Bitcoin is showing signs of fatigue, a condition that typically precedes significant directional volatility.

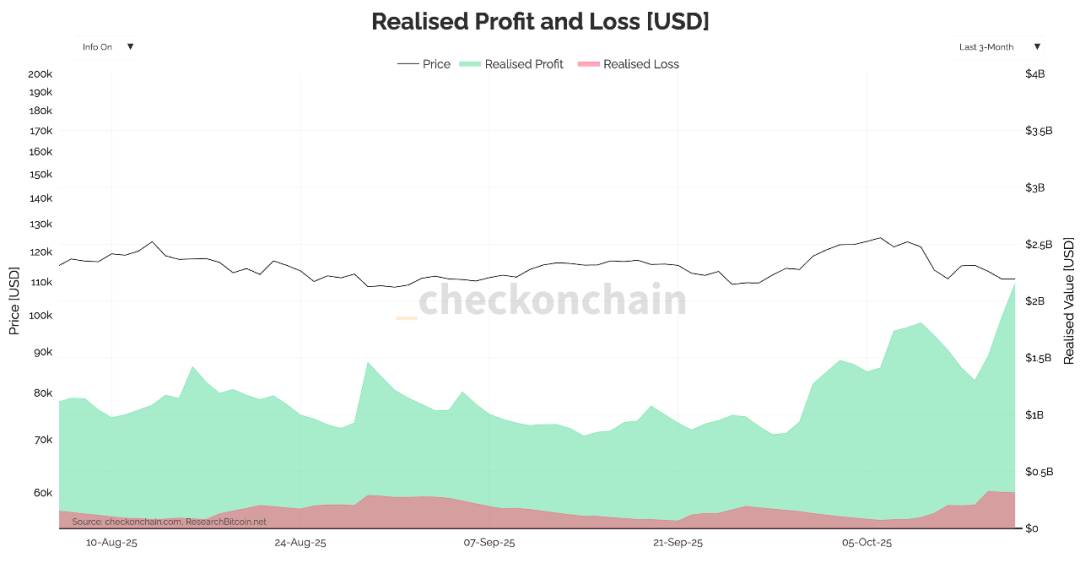

On October 15, traders realized $1.8 billion in profits, marking one of the largest profit-taking days since early summer this year.

On the same day, the market also saw $430 million in realized losses.

This data confirms the general sentiment in the market since the weekend's sharp decline: momentum is gradually fading, and a large amount of capital is flowing towards exit channels.

As of the time of writing, the price of Bitcoin is below $110,000, having dropped over 10% since the beginning of October.

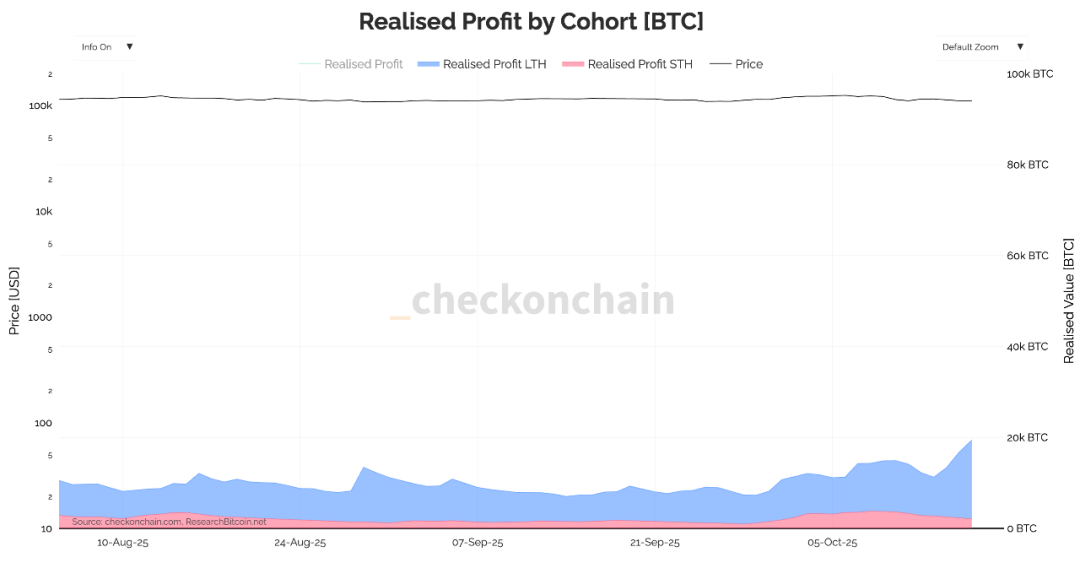

This decline is not a slow descent but rather a result of investors who entered the market in early 2025 quickly closing their positions.

Long-term holders (those holding positions for more than 3 months) are the main force behind this sell-off, with their realized profits being more than six times that of short-term holders.

Even during last week's sharp decline, long-term holders remained in a deeply profitable state, indicating that they are not panic selling.

They are engaging in de-risking operations: choosing to take profits when the market weakens rather than waiting for a rebound.

After market consolidation, a certain degree of profit-taking is a normal operation, and hundreds of millions of dollars in profit-taking in a single day can be interpreted as healthy capital rotation.

However, as observed since early October, when this capital outflow forms a sustained trend, its nature shifts from "dispersed selling" to beginning to show characteristics of "market exhaustion."

The scale of realized losses is also on the rise. Although current losses remain within a "controllable" range, they have been climbing in tandem with the scale of profit-taking.

If realized losses continue to grow in sync with profit-taking, it may indicate that de-risking operations are spreading from short-term holders to the entire market.

This spread could be highly contagious, as currently half of the short-term Bitcoin holders are in a state of unrealized losses.

Data from the on-chain analysis platform Checkonchain shows that unrealized losses currently account for about 2% of the market capitalization. While this scale is not large, the rate of increase is rapid.

If the price of Bitcoin falls below $100,000, this proportion is likely to rise to 5%, a level sufficient to transform the current market's "unease" into full-blown panic.

Historically, only during a complete bear market phase does more than 30% of the circulating supply experience losses, and the current market is dangerously close to this threshold.

If buyers can successfully defend the $100,000 level, Bitcoin may reset its short-term cost baseline and restore bullish momentum.

If it falls below $100,000, a new round of buyers' cost baseline will collapse, and all short-term circulating supply will turn into a state of loss.

This does not necessarily mean the end of the current cycle, but it could further expand the pullback to around $80,000, representing a decline of about 35% from the historical peak (ATH).

Considering the current scale of selling pressure, Bitcoin's stability remains noteworthy, but the signals transmitted on-chain are clear: market confidence is continuously weakening.

Bulls are still holding the line, but each downward candlestick makes it harder for outsiders to determine whether they are "buying the dip" or "catching a falling knife."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。