Author: Nancy, PANews

There is no doubt that the NFT market has entered a long adjustment period after a brief period of prosperity. As the speculative frenzy fades, a large number of projects have stalled or been eliminated from the market. The once-dominant NFT trading giant OpenSea has shifted from "unicorn" to "survival mode," with its valuation of tens of billions significantly shrinking amid industry pains.

Faced with stagnation in business growth and profit anxiety, OpenSea is actively seeking transformation, not only attempting to evolve into a fully integrated trading platform but also re-attracting users and liquidity through airdrop incentives.

Token Trading Surpasses NFTs, Significant Contribution from Old Users

OpenSea's business focus is rapidly shifting from traditional NFT trading to token trading.

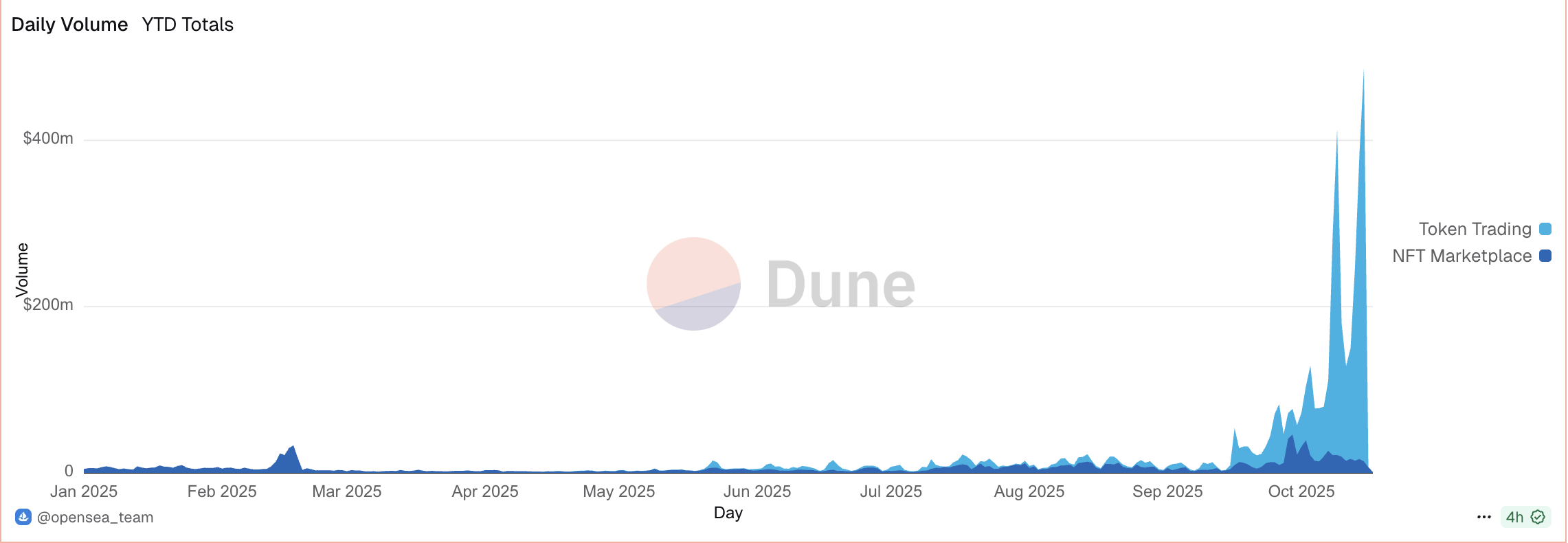

According to data from Dune, OpenSea's trading volume remained low before April this year, maintaining only a few million dollars daily, with the market still concentrated on traditional NFT trading. However, since mid-September, there has been a significant turning point in the platform's trading structure, with token trading volume rapidly climbing and surpassing NFTs for the first time, subsequently widening the gap and becoming the new growth engine for the platform. Notably, on October 15, OpenSea's token trading volume reached $474 million, setting a historical high, while NFT trading volume on the same day was only $13.747 million, accounting for less than 2.9%, highlighting a significant disparity.

