Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Market sentiment was boosted by the U.S. government’s expectation to end the longest shutdown in history, driving a broad rise in risk assets such as U.S. stock futures, cryptocurrencies, and commodities. However, the Federal Reserve is facing a complex "balancing act." New York Fed President Williams warned that American middle- and low-income families are experiencing an escalating payment crisis, which could pose a recession risk to the economy. This dilemma, combined with a cooling job market, is a key factor influencing whether the FOMC will cut rates again in December. Despite the optimism surrounding the AI investment boom replacing earlier recession fears, and Williams believing that the risk of an investment bubble is manageable, Fed Chair Powell and other officials remain cautious about the economic outlook.

In this context, Warren Buffett's upcoming open letter is drawing significant attention, seen as his farewell address before stepping down as CEO. Investors hope to gain insights into Berkshire Hathaway's future under new leadership and Buffett's views on the market. Recently, amid a tech stock sell-off, Berkshire's stock price rose against the trend, supported by its defensive business portfolio and a record cash reserve of $382 billion.

In the Bitcoin market, there is a fierce clash of bullish and bearish views, with prices hovering near key support levels. Technical analyst Ali pointed out that if Bitcoin falls below $100,980, the next key support area will be $93,400. Despite the complex market sentiment, "Rich Dad Poor Dad" author Robert Kiyosaki remains extremely bullish, setting a target price of $250,000. In contrast, Galaxy Digital research head Alex Thorn, while optimistic in the long term, has lowered his year-end target from $185,000 to $120,000, citing a shift in investor focus to other areas like AI. Short-term technical indicators are also complex, with analyst KillaXBT warning that spot selling pressure could lead to price declines. Bitcoin's open interest (OI) has increased with rising prices, but the spot market depth has turned negative, indicating intensified spot selling. In the short term, bearish liquidity is concentrated around $105,600-$105,900, while bullish liquidity is near $103,600 and $102,000. Additionally, CME has not yet opened to form a $900 upward gap, suggesting prices may retrace to test the $103,800 area. Daan Crypto Trades emphasized that the 200-day moving average at $104,000 on the CME futures chart is a critical support level that must be maintained. Delphi Digital analyst that1618guy believes that if the early November lows can hold and ETF funds flow back, Bitcoin's price could rebound to $130,000 before December, provided BTC overcomes its recent weak performance, especially needing to close above $116,000 on the daily chart to turn short-term bullish.

The Ethereum market is also at a critical juncture, with its price performance influenced by multiple factors. Analyst Ali pointed out, based on on-chain data, that there is a massive resistance wall formed by over 869,000 ETH accumulated around $3,700, while key support levels below are at $2,866, $2,528, and $1,789. There are optimistic voices in the market, with Liquid Capital founder Yi Lihua setting a target price of $7,000 for this round of Ethereum, believing that the U.S. midterm elections, potential fiscal stimulus, and crypto-friendly regulatory policies (such as the CFTC's proposal to allow stablecoins as collateral) will collectively drive a new bull market. However, short-term technicals and market data reveal challenges. According to Cointelegraph analysis, outflows from spot ETFs, a futures market premium maintaining at a low of 4%, a drop in total value locked (TVL) to its lowest level since July, and declining DApp revenues all exert pressure on Ethereum's price, making the path back to $3,900 fraught with obstacles. Analyst Daan Crypto Trades noted that Ethereum needs to return to the $3,500 area in the short term to repair its downtrend, with the current support level at $3,365 being crucial; if it fails to hold, it could trigger a deeper correction.

In the altcoin market, the established mining protocol Ore in the Solana ecosystem saw its daily revenue soar to over $1 million after launching its V2 mechanism, with token prices tripling within a week. Additionally, Trump proposed distributing at least $2,000 in tariffs as "dividends" to every American, potentially realized through tax cuts in his earlier landmark economic policy bill. Following this news, World Liberty Financial (WLFI) rose by 30%, and TRUMP coin increased by 10%. Furthermore, the privacy project ZEC remains popular, with several KOLs still promoting it, rising 20% in the past 24 hours, while NEAR has gained attention for facilitating ZEC cross-chain transfers through the Near Intents protocol, rising over 50% since November.

