Source: The Little-Known Crypto Powerhouse Behind Billions in Trading

Translation by: LenaXin, ChainCatcher

The anonymous decentralized exchange Hyperliquid, built by a small team of engineers, has attracted heavyweight investors and achieved trading volumes in the hundreds of billions in just two years. The platform focuses on perpetual contract trading, a type of contract with no expiration date, dominating the cryptocurrency speculation market with monthly trading volumes exceeding $6 trillion.

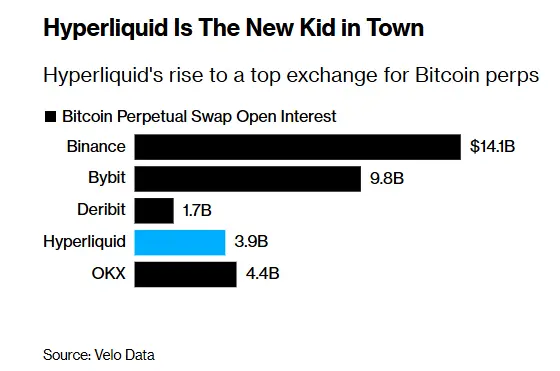

Although it is vastly smaller than industry leader Binance, Hyperliquid has surpassed Coinbase in certain areas and established a competitive advantage among decentralized exchanges.

Its development has made it a focal point in the crypto wilderness. Supporters praise its speed and transparency, but it also became the center of last week's market crash, during which traders on the platform suffered losses of $10 billion.

Hyperliquid remains dominated by a core small circle, raising questions among supporters about its level of decentralization. For supporting institutions like Paradigm and Pantera Capital, this is both a bet on the future of digital finance and a warning that much of the industry's activity still exists outside formal regulatory frameworks.

Earlier this year, at an industry summit hosted by Coinbase, BlackRock and Coatue executives discussed development plans with crypto figures, and Jump Trading President Dave Olsen specifically pointed out that Hyperliquid is Binance's "first heavyweight competitor."

What exactly are the characteristics of Hyperliquid? Why has it attracted former Boston Fed President Eric Rosengren to join the board of its Nasdaq-listed fund and successfully captured market share?

Essentially, this is a minimalist trading platform operated by a team of about 15 at Singapore's Hyperliquid Labs. The platform's front end blocks U.S. users as per industry norms, but anyone can trade on its underlying blockchain. The identity verification-free mechanism is its core attraction, reminiscent of the rapid growth of early exchanges that adopted similar models, which often quickly drew regulatory scrutiny.

Tarren Chitra, founder of crypto risk modeling firm Gauntlet, pointed out: “The fastest-growing markets are often the newest or least mature, because existing market participants largely do not understand the logic of their existence.”

Hyperliquid was co-founded by Jeff Yan and a co-founder using the pseudonym "iliensinc." Jeff Yan, who previously worked at Hudson River Trading, operated the crypto trading platform Chameleon Trading before turning to build a trading system focused on extreme speed, mostly operating outside traditional regulations.

But survival cannot rely solely on speed; the real test lies in liquidity. Platforms like dYdX and GMX have relied on token incentives to attract market makers, and their models became fragile when rewards dried up. Hyperliquid's solution is to launch the Hyperliquid market maker mechanism, where user deposits serve as the platform's liquidity pool, with algorithms continuously issuing buy and sell quotes to ensure every trade has a counterparty. Currently, the system's capital scale has surpassed $500 million.

Felix Buchter, an algorithmic trader at market maker Wintermute, stated: “Without users, there are no market makers, and a lack of liquidity cannot attract users. Hyperliquid has successfully solved this chicken-and-egg problem, as its HLP liquidity pool can provide quotes for any market.”

(Note: David Schamis, founding partner and Chief Investment Officer of Atlas Merchant Capital, discussed Hyperliquid's issuance of the HYPE token in a new $888 million agreement on the Bloomberg Crypto program with Tim Stenovec and Scarlet Fu.)

Some crypto experts have pointed out potential conflicts of interest: the HLP mechanism of the agreement can act as a counterparty in certain trades. Former Coinbase executive Vishal Gupta stated: “Operators of exchanges should set the rules and act as referees, rather than trading themselves, because no one can ensure the fairness of rule enforcement.”

Supporters argue that unlike past problematic exchanges, every trade in HLP is recorded on-chain in real-time, creating an auditable trail, which constitutes its core difference from traditional platforms. As the platform matures and large external market makers join, the proportion of HLP trades has shown a downward trend. However, it is worth noting that, unlike most competitors, HLP's code has not yet undergone a public third-party audit.

A spokesperson for Hyperliquid Labs stated: “Unlike centralized exchanges, transparency is an inherent quality of Hyperliquid. Every trade, settlement, and verification action can be verified in real-time, and the platform never holds user funds.”

During the weekend market sell-off, the HLP mechanism drew attention. Public data shows that when large traders on the platform suffered losses, the liquidity pool gained about $40 million. This crash also triggered the automatic liquidation mechanism standard for crypto exchanges; when buffer funds were exhausted, the system would reduce profitable positions to absorb the failing flow.

