Preface

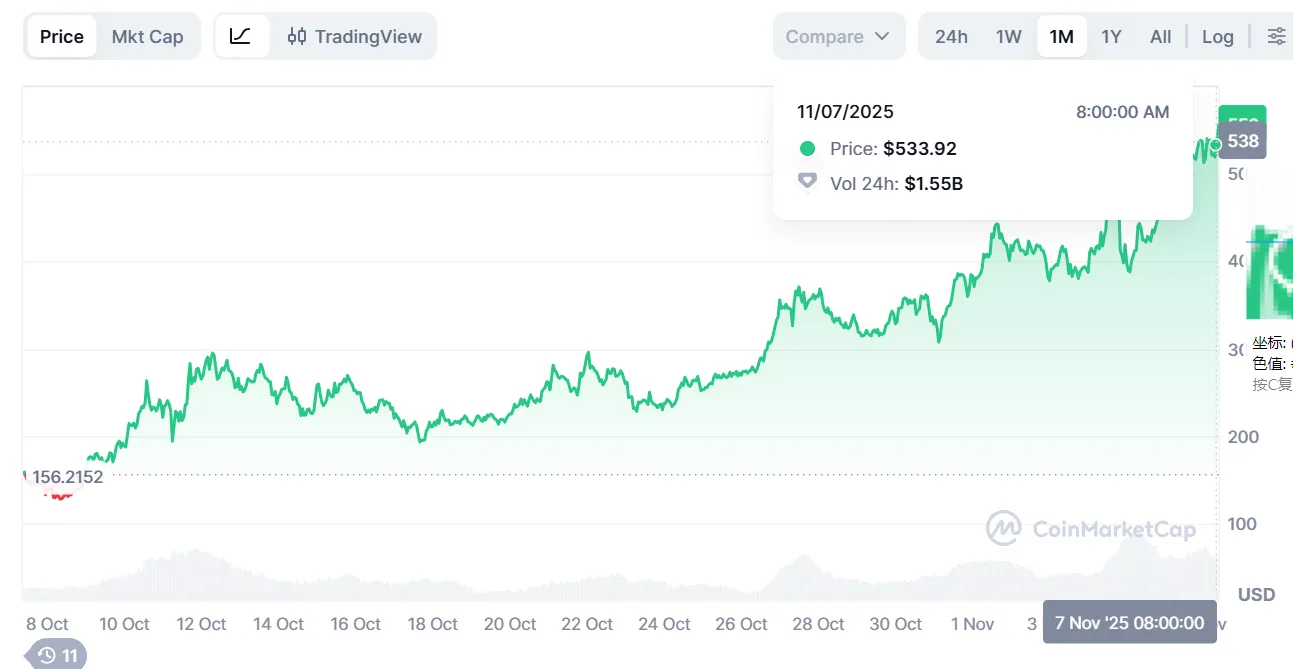

According to real-time data from CoinMarketCap, Zcash surged from $156.21 to $533.92 between October 8 and November 7, 2025, achieving a 30-day increase of 241% (3.41 times), and rising 67% from the previous high of $319 in May 2021, successfully achieving a technical breakthrough. However, it is worth noting that compared to the historical peak of $4293 in 2016, the current price is still down 88%, indicating that ZEC still has a long way to go to truly return to its peak.

In-Depth Analysis of Driving Factors

1. Prince Group Incident (Core Catalyst)

On October 14, 2025, the U.S. Department of Justice seized 127,271 BTC (worth $15 billion) from Chen Zhi, the founder of the Prince Group in Cambodia. This incident demonstrated the fatal flaw of Bitcoin's transparent ledger at the sovereign level—governments can easily track, freeze, and confiscate on-chain assets. High-net-worth users have a rigid demand for privacy protection, and the narrative that "Zcash is insurance against Bitcoin" gained empirical support. The privacy coin sector collectively exploded: ZEC rose 217%, XMR rose 9.1%, and DASH rose 12.5%.