2. Key Data (as of November 10, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $106,095 (YTD +13.35%), daily spot trading volume $6.77 billion

Ethereum: $3,604 (YTD +8.02%), daily spot trading volume $2.962 billion

Fear and Greed Index: 29 (Fear)

Average GAS: BTC: 1 sat/vB, ETH: 0.1 Gwei

Market share: BTC 59.2%, ETH 12.2%

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, 0G, FIL

24-hour BTC long/short ratio: 49.96%/50.04%

Sector performance: DeFi sector up 8.99%, PayFi sector up 8.45%

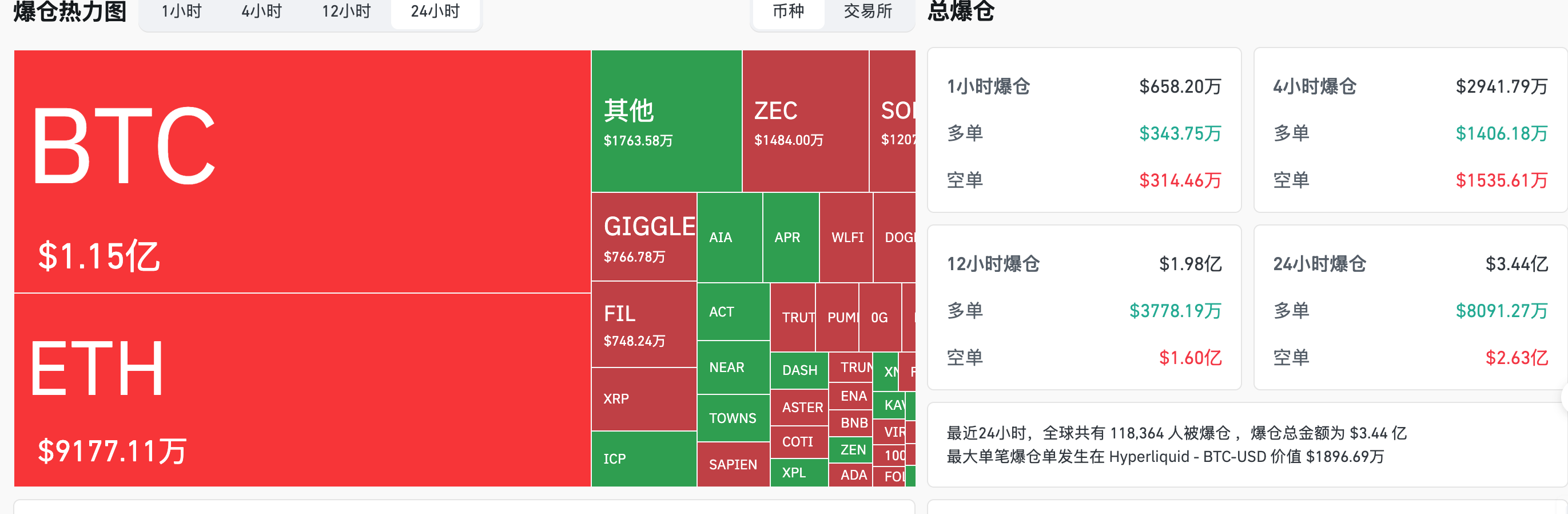

24-hour liquidation data: A total of 118,364 people were liquidated globally, with a total liquidation amount of $344 million, including $115 million in BTC, $91.77 million in ETH, and $7.66 million in GIGGLE.

3. ETF Flows (as of November 7)

Bitcoin ETF: -$558 million

Ethereum ETF: -$46.6245 million

4. Today's Outlook

Binance Alpha will launch JCT and ALLO airdrops on November 10 and 11

Linea (LINEA) will unlock approximately 2.88 billion tokens at 7 PM on November 10, accounting for 16.44% of the current circulating supply, valued at about $34.4 million;

Aptos (APT) will unlock approximately 11.31 million tokens at 2 PM on November 11, accounting for 0.49% of the current circulating supply, valued at about $33.4 million;

Solayer (LAYER) will unlock approximately 27.02 million tokens at 10 PM on November 11, accounting for 9.51% of the current circulating supply, valued at about $6.6 million;

