Author: Baba

Compiled by: Luffy, Foresight News

The leverage liquidation last Friday caused significant losses for many, and I do not wish to see anyone face such a fate. However, like a forest reborn after a great fire, the cryptocurrency market will also present new opportunities.

As leverage disappears and basis trading collapses, capital and attention are structurally forced to shift: from perpetual contracts to spot trading, from centralized exchanges (CEX) to decentralized exchanges (DEX), and from mainstream coins to small-cap coins. This shift marks the beginning of a new on-chain cycle, where reflexivity will replace leverage as the dominant mechanism in the market.

Despite the fear of leverage instilled by last Friday's crash, traders' desire for high-yield investment opportunities has not vanished; it may even be stronger due to the urge to recover losses through revenge trading. Liquidity does not disappear into thin air; it simply flows toward the best opportunities.

This market environment is precisely what can inject new vitality into the Memecoin supercycle.

Overall, as participants return to the most fundamental trading methods, the activity of on-chain spot currencies will increase, and Memecoins, in particular, have the potential to attract attention. The profit potential of Memecoins is similar to that of leveraged positions, requiring minimal capital investment to achieve high returns in the short term; moreover, there is no risk of liquidation with Memecoins (Disclaimer: the tokens you hold may still go to zero, please trade cautiously).

Trader's Perspective

First, let's break down the fundamental logic behind why people choose to trade perpetual contracts instead of spot.

The core reason market participants prefer perpetual contracts is that they address issues of capital efficiency, trading thresholds, and flexibility, especially in the decentralized and volatile cryptocurrency market. For traders, the primary goal is to maximize expected returns per unit of risk and capital.

The spot market operates on a full collateral model; to achieve a 1:1 position exposure, one must invest the full amount of capital. In contrast, perpetual contracts break this limitation. Traders do not need to pay the full principal; they can achieve higher exposure by depositing margin, and this leverage mechanism can amplify profits but also exacerbate losses. In cryptocurrency trading, capital is the most precious resource, so efficiently allocating capital is naturally very attractive to traders.

Cryptocurrencies are one of the most volatile asset classes, providing traders with opportunities for excess returns in the short term. However, high returns come with high risks: when prices rise, candlesticks often show vertical surges; when they fall, it feels like a bottomless pit. This characteristic attracts high-risk-tolerant traders, theoretically allowing their profit potential to be unlimited while their loss potential is capped at the margin.

Essentially, perpetual contracts inject the strongest catalyst into already highly volatile assets: they allow traders to pursue the legendary 1000x returns on coins considered safer than on-chain Memecoins.

But returns and risks always go hand in hand. Funding rates may invert, leading to account losses; margin calls may trigger liquidations prematurely; and reliance on the exchange's solvency can introduce systemic risks. Even so, traders are still willing to bear these risks because the return structure of perpetual contracts is more attractive. Traditional markets rely on stability, while the crypto market thrives precisely in instability.

Volatility, narrative shifts, and new underlying protocols have long been the norm in crypto trading. In such a market, information decays quickly, and new opportunities constantly emerge amid the chaos. At this time, taking on risk is not an irrational act but a strategy: if the market resets every so often, entering early and being aggressive often yields more returns than acting late and seeking safety. The crypto market rewards those who act quickly, not those who wait for validation.

Market Incentives

Currently, the market sentiment for perpetual contracts is at a recent low, creating opportunities for new mainstream plays. Keen teams have recognized this and are brainstorming ways to attract attention to their products, from airdrop plans to product launches, with many projects likely to announce significant updates in the coming weeks. As seen in many past cases, timing is often the key to a project's success or failure.

Take WIF as an example; its launch timing was impeccable. At that time, Solana was in an upward channel, the Solana community had just received a liquidity injection from the JTO airdrop, and the Memecoin supercycle was just beginning. If WIF were to launch in January 2024, the Memecoin leaders in the Solana ecosystem would have already emerged, and WIF would merely become one of the thousands of Memecoins launched daily.

If I were Alon from pump.fun, the Bonk.fun team, or a member of the Solana Foundation, I would do everything possible to redirect attention back to the Solana battlefield—the simplest way would be to revive the Memecoin market. Memecoins were once the core driver of user attraction to the Solana ecosystem, and now they have the opportunity to play that role again. Generally speaking, price increases are the most effective marketing strategy, and the capital threshold required to drive up Memecoins is the lowest.

