"One day, every company will become a Bitcoin treasury company."

Compiled & Edited by: Deep Tide TechFlow

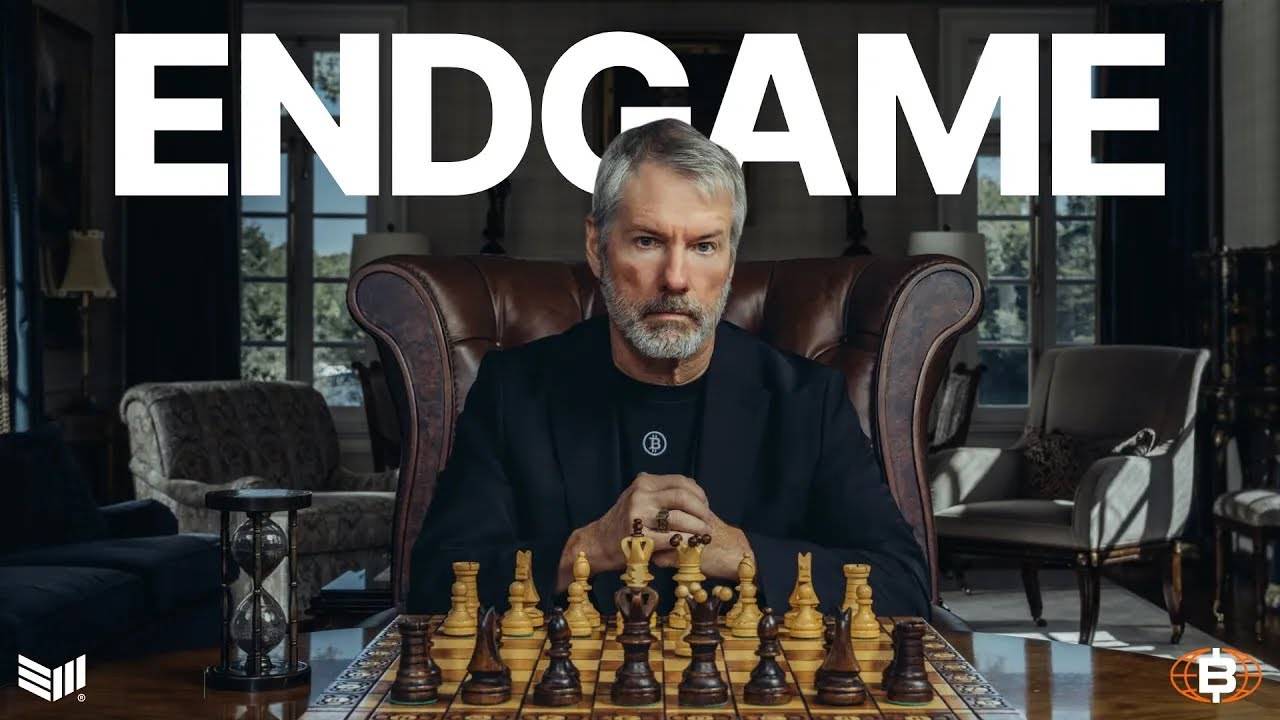

Guest: Michael Saylor, Executive Director and Co-founder of Strategy

Host: George Mekhail, Managing Director of Bitcoin for Corporates

Podcast Source: Bitcoin For Corporations

Original Title: Michael Saylor: The Bitcoin Treasury Endgame - An Exclusive At-Home Interview

Broadcast Date: September 30, 2025

Key Points Summary

An exclusive in-depth interview with Michael Saylor, discussing how Bitcoin is becoming the core of the global credit market and shaping the future economy.

In the interview, Michael shared his vision for the future of Bitcoin: it will disrupt traditional capital models, redefine corporate balance sheets, and become the cornerstone of the 21st-century economic system. From the rise of Bitcoin asset management companies to the development of Bitcoin-based credit instruments, this conversation paints a comprehensive picture of the future blueprint for currency, banking, and economic sovereignty.

Highlights of Insights

The value of Bitcoin is expected to grow by an average of 29% annually over the next 20 years, reaching $2.1 million in 21 years.

Cryptocurrency exchanges may adopt Bitcoin reserve strategies more aggressively.

The optimal strategy for investing in Bitcoin is direct investment. Corporate participation does not crowd out individuals; rather, it makes those who believed in Bitcoin early on even wealthier.

In the global capital markets, Bitcoin is the optimal capital asset choice for companies. One day, every company will become a Bitcoin treasury company.

For Bitcoin to be widely accepted globally, companies, banks, exchanges, operators, cities, states, and even federal governments need to be involved. We do not want anyone to be excluded.

I believe that 95% of decision-makers in the financial sector still do not truly understand the concepts of digital energy, digital capital, and digital currency. But this may not be a bad thing. If everyone agrees on an investment opportunity, it will not yield huge returns.

The concept of Bitcoin as digital gold or digital capital is entirely new. If we accept Bitcoin as digital gold, it can also be seen as a form of digital capital. Any credit instrument backed by Bitcoin can be viewed as digital credit.

Bitcoin reserve companies compete with traditional credit and equity instruments in the capital markets. They leverage Bitcoin as a basis for currency, creating higher quality equity and credit instruments.

The ideal choice for Strategy is to become a pure Bitcoin reserve company, focusing on issuing equity and high-quality Bitcoin credit instruments.

In the future, the Bitcoin network will evolve into a multi-trillion-dollar ecosystem, with the total amount of digital credit potentially reaching $10 trillion, $20 trillion, or even $100 trillion.

The banking networks, credit systems, and equity capital markets of the 20th century will undergo a complete transformation. Bitcoin will become the cornerstone of digital credit, digital equity, digital banking, digital capital, and the digital economy of the 21st century, with Bitcoin reserve companies playing a pivotal role in driving the development of this network.

Our goal is to make this future so desirable that no one wants to be excluded. Ultimately, everyone will need to choose between being "smart, fast, strong, and wealthy" or "stupid, slow, poor, and weak."

Following the Genius Act, the Clarity Act is expected to become the next key legislative topic. This act may further define the legality of tokenized assets.

Bitcoin is Hope

George Mekhail:

I’m glad to have a conversation with Michael Saylor today. You once said, "Bitcoin is hope." Can you share this vision of "hope"? In what specific ways does Bitcoin represent "hope"? How will the lives of ordinary people change under the Bitcoin standard?

