Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The ongoing government shutdown in the United States has led to a halt in the release of official economic data, leaving the market in a state of "blind flying," forcing investors to rely on private data to assess economic health. Among these, the report from Challenger, Gray & Christmas revealed a severe employment situation: In October, companies announced layoffs of 153,000 people, the highest for the same period in 20 years, a year-on-year increase of 175%, with artificial intelligence explicitly listed as one of the reasons for the layoffs for the first time. Weak employment data has raised concerns about an economic recession, putting pressure on U.S. stocks, with technology stocks leading the decline, and the S&P 500 index experiencing a new round of sell-offs. Against this backdrop, Tesla's annual shareholder meeting voted to approve CEO Musk's compensation plan worth a trillion dollars.

In terms of monetary policy, Federal Reserve officials are cautious about interest rate cuts due to the lack of data, but the market has priced in a 69% probability of a rate cut in December. Meanwhile, Bridgewater founder Ray Dalio warned that the Fed's end to quantitative tightening is akin to "injecting stimulus into a bubble," which could lead to a liquidity frenzy similar to 1999, but with significant long-term risks. Additionally, the U.S. Supreme Court's ruling on international trade tariffs has become a focal point; if tariffs are deemed illegal, it could drive a broad rise in U.S. stocks and affect market sentiment.

In the Bitcoin market, analysts' views have diverged significantly. JPMorgan analysts are extremely optimistic, predicting that Bitcoin could rise to $170,000 in the next 6 to 12 months, citing that market leverage levels have normalized and Bitcoin's volatility relative to gold has improved. They believe the current Bitcoin price is about $68,000 below its fair value. However, Ark Invest founder Cathie Wood has lowered her Bitcoin price forecast for 2030 from $1.5 million to $1.2 million, arguing that the rise of stablecoins is encroaching on Bitcoin's role in payment scenarios, though she remains optimistic about its long-term institutional adoption prospects. In terms of price, Bitcoin recently fell below the key psychological support level of $100,000, currently hovering around $103,000, facing strong sell order resistance above $105,000. Traders warn that this may aim to push the price down to the range of $98,000 to $93,000. CryptoQuant's analysis is more pessimistic, with its bull market index dropping to zero, and the price falling below the key support of the 365-day moving average at $102,000. If it cannot recover quickly, it may face risks of a deep pullback to $91,000 or even $72,000. Trader that1618guy also pointed out that if the weekend cannot hold the low of $98,800, it may signal a longer adjustment period. Glassnode data shows that Bitcoin spot ETFs have seen a net outflow of $2 billion since October 29, with long-term holders continuing to sell, indicating a weakening market confidence. However, on-chain indicators like the MVRV ratio have dropped to historical low areas, suggesting that the market may be forming a local bottom. Additionally, today, Bitcoin options worth over $5 billion are set to expire, with the maximum pain price at $108,000, leading to cautious market sentiment.

The Ethereum market has also experienced significant volatility, with this drop causing Ethereum to test a key long-term support area again. According to Deribit data, the maximum pain price for upcoming Ethereum options is at $3,800, with major positions concentrated in $3,500 put options and $4,200 call options. Notably, with a large number of short positions established, over $7 billion in short liquidation liquidity has accumulated around $4,000, setting the stage for a potential "short squeeze." Meanwhile, technical analysts have pointed out that a hidden bullish divergence signal has appeared on Ethereum's daily chart, which usually indicates a potential trend reversal, but the market is expected to oscillate between $2,800 and $4,100 in the short term.

The DeFi sector is undergoing a trust crisis, exemplified by the collapse of Stream Finance, which exposed the fatal flaws of the "Curator" model. This opaque fund management method has led to $160 million of user funds being frozen and triggered a chain reaction affecting multiple protocols such as Euler and Elixir, with systemic risk exposure reaching $285 million. Meanwhile, the AI and decentralized storage sectors have strengthened against the trend, with the DFINITY Foundation launching the AI platform Caffeine, driving its token ICP price up over 160% since November, and boosting the "rotation" rise of storage tokens like FIL, STORJ, and AR. In the mainstream public chain sector, analyst Murphy pointed out that Solana has entered an "oversold" structure after a significant price drop, with the current price below the holding cost of most whale wallets, and 65% of tokens are in a loss state. If the Bitcoin market stabilizes, SOL may see structural opportunities.