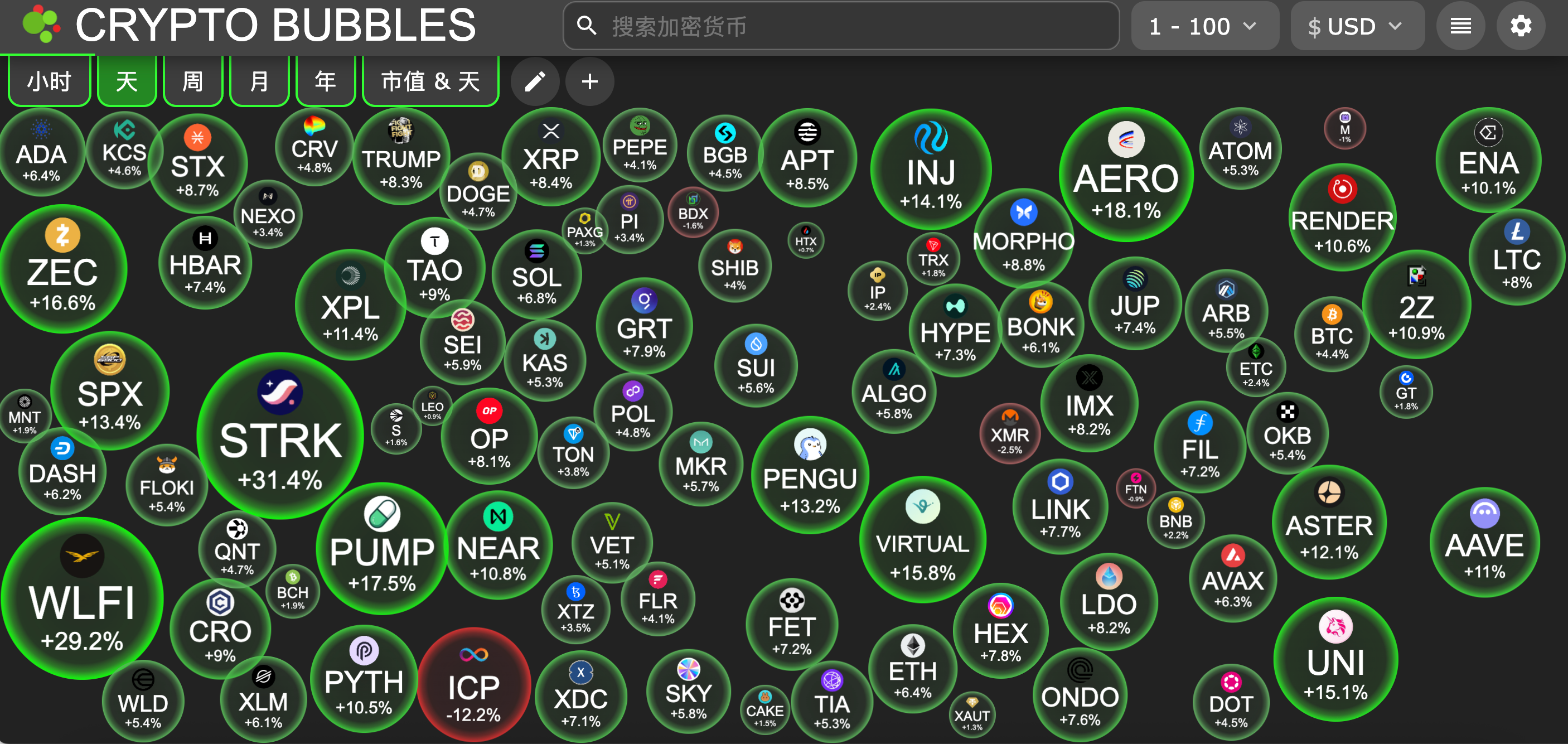

The largest gainers among the top 100 cryptocurrencies today: Starknet up 31.4%, World Liberty Financial up 29.2%, Aerodrome Finance up 18.1%, Pump.fun up 17.5%, Zcash up 16.6%.

5. Hot News

This Week's Macro Outlook: U.S. CPI May Be Absent for the First Time, Gold Awaits New Catalysts

Theoriq: AlphaVault is About to Enter the Second Phase, THQ TGE Planned for December

Early Bitcoin Investor Owen Gunden Deposits 600 BTC into Kraken

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。