Powell Speech Summary: Crypto Market Impact and Next Fed Rate Cut

What exactly did the Powell Speech actually do to the economy and markets?

According to WSJ, On October 14, 2025, Federal Reserve Chairman spoke in Chicago and suggested that the cental bank would soon stop its balance sheet reduction program.

He also indicated additional rate cuts to come this year as the labor market appears to slow.

This Address arrived at just the critical moment, with Trump tariffs sparking the US-China trade tensions , affecting both global and crypto markets.

Investors are now awaiting what's next from the Federal Reserve.

Powell Speech Summary: Key Highlights

In his latest remarks, Fed Chair Jerome Powell said:

-

The Fed’s balance sheet reduction, known as quantitative tightening (QT), could end “in the coming months.”

-

Since 2022, the central bank has cut its holdings from nearly $9 trillion to $6.6 trillion.

-

Rising overnight funding rates prompted the central bank to reconsider how much further QT should continue.

-

He also confirmed that the Fed remains on track to cut interest rates again after lowering them to 4.00%-4.25% in September.

-

He said that “ labor market risks now outweigh inflationary pressures, ” signaling a softer stance ahead.

-

However, he warned that removing the Interest on Reserves (IOR) system could make it harder for the federal reserve to control short-term rates, which could harm market stability.

Trump Tariffs Add Pressure to Global Markets

The timing of the Powell Speech is important. Just days earlier, former President Trump threatened 100% tariffs on Chinese tech imports, reigniting US-China trade war.

The action sent a panic through financial markets, triggering one of the biggest crypto liquidations of the year, which was $19 billion (mostly long positions).

Bitcoin fell sharply, with most altcoins experiencing double-digit losses.

Jerome's dovish remarks allayed some of those concerns by implying the Fed stands prepared to back the economy should trade tensions escalate.

Market Reaction: Crypto and Stocks Slide, Futures Turn Positive

Following the Powell Speech, both crypto and equities markets had mixed reactions.

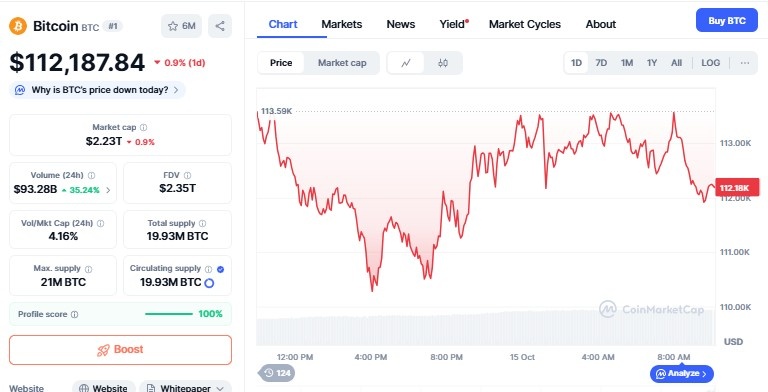

Bitcoin price fell 1.41% to around $112,000, revealing investors are still on guard following intense selling earlier in the week.

Source: CoinMarketCap

The total crypto market cap now sits at $3.82 trillion.

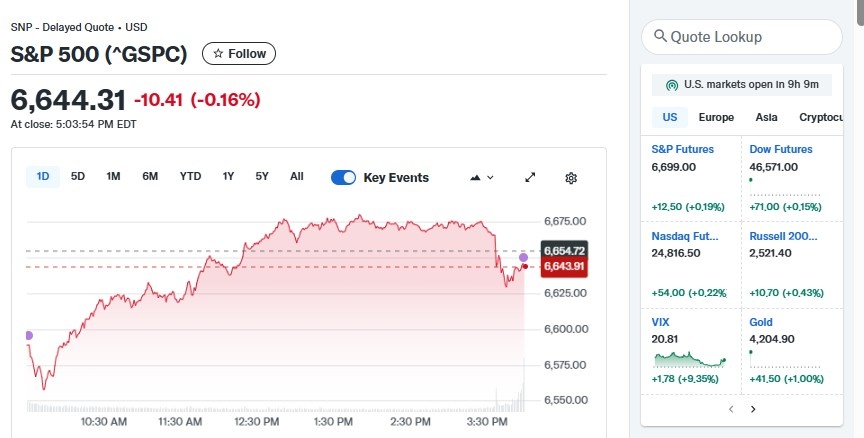

The S&P 500 finished a little down at 6,644.31 (-0.16%), mirroring continued concern over tariffs and worldwide demand.

Yet, later in the evening, S&P, Dow, and Nasdaq futures became positive, indicating renewed hope that rate reduction would provide relief.

Source: YahooFinance

Meanwhile, gold prices continued to climb, as investors took safety from market uncertainty

Analysts believe Powell’s words gave traders some comfort that the central bank will act carefully to prevent a deeper slowdown.

Upcoming Fed Rate Cut Hopes

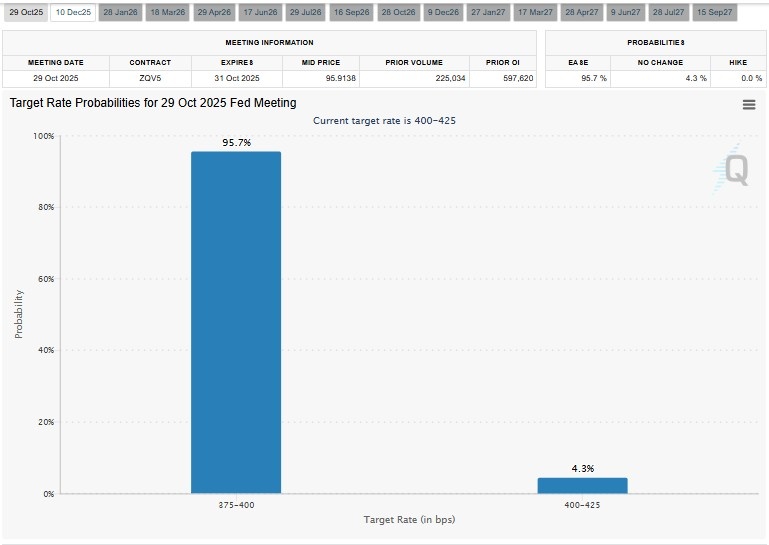

The CME Fed Watch Tool suggests 95.7% probabilities of federal reserve cutting rates in the next FOMC meeting which is to be held on 29 Oct 2025.

Source: FedWatch Tool

Final Thoughts

The Powell Speech today shows the central bank is turning more cautious as the economy faces pressure from the US-China trade war and Trump’s tariff threats.

By signaling an end to QT and hinting at more rate cuts, He gave markets a reason to hope for stability.

Still, his warning about losing the IOR tool reminds everyone that the Fed’s job is far from easy. For now, investors are betting that the Fed Powell Speech Today marks the start of a softer, more supportive policy path.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。