Asset types determine price trends.

Written by: Zuoye

Binance life is a cover for Aster's counterattack, an extreme wealth creation effect, even emotions, in the continuous rain of late autumn, are enough to make people forget the troubles of their positions, regardless of bullish or bearish.

Beyond the technical parameters and cost comparison of reporting dishes, what truly intrigues me is why the CLOB architecture (Central Limit Order Book) is suitable for perpetual contracts, and what the limits of the CLOB architecture are.

Assets determine prices

I was born too late, missing the era of DeFi Summer; I was also born too early, unable to see CLOB shine in the foreign exchange market.

The history of traditional finance is too long, so long that people have forgotten how markets are formed.

In short, finance revolves around trading assets and prices, with prices (buy/sell, bullish/bearish) and assets (spot/contract/option/prediction). Cryptocurrencies merely replayed hundreds of years of financial history in just over a decade, adding their own unique demands or improvements along the way.

CLOB is not simply a mimicry of NASDAQ or CME; breaking it down, central, limit, and order book occur on-chain, ultimately contributing to today's prosperous scene.

Order book: A mechanism for recording buy/sell prices.

On-chain limit order book: A bidding mechanism based on dual sorting of time and price, where limit price refers to a specified price.

On-chain central limit order book: Refers to recording limit orders in a unified system, such as a blockchain, which is the meaning of central.

CME (Chicago Mercantile Exchange), Binance, and Hyperliquid trading BTC contracts can all be CLOBs, but in this article, it specifically refers to CLOB Perp DEX using public chain/L2 architecture.

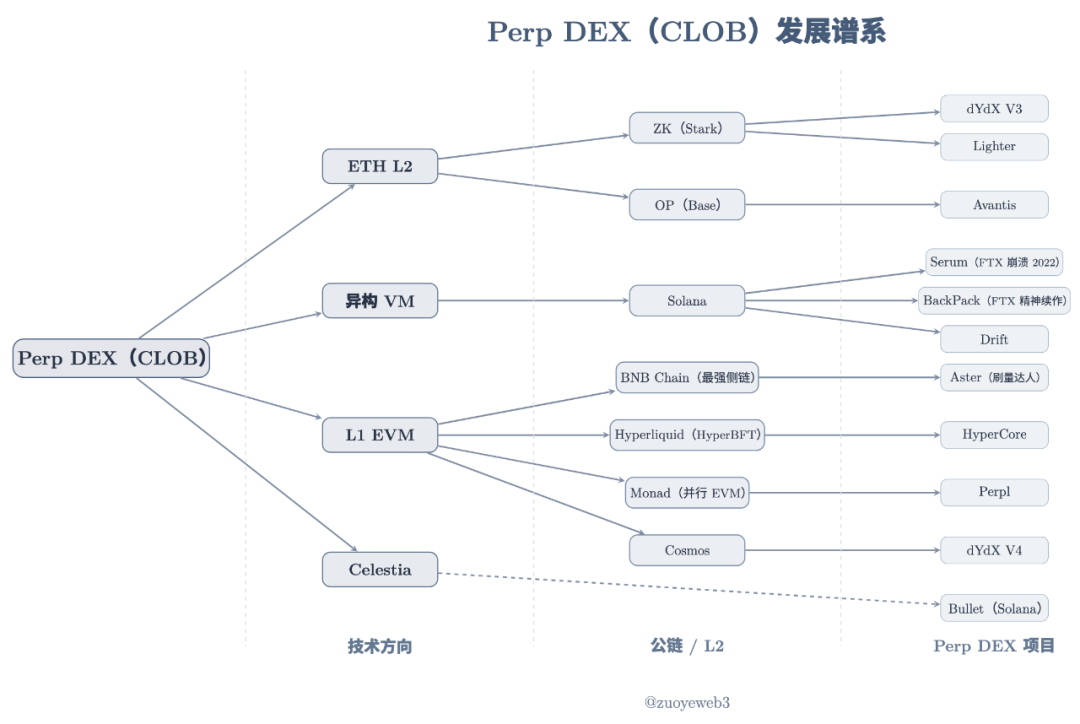

Following the discussion of the third point, here is a historical explanation: the technical route dispute continued around 2021, stemming from ETH mainnet's high costs and slow speeds. The collapse of FTX in 2022 delayed the Perp War that began at the end of DeFi Summer until 2025.

