Author: arndxt

Compiled by: Tim, PANews

When the Federal Reserve intentionally extends the maturity of its Treasury holdings to suppress long-term yields (the so-called Operation Twist and QE2, QE3), it signals that economic downturn and quantitative easing will arrive simultaneously.

Powell's metaphor of "driving in the fog" applies not only to the Federal Reserve but also reflects the current global economy. Policymakers, businesses, and investors are navigating through a fog of zero visibility, relying on liquidity reflexes and short-term interests to move forward.

The new policy framework is characterized by limited visibility, weak confidence, and liquidity-driven distortions.

1. Federal Reserve's Hawkish Rate Cut

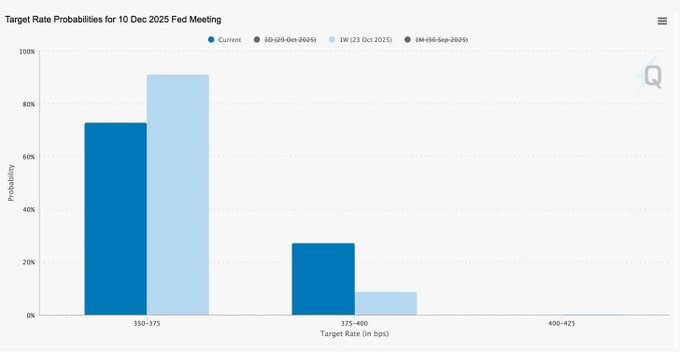

The recent "risk management" operation that lowered the interest rate range by 25 basis points to 3.75%-4.00% is less about easing policy and more about reserving options for the future.

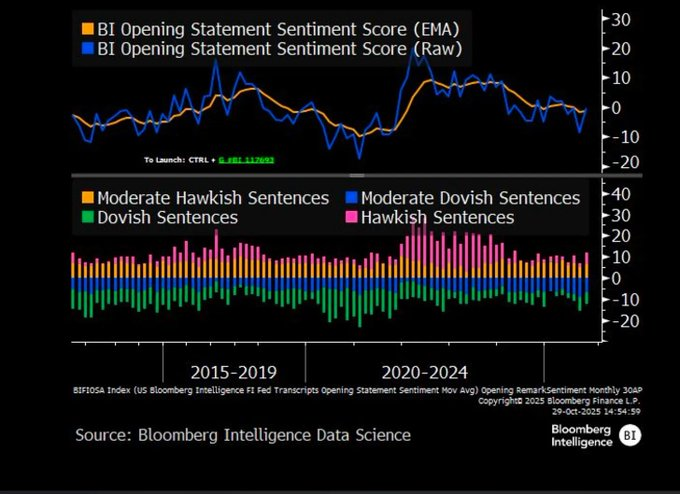

Amid opposing voices from two members, Powell effectively conveyed a clear signal to the market: slow down, policy visibility has completely vanished.

The economic data interruption caused by the government shutdown has left the Federal Reserve in a position of blind driving, with Powell sending a clear message to traders: there is no guarantee of a rate cut in December. As the market gradually digests the shift in policy stance from "data-dependent" to "cautious in a data vacuum," the probability of a rate cut has sharply declined, and the front-end yield curve has flattened.

2. 2025 Liquidity Game

The central bank's repeated backstopping has normalized speculative behavior. Liquidity, rather than productivity, now determines asset performance, a dynamic that not only pushes up valuations but also accompanies weakness in credit to the real economy.

The discussion extends to a sober recognition of the current financial architecture: passive investment centralization, algorithmic reflexivity, and retail option frenzy.

Passive fund flows and quantitative trading dominate liquidity; volatility is now determined by positions rather than fundamentals.

Retail investors' buying of call options has led to gamma squeezes that create artificial price fluctuations in the "Meme" sector, while institutional funds concentrate increasingly into narrowing leading stocks.

The host referred to it as the "Financial Hunger Games": in this system, structural inequality and policy reflexivity are forcing retail investors to adopt speculative survival strategies.

