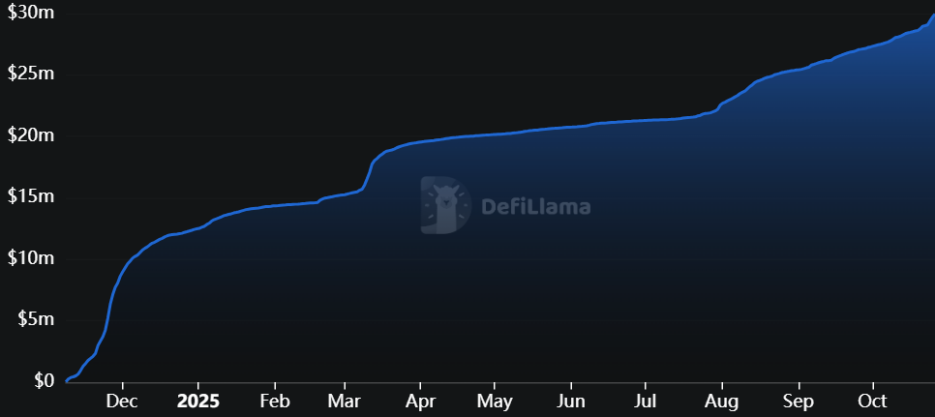

Since its launch in November last year, Clanker has generated nearly $30 million in cumulative fees, becoming a highly competitive financial infrastructure project within the Base ecosystem due to its low operating costs and high profitability.

Author: J.A.E

Recently, the decentralized social protocol Farcaster announced the acquisition of Clanker, a leading token issuance platform on the Base chain. Following the completion of the transaction, Farcaster immediately announced that Clanker would initiate a buyback and deflationary plan, using two-thirds of the protocol's long-term revenue to repurchase CLANKER tokens.

After the announcement, the price of CLANKER tokens surged significantly, with an increase of over four times within the week. On the surface, this acquisition appears to be part of Farcaster's ecological plan to build a value capture mechanism through Clanker, but it may also signal the next trend in the decentralized social space.

Clanker Empowers Farcaster with One-Click AI Token Issuance

Clanker attracted the strategic acquisition by the decentralized social protocol Farcaster, likely due to its AI-powered innovative business model and substantial revenue-generating capability.

Clanker is a token issuance platform deployed on the Base chain, and its unique value lies in its one-click generation feature driven by AI Agents, allowing users to easily issue ERC-20 tokens without any complex programming knowledge. This innovation significantly simplifies the token creation process, lowering the technical barrier to the minimum.

Notably, Clanker allows users to create tokens directly on Farcaster using social tagging (tagging @clanker), creating a new paradigm for SocialFi. AI Agents are no longer limited to chat tools but have become a high-frequency, efficient, and profitable Web3 financial infrastructure, combining AI automation with the immediacy and community-driven nature of social media. This transformation converts social sentiment into on-chain financial actions, significantly reducing the friction cost for users transitioning from "social interaction" to "on-chain transactions."

Additionally, Clanker boasts strong revenue-generating capabilities. According to data from clanker.world, since its launch in November last year, Clanker has generated nearly $30 million in cumulative fees.

The protocol's profit source comes from a 1% transaction fee charged on every trade of the tokens issued by Clanker on Uniswap V3. Of this fee, 60% goes to the protocol, while 40% is distributed to the token creators. Clanker's anonymous co-founder revealed that the protocol has been profitable since its first day of launch, with a small team and low operating costs, allowing most of its revenue to be considered net profit, making it one of the most profitable projects in the Base ecosystem.

Integration Trend of "Social Graph + Financialization" in the Decentralized Social Space

Farcaster's acquisition of Clanker may indicate that the decentralized social space will surpass traditional social graph competition and shift towards embedded financialization and direct value capture.

Alongside the acquisition, Clanker's token deployment tool will be directly integrated into Farcaster's social graph. This integration represents a deep fusion of artificial intelligence (AI) and social finance (SocialFi), forming a unified and highly operable ecosystem. With this move, Farcaster may become a "one-stop center" for community token creation.

This acquisition also marks Farcaster's upgrade from a purely decentralized social protocol to a comprehensive ecosystem that integrates social, creative, and issuance functions. While decentralized social protocols like Lens focus on data ownership, Farcaster intends to achieve a "monetization" effect through Clanker. The addition of Clanker will help Farcaster provide users with the shortest path from "idea" (posting) to "financial product" (token issuance), further solidifying its position as the decentralized social center on the Base chain and creating strong network effects and competitive barriers.

In fact, before Clanker was successfully acquired, it had also undergone a fierce acquisition battle that attracted widespread market attention. According to a tweet from Clanker's founder Jack Dishman, the crypto wallet provider Rainbow had approached Clanker in August to initiate acquisition discussions, planning to acquire Clanker for 4% of its upcoming RNBW token's total supply to integrate its token launch functionality. However, Clanker deemed the acquisition by Rainbow an unsuitable choice and rejected the proposal. After receiving the response, Rainbow threatened Clanker with public disclosure of the proposal letter if the deal was not accepted. Although Clanker reiterated its refusal, Rainbow proceeded to publish the acquisition terms without Clanker's consent, further exacerbating Clanker's dissatisfaction with their communication methods and misconduct.

In contrast, Farcaster's acquisition proposal appears to be a better fit, promising strong strategic synergies and a shared ecosystem. Jack Dishman emphasized that "Clanker's success is inseparable from Farcaster," as it is "rooted in the open social graph's lines and thriving ecosystem," indicating that Clanker's strategic choices align more closely with Farcaster's social functions. Furthermore, Farcaster's offer is cooperative, proposing acquisition terms while considering Clanker's independence and community interests. First, Farcaster retains Clanker's original token system and commits to using two-thirds of the protocol's revenue for repurchasing CLANKER tokens. Second, Farcaster has also destroyed the early protocol fee pool and locked 7% of the total supply in a unilateral liquidity position, thereby reducing circulating supply and maximizing the interests of token holders.

