Author: Gu Yu, ChainCatcher

An indisputable and obvious fact is that crypto VCs have been declining in the market cycle in recent years. The return rates, influence, and power of almost all VC institutions have decreased to varying degrees, and even VC tokens have been "scoffed at" by many investors.

There are many summarizable reasons for this, such as the fact that most VCs are accustomed to selling tokens and have too many capital-raising projects, leading users to develop a dislike for VC tokens. More funds are flowing into narratives with lower VC content, such as meme coins and AI agents, resulting in a lack of liquidity for VC tokens. Additionally, the token unlocking periods for VCs are becoming longer, leading to slower exit cycles and unfavorable positions.

Several seasoned investors have also provided their explanations. Jocy Lin, founder of IOSG Ventures, believes that during the bull market cycle of 2021, the liquidity in the primary market was extremely abundant, and VCs raised a large amount of capital in a short time. This surplus of capital led to generally inflated project valuations and inadvertently amplified the "narrative-driven" investment model. Many VCs are still stuck in the easy money model of the previous two cycles, believing that products and tokens are unrelated. They chase grand narratives and potential tracks while neglecting the project's true product-market fit (PMF) and sustainable revenue models.

Jocy Lin further explains that the dilemma of crypto VCs essentially lies in the "mismatch between value capture ability and risk-bearing." They bear the longest lock-up periods and the highest risks but are in the weakest position within the ecosystem, being squeezed by exchanges, market makers, and KOLs. When the narrative-driven model collapses, native VCs lacking industrial resources lose their foundation for existence—money is no longer a scarce resource; liquidity and certainty are.

According to Will, a partner at Generative Ventures, exchanges and market makers have become the true exploiters of all liquidity and premiums in this cycle. Most projects that receive VC funding essentially do two things: first, marketing hype, and second, paying listing fees to exchanges. These projects are essentially marketing companies that need to pay a lot of money to exchanges and market makers. Moreover, nowadays, VC tokens must be locked for 2-3 years after being listed, which is even longer than in traditional securities markets, so their liquidity expectations for unlocking exits are very poor, making it difficult to make money.

Anthony Zhu, founding partner of Enlight Capital, believes that Asian VCs, primarily focused on token strategies, are caught in a death spiral in the current sluggish altcoin market. The rapid profit-making effect of the previous bull market has created a strong path dependency at both the LP and GP levels. When this path is extended or even ceases to exist, VCs face bilateral pressure from LPs' short-term return expectations and projects deviating from fundamentals, ultimately leading to distorted actions. The current situation is essentially a mismatch of opportunities among some LPs, GPs, and the market.

However, aside from the overall decline of VCs, a more concerning phenomenon and issue is that the overall activity and influence of Asian VC institutions seem to have declined more significantly in this cycle. In RootData's list of the 2025 Top 50 VCs based on activity and exit performance released this month, only 2-3 Asian VCs, such as OKX Venture, made the cut. In the recent IPO boom and major merger exit cases (such as Circle, Gemini, Bridge, Deribit, etc.), only IDG Capital achieved significant returns from its early investment in Circle, while other Asian VCs were largely absent.

Further observation shows that once very active and well-performing Asian VC institutions, such as Foresight Ventures, SevenX Ventures, Fenbushi Capital, and NGC Ventures, have made no more than 10 or even 5 moves this year, with very little progress in fundraising.

From once being influential to now falling into silence, why have Asian VCs found themselves in such a predicament?

1. Why Can't Asian VCs Compete with Western VCs?

In the same macro environment, Asian VCs cannot compete with Western VCs. Some interviewees believe this is mainly due to factors such as fund structure, LP types, and internal ecosystems.

Jocy Lin of IOSG Ventures believes this is partly due to the severe lack of a mature LP group in Asia. As a result, many Asian VC funds primarily raise capital from high-net-worth individuals and entrepreneurs in traditional industries, as well as some idealistic OGs in the crypto industry. Compared to the U.S. and the West, the lack of support from long-term institutional LPs and endowment funds has led Asian VCs to be more inclined towards thematic speculative investments under LP exit pressure, rather than systematic risk management and exit design. The lifespan of individual funds is relatively short, making them more vulnerable during market contractions.

"In contrast, most Western funds have a cycle of over 10 years, with a more mature system in fund governance, post-investment empowerment, and risk hedging, allowing them to maintain more stable performance during downturns." In this regard, Jocy Lin also called on X to urge exchanges to introduce rescue funds amounting to hundreds of millions of dollars, stating that if they cannot participate directly, they should invest in VCs to enable them to fulfill the role of capital feeding back to entrepreneurs.

