Author: Frank, PANews

Recently, against the backdrop of a general pullback in the cryptocurrency market, Zcash (ZEC) has surged against the trend, skyrocketing over 700% in just two months during the fall of 2025, standing out in the crypto market. While investors in Bitcoin and Ethereum struggle in the chill of a "bear market," ZEC holders are basking in the blazing sun of summer.

This stark contrast raises a core question in the market: Is the surge in ZEC's price driven by a genuine increase in privacy demand amid tightening global regulations, or is it merely a financial speculation woven together by institutional capital and massive leverage?

Data Duet: Surge in Privacy and Capital Frenzy

Behind the rise, is Zcash driven by real privacy demand or by financial speculation? We may need to analyze comprehensive data on Zcash.

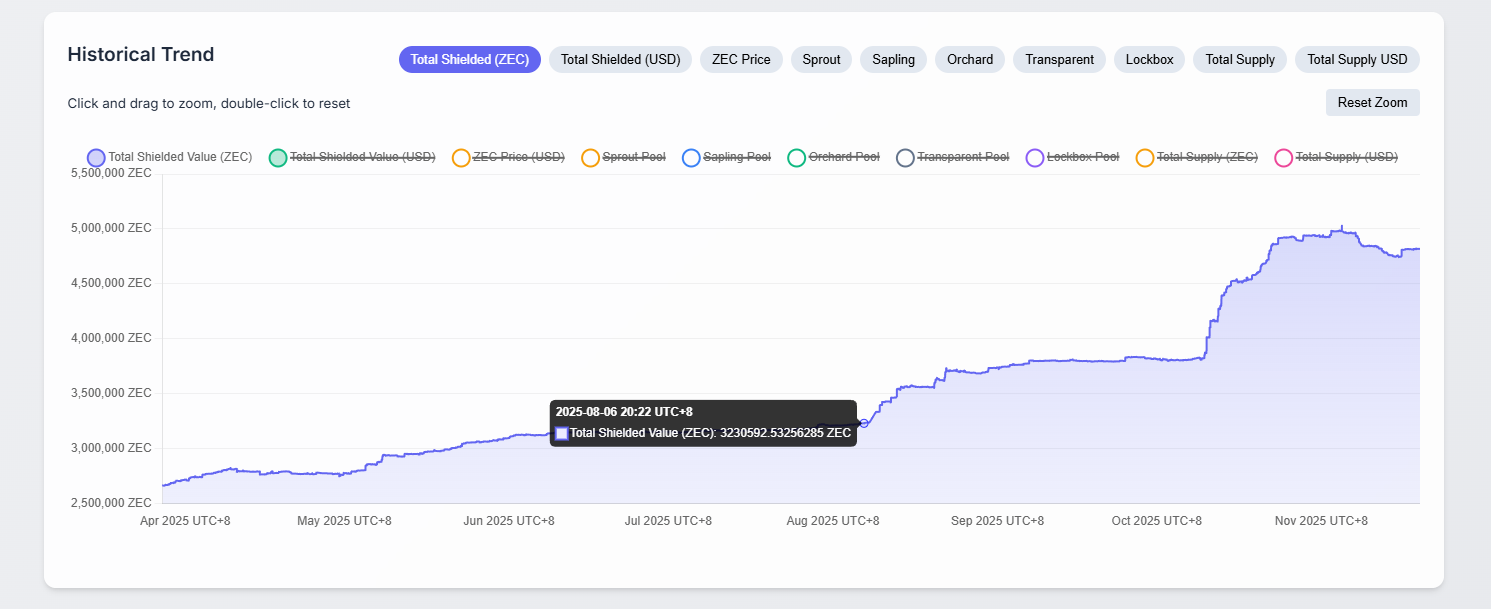

First, let's look at the on-chain privacy demand data. The shielded pool data is the core indicator of Zcash, similar to the TVL in other public chains, representing the amount of funds participating in privacy features on Zcash. The total amount in the shielded pool has seen significant growth in the past six months. On March 27, the total assets in Zcash's shielded pool were approximately 2.66 million ZEC, which rose to about 3.8 million by September, and then surged to 4.98 million on November 4. This is nearly double compared to March.

Additionally, the percentage of the total supply represented by the total amount of ZEC in the shielded pool has also seen substantial growth, increasing from 18% in October to 23% on November 11, and reaching 29.38% by November 17. As of November 17, out of 4.81 million shielded ZEC, as much as 86% flowed into the Orchard pool (Orchard is currently Zcash's most advanced protocol).

In terms of transaction volume, there has also been a significant increase since October. Prior to this, Zcash's weekly average transaction volume was around 30,000 to 40,000 transactions. On October 2, this figure surged to 100,000 transactions. The week of November 16 even reached 460,000 transactions, continuously setting new historical records since October. From the on-chain demand data, it is evident that Zcash has indeed experienced a significant increase in privacy demand recently.

