Author: Zuo Ye

Within a month, the crypto market experienced two shocks on October 11 and November 3, leading to a common question: does DeFi still have a future? At this moment, we can observe the current structure and changing direction of the DeFi market.

From the most macro perspective, DeFi is rapidly shedding the "second system effect." The impact of stablecoins on traditional banks and the payment industry is becoming increasingly real. The Federal Reserve's attempt to provide a streamlined main account is clear evidence of this. Institutional DeFi, represented by Aave/Morpho/Anchorage, is changing the operational model of traditional finance. Uniswap plans to open the fee switch, and the Perp DEX War represented by Hyperliquid is still in full swing.

The immature characteristic lies in choosing a noble death for the ideal. It is far too early to claim that DeFi has completely matured, with only the stage of large-scale adoption remaining. In the sky of DeFi, two clouds still linger:

- Who is the ultimate lender in the entire on-chain economic system? Morgan created the Federal Reserve; what mechanism should take on a similar role in DeFi?

- Beyond the established DEX/Lending/Stable products that keep nesting, how should truly original DeFi tracks or mechanisms be triggered?

Price is the Result of Game Theory

Bart, as long as you are online, I am by your side.

We are often blinded by the omnipresent. In the small universe of DeFi, all innovations so far revolve around DEX/Lending/Stablecoin. This does not mean that BTC/ETH are not mechanisms of innovation, nor does it imply that RWA/DAT/token stocks/insurance are not asset innovations.

Referring to the six pillars of on-chain protocols, BTC and Bitcoin essentially do not need any other assets or protocols. The DeFi we discuss refers to projects occurring on public chains/L2s like Ethereum/Solana. Considering the leverage cycle of token stocks and bonds, the selling cost of innovative assets is becoming increasingly high. The entire industry is pursuing products with real profitability, such as Hyperliquid.