Image caption: Perp DEX (CLOB) lineage

Image source: @zuoyeweb3

Perp DEX projects have launched in succession, but can generally be divided into three routes: ETH L2, heterogeneous VM (Solana), and L1 EVM. Celestia belongs to a random DA solution and does not rely on a specific VM architecture.

Historical documents lack real significance; currently, people do not care about decentralization but only about trading efficiency. Therefore, no comparisons will be made. It is difficult to say who is faster between Hyperliquid with 4–>16–>24 nodes and the generally single sorter L2, as well as who is more decentralized and what the significance is.

Human joys and sorrows do not connect; I only feel that they are noisy.

Technical investment has a lag; the DeFi Summer of 2020 had already sown seeds in 2017/18. By the end of 2020, Serum had slowly launched on Solana, featuring several characteristics:

Liquidity front-end and profit sharing

Expected support for spot trading

Based on Solana's high-performance matching trading

Node locking to earn MegaSerum (MSRM)

Collaboration with FTX

Cooperation with Wormhole to support cross-chain

Cross-chain assets have yield mechanisms

Holding SRM offers fee discounts

SRM buyback and burn mechanism

Expected SerumUSD stablecoin product line

Of course, the vast majority of SRM token shares are not decentralized, concentrated in FTX and even in SBF's personal hands. The collapse in 2022 gave Hyperliquid more time to develop itself.

This does not mean that Hyperliquid is a copy of Serum; any great product is either an engineering combination or an original spirit. Hyperliquid is far superior to Serum in terms of technology selection, joint market-making to create liquidity, as well as token airdrops and risk control.

From dYdX/Serum to Hyperliquid, everyone believes that relocating the Perp asset type on-chain is feasible, although there are differences in technical architecture, decentralization, and liquidity organization. However, it still does not answer what characteristics of CLOB lead to this consensus.

So, why does the Perp asset choose CLOB?

The most reasonable answer is that CLOB has a stronger price discovery capability.

This is still a historical answer and relates to AMM DEX. From Bancor to Uniswap and Curve, the exploration of on-chain liquidity initialization and applicability has been opened up around Ethereum.

DEX protocols avoid the two major problems of needing to custody user funds and maintaining liquidity by working with LPs (liquidity providers), allowing them to focus solely on maintaining protocol security. Under the stimulation of fee sharing, LPs deploy liquidity on their own.

Subsequently, LPs ultimately transfer liquidity costs to users, reflected in slippage and fees, i.e., the creation of liquidity: DEX protocols transfer to LPs, and LPs transfer to users.

However, there are two remaining issues: impermanent loss for LPs and insufficient price discovery capability of AMM.

Impermanent loss arises from the exchange of two assets; LPs need to add dual assets equally, but the trends of the two do not align. Most are stablecoin pairs with other assets to enhance stability.

The price of AMM is a "market price," meaning that LPs and project parties, as well as DEX protocols, cannot directly define the price of a certain asset but can only intervene through liquidity.

To address these two issues, the former's improvement is Curve's stablecoin trading like USDC/USDT, which aims to minimize the bidirectional changes of assets, relying on increased trading frequency to boost fees. Rather than saying Curve is suitable for stablecoin trading, it is more accurate to say it is a natural flaw. Its latest work, Yield Basis, uses economic design to "erase" impermanent loss through leverage.

The latter's improvement limit is CoW Swap's TWAP (Time-Weighted Average Price), which splits a large order into multiple smaller orders to reduce the impact of large orders on liquidity and obtain the optimal transaction price, which is Vitalik's favorite.

But stopping here, on-chain trading of Perp is publicly transparent. If an AMM mechanism is used, adjusting liquidity for price manipulation is very simple; a 1% price change can be explained for spot trading, but for Perp, it would mean queuing for heaven.

