Crypto ETP Filings Surge to 155 Across 35 Assets, Solana and XRP Lead

The investment market is in overdrive with 155 exchange-traded product (ETP) filings in 35 digital assets, a new frontier of institutional investment and regulatory development in 2025.

Crypto ETP Filings: New Investment Wave.

Exchange-traded products are at a record high in the cryptocurrency investment environment. Bloomberg Senior ETF Analyst Eric Balchunas stated that the number of active crypto ETPs that track 35 various digital assets has reached 155, a milestone in the expanding digital asset market.

Balchunas estimates that the figure will increase to more than 200 filing in the next 12 months, as regulatory approval processes are simplified and demand for investors with diversified exposure to cryptocurrency increases.

Source: Eric Banchunas X

Bitcoin, Solana, and XRP Control ETP Filing

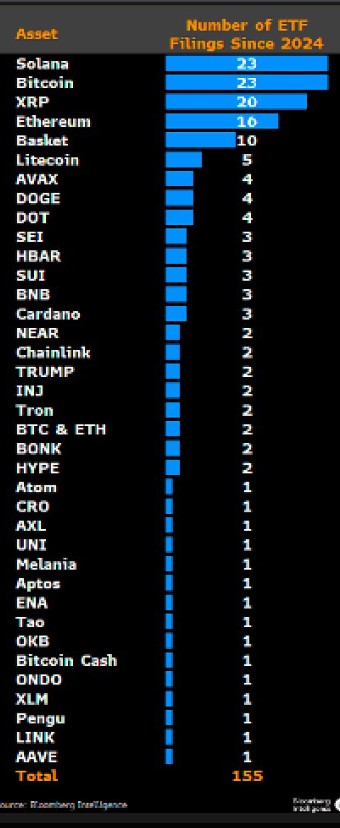

Information posted by Balchunas indicates that Solana (23) and Bitcoin (23) are in the top spot, with XRP (20) just behind them. Ethernet and basket-based ETFs, which are combinations of several digital assets, have 10 filings each.

Although Bitcoin is the most well-known asset in the world, Balchunas explained that the majority of Bitcoin and Ethereum ETFs were already registered by the U.S. Securities and Exchange Commission (SEC). Therefore, the list contains only pending filings, which are pending regulatory clearance.

This is because a lot of the Bitcoin ones have already been released. It is a list of pending filing, Balchunas clarified on X (previously Twitter).

Altcoins Are Gaining Traction in the Light of SEC Relaxed Rules.

The most recent data is showing increased interest in altcoin ETPs, with such projects as Litecoin (5 filings), Dogecoin (4), and Polkadot (4) also attracting issuers.

The chart provided by Bloomberg also shows the presence of new filings on other tokens, such as AVAX, SEI, SUI, HBAR, and BNB, which all have three filings. Two filings each have been recorded, even with small assets such as Cardano, Chainlink, Tron, and BONK.

Source: X

This growth is based on the new simplified approval requirements by the SEC, which have cut the review times from 240 days to only 75 days, making it easy to launch products. Analysts think this move will potentially cause a land rush of ETP launches, in the way that Bitcoin and Ethereum ETFs did after their approval in 2024.

Market Excitement by Regulatory Optimism

Balchunas and other Bloomberg analysts, James Seyffart, refer to the current period as the onset of a crypto ETF season. Their study indicates an institutional and retail boom in the face of more expansive market declines.

Balchunas argues that some of these new filings have greater approval probabilities, which may be 100 percent in some well-established altcoins. This optimism comes after the SEC became more open to crypto-based financial products years following its careful regulation.

XRP and Solana Experience a New Surge

Of the altcoins, XRP ETF is the only one that has filed 20, which indicates renewed institutional support in Ripple after its positive legal results in 2024 against the SEC. Equally, the high number of 23 Solana ETF filing indicates its increasing popularity as a scalable decentralized application and institutional-scale tokenization blockchain.

The positive outlook on regulatory clarity and innovation reflects the positive outlook of the industry on ETFs, as Crypto University, a crypto news outlet, said, the crypto ETF season has begun.

Prediction: More than 200 ETPs by 2026

With the current trends, analysts believe that over 200 crypto ETPs will be released into the market by the end of 2026. It would be a significant move towards mainstream financial integration of digital assets, which would provide investors with diversified exposure to a variety of blockchain ecosystems. It is a complete land rush, as Balchunas aptly described it.

Conclusion

As of 2026, the rising trend of crypto ETFs will represent a new dawn of digital asset usage, with more than 200 expected to be available, combining the accessibility of traditional finance with the opportunities of innovative blockchain adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。