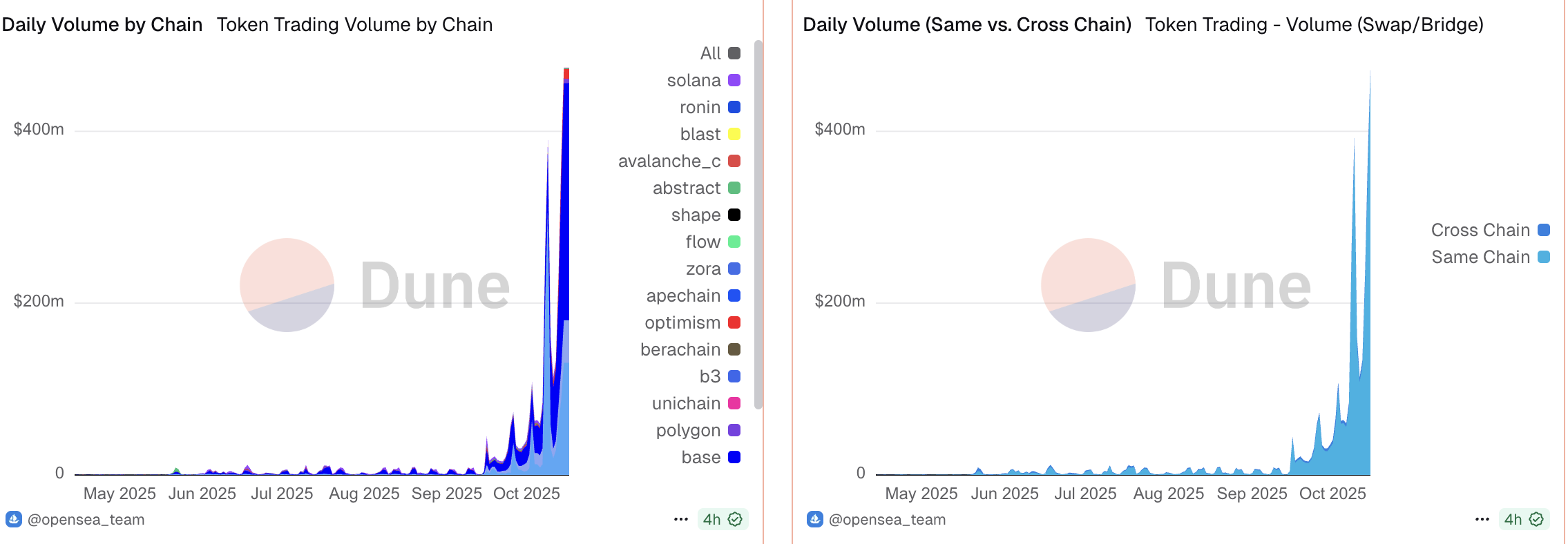

As of now, OpenSea's token trading volume this year has accumulated to $3.55 billion, with $3.03 billion contributed in the past 30 days, accounting for approximately 85.4% of the annual total. These transactions mainly come from the Base, Arbitrum, and Ethereum chains, with Base's contribution being particularly prominent. For instance, on October 16, the platform's total trading volume exceeded $470 million, with Base contributing 58.2%.

The surge in token trading has directly driven changes in OpenSea's revenue structure. According to Dune's data tracking, the revenue from token trading in the past 30 days was approximately $25.5 million, accounting for 56.8% of OpenSea's total revenue this year ($44.9 million).

In contrast, the overall trading volume of the NFT market this year was only $1.82 billion, less than half of token trading; its revenue in the past 30 days was about $557,000, far below that of the token sector. NFT trading on October 15 was mainly distributed across Ethereum, Base, and hyper EVM.

