The crypto market does not reward followers; it only rewards those who can "see through the illusion."

Written by: hitesh.eth

Translated by: Saoirse, Foresight News

The core of crypto tokens is belief. They are the purest financial instruments ever created, designed to extract hope from humanity and convert it into liquidity. The price fluctuations of tokens do not stem from practical value but from narratives, manipulation, and the understanding of how to turn "attention" into a weapon for market control. This is not a normal market; it is a psychological battlefield. Most people are completely unaware that they are merely prey waiting to be slaughtered on this battlefield.

Price Discovery

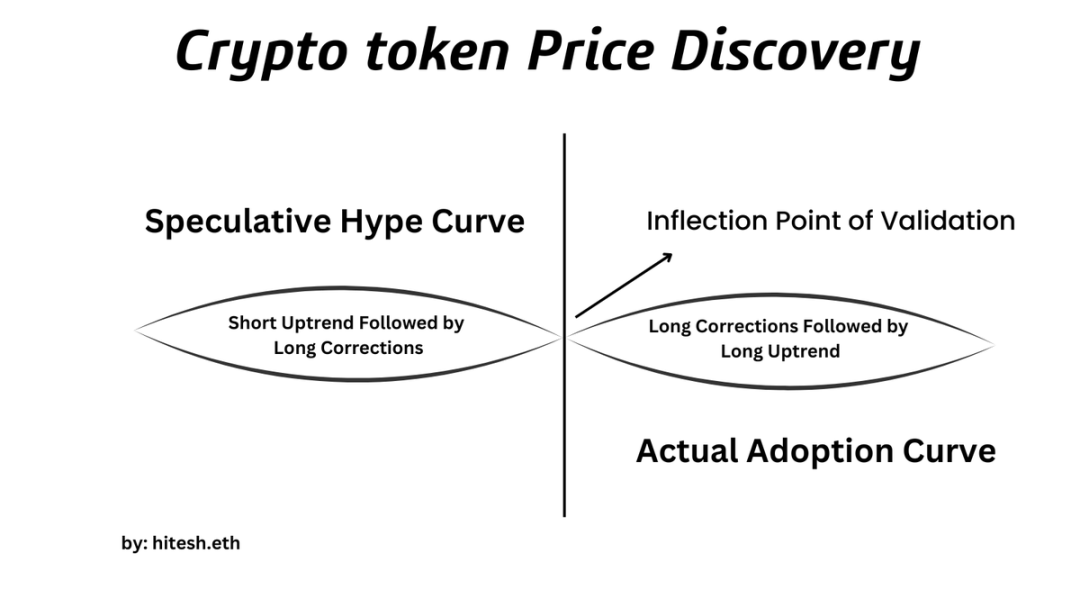

No matter how extravagant the promotional narrative, all crypto tokens follow the same price discovery cycle. The cycle begins with the "0-1 phase": at this point, hype dominates absolutely, and the actual application rate is nearly zero. Prices soar solely based on market sentiment, and communities form around fictional "future blueprints," with the momentum of promotional rhetoric completely overshadowing reality. Then, a brutal correction arrives as expected — this will eliminate weak-willed holders and expose those investors who blindly entered the market based on a mere "promise."

The deep downturn phase is often a critical turning point. Projects without real demand will quietly fade away: they stop updating tweets, halt technical development, and then slowly disappear from the market, with liquidity shifting to other projects. However, a few tokens manage to survive and enter the "1-10 phase" — at this point, the hype cools down, and actual applications begin to take off. These tokens will experience a slow and steady growth period until real demand reignites a second wave of "belief." It is this second wave of belief that will give rise to a long and strong bull market. Only these types of tokens can endure round after round of cycles; most tokens do not make it this far.

Hidden Truth

Looking ahead, tokens will become meaningless for most projects. Once private enterprises can directly tokenize equity and raise liquidity on-chain, the vast majority of crypto tokens will become worthless. Currently, only two areas of tokens possess real value: decentralized physical infrastructure networks (DePIN) and certain sectors of decentralized finance (DeFi) — because they can drive participation and collaboration on the supply side. All other token-related operations are essentially disguised financing schemes masquerading as "innovation."

The existence of most tokens is fundamentally about founders wanting to quickly raise money — but this era is coming to an end. Better financing methods are emerging, and regulatory policies are on the way. However, meme coins and junk tokens will not disappear; in fact, they will proliferate — because gambling is human nature. The only change is that the future boundaries between "gambling" and "investing" will become clearer: when you are gambling, you can no longer use "long-term investment" as a pretext. You must make a choice: either admit you are gambling or earnestly invest. Yet now, everyone pretends to be an investor, even those chasing memes and hype.

