Bitcoin Wallet Move: Satoshi Whale Transactions After 14 Years Silence

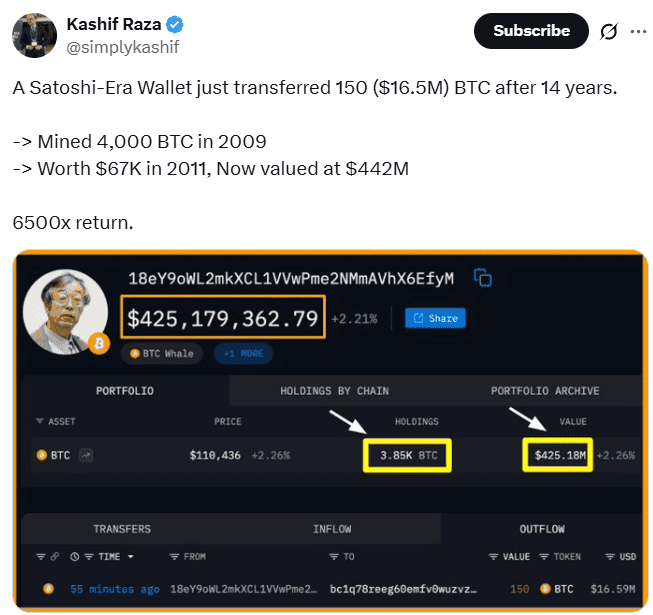

What happens when a silent giant stirs after more than a decade? The crypto world just witnessed it. A Satoshi Whale Transactions—one of the oldest addresses dating back to 2009—has come to life after 14 years of dormancy, transferring 150 BTC this week.

Source: X

Source: X

The address reportedly mined around 4,000 BTC between April and June 2009 , when Bitcoin’s creator Satoshi Nakamoto was still active online. The coins, worth just $67,724 when last touched, are now valued at approximately $16 million —a testament to Bitcoin’s incredible journey.

Rare Movement from Bitcoin’s Genesis Era

On-chain data reveals the wallet consolidated its holdings into a single address in June 2011 , remaining untouched since then. Such Satoshi whale transactions are exceedingly rare— Glassnode data suggests only a handful of pre-2011 wallets move funds annually.

Historically, these awakenings give birth to short-term chaos. Market players like to bet that early investors will be short-selling soon, inducing a temporary panic. But most earlier transfers were security overhauls, estate planning, or restructuring within a company, and not liquidation drills.

Why the Timing Raises Eyebrows?

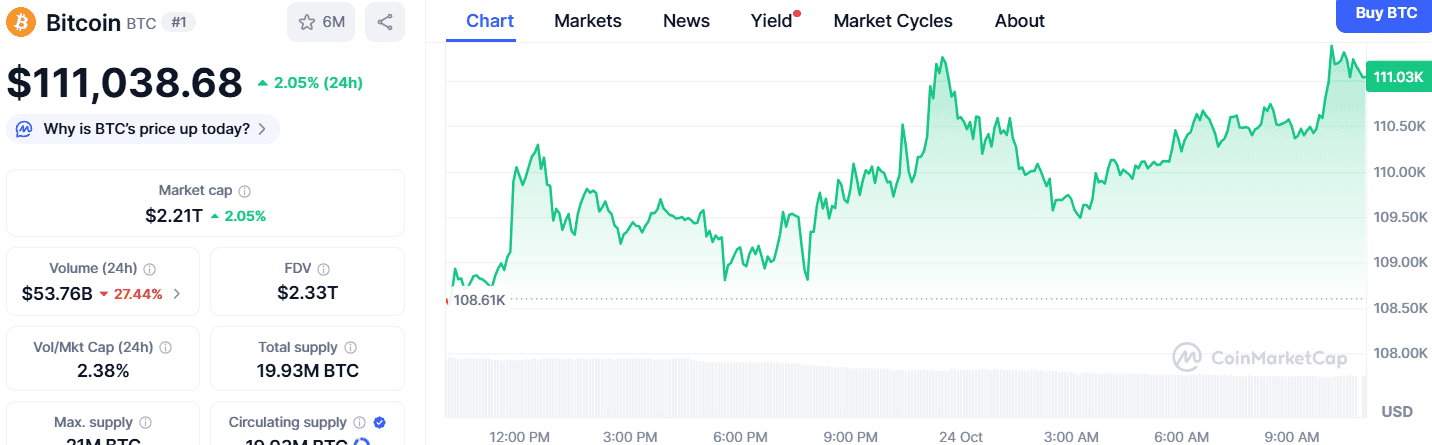

The rally follows Bitcoin's consolidation into a region of approximately $111,090.17 after a sharp drop from all-time high above $126,000 last month. The market is realizing its largest ever liquidation episode where $19 billion was wiped out in leveraged positions.

While its market cap stands at $2.21 trillion and 24-hour volume was $53.72 billion, this 150 BTC transaction is but a fraction of worldwide activity. Psychologically, though, it rekindles curiosity in early Bitcoin miners and what they will be doing next.

BTC stands at $111,046.64 at writing, registering an intraday gain of 2.05%, indicating lukewarm recovery.

What's Next for Bitcoin? Technical Outlook

Bitcoin (BTC) is standing at a price of $111,254, having regained from a low price of $110,016. A neutral momentum is signified by RSI of 47.09, while MACD histogram levels of about -1,808 indicate consistent bear pressure.

Source: CoinMarketCap

Source: CoinMarketCap

In case it goes past $112,000, BTC will move up to $115,500–$118,000. If it goes below $110,000, it could push BTC to $106,000. The chart indicates sideways consolidation within the range of $108,000–$118,000 with reducing volume, reflecting indecision.

If bullish momentum intensifies and RSI crosses above 50, it may retest $120,000 resistance; otherwise, consolidation is in the cards ahead of the next big move.

The Bigger Picture: Sentiment and Symbolism

In addition to numbers, bringing a Satoshi-era wallet to life is symbolic confirmation of Bitcoin's decentralized origin and strength. These idle fortunes are reminders of the extent to which Bitcoin supply is tied up, something that only serves to contribute to scarcity—a foundation of its value.

Conclusion

The latest Satoshi whale trade is so much of an antique that it is less a threat than a curiosity. As it briefly sets people's tongues in motion, the trade appears to be mere electronic housekeeping rather than selling tactics. In the meantime, Bitcoin's price settles in—its next move will depend on momentum above the $112,000 mark.

Disclaimer: This article is for informational purposes only, not to be considered as financial advice. Do your own research before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。