2. Exhaustion of Cryptocurrency Narratives (Market Seeking New Hotspots)

The current crypto market is in a narrative vacuum: meme coins are experiencing aesthetic fatigue, new public chains lack innovation, and DeFi has no new stories. The market urgently needs new concepts to maintain heat and liquidity. At this time, the return of the "privacy narrative" is timely—supported by the real case of government confiscation of BTC, backed by influencers like Naval, and able to stir up nostalgia for the "return of old mining coin values." As one of the leaders in the privacy track, ZEC became a target for collective speculation. This is a typical "theme rotation": when mainstream concepts are exhausted, funds will dig into niche sectors to create new hotspots.

3. Celebrity Endorsements (Igniting FOMO)

Silicon Valley investor Naval endorsed ZEC on October 1 (when it was $68), stating that "Zcash is insurance against Bitcoin," and within a week, the price rose to $150. BitMEX founder Hayes has recently frequently endorsed ZEC, igniting retail FOMO sentiment. Crypto KOL Ansem placed ZEC on par with BTC. The dense endorsements from top KOLs created a market atmosphere of "FOMO," but also buried the hidden danger of "selling after shouting."

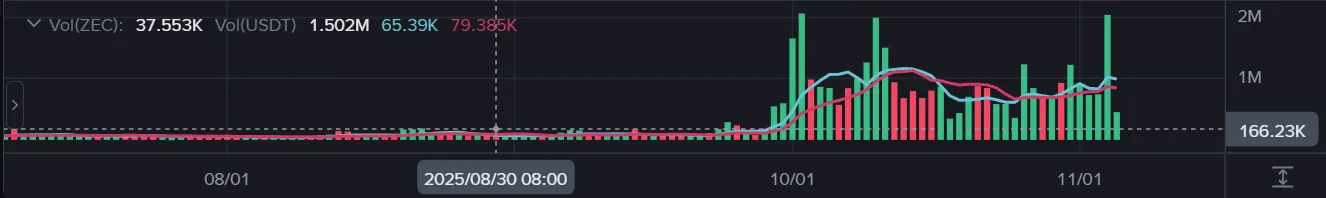

4. Liquidity Exhaustion Easily Controlled (Technical Amplification)

ZEC has long been in a "single-coin" state—daily trading volume is extremely low, attention is zero, and the price has been stagnant in the $20-50 range for years. In this extremely niche state, a small amount of capital can drive the price to skyrocket. With chips highly concentrated and a very shallow order book, the influx of buy orders leads to uncontrollable price surges. This is a typical "low liquidity amplification effect," but it also means that during sell-offs, the price will similarly plummet—there are not enough buy orders to support it.

Fundamental Verification and Risk Warning

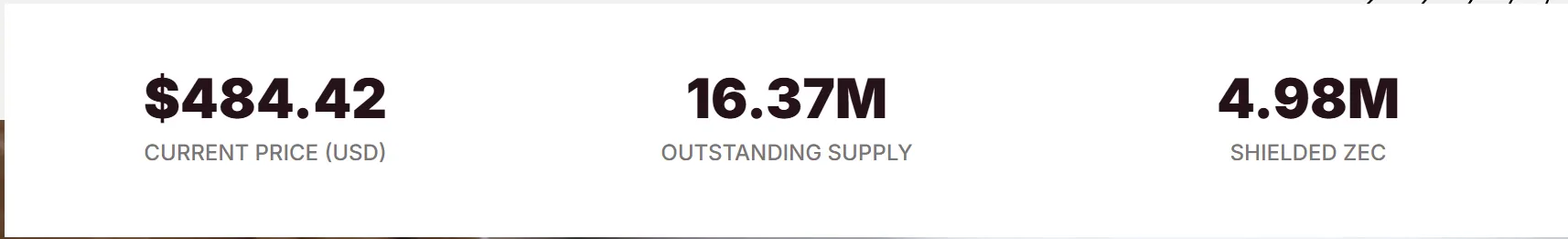

This price increase is more driven by speculation rather than fundamental growth. The core basis is that the growth in shielded transaction numbers is limited. Despite the price rising nearly tenfold, the utilization rate of the shielded pool has not increased; if there were a real explosion in privacy demand, the proportion of the shielded pool should have surged, but actual data shows almost no change.