Michael Saylor:

Looking back at human history, technology has been key to improving human life. One of the earliest technologies—fire—can be seen as a symbol of hope. Without fire, humanity might have frozen or starved. Subsequently, technology advanced, leading us into the Bronze Age, Iron Age, and Steel Age.

The invention of the wheel was also significant. Later, Rockefeller commercialized and standardized oil, giving humanity mechanical power for the first time. Today, a small trawler's engine has 70 horsepower, equivalent to the strength of 700 people, while large auxiliary ships can reach 1,000 horsepower. This technology allows humanity to utilize energy more efficiently, thereby improving life.

Bitcoin is hope because it represents digital energy. It is a technology that can transmit energy in cyberspace, as well as embody digital property, digital capital, and digital gold. More fundamentally, Bitcoin is a tool for transmitting energy across time and space, capable of supporting 8 billion people globally, millions of businesses and institutions, governments, and local municipalities.

If fire is hope because it frees you from the cold; if electricity is hope because it allows you to move freely in skyscrapers; then Bitcoin is hope because it is a form of digital energy. It can transmit energy at the speed of light from one end of the Earth to the other, solving problems for individuals or businesses. This technology represents a new phase of humanity's mastery over energy, greatly enhancing the quality of life.

George Mekhail:

As this transformation occurs, we are gradually moving towards the Bitcoin standard, or what some call "super monetization." What signs do you see indicating that this trend is being realized?

Michael Saylor:

What we are really talking about is the process of integrating digital energy into civilization. So, what do you want to see? I think we can start with the basic application of digital energy as capital. Currently, there is a rising trend of public companies recapitalizing with Bitcoin.

Our company was the first to do this in 2020, followed by two or three others, then ten, twenty, and now over 180 companies have adopted Bitcoin as a capital reserve. I expect that as we move from one hundred to one thousand, then to ten thousand, and a hundred thousand, you will know the world is accepting Bitcoin. As someone said, one day, every company will become a Bitcoin treasury company.

Thus, companies recapitalizing with Bitcoin serve as a measure of adoption. I believe another measure of adoption is the integration of Bitcoin support into software applications. Currently, there are applications running on iPhone or Android, like Cache App, that support Bitcoin, as well as wallets that support Bitcoin. But I look forward to the day when Apple integrates it into the iPhone, Google integrates it into the Android operating system, and Microsoft integrates it into the Microsoft operating system.

This will either be at the core of every consumer device operating system or at the core of the hardware itself. People are starting to integrate Bitcoin support into all hardware devices spreading around the world. I think this will be another very important sign.

George Mekhail:

You mentioned that five years ago you just entered the Bitcoin space. At that time, almost no one knew of your existence in this industry. Now, as you said, you have become a leading figure among Bitcoin treasury companies. We have spoken with many executives planning to implement Bitcoin strategies from 14 different countries. Many have mentioned that they want to become the Saylor of their respective countries. How do you view your role in this field? Do you see yourself as a leader of this movement?

Michael Saylor:

I believe we have a responsibility to set a good example for others while supporting and helping other participants in the market. We have tried many new things, conducted various experiments, and worked hard to share our experiences. Since we entered the Bitcoin space, we have been sponsoring Bitcoin business conferences and publishing operational manuals. We have open-sourced our methods and made our securities documents public, detailing our actions and the lessons learned from them. I believe we have an obligation to point out what works and what doesn’t.

What inspires me about this movement is that the Bitcoin ecosystem is different from many traditional industries. In traditional industries, it is often a winner-takes-all scenario, like Walmart defeating most retailers, Amazon pushing thousands of retailers out of business, and Apple replacing many device manufacturers. In the Bitcoin ecosystem, everyone has a chance to win.

This is because we share the same value system, and everyone acts around Bitcoin as the foundational asset. The total supply of Bitcoin is limited to 21 million, and everyone relies on the same Bitcoin network. Therefore, the growth of Bitcoin treasury companies and the success of any company holding Bitcoin will have a positive impact on the entire Bitcoin network and other companies.

I feel very gratified to see this industry continue to grow. We do our best to play our part while also seeing other companies make many outstanding contributions. Every day, new companies try different strategies, and I think we are all learning in the process. If certain strategies prove effective, they will be adopted by more people; if certain methods do not work, we will avoid repeating mistakes. Therefore, this movement is more like a collaborative effort, with everyone contributing to the common progress of the industry.

Skepticism Towards Bitcoin and the Process of Social Acceptance

George Mekhail:

I want to talk about FUD (Fear, Uncertainty, and Doubt) and some criticisms. Some people may be skeptical of your work in the Bitcoin space, and some even refer to them as "haters." Do you feel there are any criticisms or misunderstandings directed at you that stand out?

Michael Saylor:

I think when an airplane flies at supersonic speeds, it creates shock waves and sonic booms. This is because the speed of the airplane exceeds the speed at which sound travels through the air, causing air molecules to be unable to transmit information in time, resulting in turbulence and noise. Similarly, the growth rate of Bitcoin has exceeded society's ability to adapt.

Since 2011, Bitcoin has experienced multiple misunderstandings and skepticism: in 2013, 2015, 2017, 2019, and 2021, without exception. When we entered the Bitcoin space in 2020, we faced a lot of criticism as well. At that time, our stock was only $10 per share, and even when it rose to $100, the criticism continued; when the stock price fell back to $20, the criticism did not diminish. Even when we held $2 billion worth of Bitcoin, some criticized us for losing $1 billion. And when we made $10 billion, those critics disappeared, but a new wave of skeptics emerged. Every time the price of Bitcoin rises, it triggers a new wave of criticism and misunderstanding.

Even if Bitcoin rises to $100,000, $1 million, or even $2 million in the future, this misunderstanding and skepticism will not disappear; there will always be new FUD emerging. Those who once mocked our losses will vanish, but new voices will question, "Is it reasonable to buy Bitcoin now? Will it drop even lower?" This is a typical social phenomenon; new ideas always take time to be accepted.

Historically, many paradigm shifts have undergone a long acceptance process. For example, the widespread adoption of electricity took decades; John D. Rockefeller was considered crazy for 30 years until he became the richest man in the world; and nuclear energy was misunderstood for nearly 50 years until recently, when people began to realize its importance for AI data centers. Digital energy, like Bitcoin, will face similar skepticism and resistance.