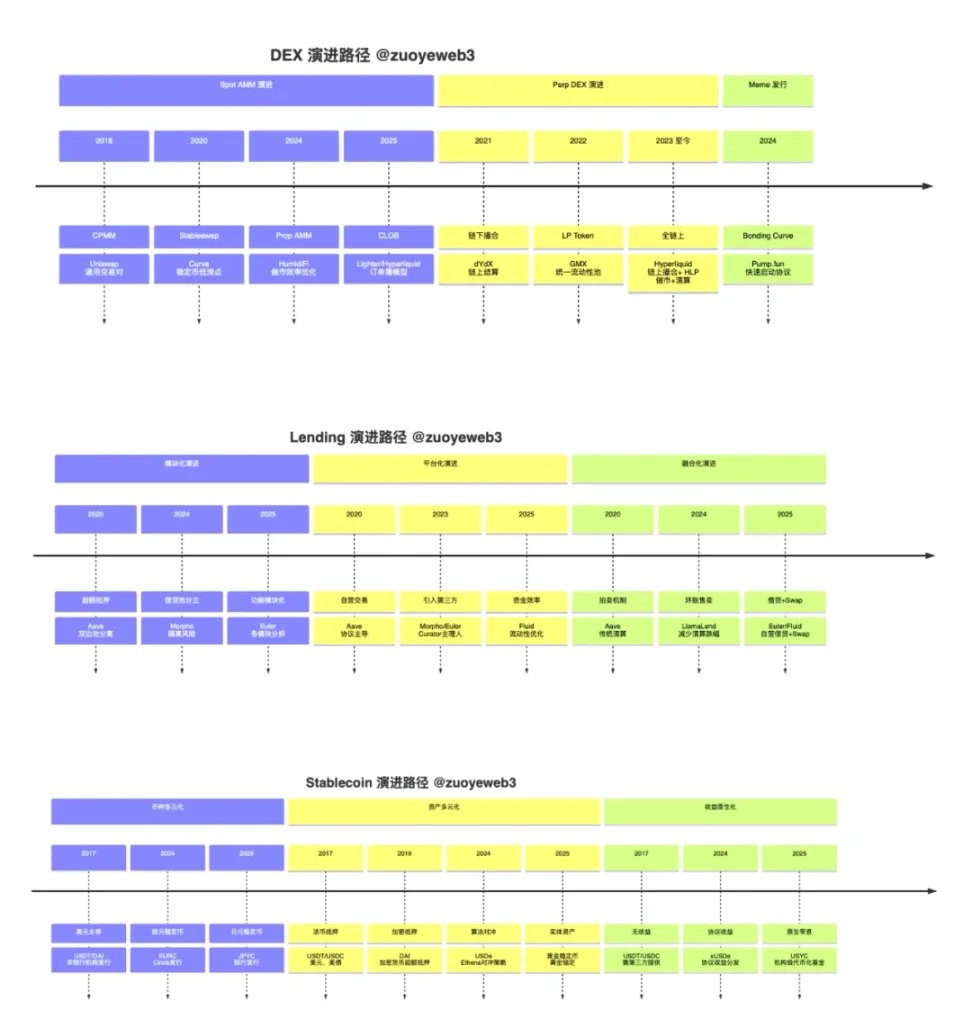

Image Caption: Evolution of the DeFi paradigm, image source: @zuoyeweb3

Since the end of DeFi Summer, DeFi innovation has been a continuous improvement of established products, existing assets, and established facts. For example, trading is divided into three types: spot, Perp, and Meme, corresponding to AMM/CLOB/Bonding Curve during the DeFi Summer period. Even the most innovative Hyperliquid still harbors many shadows of Serum.

From the most micro perspective, Pendle started with fixed-income products, embraced LST/LRT to yield-bearing stablecoins like Ethena, and both Euler and Fluid coincidentally chose to build their own lending + swap products. If users set yield strategies using Ethena and other YBS, they can theoretically utilize DEX/Lending/Stablecoin across any chain, any protocol, and any Vault simultaneously.

This synergistic effect amplifies yields while also "creating" numerous liquidation disasters and trust crises. Beyond this, there are No-Go Zones everywhere; blockchain is born free, yet it is shackled everywhere.

Decentralization is a beautiful vision, but centralization is more efficient. The more impoverished aspect is the centralization of protocols. Aave is indeed large and secure, but this also means you have fewer and newer choices. Latercomers like Morpho/Euler can only embrace unsafe main operators and "inferior" assets.

The unbanked have triggered the third world’s pursuit of stablecoins. It cannot be said that Aave's prudence created the crisis for Morpho, but unAaved has also sparked on-chain mice and the younger generation's pursuit of subprime bonds, subprime protocols, and subprime main operators.

Innovation can only occur among marginalized groups, where the cost of trial and error is incredibly low. Those who survive will repeatedly challenge the established pattern. Aave V4 will also become more like its competitors rather than its successful past.

The protocols and their tokens we see now, their market prices and trading volumes are merely intuitive reflections of the current environment. In other words, they are already acknowledgments of the results of repeated game theory.

It is difficult to say whether they are effective for the future or even if they have any reference significance. The stablecoin chains Plasma and Stablechain are exceptionally hot, but it is almost impossible to challenge the adoption rates of Tron and Ethereum. Even the xUSD challenge against the much smaller USDe has already declared failure.

The pricing system favors time; protocols that survive longer tend to last longer. The success of Hyperliquid and USDe is an outlier that deviates from the norm. It is worth discussing how much market share Euler/Morpho/Fluid can capture from Aave, but it is almost impossible to replace Aave.

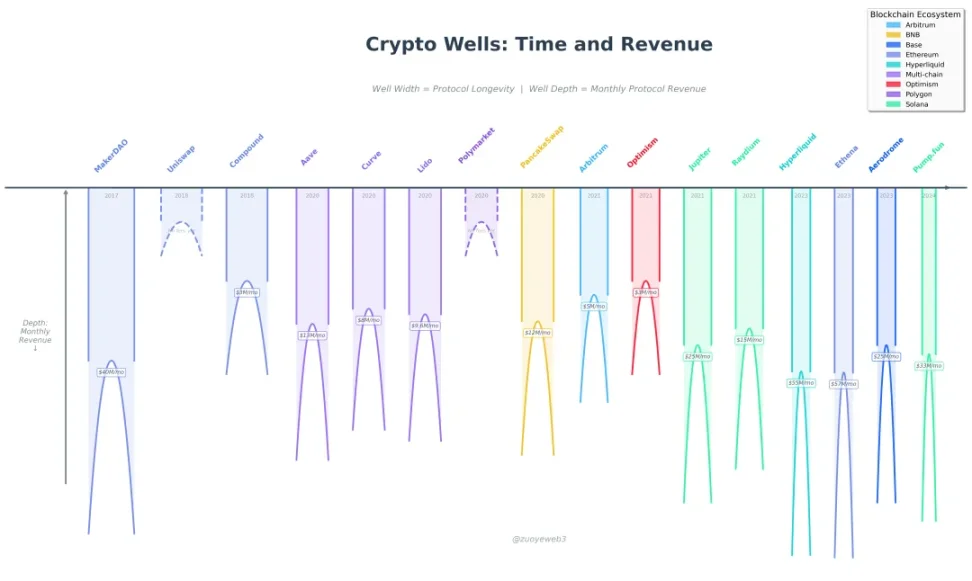

Image Caption: Crypto Gravity Well: Time Scale and Revenue, image source: @zuoyeweb3

Crypto Gravity Well: Time and App Rev【Continuous】from left to right is the token issuance time, from top to bottom is Rev

- Time: Balancer (hacked), Compound (silent), Aave (thriving) captures our time

- Rev: Earning ability is the only commercial value; one is the intrinsic token value BTC (USDT issuance, yield stablecoins want to take this shortcut), and the other is value capture ability (Pump's mining, withdrawal, and sale)

Competition is heading towards internal competition, burning money for growth.