The flaws of AMM prevent it from being used, or at least not widely used, for Perp. A technology that does not rely on liquidity changes to control prices is needed, meaning prices must be predetermined.

Transactions must occur at quoted prices or not at all, but cannot be discounted, to maintain the normal operation of the Perp market.

Eliminating impermanent loss is merely a side effect; different technical architectures will lead to different market-making mechanisms.

The price sensitivity of Perp perfectly aligns with the precise control of CLOB, meaning that assets will determine price changes, and price changes require corresponding technical architecture.

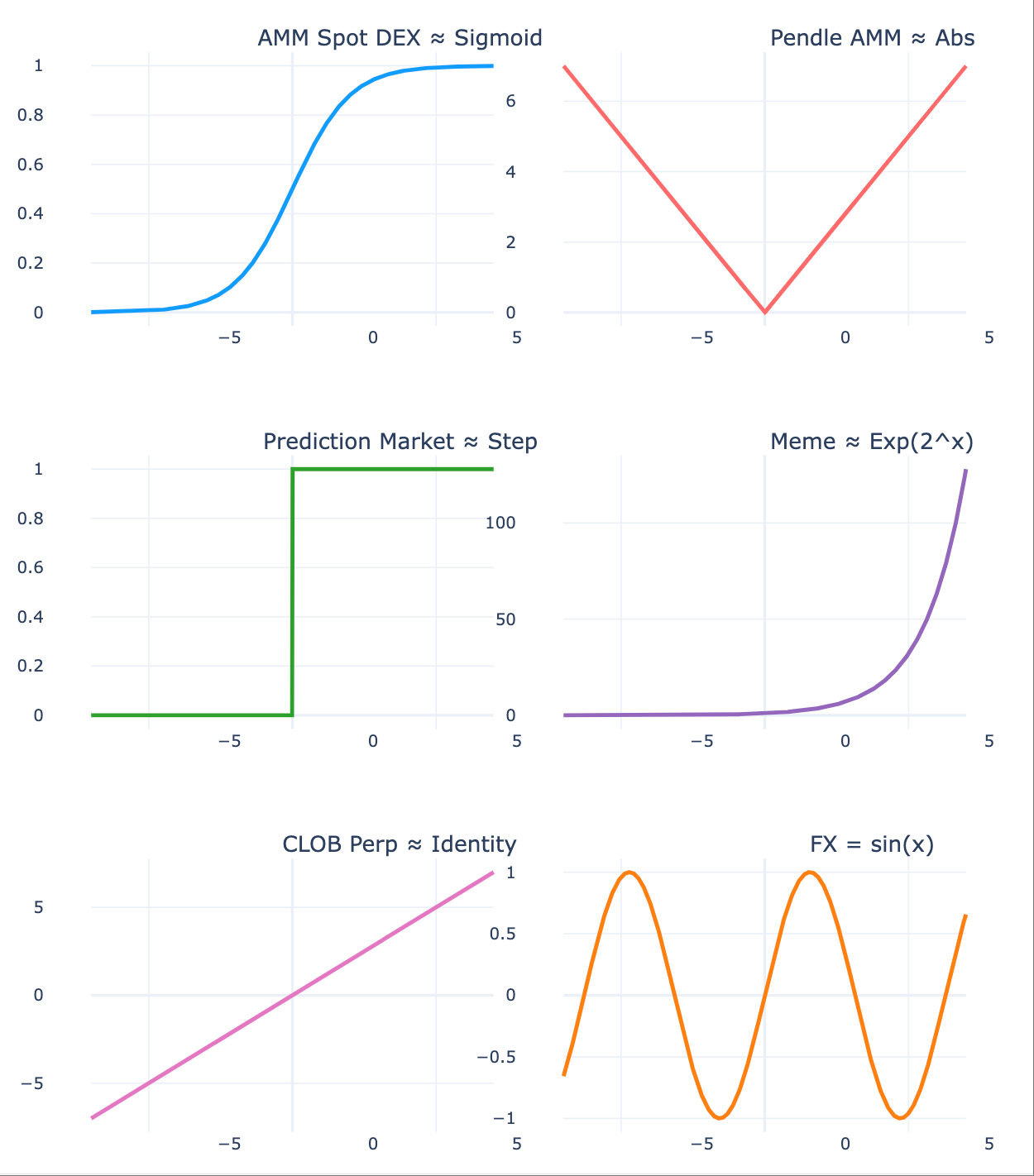

Image caption: Assets determine price trends

Image source: @zuoyeweb3

The price trend of spot assets is relatively smooth, which is the fundamental reason why users can "tolerate" slippage and LPs can "tolerate" impermanent loss; they do not lose particularly much.

Pendle creates two different price trends by segmenting assets by expiration dates, leading to different side liquidity bets in the market.

Prediction markets are more extreme, with only two situations (0,1), representing the most discrete existence, which can be understood as continuous probabilities ultimately collapsing to 0/1.

The meme market is even more extreme, with a few moving towards extreme exponential changes, while most become non-trading assets trending towards 0, aligning with the theory of internal and external markets.

Perpetual contracts exhibit the most extreme changes and can lead to negative balances, as their price changes are not only drastic but do not stop at 0, spreading downwards.

Forex trading has the smallest price changes, with daily price fluctuations within a range, even exhibiting regularity, reflecting the stability of major global economies.

AMM creates initial on-chain liquidity, cultivates people's trading habits, and settles funds, while CLOB is more suitable for controlling prices and achieving more complex trading setups. Unlike the market price of AMM, CLOB's buy/sell prices are sorted by time and price, achieving precise price discovery with the support of efficient algorithms.