It took people 30 years to go from thinking John D. Rockefeller was crazy to finally acknowledging him as the richest man in the world. When he became the richest man, people thought his legend had ended, but with the invention of the automobile, his wealth grew tenfold. This illustrates that society typically takes a long time to accept newparadigmshifts. However, when we look back at the developments of the past few decades, we find that these changes were quite natural, such as the use of fire, the spread of electricity, the invention of the wheel, the development of oil, and even the application of nuclear energy.

Take nuclear energy as an example; it has been viewed as a dangerous technology for the past 50 years, until recent years when people gradually recognized its importance. Especially in the rapidly developing era of artificial intelligence (AI), nuclear energy is seen as a key power source for AI data centers. If we do not develop nuclear energy, it may hinder technological progress and even slow down our advancement in intelligence. Although nuclear energy is a clean, sustainable, and almost inexhaustible energy source, it took humanity 60 years to gradually accept it.

Therefore, I am not surprised that digital energy will encounter similar skepticism and criticism. Many people may not understand its potential at all. As physicist Max Planck said: "The progress of science occurs with the funeral of one generation." What he meant is that the guardians of old ideas usually do not accept new thoughts; only when a new generation of decision-makers emerges, or the old generation exits, will society gradually embrace new ideas.

Sometimes, society needs to experience some dramatic events or shocks to accept new things. For example, those who do not believe in airplanes will only acknowledge their existence when planes fly over their cities and drop bombs overhead; those who do not believe in nuclear energy will only realize its power after nuclear weapons are detonated. Similarly, the COVID-19 pandemic in 2020 and the global economic turmoil have shown us the fragility of the monetary system and prompted us to rethink the potential of digital currency and digital energy.

Even so, I believe that 95% of decision-makers in the financial sector still do not truly understand the concepts ofdigital energy, digital capital, anddigital currency. But this may not be a bad thing. If everyone agrees on an investment opportunity, it will not yield huge returns. In fact, to achieve a tenfold or even hundredfold increase in assets, the key lies in discovering opportunities that are overlooked by the majority.

Take the investments during the COVID-19 pandemic in 2020 as an example; at that time, almost everyone thought buying Amazon stock was the best choice because it was obviously a necessity during the pandemic. However, it turned out to be one of the worst investments in the past five years. This tells us that a widely recognized investment opportunity often loses its potential for high returns.

George Mekhail:

Do you think there will be a critical point that will lead more people to start accepting Bitcoin, as you just mentioned? It sounds like you have observed this trend. Or, those skeptics may have started questioning five years ago, but now their views are gradually being proven wrong. However, what you just mentioned is more about the traditional financial system. So, what do you think about the skepticism within the Bitcoin community? Does this skepticism surprise you, or is there something particularly noteworthy about it?

Michael Saylor:

The Bitcoin community is indeed a very influential group with a variety of viewpoints. Some even consider Bitcoin to be "the currency of the enemy." In fact, before Bitcoin was born, the entire community was filled with skepticism; one could say that Bitcoin itself was born in an atmosphere of doubt.

This skepticism is deeply rooted in the culture and spirit of Bitcoin, forming an attitude of questioning everything. For example, "Kill your heroes" emphasizes not to trust anyone blindly but to verify everything yourself. The core idea of Bitcoin is "Do not trust anyone or any institution." If you try to answer the question: How to design a protocol that does not require trust in anyone, any company, or any government? You will find that this is indeed a very interesting challenge. I believe this skepticism has its significance.

However, at times, this skepticism can also be a form of counterproductive idealism. In fact, we do need to trust certain things in life. For example, you need to trust the companies that manufacture airplanes, the companies that make cars, and even your dentist. After all, you cannot perform an appendectomy on yourself, right? So, at certain times, we do need a certain level of trust.

I believe that a more mature view of Bitcoin is not to completely reject trust in anything but to recognize that the core value of Bitcoin lies in the rights it gives people to choose. You can choose to trust someone or some institution, and you can withdraw that trust at any time. For example, if you do not trust a certain government, you can transfer your Bitcoin to another country; if you trust a certain custodian, you can store your Bitcoin with them, and once you lose that trust, you can transfer your Bitcoin elsewhere. Even in the case where you choose to hold your Bitcoin yourself, if one day you feel you are not capable of doing so, you can transfer the custody to other family members. This flexibility is the core strength of Bitcoin.

The reason Bitcoin can provide this choice is that its very birth stems from distrust of the traditional financial system. This distrust, questioning spirit, and critical attitude are important components of Bitcoin culture. However, the potential of the technology itself can only be fully realized through cooperation. Whether it is trusting a custodian, a hardware manufacturer, or other service providers, this cooperation will ultimately allow you to achieve greater possibilities. And the uniqueness of Bitcoin is that you can choose to withdraw that trust at any time, thus protecting your property rights.

This choice is also a powerful deterrent. Take gold as an example; one of the significant reasons for its failure is the difficulty of storage. Looking back at the 1920s, when major countries around the world were on the gold standard, Germany, France, the UK, and the US held large gold reserves, but most of the gold was concentrated in London and New York. For instance, France's gold was stored in the UK or the US, and Germany's gold was stored in the US. There is a famous story about the president of the German central bank, Schock, visiting New York and meeting with Federal Reserve Chairman Ben Strong. Ben Strong wanted to show him Germany's gold, so he took him to the basement of the New York Federal Reserve Bank, but they could not find the gold.

This story illustrates the difficulty of storing gold and highlights the advantages of Bitcoin. As a digital asset, Bitcoin is not only easy to store but also gives individuals and institutions more choice and flexibility. For this reason, Bitcoin can become a more decentralized and reliable store of value than gold.

The implication of this story is that the difficulty of storing gold is so high that even a country like Germany cannot find its gold, let alone ordinary people and businesses. This is one of the reasons why gold ultimately failed— the storage process is both slow and complex, leading to the control of property rights by central institutions. Imagine if the entire world relied on gold as a basis for credit, while all the gold was concentrated in London and New York, especially New York; this centralized model essentially does not allow the 40 million companies and 400 million people globally to truly own gold.