As shown in the above image, the x-axis represents the time the protocol has continued to this day, and the y-axis represents the protocol's value capture ability. Compared to indicators like token price, trading volume, and TVL, earning ability is already the most objective representation (Polymarket theoretically does not make money).

In theory, the earlier a protocol is established, the stronger its stable profitability. For latercomers to enter the market, they can only continuously enhance their token > liquidity > trading volume flywheel. Referring to Monad/Berachain/Story, failure is a more probable outcome.

Value as a Goal in Balance

Believe in the power of the crowd, but do not trust the wisdom of the crowd.

DeFi is a movement. Compared to exchanges and TradFi, in the overall loose context, it is indeed one of the best innovation cycles in history and may give birth to a new paradigm that surpasses DeFi Summer.

Exchanges are suffering heavy blows. Hyperliquid's transparency has demonstrated a stronger anti-fragility than Binance for the first time. After November 3, the pace of lending and stablecoins has slowed but has not been disproven. People indeed need subprime bonds, as well as simple funds/bonds/equity certificates—stablecoins.

Compared to market makers being restricted by CEX liquidity migration during October 11, on-chain trading, spot/contracts, and alternative assets are actively expanding in scale. As long as problems can be engineered and combined, there exists the possibility of being completely solved.

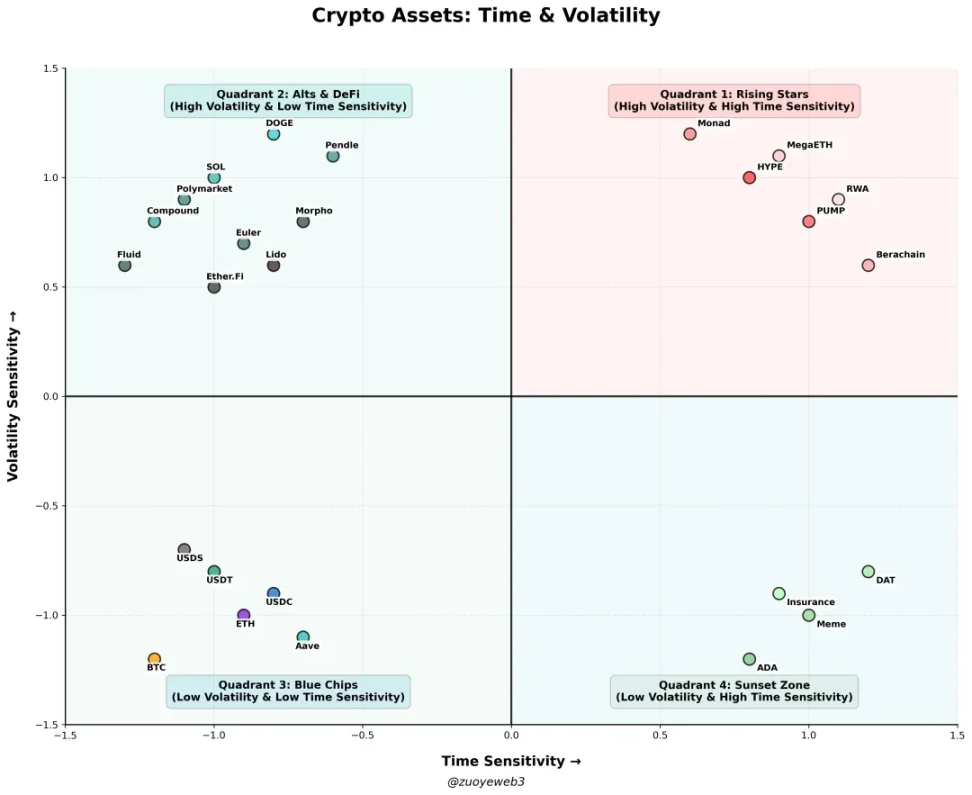

Image Caption: Crypto Assets: Time & Volatility, image source: @zuoyeweb3

- First Quadrant (Rookie Zone): HYPE, PUMP, public chains/L2/Alt L1 (Monad, Berachain, MegaETH), RWA (Bond, Gold, Real Estate)