In market data, on September 28, the contract open interest for ZEC was only $18.75 million, which grew to $360 million by October 12. Excluding the increase in open interest due to the price rising 4.5 times during this period, the total open interest still increased by $270 million. By November 17, this figure had further grown to $1.377 billion, setting a new historical high. Meanwhile, the price of the ZEC token skyrocketed from $58 on September 28 to a peak of $750, with a maximum increase of about 12 times.

Moreover, the funding rate also exhibited a rather bizarre situation. On November 7, the funding rate for ZEC contracts reached a high of -0.4192%, indicating that the market was generally paying a high price to short ZEC, with strong bearish sentiment. On that day, the price surged by a maximum of 48%, creating a historical high of $750. Short sellers thus paid a painful price, with the amount of short positions exceeding $51 million. From the liquidation distribution, it can be seen that the main short positions that day were concentrated on Hyperliquid, where the liquidation amount of short positions alone reached $33 million, contributing nearly 60% of the total liquidation amount for ZEC that day.

Driven by Real Demand, Concluded by Emotional Speculation

Overall, the data indicates that both Zcash's on-chain demand and market price have seen a significant surge during this period. But behind this data, was it demand that came first, or did price drive demand?

From the price analysis, before this round of explosive growth, the price of the ZEC token hit a low of $34 on August 20, and then slowly climbed over the next 40 days, increasing by 106%, reaching a peak of $71 on September 29. We have reason to believe that this stage marked the initial phase of ZEC's activation.

Prior to this, on-chain data shows that the ZEC in the shielded pool began to rise on August 6, increasing from 3.22 million ZEC on August 6 to 3.63 million on August 20, a growth of 12.7%. Although the ZEC token was in a downward trend during this period, the shielded pool data indicates that the market's demand for privacy coins was still on the rise. By September 29, although the price had doubled, the number of ZEC in the shielded pool only grew to about 3.8 million, not expanding in tandem with the price surge.

The changes reflected in this data comparison indicate that Zcash was indeed initially driven by real market demand, but as the token entered a phase of rising frenzy, it seemed to have deviated from the original demand logic.

Another data point also indirectly reflects this situation. As shown in the chart, the green curve represents the proportion of privacy transactions within the Zcash network. This data had been continuously rising until August 24. However, as the price surged, the proportion of privacy transactions began to decline, even though the average daily total transaction volume was still significantly increasing. The proportion of transparent pool transactions (which can be seen as on-chain transaction demand rather than privacy demand) was higher.

From this perspective, the explosive rise in ZEC's price was indeed driven by demand in the first half, while the subsequent frenzied increase was completely taken over by market sentiment.

Long-term Narrative is Good, Short-term Fuel is Exhausted

However, after the frenzy, the market may need to know whether this demand-driven expectation is a long-term narrative or merely a material for capital exploitation.

First, in terms of fundamentals, the increasing demand for privacy is closely related to the recent implementation of the EU's MiCA legislation and the advancement of stricter global KYC/trading monitoring rules. a16z's "2025 Cryptocurrency Status Report" shows that Google's search interest in privacy-related terms has surged sharply in recent months.

In this context, ZEC's "optional privacy" feature (i.e., the coexistence of transparent and shielded addresses) and its compliant design of "viewing keys" make it a more favored choice by regulatory bodies compared to hardcore privacy coins like Monero (XMR). Notable investor Naval Ravikant (author of "The Navalmanack") even directly stated, "Bitcoin is insurance against fiat, while Zcash is insurance against Bitcoin," further igniting market sentiment towards privacy coins.

Additionally, timing is also an important prerequisite for the surge in ZEC tokens. Throughout October, the cryptocurrency market fell into a downturn, with most tokens, including Bitcoin, experiencing significant pullbacks. The narratives in other market sectors seemed to have lost effectiveness, and people needed a target that could be speculated on and yield profits in the short term. Privacy coins happened to become the best theme during this phase. Overall, the recent rise of Zcash, or the entire privacy token sector, is the result of multiple factors. In this process, real demand was indeed the initial catalyst for the market, while the frenzied speculation of market capital became the main fuel behind this round of explosive growth, especially for those investors who shorted under upward pressure.

However, as this round of enthusiasm begins to cool, will the narrative of demand for privacy coins and Zcash still be effective in the long term? Currently, there is indeed potential. However, considering Zcash's current shielded pool amount of about $2.8 billion, it does not stand out compared to the TVL of other public chains, and the daily transaction volume in the privacy pool is also not particularly active. Therefore, at present, the demand for ZEC does exist, but the price support relies more on sentiment rather than demand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。