本文来自:彭博社

编译|Odaily 星球日报(@OdailyChina);译者|Moni

短短两年间,一个由十几位工程师打造的去中心化交易所,从名不见经传到吸引顶级投资机构关注、撬动数十亿美元交易量并且成为加密衍生品市场的新焦点,它就是Hyperliquid。

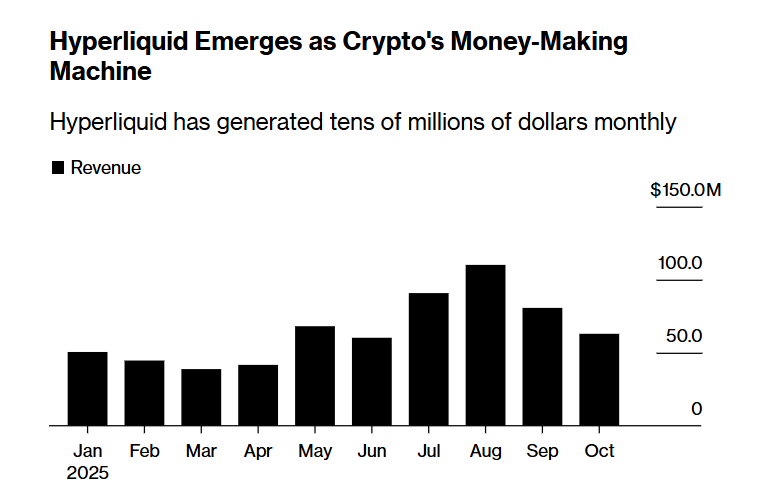

如今,永续合约(Perpetual Futures)——这种不设到期日的衍生品交易模式——正在主导着加密投机交易,每月交易量超过 6 万亿美元,Hyperliquid在该领域里如鱼得水,虽然体量仍远不及龙头币安,但在部分指标上Hyperliquid 已超越 Coinbase。

虽然在交易速度与透明度方面深受加密社区用户欢迎,但Hyperliquid爆炸式增长也引发一些争议——就在上周加密货币市场的暴跌中,平台交易者在极短时间内承受了 100 亿美元的爆仓损失。

尽管名义上是一家去中心化交易所,但Hyperliquid 仍由核心“小团队”掌控,引发对其真正“去中心化程度”的质疑。对于其投资方 Paradigm 与 Pantera Capital 等机构而言,这既是押注数字金融未来的机会,也提醒人们:加密行业的许多核心环节仍游离于监管体系之外。

今年早些时候,在纽约曼哈顿Coinbase 峰会上,BlackRock、Coatue 与其他传统金融机构代表齐聚探讨加密行业的下一阶段,期间 Jump Trading 总裁 Dave Olsen 公开将 Hyperliquid 称为首个具有实质竞争力的币安对手。由此,一个显而易见的问题出现了——

Hyperliquid为何能在短时间内脱颖而出?

从本质上来讲,HyperLiquid并不能算是一个“功能强大”的交易平台,目前由新加坡实体Hyperliquid Labs旗下大约 15 个人组成的团队运营,两位联合创始人分别是 Jeff Yan 和匿名者“iliensinc”,Jeff Yan 曾在 Hudson River Trading 任职,是一名量化交易员,之后运营一家名为 Chameleon Trading 的加密交易平台,多年的行业经验让他明白一个道理:加密货币交易平台仅靠速度并不能保证生存,真正的考验是流动性。

依靠代币激励模式的加密货币交易平台通常难以维持长期增长,比如dYdX 和 GMX, 因为一旦奖励枯竭,做市商就会离开。为了解决流动性问题, Hyperliquid 找到了自己的答案:Hyperliquidity Provider(HLP),这是一个主动做市池,允许用户存入的资金充当平台的“庄家资本”,再利用算法持续挂出买卖报价,确保市场随时有人接单,目前系统内资金超过 5 亿美元。

做市商 Wintermute 算法交易员 Felix Buchert表示:“如果没有用户,做市商就不会来;如果没有流动性,用户也不会来,所以这就涉及到一个先有鸡还是先有蛋的问题,而 Hyperliquid 的成功之处在于引入了这个 HLP ,确保可以对几乎任何类型的代币交易进行报价。”

实际上,HLP 扮演了三重角色——

1、流动性提供者:HLP 承担平台的主要做市职能,确保买卖双方的深度稳定。

2、风险缓冲器:在用户亏损或市场剧烈波动时,HLP 作为系统性风险对冲池,吸收清算损失,从而避免使用传统交易所常见的 ADL(自动减仓)。这样一来,盈利用户不会因为系统风险而被强制平仓。

3、收益分享机制:所有向 HLP 存入资金的用户,都可以分享平台的手续费收入与资金费率收益。

可以说,HLP 金库策略塑造了 Hyperliquid 独特的竞争优势,让Hyperliquid 得以在竞争激烈的赛道中快速脱颖而出。

危机渐显,HyperLiquid会是美国监管机构的下一个目标吗?