In other words, Hyperliquid reduces its own losses by using the money of winners to compensate losers, even profiting $40 million.

Analysts like Chitra from Gauntlet pointed out that Hyperliquid's ADL rules have a textbook-like aggressive quality, which may be one of the factors driving HLP profitability.

After last week's crash, Jeff Yan posted on X, emphasizing that HLP is a “neutral liquidator that does not filter profitable liquidation opportunities,” and explained that Hyperliquid's liquidation scale appears large because the data is “fully on-chain,” while centralized exchanges often underreport liquidation volumes.

If we compare HLP to an engine, the validation nodes are the control center. Hyperliquid has only about 24 validation nodes, in stark contrast to Ethereum's network of over a million nodes. Critics point out that its power is overly centralized, with the Hyper Foundation controlling nearly two-thirds of the staked HYPE native tokens, significantly influencing validation node decisions and governance, although in recent resolutions, its nodes chose to abstain to comply with community consensus.

Kham Benbrik, research director at blockchain validation firm Chorus One, noted: “Controlling more than two-thirds of the staked tokens means being able to do as one pleases on-chain.”

This power contradiction was highlighted in the so-called “JELLY incident”: at that time, large bets on illiquid tokens threatened HLP's solvency, and the validation nodes voted to liquidate the trade, with the foundation using its own funds to compensate affected users.

At that moment, Hyperliquid acted like a market operator implementing intervention, akin to traditional exchanges rolling back trades. Jeff Yan referred to this as an “extreme situation,” requiring the then 16 validation nodes to act immediately to protect users.

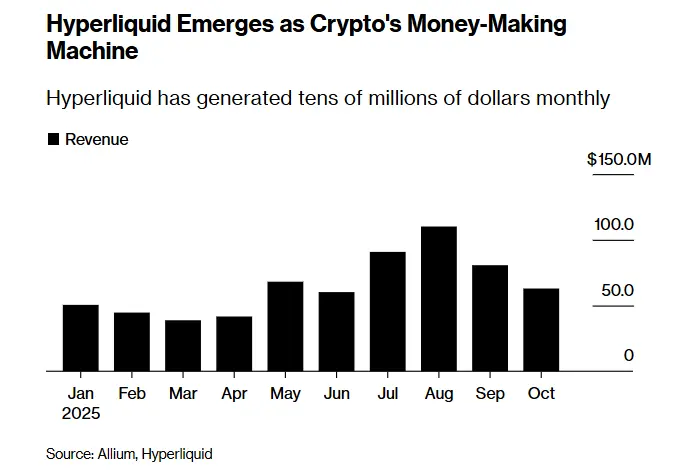

Hyperliquid's financial structure allocates most trading fees to repurchase HYPE tokens, creating a flywheel effect where trading volume boosts token prices. The fund that uses platform fees for HYPE token repurchases currently has a capital scale exceeding $1.4 billion. Supporters praise it as a growth engine, while critics warn that repurchases typically only provide short-term boosts to token prices.

Veteran crypto investor Santiago Roel Santos pointed out that token repurchases have “high reflexivity” and depend on continuously growing trading volumes to be sustainable, only sustainable if Hyperliquid continues to surpass large competitors.

Hyperliquid prides itself on innovation, but its token issuance, deeply tied to platform growth, incentivizes user participation and liquidity models that are somewhat traditional. Although Hyperliquid employs transparent on-chain operations, many previous platforms have demonstrated that when technical demands devolve into greed for fragile reward protocols, crises follow.

Market enthusiasm remains high. Paradigm invested $888 million to support the Nasdaq-listed fund holding HYPE, allowing traditional investors to participate without trading directly.

(Note: Board members of this listed fund include Rosengren.)

According to DefiLlama data, over 100 projects are currently developing ecosystems based on Hyperliquid, comparable in scale to BNB Chain or Solana.

David Schamis, co-founder of Atlas Merchant Capital, stated: “It is both a Coinbase-like exchange and an Ethereum-like Layer-1 blockchain, merging both into one system.” He also revealed that “the platform has achieved over $1 billion in annualized free cash flow with fewer than 15 full-time employees.”

After this week's Hyperliquid upgrade, senior users can create perpetual futures markets in minutes without the need for listing committee approval. Creators must stake HYPE worth millions of dollars as collateral, and validation nodes can confiscate the staked amount if they detect abuse.

This is a common risk control mechanism in proof-of-stake blockchains, potentially giving rise to trading markets for new tokens or volatility tracking products. Essentially, Hyperliquid not only opens markets to traders but also allows them to build markets independently.

Disclaimer

The content of this article does not represent the views of ChainCatcher. The opinions, data, and conclusions in the text represent the personal positions of the original author or interviewees. The translation party maintains a neutral stance and does not endorse its accuracy. It does not constitute any professional advice or guidance, and readers should exercise caution based on independent judgment. This translation is for knowledge-sharing purposes only; readers should strictly comply with the laws and regulations of their respective regions and refrain from participating in any illegal financial activities.

Recommended Reading:

Epic Crash! BTC narrowly holds the $100,000 mark, why is the altcoin market suffering a bloodbath?

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。