $500 in 1988, yet it proved accurate in predicting U.S. elections. Internet exchanges in the 2000s began to show real trading volumes, such as InTrade. By the 2012 U.S. elections, InTrade had over 82,000 users, with betting amounts exceeding $200 million for that election alone. InTrade's rapid growth demonstrated market demand but also attracted regulatory pressure—the U.S. Commodity Futures Trading Commission (CFTC) sued it for operating an unregistered exchange at the end of 2012, leading to a ban on U.S. users and the eventual closure of the platform.

In the sports betting field, the Betfair exchange (launched in the UK in 2000) continuously accumulated liquidity, becoming the world's largest market for sports and political event predictions by the 2010s. The 2020 U.S. presidential election was a milestone for Betfair, with matched betting amounts exceeding £480 million for that single market. In comparison, the trading volume of over $600 million far surpassed previous election markets, indicating a sustained increase in participation interest with each election cycle.

The trading volume of crypto-native prediction markets remained relatively small before 2020. Although Augur launched in 2018 and initially garnered significant attention (its fully diluted valuation (FDV) once exceeded $1 billion), actual usage remained limited, constrained by high Ethereum gas fees and a complex user experience. Augur's trading volume peaked at only a few million dollars, with its market liquidity being fragmented.

The game changer was Polymarket, which launched in 2020, focusing on trading speed, user experience, and low barriers to entry. Polymarket quickly rose to become the dominant platform for crypto prediction markets, especially excelling during major news events. Its trading activity surged during the U.S. election cycle. For instance, during the 2024 presidential campaign, Polymarket's trading volume reached over $2.5 billion in November 2024 alone. By the end of 2024, Polymarket had processed a cumulative trading volume of approximately $9 billion, with over 300,000 users, making it the largest prediction market in the world to date.

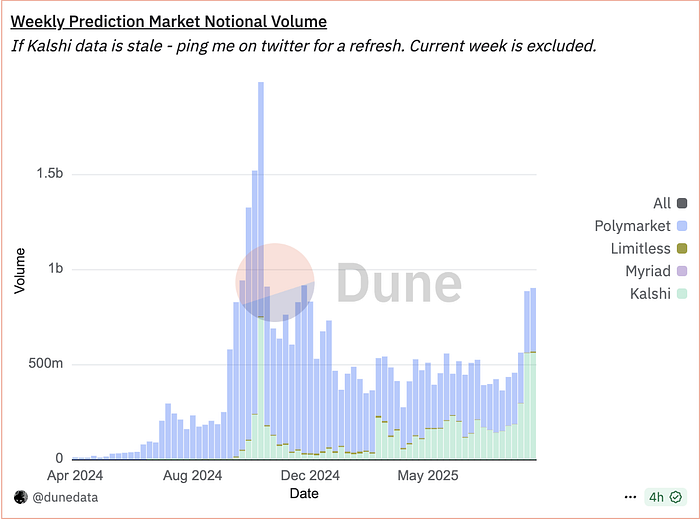

Kalshi is a prediction market exchange approved by the CFTC (U.S. Commodity Futures Trading Commission), launched in 2021. It has managed to grow rapidly while fully complying with the U.S. regulatory framework, which is noteworthy. The following chart shows the nominal trading volume growth curve of Kalshi.

The Biggest Challenges Facing the Field

Despite progress, prediction markets still face several long-standing challenges that hinder their attainment of the status of traditional financial markets.

1. Regulatory Uncertainty and Legal Barriers

So far, the most significant obstacle is regulatory issues. In many jurisdictions, prediction markets with real money participation are legally considered gambling or unregistered financial exchanges. Early attempts by crypto platforms to circumvent these regulations through offshore operations or as decentralized protocols have also led to penalties (for example, Polymarket was fined $1.4 million by the CFTC in 2022 and banned from serving U.S. users). Globally, different jurisdictions have varying stances: some countries (like the UK through Betfair) allow regulated exchanges to conduct betting on specific events, while others completely prohibit public event betting. This fragmented legal environment creates uncertainty, forcing many prediction market projects to operate in gray areas or adopt regional restrictions. Even if federal regulatory agencies show signs of leniency (notably, the CFTC issued a no-action letter in September 2025 allowing an affiliate of Polymarket to operate event markets legally in the U.S.), state-level regulations can still pose obstacles—recently, Robinhood's attempt to enter the event market was halted by regulators in states like Nevada and New Jersey.

2. Liquidity and Market Depth

For markets to produce accurate probability pricing and attract genuine investors, sufficient liquidity is a prerequisite. Most prediction markets often struggle to maintain adequate liquidity except for a few marquee events. We often see trading volumes spike briefly before quickly declining— for example, after the results of the 2024 U.S. elections were announced, Polymarket saw user activity and trading volume plummet by 84% overnight as traders exited after the major event concluded. Smaller or niche markets are more prone to issues such as wide bid-ask spreads and low participation, making them not only susceptible to manipulation but also causing traders to lose interest in participating.