危机一:HLP代码并未通过公开的第三方审计

HLP是HyperLiquid快速发展的助推器,但同时也埋下了危机的种子。

一些加密行业业内人士发现HLP存在潜在利益冲突,Coinbase 前高管 Vishal Gupta 指出:“ HLP 可以在某些交易中充当交易对手,当你运营一家交易所时,应该制定规则,应该成为裁判,但不应该在场上参与比赛,否则没有人能确保你公平地执行你的规则。”

尽管Hyperliquid 上每笔 HLP 交易都会实时记录在链上,可供公开审计,同时随着更多外部做市商加入HLP 在总体交易量中的占比也逐步下降,但需要注意的是HLP代码迄今为止并未通过公开的第三方审计。

Hyperliquid Labs 发言人解释说:“与中心化交易所不同,Hyperliquid 的透明性是天生设计的一部分。每笔交易、清算与验证者行为都可实时验证,且平台从不托管用户资金。”

上周末的市场暴跌中,HLP 再次成为关注焦点。公开数据显示,当Hyperliquid 平台大户遭受损失时,HLP 金库录得约 4000 万美元的收益。此次暴跌还触发了 Hyperliquid 的自动减仓机制(ADL),这是加密交易所的标准防线:当风险缓冲耗尽,系统会从盈利账户中扣减头寸以吸收亏损流。

一些分析人士认为, Hyperliquid 的 ADL 规则异常激进,堪称教科书级。事后 Jeff Yan 在 X 上回应称,HLP 是非掠夺性的清算者,不会主动选择有利可图的清算,他还解释称Hyperliquid 的所有订单、交易及清算均在链上执行,任何人都可无许可验证清算过程及系统偿付能力,这种透明性与中立性使完全链上 DeFi 成为全球金融基础设施的理想形态。一些中心化交易所(CEX)在清算数据方面存在严重低报现象。例如,币安在同一秒内若出现数千笔清算,仅会公开展示一笔,这可能导致实际清算规模被低估百倍,希望行业将透明与中立视为新金融体系的核心特征。

危机二:中心化的“去中心化”,治理结构存争议

如果说 HLP 是引擎,那么验证者就是驾驶室。

Hyperliquid 目前大约有 24 个验证节点,远少于以太坊超百万节点。批评人士认为这种设计集中化程度较高,比如区块链验证公司 Chorus One 研究主管 Kam Benbrik 就指出:“当你掌握超过三分之二的质押权时,几乎可以在链上为所欲为。”

虽然无需身份验证是 HyperLiquid 吸引加密用户的核心,这种模式也延续了过去一些高增长加密货币交易所的发展路径,但问题是此类交易所往往随后会遭遇监管审查。加密货币风险建模公司 Gauntlet 创始人 Tarun Chitra解释说:“增长率最高的市场往往是新兴市场或最不成熟的市场,因为大多数现有市场参与者并不理解它们存在的意义。”

目前,Hyper Foundation 依然控制着近三分之二的质押代币 HYPE,因此在治理与验证决策中拥有显著影响力,虽然Hyper Foundation 在部分决策中选择弃权以尊重社区共识,但其权力集中仍备受关注,而这种中心化问题在此前的“JELLY 事件”中被明显暴露出来:当时“攻击者”利用平台公开的计算逻辑、算法流程与风险控制机制对流动性较差的JELLY代币制造了一场对市场和交易者都极具杀伤力的“无代码攻击”,HyperLiquid验证者最终投票清算该交易,基金会动用自有资金补偿受影响用户——那一刻,Hyperliquid 几乎与回滚交易的传统交易所无异。

Jeff Yan 当时解释称,JELLY 事件是一次“特殊情况”,需要当时 16 个验证者紧急介入以保护用户利益。

危机三:财务结构风险,监管灰区的自我平衡

在财务结构上,Hyperliquid 机制似乎也蕴含高风险,平台将大部分交易手续费用于回购 HYPE 代币,形成一个“飞轮效应”:交易越多,代币价格越高。截至目前,由平台费用驱动的援助基金HyperLiquid Assistance Fund已累计超过 14 亿美元,支持者认为这是增长动力,但批评者则警告称此类回购往往只在短期内提振价格。

长期投资者 Santiago Roel Santos 指出,这种代币回购模式“高度自反”,而且依赖交易量持续增长才能维持。

事实上,对于一个以创新自居的平台来说,这种模式其实相当传统,即:交易所通过与平台增长紧密相关的代币来鼓励用户参与和提升流动性。

虽然 Hyperliquid 的流程完全上链且透明,但历史上不少类似平台都因“代币激励泡沫”而迅速崩塌,许多看似是对技术的需求,最终都被证明仅仅是对一个不稳定奖励协议的贪婪。

尽管如此,市场兴趣仍在飙升。

据 DefiLlama 数据,目前已有超过 100 个项目在 Hyperliquid 上构建,其生态规模可比肩 BNB Chain 或 Solana。Atlas Merchant Capital 联合创始人 David Schamis 表示:“某种意义上,Hyperliquid 既像 Coinbase(交易所),又像以太坊(公链)——两者合二为一,该平台已实现超过 10 亿美元的年化自由现金流,而全职员工还不到 15 人”。

Hyperliquid Labs今年五月已向美国商品期货交易委员会(CFTC)提交两份评论信,其中称将支持美国去中心化金融(DeFi)发展的明确监管框架,而且也承诺与监管机构保持建设性合作,共同推动更开放、透明和高效的金融系统发展。然而,HyperLiquid的成功似乎已经暴露当前监管框架中的一些漏洞,尤其是当前美国相对宽松的态度为 Hyperliquid 提供了发展空间。但问题是,HyperLiquid还能在监管视线之外持续多久呢?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。