Why Crypto Market Is Up Today: Ignite a Bull Run or Crash Incoming?

Why crypto market is up today? The global crypto market is buzzing with optimism, climbing 0.48% in the last 24 hours to reach a massive $3.76 trillion market cap. The surge is driven by renewed macroeconomic optimism, liquidity expectations, and a political twist that shook the digital asset space.

Fed Rate Cut Hopes Fuel Market Optimism

One of the greatest reasons why crypto market is up today is due to the potential rate cuts by the Federal Reserve. Journalist Alex Mason reported that the Fed can inject $1.5 trillion into the economy via potential October and November rate cuts.

Such liquidity injections usually propel risk assets — and cryptocurrency is no different. With speculators holding out for cheaper financing and money entering the ecosystem, Bitcoin (BTC) and leading altcoins have seen fresh buying pressure. Bitcoin trades at $111,655, 0.4% higher intraday but 4.12% higher on the week, while Ethereum commands 12.4% share.

Adding to the hope, the latest Consumer Price Index (CPI) release indicates expectations at 3.1%, better than the previous month's figure of 2.9%. Traders also believe a lower CPI reading could encourage the Fed to go ahead with another rate cut of 25 bps, further supporting the narrative of the bulls.

Trump's Pardon of CZ Ignites Binance and Market Rally

In a shocking twist, U.S. President Donald Trump granted a presidential pardon to Binance founder Changpeng "CZ" Zhao, who had already been convicted of bank-related offenses.

The unexpected move initiated a sharp rally in BNB and boosted overall sentiment. Trump's statement was also accompanied by news of new U.S.-China trade negotiations to be held in Washington later this month, further fueling expectations on global liquidity and regulatory relaxation.

The crypto universe lives on surprise movers — and this amnesty, coupled with geopolitical events, was a huge psychological boost.

Liquidation Metrics and Fear Index Indicate Inflection

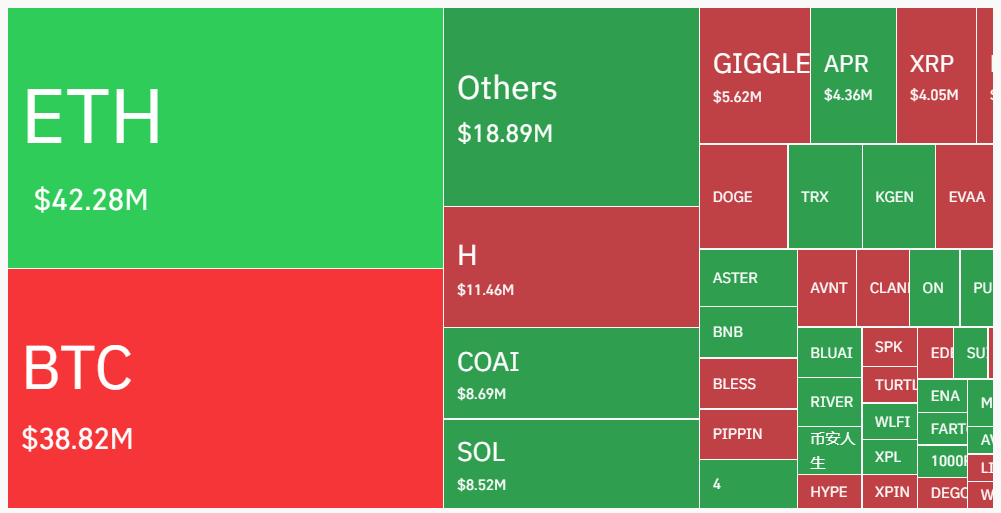

In the last 24 hours, 118,535 traders got liquidated, amounting to $194.79 million. The single biggest liquidation was on HTX (BTC-USDT) of $2.91 million. ETH and BTC liquidations, on the other hand, reached $42.28 million and $38.82 million.

Source: Coinglass

Source: Coinglass

The Fear and Greed Index also shifted from Extreme Fear (23) last week to Fear (37) today — a solid indication that sentiment in the space is slowly coming back. This shift usually occurs before an extended bull trend as retail and institution investors begin to regain confidence.

What's Next for Crypto Markets?

All attention currently is on upcoming Fed rate cut announcements, which will set the next wave. When these cuts take place as anticipated, the crypto market could trigger a robust liquidity wave that will take Bitcoin and major altcoins to new record highs.

Conclusion

The present crypto rally is being driven by rate cut hopes, Trump's pardon of CZ, and a move in global sentiment. As liquidity hopes increase and fear decreases, investors set up for the potential breakout. The next Fed move will set up to decide if this bull wave persists or dissipates.

Disclaimer: This article is for information purposes only and should not be considered an investment advice. Do your own research before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。