In contrast, Bitcoin is an asset that can be genuinely controlled by individuals and businesses. While I advise those idealists not to trust banks or companies blindly, it is undeniable that during the gold era, the difficulty of storing gold was so high that no company could independently store its gold, and even banks could not do so. If we enter a world with 40,000 banks as Bitcoin custodians, it will be a significant improvement from the highly centralized world of only six to eight gold custodians in the past.

Therefore, I believe that the core value provided by Bitcoin lies in the freedom of choice it grants people. I do not oppose banks accepting Bitcoin. In fact, if every country in the world is willing to accept Bitcoin and become custodians of Bitcoin, we will achieve a global system where Bitcoin is jointly held by 150 countries. This system will be more decentralized than the gold standard and can last for hundreds of years. Even in the most conservative scenario, if only banks and governments can hold Bitcoin, its level of decentralization will be 100 to 1,000 times higher than the gold standard. If companies also participate, this number will rise to 10,000 times. And in a world where millions or even tens of millions of individuals can self-custody Bitcoin, the degree of decentralization will increase by hundreds or thousands of times.

Therefore, I prefer to focus on the fact that even in the worst-case scenario, today’s decentralized monetary system is far more robust in terms of integrity and fairness than the gold standard of 100 years ago, or even the best periods in history. This progress is remarkable, providing a more equitable and efficient foundation for the future financial system.

The Role of Governments and Institutions: Promoters of Bitcoin Globalization

George Mekhail:

Recently, the U.S. government acquired a 10% stake in Intel, sparking widespread discussion in the community. Do you think there is a connection between this equity strategy and the government's goal of becoming a global Bitcoin superpower?

Michael Saylor:

I believe there is no connection between the two. When the government expresses a desire to become a global Bitcoin superpower, their goal is to promote the adoption of Bitcoin through policies and support measures. They want the banking system to fully support Bitcoin, such as providing loans, yields, and credit services; they hope to promote the trading and circulation of Bitcoin; they want tech giants like Apple, Google, Meta, and Microsoft to support Bitcoin. They also hope that more publicly traded companies will purchase Bitcoin, that the number of institutional custodial services will increase, and that favorable tax and securities regulations for Bitcoin will be established. Additionally, they want U.S. financial companies, such as BlackRock and Coinbase, to lead the global adoption of digital assets and Bitcoin.

George Mekhail:

However, some criticize that if companies hold a large amount of Bitcoin, it could negatively impact ordinary people. How can we avoid marginalizing small users?

Michael Saylor:

In fact, it does not. When our company started participating, the price of Bitcoin was $9,000 each, and now it has risen to $115,000 each. This increase is primarily because our company purchased 3% of Bitcoin, while institutions like BlackRock bought about 4%. Even so, 93% of Bitcoin is still held by individuals, with a total value close to $2 trillion. This means that individuals who held Bitcoin before companies got involved have already profited $1.8 trillion. Therefore, company participation has not marginalized individuals; rather, it has made those early believers in Bitcoin even wealthier.

Individuals can freely decide how to use this wealth. For our company, if we can hold 5% of the Bitcoin network, the price of Bitcoin could rise to $1 million each. If the holding percentage is higher, the price could even reach $10 million each. When we reach a 7% holding percentage, if companies like BlackRock follow us, the price of Bitcoin will further increase, while the remaining 85% of Bitcoin is still held by individuals.

In fact, companies are a crucial driving force in the Bitcoin ecosystem. Every company and every large purchase injects momentum into the Bitcoin network. Without company participation, the price of Bitcoin might hover around $5,000. Worse still, if companies choose to support other networks, such as Bitcoin Cash, Litecoin, or Ethereum, the value of Bitcoin could further decline or even gradually disappear. Subsequently, these companies might lobby governments to amend laws to support other networks, thereby completely marginalizing Bitcoin.

This is essentially a "protocol war," a competition to determine the future ownership of currency. To win this war, support from institutional capital is needed, as well as company participation, because government policies have a decisive impact on the flow of funds. Governments can restrict the inflow of funds into a certain network through policies, or they can promote the influx of funds through supportive policies. Therefore, the participation of companies and institutions is crucial for the future of Bitcoin.

Thus, I believe that the role of companies in the Bitcoin ecosystem is vital. They can protect individuals from the risks of Bitcoin assets being confiscated, networks being shut down, or facing high taxes by employing lobbyists, conducting marketing, and defending the Bitcoin network. Companies are the first line of defense for Bitcoin, while miners are the technical defense, ensuring the security of the network through energy and computing power. Bitcoin treasury companies are the economic defense, maintaining the stability of the network through capital support. Bitcoin exchanges are another technical defense, responsible for developing mobile applications and websites to promote the circulation of Bitcoin. We hope that these key participants, including exchanges, treasury companies, and miners, can thrive globally and have ample capital support.

Therefore, I believe that there is no conflict of interest between companies and individuals. This is not a zero-sum game. If Bitcoin is to be widely accepted globally, then companies, banks, exchanges, operators, cities, states, and even the federal government all need to participate. We do not want anyone to be excluded.

Finally, I would like to use a metaphor to illustrate: Bitcoin is like the English language. If you can speak English and find that the most powerful people in the world are also using English, would you feel dissatisfied? If the banks that control global wealth also provide services in English, would you feel that they are depriving you of your language? Obviously not. On the contrary, we hope that those who are wealthy, powerful, and influential can use our language and adopt our protocol. If their actions could potentially harm you, you can also learn their language to identify and respond. Bitcoin is essentially a protocol. Ultimately, we hope that everyone can use this protocol because it will make the world a better place, and you will benefit from it.

Bitcoin Treasury Companies Drive Ecosystem Development

George Mekhail:

Let's talk about Bitcoin treasury companies and their wave in the adoption of Bitcoin. Although we have previously discussed that competition is not a zero-sum game, we still see some regional competition trying to gain an edge in this field. What would you say to those companies involved in this capital competition? What advice do you have for them?

Michael Saylor:

Let's start with the basic concepts of the industry. Bitcoin is the monetary foundation of the crypto economy; it is digital gold. If we look back at history 3,000 years ago, such as reading Xenophon's "Anabasis," the Athenians and Spartans did not trust each other, and neither trusted the Persians, but these mutually hostile groups had one commonality: they all fought for gold. Why gold? Because around 600 BC, gold was widely regarded as valuable currency. Despite their differences in beliefs and cultures, they reached a consensus on the value of gold.