Clanker Places Greater Emphasis on Creator Incentives Compared to Pump.fun

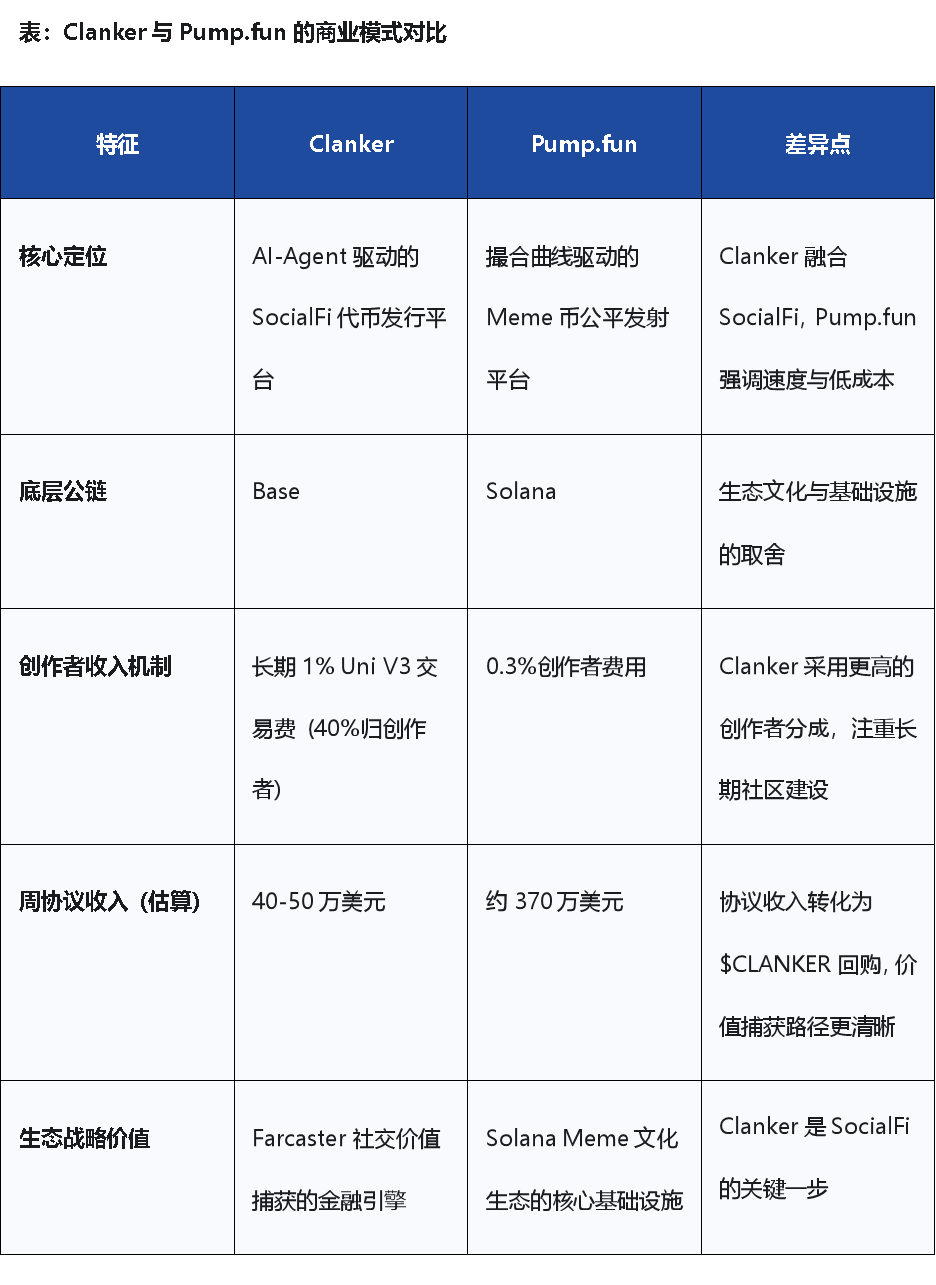

Clanker's success is not merely a replication; its business model significantly differs from the Meme coin launch platform Pump.fun on Solana.

The main distinction between Clanker and Pump.fun lies in their incentive mechanisms. Clanker adopts a creator economy model based on the long-tail effect and continuous incentives. Tokens issued through Clanker generate ongoing revenue sharing (40% of transaction fees) for token creators when traded on Uniswap V3. This mechanism may encourage creators on Farcaster to view Meme coins as a sustainable source of income, closely linking their interests with the long-term liquidity and trading volume of the tokens, which aligns more with Farcaster's decentralized social spirit.

In contrast, Pump.fun's mechanism focuses more on incentivizing early users and price discovery through bonding curves, transitioning to DEX after reaching a certain market cap. While this model benefits short-term speculation and fair launch culture, it does not provide the same level of ongoing income security for creators as Clanker's revenue-sharing model.

In terms of liquidity management and trading mechanisms, the two platforms have also chosen different strategies. Clanker employs a long-term 1% Uni V3 trading fee mechanism, focusing on sustainable liquidity supply and fee generation. The advantage of this model is that liquidity remains on Uni V3, transparent and controllable, ensuring depth and credibility of liquidity, which helps attract more traders.

On the other hand, Pump.fun uses bonding curves to determine prices, only launching on DEX after the tokens reach a certain market cap. While this model somewhat delays internal selling pressure, it may lack the depth of integration with mature DeFi infrastructure that Clanker possesses in liquidity management.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。