Psychological Traps

Crypto tokens are essentially "promissory data strings," designed to manipulate human behavior. The token supply unlocking mechanism is set to control people's "hope"; the lock-up schedule is designed to slowly inject "belief" into the market. The so-called "incentives" are not just financial temptations but also carefully crafted emotional traps. The true "product" of such projects is not the token but "belief." All promotional narratives aim to target people's "reactive thinking" — that part of you driven by fear, anxiety, guilt, desire, and other emotions.

People are not buying tokens; they are buying "an opportunity to escape the current reality." This is why the spread of tokens is faster than logic — because the spread of belief is faster than the truth. This is also the reason for the existence of "coordinated hype": venture capitalists enter early, market makers manipulate price trends, exchanges time the listing of tokens, influencers stir up greed, whales quietly build positions, and finally, retail investors enter at the end of the chain, becoming "exit liquidity providers." This is not a conspiracy; it is an inherent process of market operation, the norm of the entire system.

The Demise of Tokens

What drives token growth is speculation, not practical value. All tokens are fighting in the same "attention war" — tokens that cannot retain attention will ultimately perish. In this market, attention is more important than "actual application," more important than "returns," and more important than "product usage." Yet most project teams do not understand this; they focus solely on price fluctuations while neglecting user growth.

Some projects may create a "false appearance of growth" through incentives, but once users start caring more about token prices than the product itself, the game is over. Incentives should be a "bridge to promote actual application," but they are treated as a "substitute for real demand." When a project loses control over token dynamics and becomes a "prisoner" of its own price chart, its core mission collapses: founders no longer focus on development but instead respond perfunctorily; the project vision fades, and the token becomes a curse. For those projects that "could have succeeded without tokens," tokens ultimately become their grave.

Exit Liquidity

If you do not know "from whom you are buying tokens," then you are someone else's "exit liquidity" (bag holder). The price discovery process of tokens is essentially a "coordinated game" controlled by insiders: venture capitalists, exchanges, market makers, investment alliances, whales, and key influencers work in concert to control the market. When retail investors see a token's "popularity soaring," insiders have already built their positions, waiting for retail investors to provide liquidity. The seed round is the stage for creating the greatest wealth, but retail investors never have the chance to participate — projects will complete financing at extremely low valuations, yet reach multi-billion dollar fully diluted valuations upon listing.

Retail investors always think they are "entering early," but in reality, they are late — their entry merely provides an exit opportunity for those who "entered at lower levels." To survive in this game, one must anticipate narrative trends in advance, enter before influencers start promoting, and build positions before liquidity incentives kick in. If you wait until YouTube influencers start recommending a token to buy, you have already lost. If you do not conduct your own research, it is not called "investing" — you are merely "borrowing someone else's belief," and this borrowed belief will ultimately lead to significant losses.

Future Divergence

The crypto space is splitting into two worlds: "regulated crypto" and "crypto anarchy." The former is controlled by the government, with compliant infrastructure, approved tokens, and comprehensive monitoring; the latter is raw, brutal, and free — privacy-driven blockchains, true decentralization, and pragmatic developers will survive in this world. Tokens were initially a symbol of "counter-mainstream culture," but that culture has long since faded. Cryptocurrencies have betrayed their original intent, becoming "Wall Street on the blockchain." However, a "purification" is about to occur: tokens without real demand will perish, and projects without core objectives will disappear.

Narratives without substantive content will vanish; only tokens tied to "real applications, real cash flow, and real goals" will survive, while the rest will disappear. You need to think clearly about why you are here — because tokens are like a mirror, exposing your greed, impatience, and fantasies. Most people come here for "freedom," yet find themselves trapped in speculation; they come for "wealth," yet lose themselves in greed; they come for "truth," yet become addicted to lies. This market cannot save you; narratives cannot save you — what can save you is discipline and insight. The survival rule is simple: learn the rules, act before the crowd, never be a bag holder, recognize who you are, and then engage in this "battle."

Conclusion

The crypto market does not reward followers; it only rewards those who can "see through the illusion." The crowd always acts slowly, always chases hype, and will always become someone else's bag holder. Do not be part of the crowd: establish your own processes, build your own advantages, and cultivate your own patience. If you understand this game, you will not fear it — instead, you can leverage it.

This "purification" will not destroy you; it will only create opportunities for you. The road ahead will not be easy: the market will test your beliefs, your timing judgment, your patience, your emotional control, and your ability to uphold the truth when "the crowd is drowned in noise." Now is not the time to pray for a bull market; it is the time to build your own "belief." There is only one question left: when the next cycle begins, will you be an "early entrant" or once again become an "exit liquidity provider"?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。