Robert Kiyosaki Bitcoin Outlook: Scarcity, ETF Moves, and Whale Buying

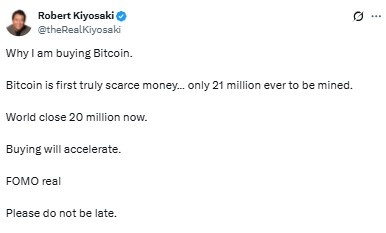

What makes Robert Kiyosaki Bitcoin prediction so powerful? The “Rich Dad Poor Dad” author recently said, “I’m buying Bitcoin before it’s too late.” He believes it is the only form of money that is truly scarce, with only 21 million coins ever to exist.

Source: X (formerly Twitter)

Since nearly 20 million have already been mined, he thinks time is running out for those waiting to buy.

Kiyosaki warns that when more people realize this shortage, buying will accelerate, and FOMO will become real. He’s urging everyone not to wait until it’s too late.

While some critics argue that this cryptocurrency has no real value and is too volatile, others agree that Kiyosaki scarcity often drives long-term value.

Investors who share his mindset see Bitcoin as digital gold. But traders view it differently. They say it’s important to know whether you’re investing for the long term or just trading for short-term profits.

ETFs Show Big Investors Are Entering Bitcoin

It’s price moved up 0.59% in the last 24 hours, showing a small but steady rise. One reason for this optimism is the growing interest from big financial firms. T. Rowe Price, which manages about $1.8 trillion, recently filed for a crypto ETF that includes Bitcoin and Ethereum.

This action by an established asset manager indicates that institutional investors are beginning to have faith in Bitcoin's long-term prospects. ETFs tend to introduce more liquidity to the market, i.e., money can enter easily.

But U.S. government reluctance may delay things. Investors also keep an eye on the GENIUS Act, a bill that would make stablecoins more regulated and bring even more large investors.

Bitcoin Technical Outlook

Bitcoin price hovers around $108,435, exhibiting recovery after remaining above crucial support at $108,000.

Source: Trading View

The 51.7 RSI displays neutral momentum, indicating equilibrium between buyers and sellers.

The MACD is flipping bullish since the MACD line crossed over the signal line, suggesting early potential for upside. Breaking above $109,000 would confirm short-term strength, while a break below $107,000 would attract selling pressure.

Stablecoin Reserves and Whale Activity

There’s another interesting sign for coin’s future. Stablecoin reserves on exchanges are at record highs, meaning investors are holding large amounts of cash ready to buy BTC when the time is right. This suggests confidence, even if people are waiting for better market conditions.

At the same time, Bitcoin ETFs now hold about 1.51 million BTC, or 7.2% of total supply. BlackRock’s IBIT ETF , with $88.5 billion AUM, is leading the charge.

Meanwhile, big investors holding large amounts of BTC added over 248,000 BTC recently, showing they still believe in the long-term story.

Final Thoughts

Robert Kiyosaki’s message is clear; he believes Bitcoin’s limited supply and growing institutional support make it the smartest investment right now. As ETFs grow, whales accumulate, and governments discuss clearer rules, Kiyosaki’s confidence seems to be paying off.

Whether you agree with him or not, his warning stands: the time is running out, and the race for the last of this digital asset is already on.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。