Price determines liquidity

A lifetime is said to be a lifetime, but a difference of a year, a month, a day, or an hour does not count as a lifetime.

CLOB replaces AMM, completing price discovery for Perp, and still needs to organize market liquidity. AMM DEX achieves the normalization of individual LP existence through two transfers (protocol to LP, LP to users).

However, between price and liquidity, there is also the scale phenomenon unique to Perp.

The issues of Perp DEX are relatively complex. AMM only calculates gains and losses upon final settlement; otherwise, whether for users or LPs, they are merely accounting for unrealized gains and losses, as perpetual contracts focus not on the contract itself but on the perpetual nature.

There exists a fee mechanism between bullish and bearish positions, meaning when the fee is positive, the long pays the short, and when the fee is negative, the short pays the long.

From a pricing mechanism perspective, this keeps the contract price aligned with the spot price. When the contract price is lower than the spot price, it indicates a bearish market. To maintain the market's existence, longs must pay fees to shorts; otherwise, if there are no shorts, there is no perpetual contract market, and vice versa.

As mentioned earlier, AMM is a transaction between two assets, but the U-based BTC contract does not actually require both parties to exchange BTC; rather, they exchange their expectations of BTC's price, conventionally represented in USDC to reduce volatility.

This expectation requires two points:

The spot asset must be able to achieve price discovery, such as a fully traded BTC market; the more mainstream the coin, the more sufficient its price discovery, making it less likely to experience black swan events.

Both bullish and bearish parties must have strong capital reserves to offset extreme market conditions caused by leverage and effectively manage them when they occur.

In other words, the pricing mechanism of Perp tends to enlarge market scale, and this scale generates liquidity.