From the 17th century to most of the 20th century, the world economy revolved around gold. Countries issued bonds backed by gold, and all credit instruments were based on gold. These credit instruments have historically gone through cycles from the gold standard to detachment from the gold standard and back to the gold standard. This gold-backed credit system lasted from the 18th century to the 20th century, until the dollar detached from the gold standard in 1971. For centuries, gold has been at the core of credit instruments until Satoshi Nakamoto invented Bitcoin. Initially, there was controversy over the nature of Bitcoin, but by 2025, a global consensus will have been reached: Bitcoin is digital gold.

In discussions on CNBC, it is widely believed that Bitcoin is the monetary foundation of the crypto economy, the digital gold. While other cryptocurrencies may be seen as digital silver, digital copper, or digital silicon, the history of Western civilization is not built on copper or silver. The experiment of gold as currency has been successful, while the attempts with silver have not lasted. Today, we are transitioning from a metallic currency network to a cryptocurrency monetary network.

So, what exactly are Bitcoin treasury companies? Here, we need to understand two important paradigm shifts: First, the concept of Bitcoin as digital gold or digital capital is entirely new. In fact, it is only in the past nine months that this consensus has gradually formed globally. This also means that we can now issue credit instruments based on digital gold, or digital credit. Second, if we accept the view that Bitcoin is digital gold, then it can also be seen as a form of digital capital. Any credit instrument backed by Bitcoin can be viewed as digital credit.

From a broader perspective, the true potential of Bitcoin treasury companies lies in their ability to fundamentally change the existing equity and credit markets. Suppose I establish a company focused on Bitcoin investment, holding $1 billion in Bitcoin assets; then I possess $1 billion in digital capital. I can issue digital credit based on this capital. This is similar to traditional gold banks. If I own $1 billion in gold, I can issue $100 million in gold-backed credit notes. Then, I might think, why not issue $500 million or even $1 billion in gold notes? This leverage effect will fundamentally change the capital markets. So, from this logic, you will soon find that the collateral ratio for gold notes may reach 5:1, meaning that $5 of gold-backed credit notes corresponds to only $1 of actual gold. This method of credit issuance is the foundation of the modern banking system. The strongest form of credit is to achieve a one-to-one guarantee. This means that theoretically, $1 billion in Bitcoin can be used to issue $1 billion in fully one-to-one guaranteed Bitcoin credit notes.

So, what does this model replace? It is actually replacing the existing credit system, such as loans backed by retail residential or commercial real estate, corporate credit based on company cash flows, or fiat credit relying on government promises to print more money. These traditional credit instruments dominated the 20th century, with a total volume reaching trillions of dollars.

When we understand the operational model of Bitcoin treasury companies, we find that their business logic is very attractive: accumulating a large amount of Bitcoin capital throughequity financing, and then issuing credit instruments based on this Bitcoin. These instruments can be credit tools similar to bonds, convertible bonds, preferred stocks, or even variable floating preferred stocks. In other words, companies can issue various forms of credit based on Bitcoin as "digital gold."

By issuing these credit instruments, companies effectively create a leverage effect for capital. More importantly, as capital is leveraged, the equity of the company will transform into "digital equity," which may outperform Bitcoin itself. So, who are these Bitcoin treasury companies actually competing against? In fact, they are not competing with each other but are competing with traditional credit and equity instruments in the capital markets. They leverage Bitcoin as a basis for currency to create higher-quality equity and credit instruments. In this context, we can foresee the rapid growth of these companies. If these companies can understand and apply this model, they will gain a significant competitive advantage.

The market offers enormous development space for those giant companies. Take Meta Planet as an example; it could not only become the most valuable hotel company in the world but also the most valuable company in Japan. Although their scale is much smaller than ours, that is not important. The key is that they are not competing with us; they are competing with the equity market in Japan and the credit market based on the yen. This is a unique capital market environment.

Currently, these capital markets are waiting for the emergence of a giant enterprise, and those giant companies focused on digital credit issuance may achieve 100-fold growth. Therefore, we are not competing with other Bitcoin treasury companies; we are promoting and advocating the concept of digital credit. Our goal is to drive the digital transformation of the credit market. If we can capture 1% of the market share, it means we can sell $1 trillion in digital credit, and just 1% of success can have a huge impact.

It is worth mentioning that there are more than a dozen companies in the U.S. promoting digital credit, which is beneficial for us. We have 100 million retail investors, yet many people in the Bitcoin community are even unaware of products like Stretch (Stretch is a floating-rate perpetual preferred stock launched by Strategy Company, designed to provide cash-like tools for investors seeking indirect Bitcoin exposure and stable returns). If we could offer a bank account backed by Bitcoin with a 10% yield, it would undoubtedly attract more investors. Moreover, another 100 companies could replicate this model.

You might ask, will this squeeze our market space? In fact, it will not. What we are describing is a higher-quality banking system. Instead of choosing the 2% or 3% yield offered by traditional fiat banks, why not opt for the 10% yield provided by Bitcoin treasury companies?

History can illustrate this point. In 1920, there were about 25,000 banks in the U.S., and today there are only 5,000. Therefore, in the future, there may be 5,000 Bitcoin treasury companies in the U.S. Will this not affect us? It will not negatively impact other companies either, until 50% of the global credit system transforms into a Bitcoin-based credit system. When the total amount of credit backed by Bitcoin reaches $100 trillion, the total scale of the Bitcoin ecosystem will also reach trillions of dollars. This is not just a transformation of an industry but a significant leap for an ecosystem, from which many companies will benefit.

So, who will be the ultimate losers? The answer is those companies that remain stuck in the 20th-century credit issuance model. The credit products they issue lack sufficient collateral, have poor liquidity, and low yields. These companies will gradually lose market share because why would investors choose low-quality credit with poor liquidity and a yield of only 4%, instead of investing in credit products with good liquidity, yields that are two or three times higher, and collateral ratios of 10 times?

Therefore, these outdated credit issuers will be eliminated by the market. Many of them are small institutions that people have never heard of, such as the 4,000 regional banks in the past over-the-counter market. The market share of these weak credit issuers will gradually decrease, but this will not happen overnight; it is a process that will take 10 years or even decades to complete.

In the Bitcoin ecosystem, it is not easy to get into trouble. However, if you engage in excessive leverage using short-term, high-interest margin loans, problems may still arise. If you also use your own assets as collateral, this ultra-high leverage operation indeed carries significant risks. However, I believe that publicly listed Bitcoin treasury companies are unlikely to adopt such extreme practices, as the market will not allow them to achieve such high leverage.

