Robert Kiyosaki Says Trump 401k Policy Will Boost Crypto, Gold Access

Can one policy shift reshape how millions of Americans plan for retirement?

That question is at the center of the Trump 401k policy, which allows traditional retirement accounts to invest in alternative assets including gold, real estate debt, crypto like Bitcoin and Ethereum, private equity, and private credit.

President Trump signed this executive order in August, aiming to expand investment choices for workers and retirees. The move comes alongside Trump’s diplomatic initiatives in the Middle East, drawing both political and financial attention.

Robert Kiyosaki Praises the Policy

Financial educator and bestselling author Robert Kiyosaki praised the Trump 401k policy on social media, writing “I LOVE TRUMP.”

Source: X (formerly Twitter)

He criticized traditional Wall Street structures, claiming that rich investment bankers controlling stock and bond markets have been “screwing” the working class through their 401ks.

Kiyosaki warned that millions of baby boomers risk homelessness as inflation erodes the real value of their 401k savings, echoing concerns voiced even by Warren Buffett.

By opening access to alternative assets, the policy gives Boomers protection and lets Gen X and Millennials diversify earlier for stronger wealth growth.

He believes the new policy levels the playing field, giving everyday employees access to assets traditionally reserved for business owners and investors, what he calls the “B and I side” of his Cashflow Quadrant.

Unlike typical savers, Kiyosaki has never owned a 401k, relying instead on gold, silver, oil, crypto, real estate, and private investments. Robert Kiyosaki tweet says he will now buy even more Bitcoin, Ethereum, gold, and real estate .

Wall Street Eyes the $13 Trillion 401(k) Market

According to The Wall Street Journal , major firms like Apollo Global Management, BlackRock, and Blue Owl Capital are preparing to offer private equity and private credit products to retirement savers.

Source: WSJ

-

The 401(k) market is valued at $13 trillion, and Wall Street sees huge potential in expanding its reach.

-

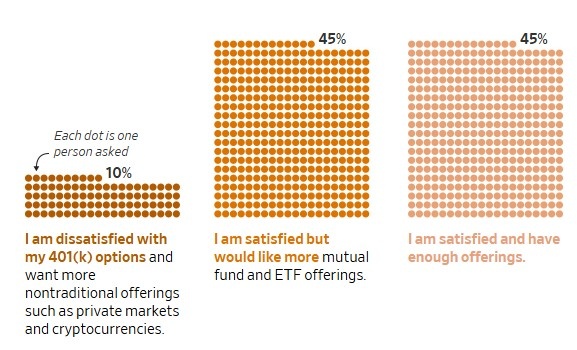

A Harris Poll survey of over 2,000 U.S. adults found that:

-

Only 10% of respondents are dissatisfied with their current retirement investment options.

-

However, awareness of alternative assets is low; nearly 40% have never heard of private credit funds, and just 15% say they are “highly familiar” with them.

Despite this,

-

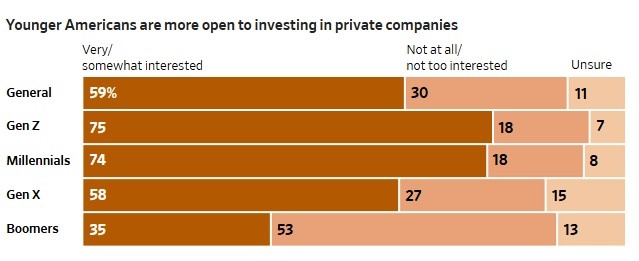

59% of Americans show general interest in private company investments when informed of the opportunities.

-

Nearly 90% are open to allocating a portion of their savings to private assets.

-

Around 30% are willing to commit between 10% and 14% of their portfolio.

Source: WSJ

The Trump 401k policy might also introduce Bitcoin and Ethereum into mainstream retirement portfolios.

That's noteworthy: today, crypto exposure in the retirement plan is distinct and typically restricted to special plans.

By making crypto one of the assets eligible for use as approved alternative assets, millions of investors could get their hands on Bitcoin in regulated retirement accounts. It will be fueling new demand and long-term ownership as a positive influence for the crypto sector.

Kiyosaki’s Message: Think Independently

He advises Americans to learn and comprehend other assetts than just blindly following Wall Street-affiliated financial planners.

He is convinced this change will make more individuals financially wiser and richer with time.

Final Thoughts

The Trump 401k policy is more than a retirement adjustment; it's a fundamental structural change.

By providing employees with access to alternative assets, it could diversify portfolios, advance crypto adoption, and alter how Americans accumulate wealth for decades to come.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。