Inside Michael Saylor Bitcoin Strategy as Crypto Market Turn Red Today

While most of the crypto market flashed red this week, Michael Saylor Bitcoin strategy stayed true to its “orange” conviction – buy the dip, hold long, and accumulate more BTC.

Source: MichaelSaylor

The founder and executive chairman of MicroStrategy remains the most vocal bull in the market, even as BTC slid 3.2% in the last 24 hours and over 7% for the week. Saylor’s post on X summed it up perfectly: “Orange is the color of November.”

MicroStrategy Bitcoin Acquisition Continues

Despite the pullback, Saylor’s company MicroStrategy now holds 640,808 Bitcoin, valued at roughly $71.07 billion, with unrealized gains of over ₿140,000 in 2024 alone. The average yield for the year stands at 74.3%, reflecting how the firm’s early conviction in Bitcoin continues to outperform most traditional assets.

Source: MicroStrategy

His approach remains simple but powerful, converting corporate cash into Golden asset-BTC and treating it as a superior treasury reserve asset. Every dip, according to Michael-Saylor, is an opportunity, not a setback.

Crypto November 2025: Red Charts vs Orange-Conviction

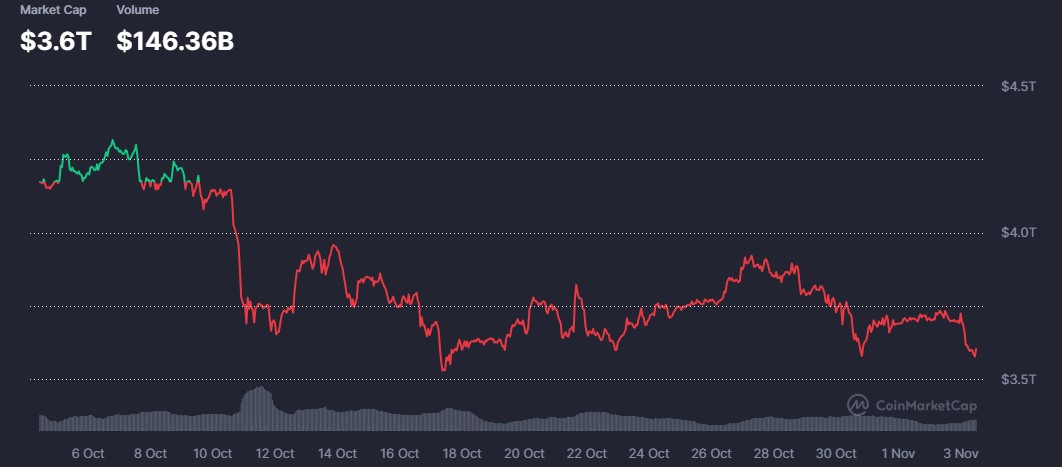

The broader crypto market , however, tells a different story. A 3.2% daily drop extended a 7.37% weekly slide as investors reacted to hawkish U.S. Fed comments, a $128 million Balancer exploit, and $395 million in liquidations.

Fear is rising, but Strategy owner sees accumulation time. While the Crypto Fear & Greed Index dropped to 36, MicroStrategy’s BTC-stack grew again this quarter, proving that conviction outweighs volatility.

Market Pressure Meets Long-Term Vision

Bitcoin ETFs saw over $1.15 billion in outflows last week as traders trimmed exposure ahead of key economic data. Yet, Saylor-remains unfazed. His steady BTC yield, 26% year-to-date, reflects that even amid macro jitters, his buy-and-hold strategy continues to outperform short-term speculation.

Analysts say Saylor’s stance could set the tone for “institutional patience,” especially as BTC dominance climbs above 59%, signaling a rotation back into blue-chip crypto.

The Orange Signal Ahead

As the Fed tightens its tone and DeFi faces renewed security concerns, Bitcoin’s resilience continues to define the market’s emotional cycle. For Michael-Saylor, every correction is another “orange moment”, a chance to strengthen conviction in digital scarcity.

If BTC holds its $106K support, bulls expect another breakout wave toward year-end. But even if prices dip lower, Michael Saylor’s strategy remains unchanged: buy the dip, hold forever, and let the orange-shine through the red.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。