Therefore, as long as Bitcoin treasury companies choose prudent financing methods, such as issuing long-term convertible bonds,preferred stocks, or even longer-term junkbonds, while holding Bitcoin as a core asset, their financial situation will remain stable.

In a crypto winter, Bitcoin miners are often the most affected. The reason is that they typically borrow short-term loans for 12 or 18 months at high interest rates of 15%, and these funds are not used to purchase Bitcoin but to buy mining machines. The value of mining machines depreciates by 20% to 30% each year. If you use short-term loans to purchase rapidly depreciating assets, financial issues are almost inevitable. In contrast, if you borrow mid-term or long-term loans to purchase assets that appreciate by 30% to 60% each year, your financial situation will be much more stable.

Thus, as a publicly listed Bitcoin treasury company, to truly get into trouble, one would need to make very irresponsible decisions. Of course, there may be a few companies that experience financial instability due to foolish actions, but overall, Bitcoin treasury companies can be categorized into the following three types:

The first type is companies focused on digital credit issuance, such as enterprises like Meta Planet. These companies focus on issuing equity and pure credit products and may achieve 100-fold or even 1,000-fold growth, becoming the next "MAG 7" stocks (the fastest-growing top companies by market capitalization). Their market value could grow from $1 billion to $10 billion, or even reach $1 trillion.

The second type consists of strong Bitcoin participants. While they may not be absolute market leaders, they play an important role in the Bitcoin ecosystem. These companies typically engage in various businesses and are expected to achieve 10-fold or 20-fold growth. Although their performance may not be as dazzling as that of the "MAG 7," it will still be very impressive. They may purchase large amounts of Bitcoin while also conducting some business. Although they are not entirely focused on Bitcoin, they can still perform well.

There are also some companies that will purchase a small amount of Bitcoin while running other businesses. Over time, the other businesses of these companies may stabilize, while the value growth of Bitcoin will support the company's market value. Therefore, while these companies may not incur losses, their growth may only be around 2 to 4 times due to not being 100% focused on Bitcoin. The key to all this lies in the beliefs of the management team and the choice of business model.

If you ask what kind of company I want to become, the ideal choice is to become a pure Bitcoin treasury company, focusing on issuing equity and high-quality Bitcoin credit instruments. You should strive to secure a place in major markets such as the UK, France, Brazil, Norway, Japan, the U.S., Canada, Germany, and Italy. Local companies usually have advantages in terms of taxes, regulations, marketing, and culture in their home markets.

In these capital markets, you can offer the highest-yielding credit products, while these markets are flooded with low-yield or even negative-yield products. For example, in Switzerland, the yield on short-term funds is negative. We took five years to grow from $600 million to $120 billion (depending on specific market capitalization), but we went through 20 different credit issuances during this process and paid many costs. If you start from scratch today, you can skip the exploration of the first four years. The strategy I recommend is: first raise equity capital, purchase Bitcoin, invest all funds into Bitcoin, and then issue short-term Bitcoin-backed credit instruments. This approach can eliminate volatility and risk while providing investors with yields that are 500 basis points (i.e., 5%) above the market'srisk-free rate.

You can establish a company focused on a single credit instrument and equity tool, achieving rapid growth by continuously repeating this model. Theoretically, you could complete what we have done in a shorter time, possibly in half or even a third of the time. The key to all this is whether the company's leaders have enough charisma and credibility, and whether the brand is trustworthy and focused.

The Bitcoin-Driven Credit Market Revolution

George Mekhail:

Does the ultimate goal you describe mean establishing a more complete banking system? Is this part of your strategic direction? Currently, such products already exist, and people can invest their funds in them, which are very high-quality assets for the market. But the question is, do we only need to educate the public to make them aware of the existence of these products? Or do we need to take more measures to promote their development?

Michael Saylor:

Yes, I believe the ultimate goal is to accumulate $1 trillion worth of Bitcoin and grow at a rate of 21% per year. Then, we will accelerate growth by issuing more credit products. Ultimately, we hope to have $1 trillion in Bitcoin collateral, growing at a rate of 30% per year, while issuing $100 billion in credit instruments annually, with an annual growth rate of 20% to 30%. The yields on these credit products will be 200 to 400 basis points higher than traditional real estate mortgages, corporate bonds, or fiat-backed credit instruments.

In this way, we can reactivate the credit market instead of allowing Swiss investors to continue accepting the status quo of zero yields. Suppose half of the credit market in Switzerland becomes digitized; then the originally zero yield could rise to 200 to 300 basis points. This increase can not only raise the risk-free rate but also alleviate financial repression, thereby improving the health of the traditional credit market. At the same time, it also provides Bitcoin investors with higher returns, such as a 3% return rate.

A similar situation applies to the yen market. Ultimately, the yield on tens of trillions of dollars in assets will no longer be 50 basis points but will reach an average level of 300 to 400 basis points. Through these changes, the credit market will regain health and integrity. This process requires cooperation among Bitcoin treasury companies.

In the future, the Bitcoin network will develop into a multi-trillion-dollar ecosystem, with the total amount of digital credit potentially reaching $10 trillion, $20 trillion, or even $100 trillion. If there is $100 trillion in digital credit supported by $200 trillion in digital capital, this system will no longer be a traditional fractional banking system but will achieve a model of 2x over-collateralization. This model is even superior to the top AAA-rated corporate bonds in the U.S., which typically only have 2.5x over-collateralization.

Therefore, all these credit products will achieve AAA investment-grade status, with higher yields and stronger transparency. I believe the ultimate goal is to reactivate and transform the credit market through Bitcoin, digital gold, and digital capital. At the same time, the equity market will also benefit from this, revitalizing it. For example, companies like Meta Planet will be included in equity indices. Over time, all companies in the S&P 500 index may hold Bitcoin. When these companies incorporate Bitcoin into their asset portfolios, the S&P index will contain a large amount of Bitcoin components, and the value of Bitcoin will continue to grow at a rate of 21% per year.

In the future, companies will become healthier, and credit risk will significantly decrease. At that time, the yield on savings accounts will rise sharply. I believe that the banking network, credit system, and equity capital market of the 20th century will undergo a complete transformation. Bitcoin will become the cornerstone of digital credit, digital equity, digital banking, digital capital, and the digital economy in the 21st century, while Bitcoin treasury companies will play the role of engines driving the development of this network.