3. Oracle and Settlement Challenges

Since prediction markets revolve around real-world events, reliable mechanisms are needed to determine event outcomes. Decentralized markets have tried various solutions, each with its issues. Augur's model relies on REP token holders to report results and resolve disputes through a forking mechanism. Although this model is decentralized, it may take weeks to settle in contentious events, and theoretically, if malicious actors hold a large amount of REP, the market could be manipulated. New-generation systems use optimistic oracles or external data sources, such as Polymarket utilizing UMA's optimistic oracle, which means that results are assumed to be true once submitted unless challenged within a set time window. This approach speeds up most settlement times but still relies on a group of trusted challengers, and if the data itself is ambiguous, issues may arise. Centralized platforms (like PredictIt, Betfair, Kalshi) typically determine outcomes through internal team decisions or preset news sources, but this also carries trust risks.

Emerging New Primitives

To overcome current limitations, prediction market projects are experimenting with new primitives and mechanisms.

1. Prediction Derivatives Market

An obvious trend is the creation of derivatives on top of prediction markets, allowing traders to leverage their bets on event outcomes like trading stock futures or options. In traditional finance, the scale of the derivatives market is often much larger than the spot market, so introducing this concept to prediction markets could significantly enhance overall trading volume and liquidity.

2. Advanced Automated Market Makers and Liquidity Mechanisms

Improved market-making primitives specifically tailored for event markets are expected to emerge. While standard constant product automated market makers (AMMs) can provide basic liquidity, they are not ideal for binary prediction markets due to their low capital efficiency and susceptibility to high slippage during large trades. Future deployments are more likely to utilize new AMM formulas, such as dynamic concentrated liquidity or adjusted LMSR (Logarithmic Market Scoring Rule) models.

3. Interoperability Primitives

As the ecosystem matures, interoperability between prediction market platforms and other DeFi protocols will become an important development direction. For example, using outcome tokens from prediction markets as collateral in lending protocols— in other words, users could pledge these tokens based on the computable expected value of their betting combinations to borrow stablecoins. Additionally, tiered or index-structured products may emerge: by issuing index tokens representing a basket of outcome tokens (similar to "prediction ETFs"), they could be freely traded in secondary markets or used for broad betting on a particular theme.

Investment Opportunities in Prediction Markets

1. Derivatives Market

The derivatives market built on prediction markets may represent the next stage of trends in this field. Such projects include perpetual contracts, options, or other leveraged financial instruments centered around event outcomes. The core idea is simple: in mature financial systems, derivatives trading volume far exceeds spot trading, and prediction markets are expected to follow a similar growth path in the future.

- Gondor: A DeFi lending protocol for prediction market traders. It releases liquidity for prediction market traders by allowing users to collateralize their positions to borrow without closing their Polymarket holdings. Users deposit YES/NO shares as collateral to obtain stablecoin loans; the protocol dynamically adjusts the LTV (loan-to-value ratio) based on market probabilities and triggers automatic liquidation, enhancing capital efficiency for longer-term event markets.

- D8X: A next-generation on-chain futures protocol designed for leveraged prediction markets. D8X has launched order book-based perpetual contracts for event outcomes, combining crypto prediction markets with high-leverage trading. D8X focuses on addressing the unique volatility issues of $0–$1 event contracts, aiming to release derivative trading volume for various events from political elections to sports events, viewing "event leveraged trading" as a natural evolution direction for the prediction market industry.

- dYdX: The leading decentralized perpetual contract exchange dYdX is also entering the event market space. Its V4 upgrade will open permissionless binary event markets on an independent application chain, allowing users to leverage real-world events through perpetual contracts. To this end, dYdX introduces the shared liquidity pool MegaVault and on-chain oracle mechanisms to support event settlement.

- Aura: A protocol providing leveraged trading for event outcomes. It allows users to engage in directional leveraged trading on real-world narratives (elections, sports, crypto events) through perpetual-style contracts. Aura is natively built on Hyperliquid, utilizing its unified margin system to achieve deep liquidity and low-latency matching while integrating Polymarket data as a settlement reference source.

- Polyindex: A prediction market index protocol that allows users to create ERC-20 index tokens composed of multiple Polymarket event contracts. Index creators select a set of event IDs and set weights, and the protocol continuously synchronizes Polymarket's market prices, liquidity, and event outcomes. Users only need to hold a single token to gain exposure to a basket of events; as the underlying events settle, the index will automatically complete the settlement.