- Second Quadrant (Shitcoin Zone): DOGE, SOL, Compound, Pendle, Polymarket, Euler, Fluid, Morpho, Ether.Fi, Lido, No-USD Stablecoin, Option

- Third Quadrant (Industry Leaders): BTC/ETH/USDT/USDC/USDS/Aave

- Fourth Quadrant (Death Zone): ADA, Meme, DAT, Insurance

Placing numerous new assets in the Rookie Zone, they are sensitive to both time and volatility, essentially belonging to short-term speculative assets. Only by surpassing simple game cycles and falling into stable holding groups and usage scenarios can they enter the Shitcoin Zone, where time is not particularly sensitive, but liquidity cannot withstand severe market fluctuations. Most projects will remain here.

Moreover, the harder the project teams work—such as through ve(3,3), buybacks, burns, mergers, renaming, etc.—they may still remain here, which can be seen as a smooth climbing period. If they do not progress, they regress; striving to advance may even lead to setbacks.

The subsequent story is simple: successfully crossing the tribulation to enter the Stable Zone, becoming so-called assets that transcend cycles, such as BTC and ETH, perhaps adding half a SOL and USDT. However, the vast majority of assets will slowly die, at which point they are neither sensitive to time nor exhibit any volatility.

Meme and DAT will exist as a track for a long time, but the assets under them will find it difficult to have long-term opportunities, while a few representative assets like DOGE and XRP are outliers.

In reality, if protocols are viewed as asset innovations, many problems will be easily resolved. The entrepreneurial goal is to sell oneself once and not pursue becoming a continuous open system:

- Spot DEX: Trading itself concentrates on mainstream assets (BTC/ETH) and whale rebalancing. Retail investors no longer trade shitcoins; the core of the project is to seek specific clients rather than become an unrestricted public infrastructure, such as rationalizing the information gap between whales and retail investors in dark pools.

- Perp DEX: Lighter massive financing news is a prelude to token issuance, and VCs are highly differentiated. Big Names resemble TGE financing parties, while small VCs can only perish in the Perp track, and retail investors can only pick up scraps on various launchpads.

- Meme: Emotion itself becomes a tradable asset, unable to become a consensus across the entire industry. There is no indication of PumpFun's ability to solve this problem.

- Platform & Modular Lending: A long-term trend, lending protocols can sell their liquidity, brand, and technology in chunks, essentially a B2B2C model.

- DEX + Lending Integrated Development: Among the latest in the nesting, a dedicated article will be published later to introduce its mechanism.

- Non-USD Stablecoins / Non-pegged USD Stablecoins: In the short term, focusing on developed regions like the Euro, Yen, and Won, but in the long term, the market can only be in the third world.

Here, the market situation of yield-bearing stablecoins is singled out. Overall, yield-bearing stablecoins are the asset form that best connects DEX/Lending/Stable, but they will require massive engineering combination capabilities.

In contrast, there are innovative models outside of DEX/Lending/Stable, with currently limited observational samples. For example, the stablecoin NeoBank remains a comprehensive model of the three, while prediction markets belong to a broad DEX type. Potentially promising ideas could be found in Agentics and Robotics.

The internet has brought about replicable scale expansion, which is vastly different from the production models of the industrial era. However, there has long been no corresponding economic model. Advertising economics often comes at the expense of user experience. Compared to LLMs on-chain, Agentics is at least more aligned with the technical characteristics of blockchain, namely the extreme programmability that leads to around-the-clock trading efficiency.

With the gradual decrease in Gas Fees, along with years of TPS improvements and ZK developments, large-scale adoption of blockchain may occur in a replicable economy that does not require human participation.

The combination of Robotics and cryptocurrency is not particularly interesting in the short term. At least until Yushu sheds its gimmicky and educational value, it will be difficult for robots to truly take root in Web3. As for the long term, only time will tell.

Conclusion

Make DeFi more DeFi.

Robotics has taken too long; liquidation is a race against time.

The composite liquidation mechanism of DEX + Lending is a proactive construction against the DeFi crisis, yet it could not prevent the spread of the crisis on November 3. The most effective response was Aave's early refusal. Looking at the entire industry, how to handle liquidation and restore the market has become the biggest challenge.

In 2022, after the 3AC incident erupted, SBF actively sought to acquire and restructure the involved protocols. Less than six months later, FTX was also taken over by traditional law firms. Following the xUSD explosion from Stream, it was also promptly handed over to law firms.

Code is Law is about to become Lawyer is Coder.

Before SBF and the law firms, BTC long served as the ultimate liquidator. It just requires a long time to rebuild people's trust in the on-chain economy, but at least we still have BTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。