We are in an era full of innovation, with phenomena similar to the "Cambrian explosion" occurring globally, with new ideas emerging continuously, and South America and North America having different approaches to Bitcoin applications. In the future, Bitcoin will gradually appear on the balance sheets of insurance companies, banks, and tech companies. If we reimagine insurance and use Bitcoin as the core driver, it will completely change the insurance industry, providing users with better protection. Similarly, if bank accounts are driven by Bitcoin rather than fiat, when you open a money market account, you might receive a yield of 10.2% (i.e., 1020 basis points).

With the transformation of the banking and insurance industries, along with tech giants like Apple and Google promoting Bitcoin through their global channels, we are about to witness a digital transformation. This transformation will make the economy smarter and more efficient, increasing productivity by 10 times or even 100 times. Those who successfully integrate into this digital economy will enjoy rapid growth and wealth accumulation, while regions or countries that are excluded may fall into backwardness and isolation due to their inability to access this system. Our goal is to make this future so desirable that no one wants to be left out. Ultimately, everyone will need to choose between being "smart, fast, strong, and wealthy" and being "stupid, slow, poor, and weak."

George Mekhail:

So, do you anticipate that in future strategies, Bitcoin credit will be extended to institutions, sovereign nations, or other pressure-type organizations?

Michael Saylor:

We are not expanding credit through loans, but rather by issuing credit instruments. If a country wants to achieve a 10% return, they will choose to purchase our credit instruments instead of traditional products with only a 3% yield. Our goal is to create credit, not to lend credit. We aim to issue not just $10 billion in credit, but $100 billion, or even $1 trillion, tens of trillions of dollars in credit. All of this credit will be secured by digital capital as collateral.

The Future Trends, Opportunities, and Market Potential of Bitcoin Treasury Companies

George Mekhail:

We just discussed different types of Bitcoin treasury companies, such as those focused on Bitcoin and those with significant operational businesses. Have you observed any trends among them, or what expectations do you have for the future? In your view, what factors are key? In which areas should companies explore more to achieve success?

Michael Saylor:

I believe that cryptocurrency exchanges may adopt Bitcoin treasury strategies more actively, which presents a great opportunity for them. For example, platforms like Gemini and Coinbase have become publicly listed companies and may engage in some interesting experiments in this area in the future.

Additionally, I think insurance companies, especially publicly listed ones, may gradually accept digital capital. They have large amounts of capital to invest, so they are fully capable of changing their operational methods by adjusting their balance sheets. Some financial institutions, such as Apollo, BlackRock, and Blackstone, are also representatives of innovation. These companies, as publicly listed entities, have the opportunity to incorporate Bitcoin into their balance sheets. For instance, BlackRock just launched the most successful ETF in history, and they might consider holding some Bitcoin as an asset, which would be a good opportunity for them.

I also believe that more and more innovative credit or equity instruments will be developed by participants familiar with the crypto economy. If these large companies do not take action, some smaller startups will seize the opportunity to enter the market. For example, Coinbase filled the gap left by traditional banks that were unwilling to custody Bitcoin. If insurance companies or cryptocurrency exchanges are reluctant to adopt Bitcoin, startups like Strike may quickly rise to capture market share. Especially those startups that are publicly listed and can raise large amounts of capital will have significant growth potential if they can integrate this capital into wallets or credit products.

George Mekhail:

As the market develops, the dynamics of game theory become increasingly interesting. How do you see the future, especially when Bitcoin treasury companies face significant market pullbacks? Will there be opportunities for consolidation or acquisitions? In this case, will Bitcoin treasury companies become the ultimate acquirers?

Michael Saylor:

My view is that the value of Bitcoin will grow at an average rate of 29% per year over the next 21 years, reaching $2.1 million after 21 years. Therefore, I expect the risk-free growth rate of Bitcoin to be 29% per year. This means that even if I do nothing, I can achieve a 29% risk-free return. For any investment idea based on the Bitcoin network, as long as its expected return exceeds 29%, plus a certain risk premium and other premiums, it is worth a try.

Even considering the issue of "diversification discount," it is still necessary to be aware of this when running a publicly listed company. If my company relies entirely on Bitcoin as the sole source of risk and return, then the business model would be very simple. By accessing our website, investors can view real-time data on Bitcoin's volatility, annualized returns, and prices, and quickly calculate risk and credit spreads. The data updates every 15 seconds, making the entire process simple and transparent.

If we choose to acquire another company, such as an undervalued enterprise by 40%, investors may need to spend a lot of time determining whether the deal is reasonable, and it may even take 10 years to verify whether their decision was correct. In this case, the originally transparent business becomes complex and opaque, leading to a discount in investors' assessments of the company's value.

Therefore, the optimal strategy for investing in Bitcoin is to invest directly. Suppose you are a publicly listed company with $1 billion in capital; you can choose to purchase $1 billion worth of Bitcoin at a one-time income price, and this asset has an average annual growth rate of 55%. In contrast, any investment project with an annual growth rate below 30% will seem unattractive.

In my view, Bitcoin is the most ideal acquisition target. It is the world's leading digital currency network, with an expected average growth rate of 30% over the next 20 years and virtually no risk. In this case, why choose other investment directions? Other directions may not only increase uncertainty but also introduce "diversification discounts." The assets of diversified companies often trade below their net asset value because the market believes their diversified investments dilute their core business, and this dilution can divert the company's focus.

Thus, while there is indeed a possibility of acquiring Bitcoin treasury companies that are trading below their net asset value, this does not suit us. There are many companies in the market focused on acquisitions, such as private equity investors and diversified companies. Their business models allow them to acquire other companies rather than focus on Bitcoin investments.

If you are a staunch supporter of fiat currency or an advocate of any other investment philosophy, you may find that some companies' business valuations are lower than the book value of the Bitcoin they hold. In this case, you might choose to acquire these companies to obtain their operational businesses for free while also gaining the value of Bitcoin. This strategy makes some sense.