- The "Alternative Value" of Privacy Coins: Anonymous Exchange Tools

Crypto KOL CryptoMaid pointed out: "For over a decade, the main role of these anonymous coins has been that when someone wants to sell Bitcoin anonymously, they first convert it to an anonymous coin, and then slowly sell it on third- or fourth-tier exchanges. Every bull market requires a big door to be drawn." This reveals the true positioning of privacy coins: BTC anonymous exchange tools, rather than value storage. Combined with the recent decline in BTC, the rise of ZEC may accompany selling pressure from BTC. Once BTC stabilizes or rebounds, the "exchange demand" for ZEC will disappear, and the price will quickly fall back. This explains why privacy coins surge in every bull market but never maintain long-term high positions—the core value lies in "transfer" rather than "holding."

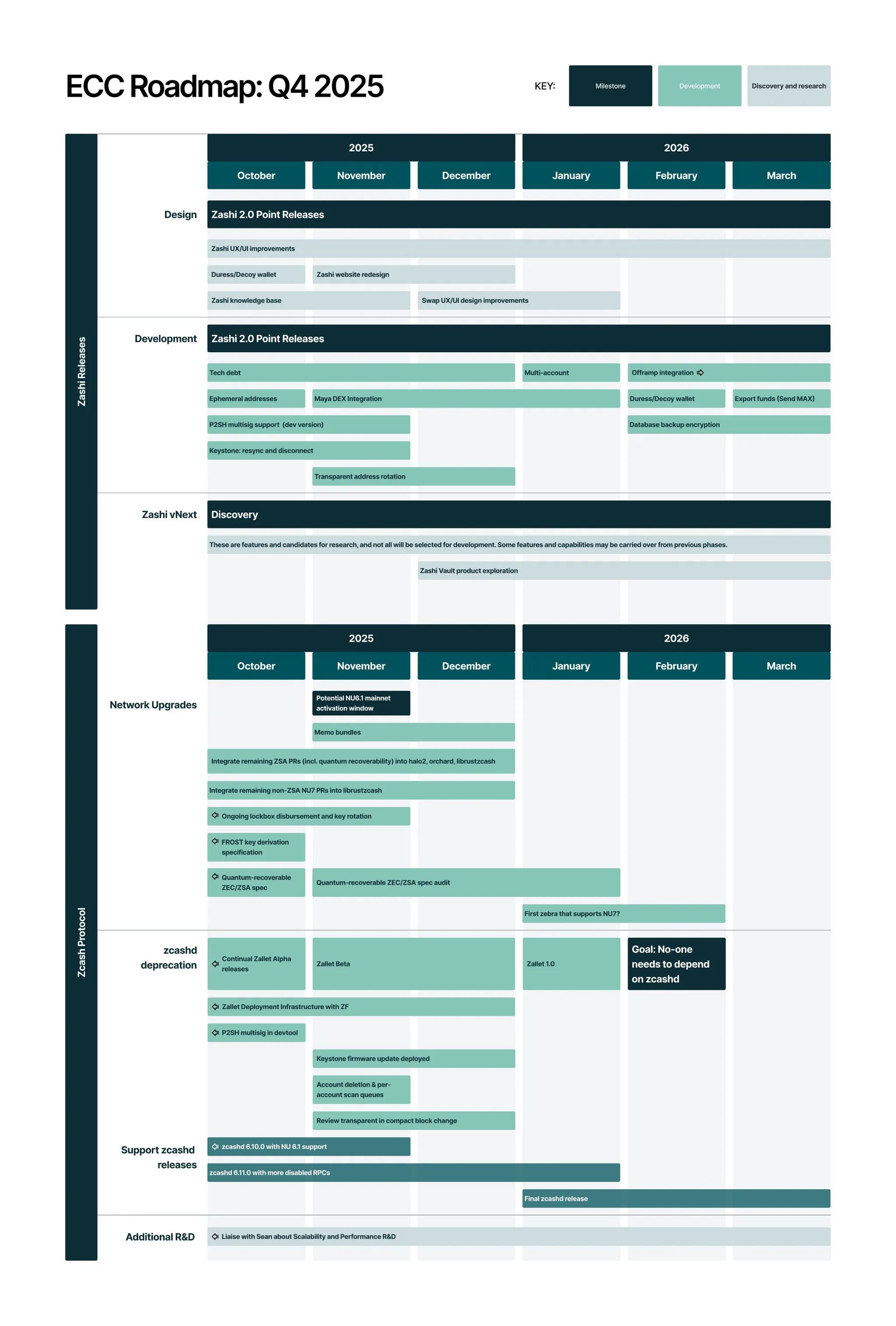

- Technological Progress Cannot Conceal Adoption Dilemma

The Orchard protocol upgrade and the ECC Q4 2025 roadmap indeed show that ZEC is not an air project. However, the key issue is that technological upgrades have not translated into growth in shielded transactions, with 70% of transactions still being transparent. zk-SNARKs technology being advanced does not equal market adoption; ZEC's challenge is not technical capability, but achieving real user growth under regulatory pressure.

Final Conclusion

The technical aspect has reached an extremely dangerous level: The price has risen from $50 to $550, with a 40-day increase of ten times, presenting a typical parabolic surge. Trading volume has shrunk even as it hits new highs, forming a textbook-level divergence between volume and price. This technical pattern historically leads to a violent correction of 30-50% in 90% of cryptocurrency cases.

The fundamentals do not support the current valuation at all: On-chain data provides solid evidence: shielded ZEC is 4.98M, accounting for 30.4%, with no significant change before the price surge. The price rose 232% but the utilization rate of the shielded pool saw zero growth, confirming the judgment of BuyUCoin's CEO—that it is "more driven by speculation rather than fundamental growth." 70% of ZEC transactions are still transparent, fundamentally contradicting its "privacy coin" positioning.

Driving factors are unsustainable: The Prince Group incident is a one-time catalyst that will not continue to occur; the theme rotation caused by the exhaustion of cryptocurrency narratives is essentially short-term speculation; KOL endorsements carry the risk of "selling after shouting"; the double-edged sword of liquidity exhaustion means that rapid increases will also lead to rapid declines.