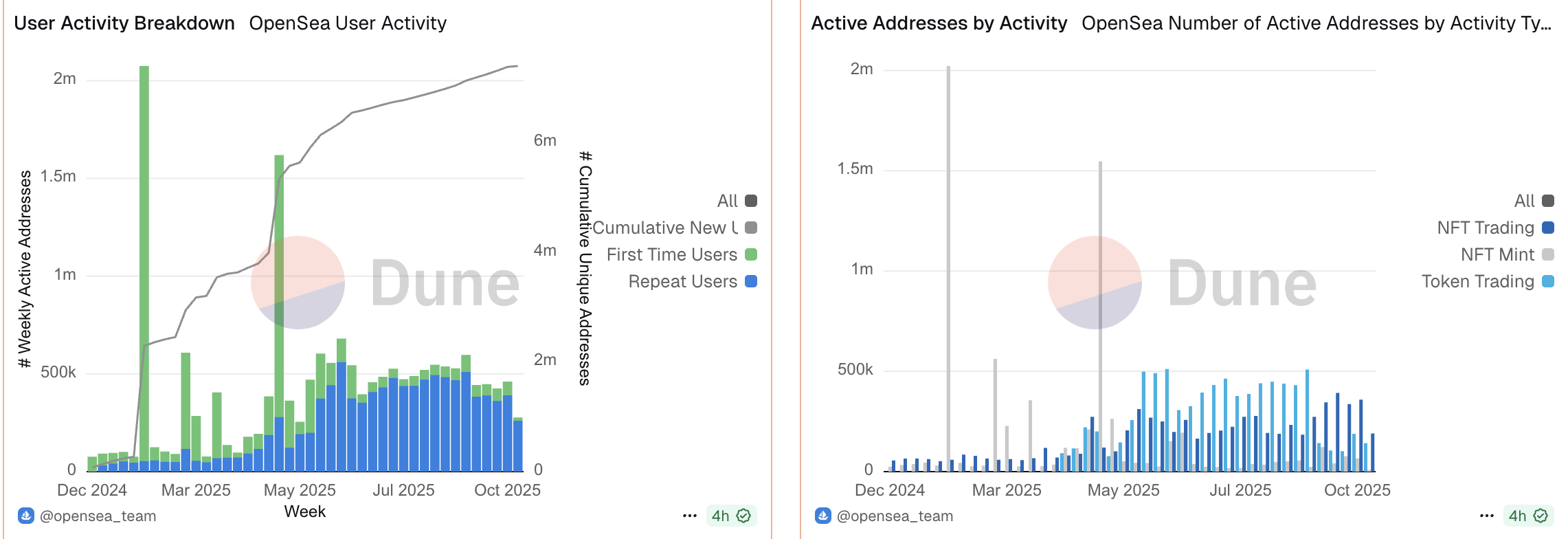

It is noteworthy that the significant increase in OpenSea's trading activity is not driven by new users but rather by the high-frequency operations of existing users. Since the second half of 2025, the number of active addresses on the platform has started to rise significantly, with a consistently high proportion of repeat users. For example, on October 13, the number of active addresses on the platform reached 276,000, of which 94.2% were repeat users, indicating that the growth in OpenSea's trading volume relies more on the re-engagement and high-frequency interaction of existing users rather than the expansion of new users.

In simple terms, OpenSea's short-term explosive growth stems from the high-frequency liquidity of the token trading market and the deep participation of old users.

Aiming to Create a Fully Integrated Application, Accelerating Transformation through Airdrop Incentives

In July this year, OpenSea announced plans to create a fully integrated application that combines NFT, token, and DeFi functionalities, aiming to provide users with a new experience. This strategic layout began several months ago.

In February 2025, OpenSea fully launched its transformation, introducing the new platform OS2 for public testing. OS2 is a completely restructured product, featuring a new interface and search functionality, as well as modes for collectors and professional users. In addition to traditional NFT trading, the platform also supports token exchanges and native cross-chain purchases, supporting multiple blockchains and enhancing user participation through diversified incentive mechanisms.

At the same time, OpenSea announced a token issuance plan to reward long-term supporters and OG users, promoting sustainable development. As explained by the official statement at the time, "The NFT bull market changed us; we became too corporate, too Web2, afraid of risks, and neglected the original intention of building for users." This long-awaited news reignited market interest. After all, during the NFT bull market, competitors like Blur captured a significant market share from OpenSea through token issuance, raising expectations for its own token launch.

To promote the token trading business, OpenSea is making efforts on both product and technology fronts. The platform integrates multiple blockchains, including Solana, HyperEVM, Base, Polygon, Arbitrum, and Sei, and collaborates deeply with applications like Uniswap, MetaMask, Meteora, and Coinbase Wallet to optimize the cross-chain trading experience. Additionally, OpenSea acquired Rally to introduce its mobile-first Web3 application and Rally wallet, supporting token trading across 19 blockchains. The newly launched mobile application also natively integrates the AI tool "OpenSea Intelligence," enabling real-time analysis of cross-chain investment portfolios and one-stop trading, providing users with intelligent asset management and trading experiences.

In terms of user traffic activation, OpenSea is actively seizing market trends. For example, the platform launched related tokens to capitalize on the NFTStrategy craze and injected 20 ETH into the reward pool to incentivize trading activity. The airdrop incentive program is a more significant driving factor. Last month, OpenSea announced that the rewards before the TGE entered the final stage and launched the "Treasure Chest" event, where users could collect and upgrade treasure chests through cross-chain trading, daily tasks, and supplies to earn rewards, with 50% of the platform's fees allocated for user incentives. After the event launched, the cumulative trading volume exceeded $2 billion. The Wave 1 phase has concluded, and a total of $12.2 million worth of tokens and NFT rewards will be distributed; the Wave 2 phase started on October 15 and will run until November 15, with an initial reward pool including $1 million worth of OP, SOMI, and ETH tokens. This indicates that the increase in OpenSea's trading activity is closely related to the airdrop and reward mechanisms.

According to recent disclosures from OpenSea, the platform plans to launch the SEA token in the first quarter of 2026. Of the total supply, 50% will be allocated to the community, with initial claims accounting for half, and users participating in OpenSea's reward program and OG users will be given priority. Additionally, the official previously revealed that it is evaluating historical usage data and trading volumes of users from different years and will develop more precise incentive strategies based on user profiles.

After the launch of the SEA token, OpenSea will also provide users with more utilization options, including staking features, allowing users to stake SEA behind their favorite tokens and collectibles. Furthermore, 50% of SEA's revenue will be used to buy back SEA at the time of release, aiming to ensure the token's value and the healthy development of the ecosystem.

Of course, during this period, OpenSea is also continuously advancing its NFT business, including launching the NFT reserve program OpenSea Flagship Collection, planning to invest over $1 million to acquire historical and emerging NFTs to activate the vitality of the NFT market and enrich the platform's ecosystem.

In summary, before the full implementation of OpenSea's airdrop plan, its market activity will continue to be driven by incentive mechanisms in the short term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。