Jocy Lin also mentioned that Western funds tend to adhere to a human-centered value investment philosophy, allowing them to operate projects in the crypto industry for the long term. Founders who can maintain a project's fundamentals across cycles possess significant entrepreneurial resilience, and such founders are extremely rare in the industry. While some Western investors have succeeded, the success rate of their investment models in the crypto industry is very limited.

Moreover, the subsequent rise in project valuations driven by U.S. funds has negatively impacted many participating Asian funds. Due to shorter fund cycles and a pursuit of short-term cash returns, Asian funds have begun to diverge, with some betting on higher-risk tracks like gaming and social media, while others aggressively enter the secondary market. However, both of these models struggle to achieve excess returns in the volatile altcoin market, even leading to significant losses. "Asian funds are very patient and faithful, but this industry has relatively let them down in this cycle," Jocy Lin lamented.

Anthony Zhu shares a similar view. He states that Western funds are generally larger in scale and have deeper pockets, allowing for more flexible investment strategies and better performance in non-unidirectional rising market environments.

Another key factor is that Western projects have more exit methods and opportunities, rather than relying solely on listing on a single exchange. In the recent merger boom, the main acquirers have been leading crypto companies and financial institutions from the U.S. and Europe. Due to geographical, cultural, and other reasons, Asian crypto projects have not yet become high-priority targets for these acquirers. Additionally, most current IPO projects also have a Western background.

Source: RootData

Due to more accessible equity exit channels, Western VCs often have more diverse investment targets. In contrast, many Asian VCs, limited by team backgrounds, fund structures, and exit channels, typically avoid equity investments, thus missing out on many tenfold or even hundredfold project opportunities.

However, Anthony also emphasizes that while Asian crypto VCs focused on token investments have performed poorly overall since the last cycle, some Asian dollar VC institutions investing in equity projects have performed excellently. "Mainstream institutional VC investors tend to be more patient, and their performance will manifest over the long term. Asia has some of the best crypto entrepreneurs in the world working hard on innovative products, and in the future, more Asian projects will enter mainstream exit channels in the U.S. and Europe. Asia also needs more long-term capital to support outstanding early-stage projects."

Will offers another unconventional perspective. In his view, the poor performance of Asian VCs is due to being too close to Chinese exchanges. The closer they are, the worse it gets, as they all pin their exit hopes on exchange listings. However, in this cycle, exchanges are the biggest exploiters of liquidity. "If these VCs had seen the situation clearly before, they should have bought exchange tokens like BNB, OKB, and BGB, rather than investing in so many small projects that rely heavily on exchange listings, only to find themselves locked in."

2. The Transformation of VCs and the Industry

Crisis breeds change, and a major reshuffling of the crypto VC landscape is now inevitable. If the years 2016-2018 marked the rise of the first generation of crypto VCs, and 2020-2021 saw the emergence of the second generation, we are now likely entering the third generation of crypto VC cycles.

In this cycle, in addition to the previously mentioned focus on dollar equity investments, some VCs will pay more attention to the more liquid secondary market and related OTC fields. For example, LD Capital has completely shifted to the secondary market in the past year, heavily investing in tokens like ETH and UNI, sparking significant discussion and attention, and has become one of the most active players in the Asian secondary market.

Jocy Lin states that IOSG will not only place greater emphasis on equity and protocol investments in the primary market but will also extend its research capabilities based on past foundations, considering various strategies such as OTC or passive investment opportunities and structured products in the future to better balance risk and return.

However, IOSG will still maintain an active stance in the primary market. "In terms of investment preferences, we will focus more on projects with real revenue, stable cash flow, and clear user demand in the future, rather than relying solely on narrative-driven investments. We hope to invest in targets that can still possess intrinsic growth momentum and sustainable business models in an environment lacking macro liquidity," Jocy Lin said.

When discussing cash flow and revenue, the most notable project in this cycle is Hyperliquid, which, according to DeFillama data, has generated over $100 million in revenue in the past 30 days. However, Hyperliquid has never received VC investment, and this community-driven development model that does not rely on VCs sets a new path for many projects. Will there be more high-quality projects learning from Hyperliquid, further diminishing the role of crypto VCs? Additionally, with the increasing number of KOL rounds and community rounds, to what extent will they replace the role of VCs?