Regulatory risk is a sword of Damocles: The issue facing privacy coins is not "whether they will be regulated" but "when they will be regulated." The attitudes of the U.S. and the EU towards privacy coins are becoming increasingly severe, with Monero, Dash, and others already delisted in multiple regions. Once Coinbase announces the delisting of ZEC, the price could plummet by more than 70% in a single day, putting investors in dire straits.

A warning of the doomsday chariot: The surge of privacy coins often signals the onset of a bear market.

Historical data shows that ZEC surged from $50 to $703.75 in January 2018 before plummeting 93%, and from $57 to $386 in May 2021 before dropping 92%. After these two peaks of ZEC, Bitcoin entered a prolonged bear market lasting 1-2 years: in 2018, BTC fell from $20K to $3K (-85%), and in 2021, BTC fell from $69K to $15K (-78%). Privacy coins are referred to as "doomsday chariots" because their surges often represent the last frenzy of market capital exhaustion, serving as a leading indicator for the entire crypto market entering a systemic bear market. When even long-silent privacy coins are being speculated upon, it indicates that the market has run out of things to speculate on, and funds have been dug into the most marginal and obscure targets, which is a typical feature of the "garbage time" at the end of a bull market.

Conclusion

The market often interprets the surge of a certain sector as "value discovery" or "track rise," but the case of ZEC may be the opposite—it is a contrarian indicator. A true track rise should be accompanied by user growth, application landing, and capital influx, but the surge of privacy coins presents completely different characteristics: it occurs at the moment when market capital is most scarce, representing the last struggle of speculative funds after mainstream asset speculation has been exhausted. It is akin to the end of the 2000 internet bubble, where even websites selling pet supplies could IPO and surge, not because pet e-commerce had prospects, but because there was nowhere else for the money to go. The structural flaws of privacy coins determine that they can only play a game of passing the parcel among existing funds; therefore, their surges are essentially a result of liquidity exhaustion rather than value reassessment, symptomatic of a market cycle turning point rather than the beginning of a new cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。