BlackRock CEO Bitcoin Remarks Signal Shift, He Calls It ‘Digital Gold’

Larry Fink, the CEO of BlackRock, believes so. In a recent CBS interview, the BlackRock CEO Bitcoin remarks caught investors’ attention as he called the cryptocurrency “digital gold.”

Source: X (formerly Twitter)

He said BTC is now an “alternative asset” similar to gold and admitted he had to “relook at his assumptions” about crypto. Fink’s change in view shows how much Wall Street’s perception of this cryptocurrency has evolved in recent years.

Larry Fink’s Changing Perception on Crypto

Back in 2017, the BlackRock CEO BTC stance was very different. Fink once called it an “index of money laundering.”

But now, he says this cryptocurrency deserves a role in modern portfolios, though he warned against over-investing.

"It's not a bad asset," he stated, "but it shouldn't be a large portion of your portfolio."

This shift is testament to the transformation of Fink's opinions on this cryptocurrency from skepticism to guarded optimism.

As the CEO of the largest asset manager in the world, with $12.5 trillion under management, Fink's evolving opinion has enormous significance throughout global markets.

BlackRock's iShares Bitcoin ETF Dominates the Market

BlackRock's entry into crypto via its iShares Bitcoin Trust (IBIT) has been a game-changer.

-

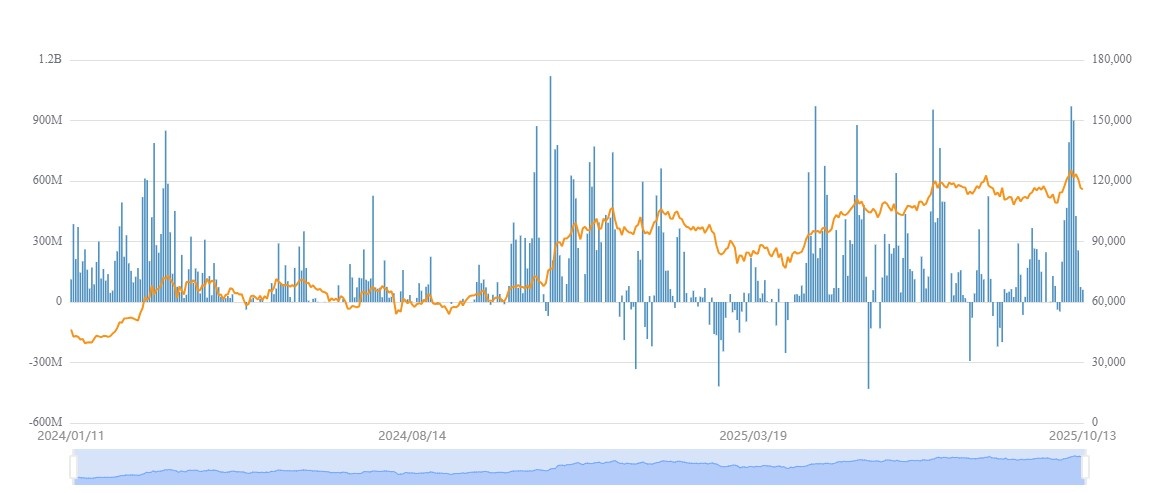

The ETF oversees more than $93 billion in assets, becoming the largest BTC ETF globally.

-

SoSoValue indicates that BlackRock's funds related to BTC have over $157 billion in total assets, accounting for almost 6.8% of it's market capitalization.

Source: SoSoValue

Retail investors accounted for half of the ETF's demand, with many first-time users on BlackRock's iShares platform.

The BlackRock CEO forecast captures increased retail appetite and the increasing connection between traditional finance and crypto investing.

Institutional Demand and Global Impact

Experts believe Fink’s remarks mirror a broader trend of institutional adoption.

Fabian Dori, Chief Investment Officer at Sygnum Bank , said that BlackRock’s open support of Bitcoin is a sign that “crypto has moved from involvement to adoption.”

He also noted that if U.S. debt keeps growing, this digital asset could become a global reserve alternative, a sentiment that aligns with Blackrock CEO Bitcoin perception as a hedge against uncertainty.

Huge financial managers like Fidelity and Vanguard have begun including BTC in their investment models, and companies like Michael Saylor’s Strategy, Tesla and Metaplanet are keeping it as an inflation hedge.

Bitcoin Price Shows Mixed Market Signals

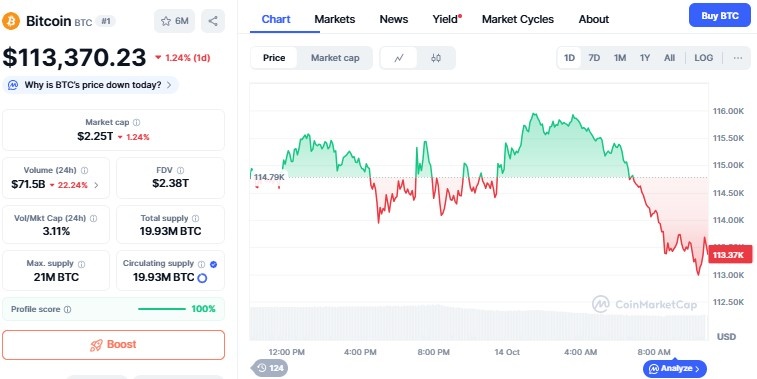

The price recently fell below its 7-day moving average of $117,282, indicating short-term weakness.

It is now trading at $113,370 with a decrease of 1.32%.

Source: CoinMarketCap

Looking at the Bitcoin price prediction , analysts predict $115,390 as a recovery level and $112,000 as significant support.

In spite of the short-term declines, Fink's comments have assisted in improving investor confidence, with traders regarding BTC as a serious asset for the future.

Wall Street’s Growing Confidence on Crypto

The BlackRock CEO Larry Fink opinion on BTC reflects how traditional finance is warming up to crypto. Once skeptical leaders now call it a valuable long-term asset. Fink summed it up clearly: “For those looking to diversify, it is not a bad asset.”

His acknowledgment signals that it is no longer on the sidelines; it's part of the financial mainstream, seen by many as digital gold for a digital world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。