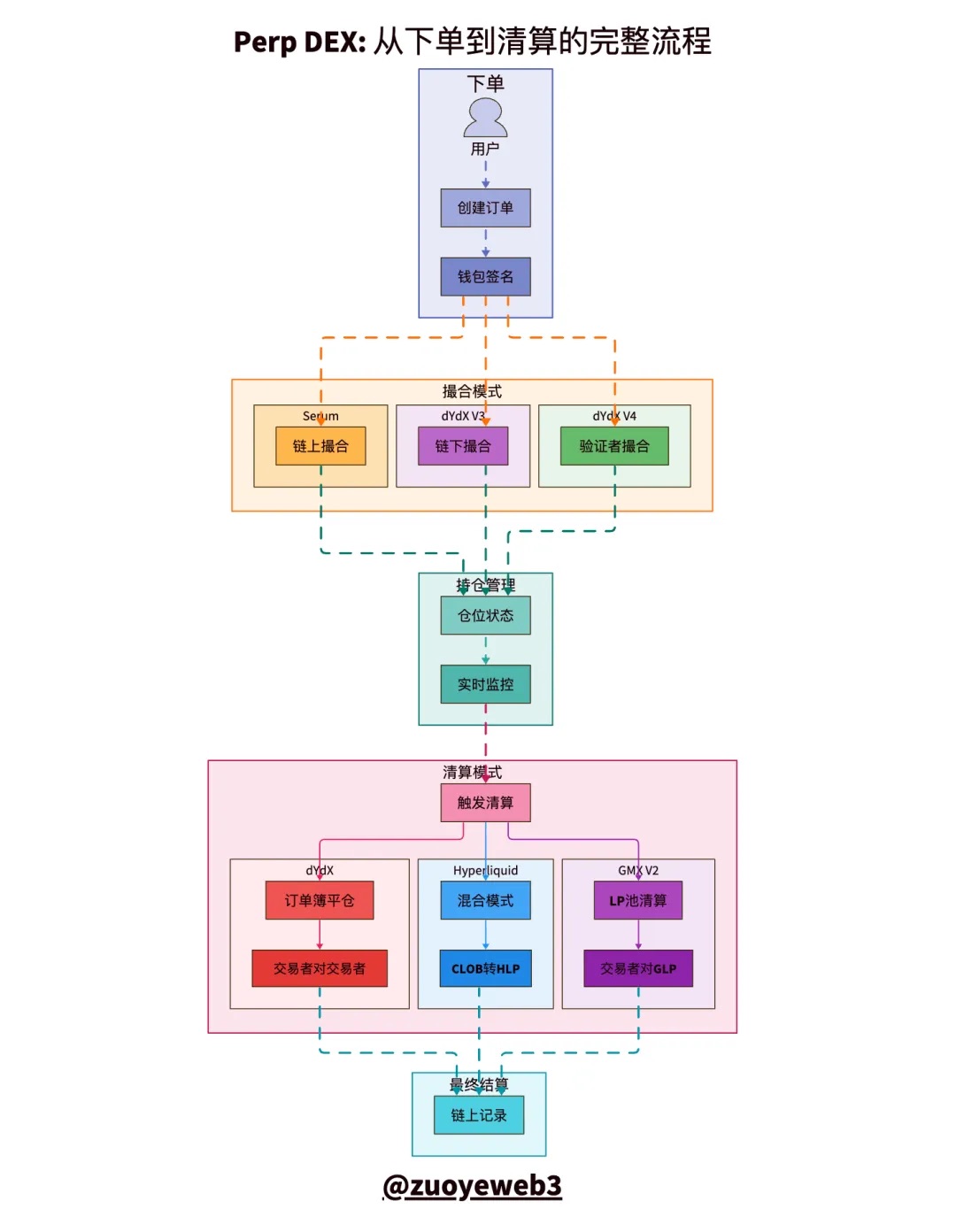

Image caption: Comparison of CLOB Clearing and Settlement Process Models

Image source: @zuoyeweb3

In the entire trading process of Perp, it can be divided into five main parts: order placement, matching, position holding, clearing, and settlement, among which the most challenging are the matching and clearing mechanisms.

Matching is a technical issue, that is, how to match buy/sell quotes with the highest efficiency and minimal time, with the market ultimately choosing "centralization."

Clearing is an economic issue; contracts can be understood as non-fully collateralized loans. Exchanges allow you to leverage a large position with a small amount of capital, which is the essence of leverage.

On the surface, exchanges allow you to amplify leverage with collateral, but in reality, you must pay margin to maintain the existence of leverage. Once it falls below the liquidation ratio, the exchange takes your collateral.

From the inside, clearing is a natural behavior of both bulls and bears under normal circumstances. However, as mentioned earlier, the price of Perp can infinitely extend beyond 0, compounded by the amplifying effect of leverage, leading to debts far exceeding the value of collateral.