Once reflexivity and speculative sentiment kick in, the prophecies of high-market-cap Memecoins will become self-fulfilling. People will enter due to FOMO: a certain Memecoin performs well → traders FOMO in → price targets are raised → Memecoin bulls become louder → more Memecoins rise → more Memecoins are launched. This is a flywheel of speculation and validation reinforcing each other.

As we see the increased activity of Memecoin bulls like @theunipcs and @miragemunny on social platforms, it indicates that speculative sentiment is returning to the Memecoin space. For pump.fun and Bonk.fun, increased activity will bring more fee income, further driving the repurchase of PUMP and BONK tokens. Currently, the price trends of USELESS and NEET have shown positive signs, perhaps signaling the early stages of this trend.

From the perspective of traders who faced account deficits due to liquidations last Friday, they typically have two paths to choose from:

- Temporarily exit the crypto market and reassess their trading strategies;

- Continue to take on higher risks and engage in revenge trading.

I do not recommend emotional trading, but our goal is to predict the behavior of market participants rather than guide them on what they should do. These traders already have a high-risk appetite, so they will naturally be attracted to opportunities that are most likely to recover all their losses. Once an upward momentum appears in the Memecoin space, they are very likely to invest their funds there.

Attention and Capital Flow

Essentially, Memecoins are the purest form of currency in the attention economy. Why do they have no fundamental value yet reach market capitalizations in the billions? The answer is attention.

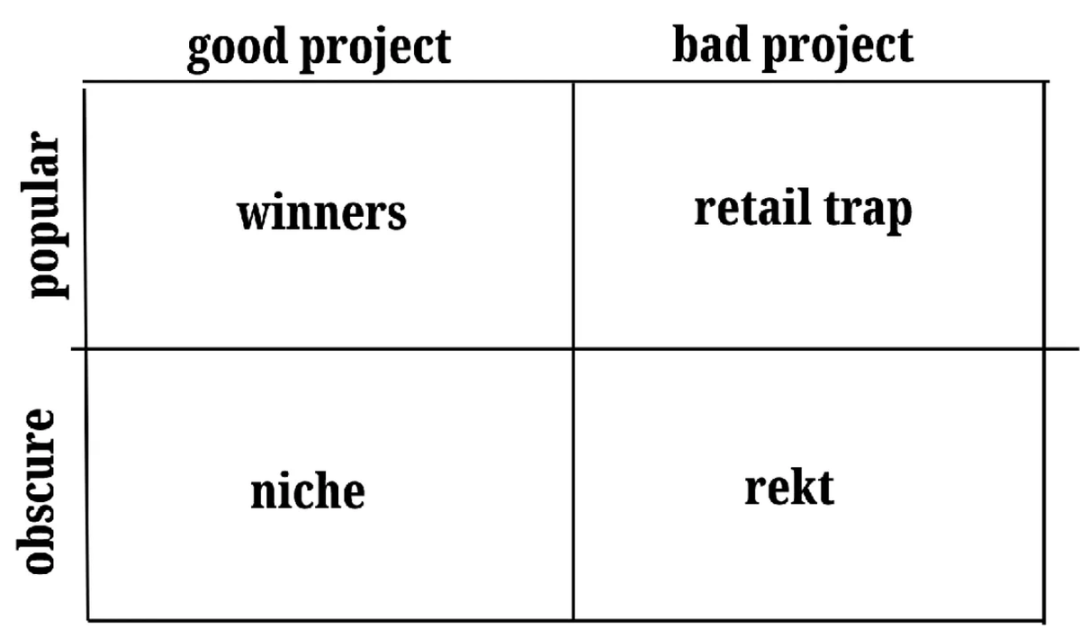

Attention is the core driving force behind the flow of capital in the cryptocurrency market. This also explains why high-quality products may not necessarily drive price increases, while poorly experienced products like Cardano can perform well in price. In the crypto space, project teams need years to create value for their protocols, but the attention span of the crypto community is as short as that of a goldfish: their expectations for projects often focus only on the next few weeks or even days, meaning price movements can hardly reflect fundamental changes in the protocol accurately. Instead, price fluctuations are more driven by hype on Twitter or opinions in Telegram groups.