2. Key Data (as of November 7, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $102,332 (YTD +9.36%), daily spot trading volume $121.11 billion

Ethereum: $3,365 (YTD +0.82%), daily spot trading volume $73.5 billion

Fear and Greed Index: 21 (Fear)

Average GAS: BTC: 1 sat/vB, ETH: 0.1 Gwei

Market share: BTC 59.7%, ETH 11.9%

Upbit 24-hour trading volume ranking: XRP, BTC, ETH, MMT, FIL

24-hour BTC long-short ratio: 49.57%/50.43%

Sector performance: AI sector up 11.8%, DePIN sector up 13.6%

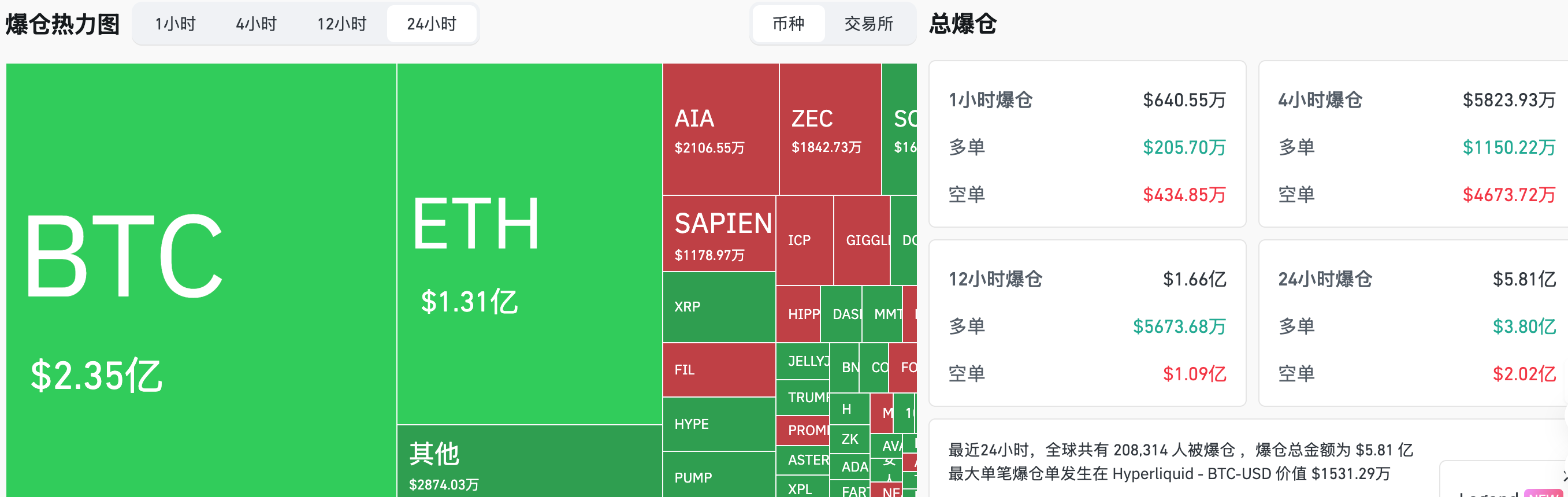

24-hour liquidation data: A total of 208,314 people were liquidated globally, with a total liquidation amount of $581 million, including $235 million in BTC liquidations, $131 million in ETH liquidations, and $21.06 million in AIA liquidations.

3. ETF Flows (as of November 6)

Bitcoin ETF: +$240 million, turning from net outflow to net inflow after 6 days of outflow

Ethereum ETF: +$12.5099 million, turning from net outflow to net inflow after 6 days of outflow

4. Today's Outlook

U.S. October unemployment rate: previous value not published, expected value 4.4% (to be confirmed)

U.S. October seasonally adjusted non-farm payrolls (10,000): previous value not published, expected value 1.5 (to be confirmed)

RedStone (RED) will unlock approximately 5.54 million tokens at midnight on November 7, accounting for 2.40% of the current circulation, valued at approximately $1.8 million;

Space and Time (SXT) will unlock approximately 24.64 million tokens at 9 PM on November 8, accounting for 1.62% of the current circulation, valued at approximately $1.3 million;

BounceBit (BB) will unlock approximately 29.93 million tokens at 8 AM on November 9, accounting for 3.85% of the current circulation, valued at approximately $3.3 million;

The largest gainers among the top 100 cryptocurrencies today: DeAgentAI up 655%, Filecoin up 59.2%, Internet Computer up 32.2%, Tezos up 21.3%, Aptos up 18.7%.

5. Hot News

Google to integrate Kalshi and Polymarket prediction data into Google Finance

Deribit: Over $5 billion in Bitcoin and Ethereum options set to expire on Friday

Elixir: 80% of deUSD holders have completed redemptions in the past 48 hours

Solana, Fireblocks, Monad, and others collaborate to promote cross-chain payment standardization

Binance becomes a validator node for the Sei network, helping to ensure Sei network security

Exodus discloses October financial update: holds 2,147 BTC, 2,784 ETH, and 49,567 SOL

GoPlus: Creator of meme coin "Binance Life" actually made only $4,000

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。