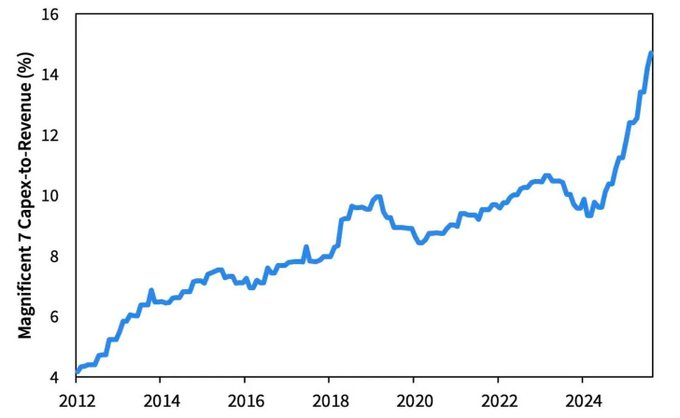

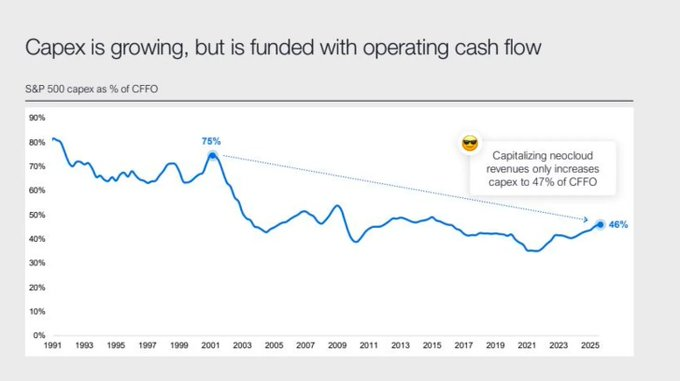

3. 2026 Outlook: Capital Expenditure Boom and Risks

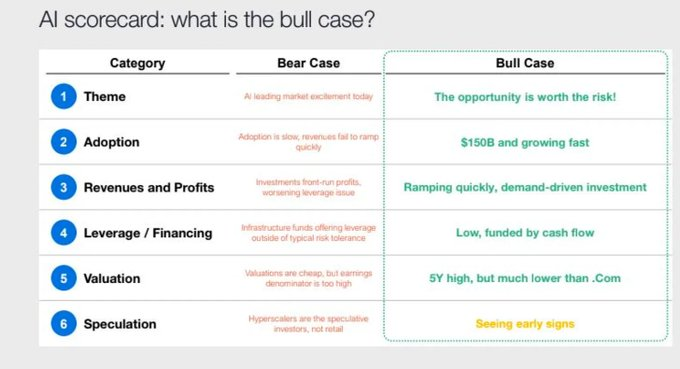

The wave of capital expenditure in artificial intelligence reflects the industrial transformation at the end of the technology giants' cycle: currently supported by liquidity, but in the future constrained by leverage sensitivity.

While corporate profits remain strong, the underlying landscape is undergoing historic changes: technology giants are transforming from light-asset cash cows to heavy-asset infrastructure operators.

Initially, AI and data center construction relied on cash flow support, but now they are shifting towards record debt issuance (such as Meta's $25 billion oversubscribed bond).

This transformation implies margin compression, rising depreciation costs, and ultimately leads to refinancing pressures, laying the groundwork for the next turn in the credit cycle.

4. Economic Structure Review: Trust, Inequality, and Policy Cycle

From Powell's cautious tone to the reflections after the last podcast, a common thread is becoming clearer: concentration of power and erosion of trust.

Policies continue to provide bailouts to large institutions, exacerbating wealth concentration and undermining market integrity. The coordinated actions of the Federal Reserve and the Treasury, shifting from quantitative tightening to Treasury bond purchases, have reinforced this trend, resulting in continued ample top-level liquidity, while ordinary households struggle to survive under the dual pressures of stagnant wages and rising leverage.

The decisive macro risk today is no longer inflation, but institutional fatigue. The market may seem to be advancing rapidly, but trust in fairness and transparency is eroding, which is the true systemic issue of the 2020s.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。