In the attention economy, Memecoins are perfect attention absorbers. They are inherently reflexive tools: small circulating supply, high turnover rate, and prices determined by attention. Injecting $1 million into a Memecoin with a market cap of $10 million will cause price fluctuations ten times greater than the same amount injected into a centralized exchange altcoin. This convex return structure will attract remaining funds after liquidations back into the Memecoin casino.

The resulting attention vacuum will draw in onlookers; no one can resist the vertical surge of green candlesticks, which adds fuel to the Memecoin cycle.

In the risk economy of cryptocurrencies, leverage and reflexivity are substitutes. When there is ample leverage in perpetual contracts, the reflexivity of the spot market is suppressed; when leverage collapses, the reflexivity of the spot market will dominate.

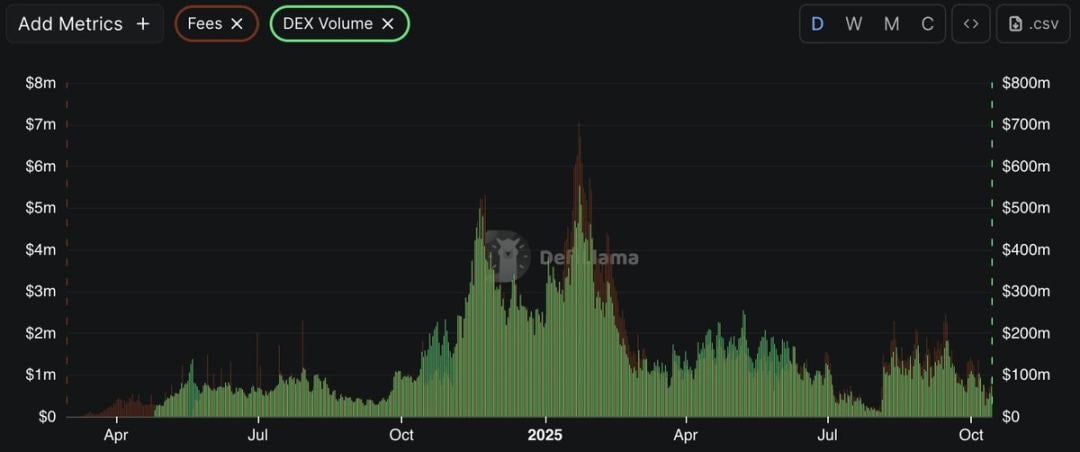

Before the crash, thanks to the success of Hyperliquid and the rise of competitors like Lighter and Aster, the attention and liquidity of perpetual contracts reached historical highs; meanwhile, the market sentiment and attention for Memecoins fell to cyclical lows. The candlestick charts were dismal, players turned to other areas, and social platforms were filled with ridicule of Memecoins, with sellers having no coins left to sell. This situation precisely indicates that the field is ready for a bottoming rebound.

I personally waver on whether Memecoins are more beneficial than harmful to the overall cryptocurrency landscape, but my opinion is irrelevant. Ultimately, the market and prices will determine whether Memecoins can replace perpetual contracts as the focus. This is a typical manifestation of Keynes's beauty contest in modern markets: in Keynes's original metaphor, investors do not choose the faces they find most beautiful but rather the faces they think others will find beautiful.

From the current market environment, Memecoins seem most likely to emerge as the winners of the beauty contest. They meet all the conditions to attract perpetual contract traders—high returns, high volatility, and low short-term capital investment. Given that many are wary of the risk of liquidation crashes, attention is poised to shift toward new mainstream plays, and capital will naturally flow accordingly.

Current State of the Solana Ecosystem

The Memecoin craze of 2023 began with Solana, and it is likely to become the center of the craze once again. Although the current sentiment and on-chain activity for Memecoins are at a low point, just a little upward momentum can quickly turn the situation around. As shown in the chart below, the trading volume and fees for pump.fun have been declining since mid-September—despite Bitcoin rebounding from its September lows and reaching new historical highs in October, on-chain activity has not warmed up accordingly.

