Fed Liquidity Injection Boost $29B Overnight: BTC Surge, What Next?

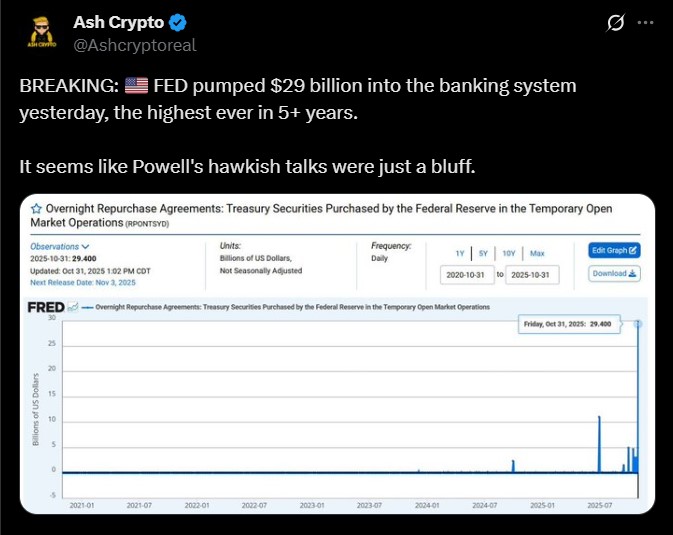

The Federal Reserve quietly added $29 billion in cash flow to the U.S. banking system, the biggest Fed liquidity injection in more than five years, and it immediately moved the crypto market.

Bitcoin, Ethereum, and other coins bounced back after days of falling prices, giving traders fresh hope. The total cryptocurrency market cap jumped 2%, reaching $3.71 trillion.

But experts say this might not be a long-term change. The Federal reserve's goal was to fix short-term banking stress, not start another big money-printing phase.

Fed Liquidity Injection Double Game: Talk Tough, Print Quietly

Cryptocurrency analyst Ash Crypto explained it perfectly : “Powell’s hawkish talk was just a bluff. Fed liquidity boost adds $29 billion = turning dovish overnight.”

He said that after Powell speech US Fed liquidity injection was just a short-term repo operation, like clearing a small blockage in the system, not flooding the market with new money.

This crypto fed news reflects two-sided game:

-

Hawkish talk in public to look serious about controlling inflation.

-

Quiet Cash flow boost in the background to keep banks stable.

In short, Jerome Powell is talking tough to protect credibility, but still adding cash to prevent a financial freeze.

Fed Liquidity Boost Impact on Crypto Market Explained

Crypto Liquidity is like oxygen for markets, and this fresh $29B cash flow triggered a market surge in just a few hours.

-

Bitcoin Price surged around 2% to $110,399.66

-

Ethereum price analysis reflects that the asset surged 1.31% to $3,874.12 after the weekly crash. $ETH chart for now looks healthy, but its trading volume fell 47.31% to $21B.

-

After they added $29 billion fund, the overall crypto also surged around 2%, resulting in improved investor sentiment as fear and greed index also rose from yesterday’s 29 to today’s 33% fear rate.

History Repeats? The 2020 Chart Hints At BTC ATH

This isn’t the first time the federal reserve has done this. The last big Fed liquidity injection was in 2020, and that year BTC price exploded to new highs.

That’s why many traders are getting excited again. But experts warn this cash flow infusion is still a temporary fix, not a new long-term easing plan.

Despite the token’s price increase, trading volume dropped 52.76% to $31.05B. That means people are cautiously optimistic — not rushing in yet.

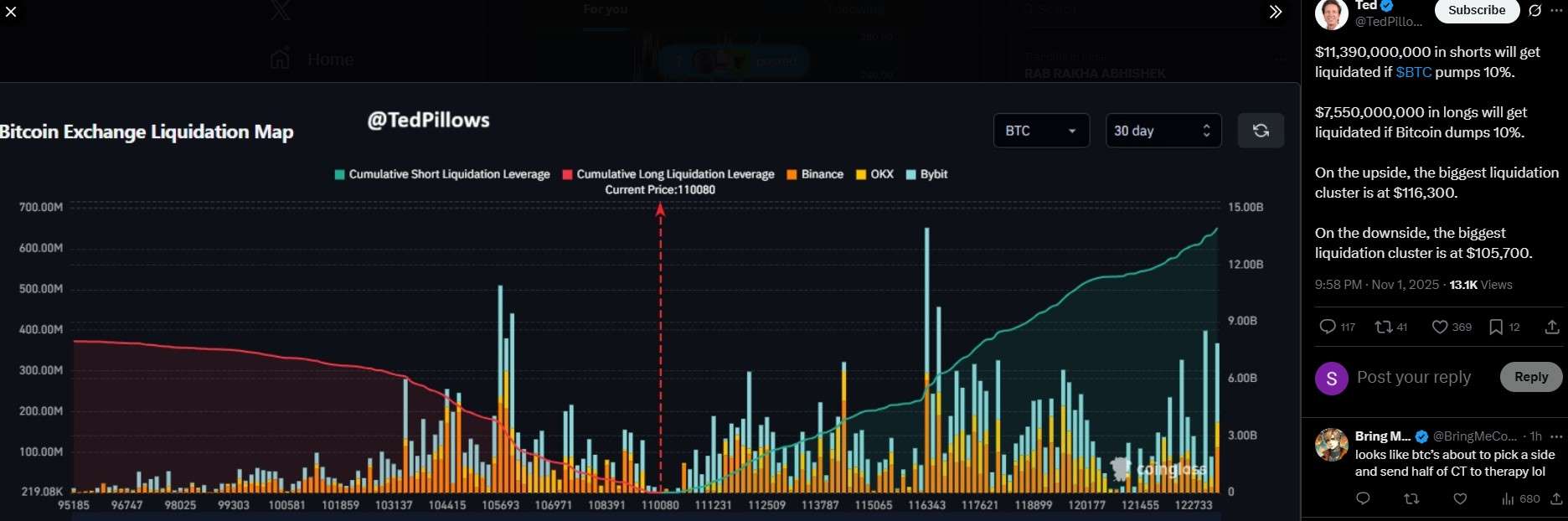

Analyst Ted Pillows shared two possible BTC liquidation scenarios:

-

If it jumps 10%, around $11.39B in shorts will be wiped out.

-

If it drops 10%, about $7.55B in longs will be liquidated.

Key price zones to watch:

-

Upside target: $116,300

-

Downside support: $105,700

In short, if the crypto king breaks above $116K, we might see a short squeeze and a fast rally to new ATH. But if it falls below $105K, the opposite could happen.

Top Crypto Analyst at Coingabbar added, “If cash inflow keeps showing up, that’s when it becomes structural easing. For now, “Federal Reserve is just fixing a small blockage in the system, not adding more money into it.

Conclusion

The Fed liquidity injection of $29B has brought life back to the cryptocurrency market, even if only for now. Whether this turns into a long rally depends on if the federal reserve keeps adding cash in the coming weeks. For now, it’s clear that Powell is balancing two sides — talking tough to fight inflation but quietly keeping the system running.

Disclaimer: This article is for informational purposes only, and does not support any investing advice. So always DYOR before making any financial decision in the crypto industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。