Bitwise Solana ETF Sparks FOMO Is Launch Date Near?

Bitwise updated its Solana fund filing to add “Staking” and set a low 0.20% sponsor fee. The move signals an aggressive push to win flows and earning yield for holders.

Bitwise Solana Etf Update: Staking Added, 0.20% Fee

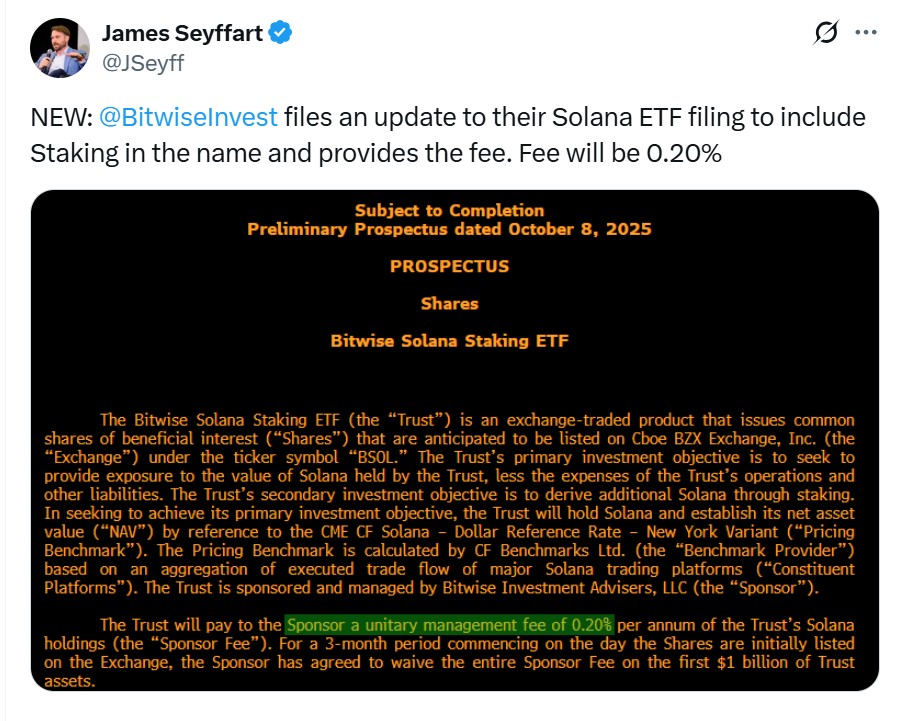

Bitwise has amended its Solana filing to include “Staking” in the fund name and disclosed a unitary sponsor fee of 0.20% per annum on the trust’s Solana holdings. The filing also says the company will waive the fee on the first $1 billion of assets for three months after listing. Bloomberg analysts reported the Bitwise Solana ETF news .

Source : X

Fee Details And How It Works

The sponsor fees of 0.20% will be calculated daily and taken from the fund’s net asset value. For the first three months after shares list, the sponsor will waive this fees on the first $1 billion — a temporary incentive meant to jump-start inflows. The exact mechanics and daily accrual method are spelled out in the SEC amendment.

Market and Community Reaction

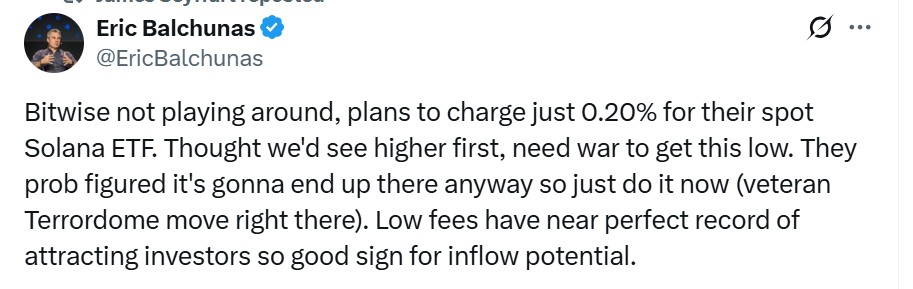

ETF observers called the 0.20% fee aggressive — Bloomberg and ETF analysts noted the low price as a clear bid to attract investor money quickly. Eric Balchunas said Bitwise “is not playing around,” and flagged the fee as lower than many expected. Social feeds and industry outlets picked up the amendment within hours.

Source : Eric Balchunas

Will The Bitwise Solana ETF Attract Institutional Investors?

The low cost and stake earning improve the product’s appeal to cost-sensitive institutions. Institutions watch custody, compliance, operational risk, validator selection, and slashing protection all matter.

If the firm can show strong custody controls and clear earning rules, the product could draw large managers. Analysts expect the fees and earning feature to be strong selling points for wealth managers and funds.

Bitwise Solana ETF Expected Launch Date

The filing sets the fees mechanics but does not give an exact public listing date. Some analysts have predicted approvals and launches could happen within weeks once regulators act; one analyst suggested mid-October as a plausible window for approvals of staking ETFs. Until the SEC grants final approval and the exchange lists the shares, there’s no official launch date.

Will Us Shutdown Will Affect the ETF Launch Is Delay Expected

The U.S. government shutdown can slow the SEC and pause routine approvals, so the listing could be delayed. Final approval and exchange listing usually wait until agencies fully operate again — the length of any delay will match how long the shutdown lasts.

Bottom Line

This move to add staking and set a 0.20% sponsor fee is a bold play to win early flows. The product will look attractive if custody and staking mechanics are solid, but actual institutional uptake depends on final approval, auditability, and trust in the staking setup. Expect more filings, analyst chatter, and price reaction as the SEC and exchanges advance the listing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。