Anthony believes that for certain types of DeFi projects like Perp, due to the small team size required and strong profit-making effects, models similar to Hyperliquid may continue to exist. However, this may not hold true for other types of projects. In the long run, VCs remain an important force in promoting the large-scale development of the crypto industry and linking institutional capital with early-stage projects.

"The success of Hyperliquid largely stems from its product's self-circulating characteristics—being a perpetual contract protocol, it inherently possesses the ability to generate revenue and market-driven effects. However, this does not mean that the 'no VC' model can be universally replicated. For most projects, VCs remain a key source of funding for product development, compliance consulting, and long-term capital in the early stages," Jocy Lin stated. "In any sub-sector and industry of traditional TMT, there is not a single track without the participation of VCs and capital (such as AI or healthcare). Industries without VCs are absolutely unhealthy. The moat of VCs has not disappeared; it has transformed from providing money to providing resources and patience."

Jocy Lin also shared a statistic: projects backed by leading VCs have a three-year survival rate of 40%. In contrast, fully community-driven projects have a survival rate of less than 10% over the same period.

When discussing KOL rounds and community rounds, Jocy Lin believes their rise is indeed changing the structure of early financing. They can help form consensus and community momentum in the early stages of a project, especially excelling in marketing and go-to-market (GTM) strategies. However, the empowerment of this model is mainly limited to narrative dissemination and short-term user mobilization, with limited support for long-term governance, compliance, product strategy, and institutional expansion of projects.

Currently, Asian crypto VCs are facing the lowest point in many years. The rapid changes in internal and external ecosystems and narrative logic have led VCs onto different trajectories. Some VC names have already fallen into the dust of history, some are still hesitating, and some are making drastic adjustments, exploring how to form a healthier and more sustainable relationship with projects.

However, the exploitative state of market makers and exchanges continues. The high frequency of listings by Binance Alpha has even exacerbated this situation. Finding a breakthrough in exit paths and investment strategies to escape this negative ecological relationship will remain one of the biggest tests for the new generation of VC models.

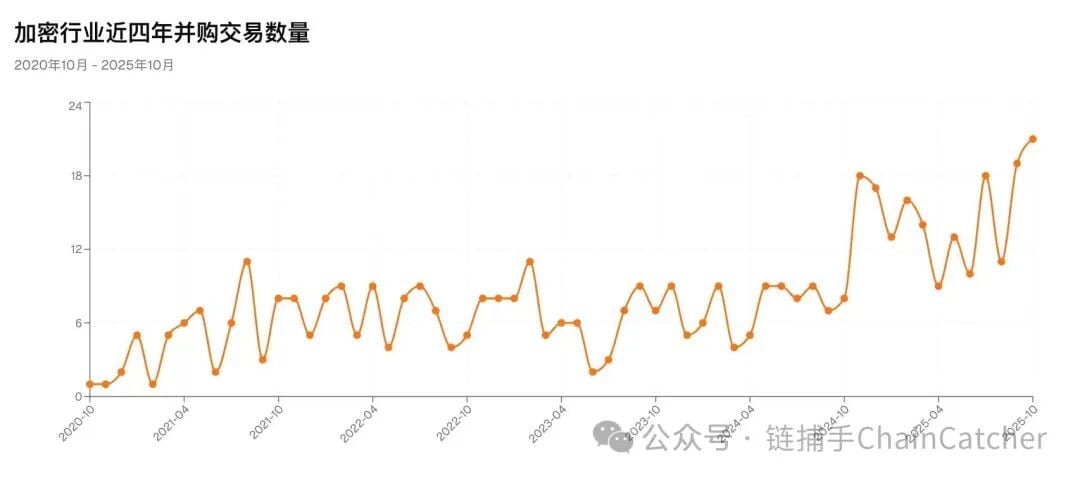

Recently, crypto industry giants like Coinbase have significantly accelerated the frequency of mergers and acquisitions. According to RootData statistics, the number of mergers and acquisitions in the first ten months of this year has exceeded 130, with at least seven crypto companies going public. The total fundraising for crypto-related listed companies (including DAT companies) has surpassed $16.4 billion, setting a new historical high. According to reliable sources, a well-known traditional Asian VC institution has established an independent fund primarily focused on equity investments, with a lifespan of around 10 years. More and more VCs are aligning with the "old rules" of the equity investment market.

This is perhaps one of the strongest signals the market is sending to VCs about the new cycle: there are still many opportunities in the crypto primary market, and the golden cycle for equity investment may have already arrived.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。