For example, you could acquire a loss-making retail company that holds a large amount of Bitcoin. Another company might achieve profitability by cutting costs, optimizing operations, and divesting Bitcoin because they see the value of Bitcoin but do not want to engage in the retail industry. If a company's overall valuation is lower than the value of the Bitcoin it holds, this usually means the market views its operational business as a burden. In contrast, I prefer to invest directly in Bitcoin, which is a globally leading digital asset growing at 29% per year. My investors also support this transparent and efficient investment approach rather than wasting funds on acquiring problematic businesses.

For pure Bitcoin companies, acquiring other Bitcoin treasury companies is not attractive. But for private equity investors or diversified companies, such transactions may align with their business logic. Ultimately, whether to engage in such transactions depends on the company's cost of capital and strategic goals. If you believe that Bitcoin's average growth rate over the next 20 years is 29%, then directly investing in Bitcoin is clearly the superior choice. For companies with lower capital costs, acquiring Bitcoin-related assets remains an attractive strategy.

George Mekhail:

So does the strategy of purchasing Bitcoin apply to all capital markets? Are there still some undeveloped markets? For instance, we have not seen any substantial progress in Africa. What do you think are the most promising markets currently? Are there overlooked opportunities?

Michael Saylor:

In the global capital markets, Bitcoin is the optimal capital asset choice for companies. In some countries, such as Cuba or North Korea, although the law may prohibit the use of Bitcoin, from an economic perspective, Bitcoin remains a better choice. Particularly in Venezuela, Nigeria, and much of Africa, the appeal of Bitcoin is especially evident, as its average annual growth rate reaches 55%, and it may continue to grow at nearly 30% in the future.

In contrast, many other capital assets are either collapsing or pegged to the dollar. In Africa, local currencies and credit systems generally face depreciation pressure. Therefore, every company should leverage Bitcoin.

The next question is, for an investor in a publicly listed company, where can they achieve the greatest returns? How can they realize 10-fold or even 100-fold returns in equity investments? The answer often lies in those mature but financially repressed capital markets. For example, Switzerland and Japan have large capital markets, with funding measured in trillions of dollars, but the risk-free rates in these markets are extremely low; for instance, the yield on a one-month government bond may be close to zero or only 50 basis points, while Bitcoin can provide annualized returns of up to 55%.

Therefore, theoretically, any pure Bitcoin company in these markets, in any European market, has risk related to basis points, and Switzerland and Japan are excellent markets. If the risk-free rate in the U.S. drops to 200 basis points, this would be a significant boon for Bitcoin treasury companies in the U.S. Because in this case, the company could offer investors a 7% dividend yield while capturing 90% of long-term gains and 100% of short-term gains. This business model has tremendous profit potential.

The Future of Asset Tokenization

George Mekhail:

I want to talk about the topic of "tokenizing the world," which seems to be a timeless trend. How do you think this trend will develop within the Bitcoin ecosystem? What is the next asset that might be tokenized?

Michael Saylor:

The core idea is to enable everything to move at the speed of light. So, why not tokenize the dollar? We could even tokenize Bitcoin on the Lightning Network or tokenize various assets in other ways. Now, everyone wants Bitcoin transfers to be faster, moving from seconds to milliseconds. To achieve this, tokenization can be done on the third-layer protocol of Bitcoin. Additionally, almost all stocks and bonds can be tokenized. For example, BlackRock has already tokenized U.S. Treasury bonds and some of its financial instruments.

If Apple or Microsoft stocks were tokenized, anyone could hold Apple stock even on a Saturday afternoon in India. Tokenization can make capital markets more efficient, equitable, fast, intelligent, and powerful. At the same time, it empowers users with self-custody or partial self-custody capabilities. If this tokenization is done on a decentralized network, then stocks and securities may become more like bearer securities—whoever holds them owns them.

Now, I believe there is a general consensus that assets should be tokenized. Individuals such as Atkins from the SEC, Contez from the CFTC, and Scott Best from the Treasury support this view. They believe that the United States should lead the world in the field of digital assets, which means promoting the tokenization of all assets.

Currently, the U.S. has only one relevant law, the Genius Act, which includes some provisions regarding the tokenization of the dollar, but it does not fully grant comprehensive usage rights for tokenized assets. Existing laws still impose many restrictions on tokenization. For example, only banks can provide yield services for tokenized dollars. Nevertheless, there are some legal advancements pushing the tokenization process forward. Following the Genius Act, the Clarity Act is expected to become the next key legislative topic. This act may further define the legality of tokenized assets.

However, the Clarity Act has not yet fully accepted the concept of "digital securities." Therefore, even if the act is passed, it remains uncertain whether the tokenization of stocks, bonds, and other real-world assets will be legally recognized. This legal ambiguity leads to uncertainty in the direction of technological development.

For instance, if the law clearly allowed for asset tokenization and rapid transfer, Apple could fully tokenize every stock through its Apple Pay network. However, due to the lack of clear legal provisions, if Apple allows the transfer of these tokenized securities between sanctioned individuals, it may face legal liability. This uncertainty could delay Apple's tokenization process.

This indicates that decentralized networks or quasi-decentralized networks have significant advantages in the field of tokenization, as they can achieve asset tokenization in the absence of clear regulations. Therefore, I believe we are gradually moving towards a world that recognizes digital securities and digital tokens, a trend that has also been acknowledged by the SEC and CFTC. Although this goal has not yet been fully realized, it is foreseeable that it will be gradually advanced in the future through rule-making.

As for whether tokenized stocks, bonds, or other crypto tokens can be fully legalized, I am still uncertain. I think we are in a transitional phase, and there may be industry leaders who will take the lead in promoting the application of these technologies, gradually making them the de facto industry standard.

Once these factual standards are established, a large amount of capital will flow into these areas. Perhaps by 2028, these tokenized assets will be formally incorporated into the legal framework, or perhaps they will not, which may also spark some controversy. I cannot provide a definitive conclusion on this. But I can say for certain that Bitcoin, as a digital commodity, has a very clear value storage function and can issue digital credit based on Bitcoin. Furthermore, there is already a certain degree of legal clarity in some areas, such as companies being able to create stablecoins that do not pay interest, and banks potentially tokenizing deposits.

As for other areas, there remains a lot of uncertainty; it can be said to still be a "Wild West" world. In this environment, despite the risks and uncertainties, the current political atmosphere is relatively free and open, with the White House, SEC, Treasury, and CFTC all holding supportive attitudes. The situation two years ago was completely different, as the regulatory environment was more conservative, filled with skepticism and resistance, and political support was very limited.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。