Once the market fails to clear bad debts, it requires artificially supplementing margin, forcibly canceling trades, or using insurance funds to cover losses. Essentially, this is socializing debt; if there is debt, it is shared.

The liquidity of Perp is an inevitable pursuit to maintain scale, but the tasks that individual LPs cannot accomplish in AMM, beyond capital size limitations, also require the high-intensity trading expertise of professional market makers.

The reasoning is not complicated; individual LPs deployed in AMM DEX do not need to operate frequently, but Perp DEX must always pay attention to the extremity of leverage.

During normal trading, as long as extreme market conditions are not triggered, there exists a mechanism similar to AMM's LP incentive trading volume, such as GMX mimicking the LP mechanism of AMM DEX, stimulating LP trading enthusiasm with its own tokens, developing its own GLP pool, where users can add liquidity and receive rewards like fees.

In fact, this is a very "innovative" mechanism, allowing individual LPs to participate in Perp market making for the first time.

This volume-inflating mechanism can lead to abnormally high trading volumes for Perp, but OI (Open Interest) will decline after the token issuance as LPs withdraw, ultimately entering a death spiral of declining tokens and liquidity.

It can also be concluded that LPs must passively bear the final clearing, which is a difference between Perp and AMM. In AMM, users buy and hold, and LPs bear their own profits and losses, but in Perp, LPs actually replace project parties in bearing the clearing function, and this cannot be transferred to users.

The so-called insurance mechanism protects the risks of the project party and does not safeguard the LPs themselves.

Both GMX and Aster's volume-inflating activities will quickly end, while Hyperliquid's HLP operates relatively stably. However, when facing $JELLYJELLY, HLP still bears the losses, fundamentally indicating the unreliability of this liquidity creation and insurance mechanism.

As mentioned earlier, over 92% of HyperCore's fees are used for $HYPE buybacks, and 8% for HLP profit sharing, indicating that Hyperliquid does not value the future of mechanisms like HLP. The liquidity of HyperCore is primarily maintained by professional market makers, who focus on node profit sharing and the appreciation of $HYPE.

The vault mechanism can be seen as an appendix that Perp learned from AMM; directly pulling the network cable or enhancing trading depth would be more effective than this.