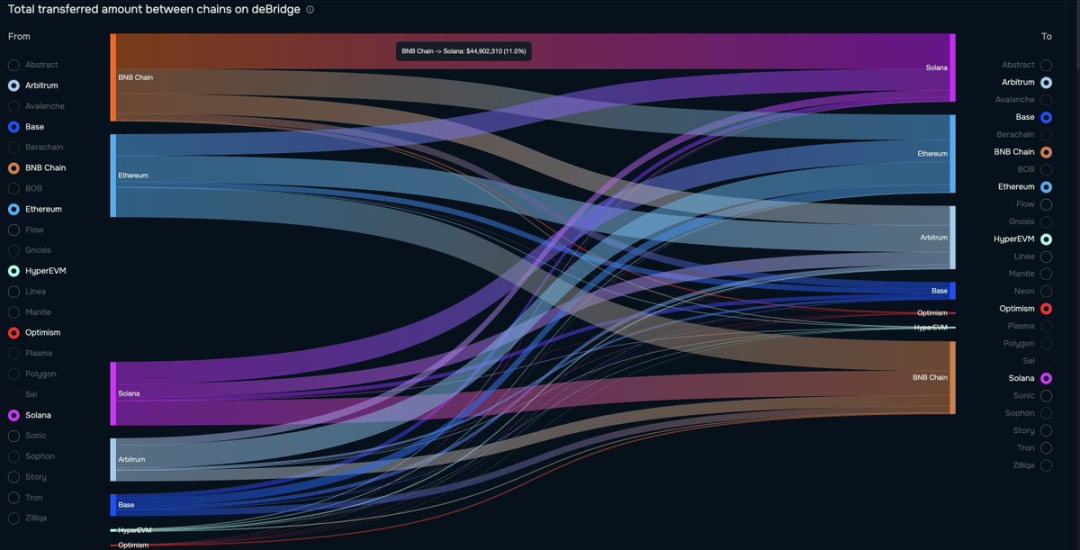

In the past seven days, the BNB Chain has experienced the largest outflow of funds, with 11% of the funds flowing into Solana through cross-chain transactions. This signal indicates that profits from the Binance craze are returning to the Solana on-chain ecosystem. If this trend continues, it is reasonable to speculate that a significant portion of these funds will be injected into Memecoins.

Trading Strategies

Assuming that after the liquidation, attention and capital will return to Memecoins, the trading strategy is actually quite simple: if you believe in the revival of Memecoins, early positioning is the option with the highest expected value.

Although the leading coins from the previous Memecoin cycle may rebound as activity increases, the coins with the greatest profit potential are often the newly launched Memecoins. New coins mean new memes, new code, and new possibilities—these characteristics generate interaction heat far greater than that of older coins whose stories have already been priced in.

Old coins often carry historical burdens: past highs, trapped positions, and narrative breaks; whereas new coins do not have these constraints, lacking psychological price ceilings and community legacy issues, making it easier for traders to believe that this time will be different. The first few bullish candles of a new coin can create the illusion of discovering a new opportunity, which is enough to initiate a reflexive feedback loop.

As past Memecoin cycles have shown, being a pioneer in trends always yields profits, as leading coins typically emerge in the early stages of a craze. Take WIF and FARTCOIN as examples; both were launched at the beginning of an upward trend, allowing sufficient time to accumulate users. No matter how strong the momentum of a certain Memecoin is, it cannot rise vertically forever: they need to undergo significant corrections to flush out early holders and provide attractive entry points for onlooking traders. This will create a more committed group of holders, achieve broader token distribution, and subsequently attract more attention.

Before the emergence of a new Memecoin leader, no one can accurately predict its form. Therefore, now is the time to closely monitor Twitter, Telegram, and Dexscreener to discover potential Memecoins that could become the next on-chain leader. When researching Memecoins, consider the following questions:

What is the total addressable market (TAM)? Does it resonate only within the crypto community, or does it have the potential to enter mainstream visibility (like FARTCOIN)?

What entities are motivated to drive the success of this token? Are there large institutions willing to stake their reputation on it?

What are the consensus points? What is the core narrative driving the price increase?

How strong is the meme's virality? Does it possess self-propagating attributes?

This list is not exhaustive, and leading coins may not meet any of the above criteria. The purpose of listing these questions is to encourage you to think about the key factors that drive Memecoins to gain attention.

Conclusion

I cannot guarantee that the revival of Memecoins will definitely happen, and this article is not meant to encourage you to blindly buy all new coins on Dexscreener. However, this is a trend worth paying attention to, and there will be clear signals when attention returns to Memecoins: increased trading volume on decentralized exchanges, new trading pairs, rising market caps of newly launched tokens, and more K-line shares on social platforms. Please have faith in the value of certain things.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。