2. Permissionless Market Creation

The most powerful growth lever for prediction markets lies in allowing anyone to create and trade new markets without intermediaries. Such projects provide infrastructure for user-generated event markets, covering everything from political and crypto prices to niche community predictions. This unleashes exponential innovation space, similar to the democratization of liquidity achieved by Uniswap in DeFi. By lowering the market deployment threshold, these protocols can far exceed the scale of any centralized prediction platform, transforming every narrative, event, or data source into a tradable market.

Augur: A pioneering protocol launched in 2018 that validated the concept of user-created prediction markets. Augur V2 supports a variety of markets from elections to sports without centralized approval, accumulating over $100 million in trading volume by 2025. However, its early versions faced challenges in user experience and liquidity, paving the way for the development of better solutions.

The Clearing Company: Founded in 2025 by former Polymarket team members, it aims to create a regulated on-chain exchange for permissionless event contract trading. Its goal is to combine decentralized features with legal compliance, enabling anyone to create retail-focused event markets.

Melee Markets: A recently funded startup that builds user-generated markets in an innovative way. On the Melee platform, "anyone can create a market about anything," covering everything from objective event outcomes to opinion-based questions. Its innovation lies in the "viral market" mechanism, rewarding early bettors on popular questions, combining predictive certainty with the growth potential of social tokens.

Kash: A social-native prediction protocol that directly embeds "lightning prediction markets" into social feeds, allowing users to predict and bet on news events, narrative hotspots, or viral content without needing to navigate away. Each market lasts for 24 hours and automatically settles in USDC. Kash significantly lowers interaction barriers through gas-free transactions and AI-driven hot event generation, enabling every social trend moment to be transformed into a tradable market event.

XO Market: A permissionless belief market platform where anyone can create, trade, and settle binary event markets in real-time. The platform is based on a sovereign Rollup architecture to ensure a fast and transparent trading experience. It also introduces adaptive liquidity curves and decentralized arbitration mechanisms to ensure fair settlements for both fact-based events and social narrative-based events.

3. Prediction Market Sports Betting

Sports betting is one of the largest gambling markets globally and is now facing new challenges. Investing in sports prediction projects can tap into a vast user base of sports fans who already have a strong and stable betting willingness. Its unique selling point is clear: prediction markets operate 24/7, settle instantly in stablecoins, and do not lock your positions (you can exit your bets before the end of the game).

- SX Network (SX Bet): One of the earliest decentralized sports betting platforms, established in 2019. SX Bet initially operated on Ethereum and later migrated to the Arbitrum-based independent chain SX Chain. It adopts a peer-to-peer betting trading model, allowing users to hedge odds against each other (even allowing parlay bets across multiple games). To date, this model has achieved over $350 million in cumulative betting volume. SX has also introduced a native token ($SX) and "betting mining" rewards, allowing winning bettors to earn tokens and participate in platform governance—effectively making the community "the house" rather than a centralized betting company.

- BetDEX: A decentralized sports betting exchange co-founded by former FanDuel executives in 2021. BetDEX is built on Solana through the Monaco protocol and launched at the end of 2022, aiming to provide a global experience similar to Betfair on the blockchain (low fees, high speed, and instant settlement for all bets). Notably, it is the first Web3 sports betting platform to obtain a full gambling license— in November 2022, BetDEX secured a full license for a sports betting exchange in the Isle of Man, allowing it to operate online gambling legally in approved regions.

- Aver: A decentralized betting exchange based on Solana, officially launched in mid-2022 after completing a $7.5 million seed round of financing, with investors including Jump Trading and Susquehanna. Aver uses a fully on-chain order book (rather than AMM) to match bets on sports and other events, providing a low-latency trading experience close to Web2 platforms. The order matching, result settlement, and reward distribution in its betting process are all executed by Solana smart contracts, allowing users to manage their funds independently and withdraw profits to their personal wallets immediately after each event concludes.

- Frontrunner: A newer decentralized sports prediction market focused on American sports and esports. Frontrunner's platform (testnet launched at the end of 2022) presents sports betting in a stock market-like format: users buy and sell "shares" of teams or players in leagues like the NFL, NBA, and Premier League through a trading interface. The platform plans to launch index markets similar to ETFs (e.g., a basket of teams) and support stablecoin betting. Frontrunner is built on Injective (a Cosmos-based blockchain) to achieve zero gas fees and utilizes its built-in order book module for matching.

- Divvy: A Solana-based sports betting protocol that allows users to bet directly on the outcomes of major sporting events through crypto wallets, with all bets hosted by decentralized smart contracts for instant, trustless payments upon settlement. Its uniqueness lies in its community-driven liquidity pool serving as the counterparty for bets, allowing users to provide funds to this pool, thereby acting as the house and earning a portion of the house profits over time.

Project Ecosystem Diagram

Cited sources: coinshares.com; betting.betfair.com; medium.com; dlnews.com; blockworks.co; pymnts.compymnts.com; newsletter.sportingcrypto.com; https://polymark.et/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。