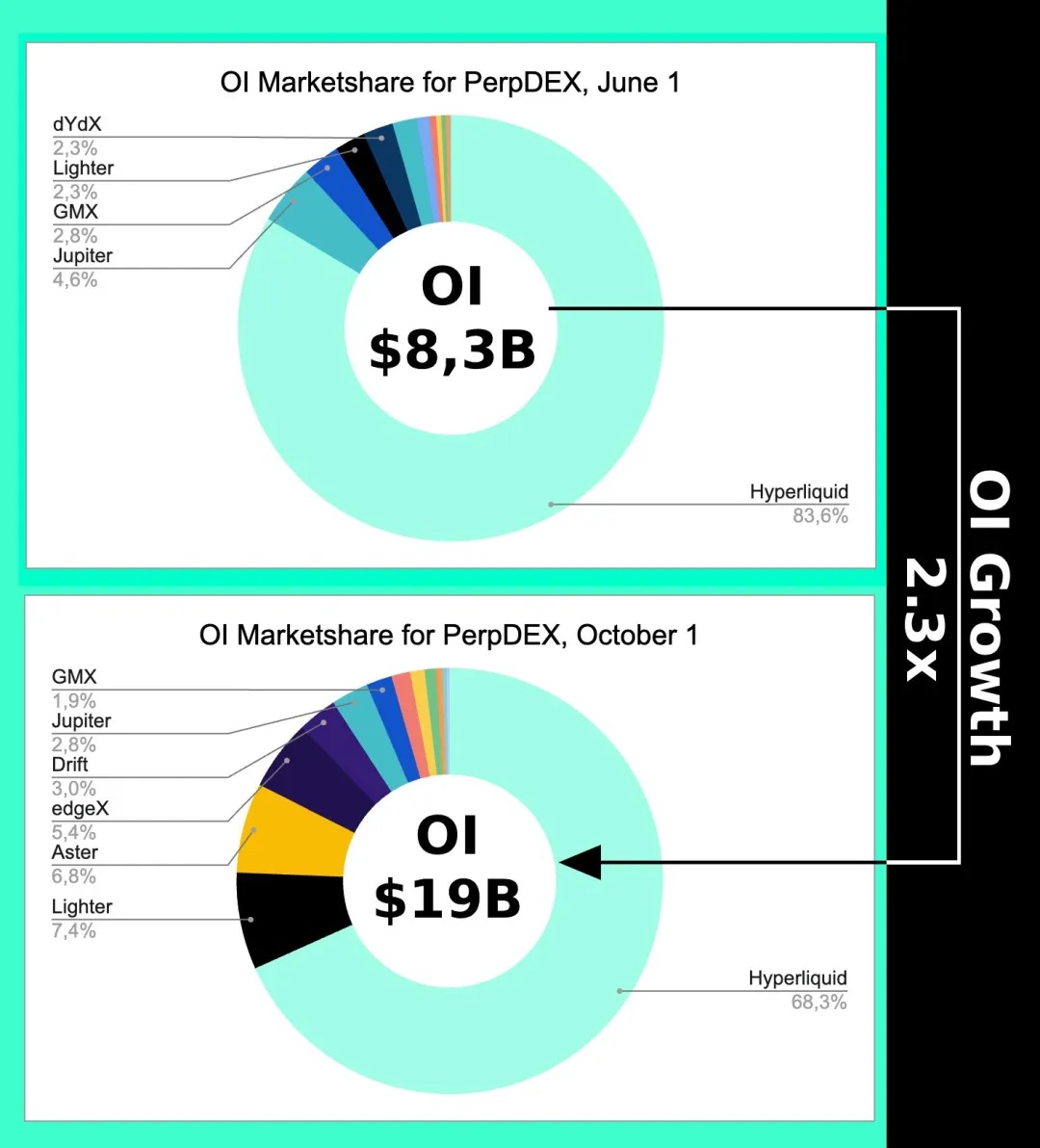

Image caption: OI Change Trend

Image source: @Eugene_Bulltime

Even in early October, when Aster initiated the Perp DEX war most intensely, Hyperliquid's market share only declined by about 15%, while its volume was surpassed several times by Aster, indicating that the CLOB price mechanism triggers scale effects, leading to liquidity primarily referring to position volume rather than trading volume.

This also indirectly explains why Hyperliquid wants to develop the Unit cross-chain bridge and BTC spot trading market—not for fees, but for price accuracy, ultimately freeing itself from dependence on Binance quotes.

CLOB can also be used for spot trading, and AMM can be transformed by AC to be used for perpetual contracts.

Focus on the adaptation of price and assets, and do not lose direction due to technical parameters.

Conclusion

Life will find its way out.

Binance's annual $150 trillion is essentially the upper limit of Perp trading, but the daily trading volume in the foreign exchange market is around $10 trillion, with an annual trading volume 300 times that of Perp. Hyperliquid's architecture is also migrating to HyperEVM, especially with the anticipated developments in foreign exchange, options, and prediction markets like HIP-3/4.

It can be understood that Perp will eventually reach a peak, and in the mutual competition between assets and prices, a more suitable technical architecture for the price discovery mechanism of the new generation of assets will emerge, such as RFQ, etc.

But there is no doubt that it will no longer be a competition over the degree of centralization of blockchain. The technological competition of 2021 was merely a boring callback; focusing on the technical architecture of blockchain is essentially living in the past and unable to extricate oneself.

Whether OI or trading volume continues to grow, the CLOB competition has already ended. 2018 was the DeFi Summer, and by 2022, Hyperliquid has already won. The next question is whether HyperEVM can squeeze into the final public chain dinner, and whether it will still be boring after Monad issues its token. The ability of HyperEVM to achieve an ecological closed loop is what will be truly interesting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。